August 6, 2024. Andreja Stojanovic.

Gold has been a particularly interesting asset since the start of 2024, thanks to its strong rally to a new all-time high and forecasts predicting it could rise to and beyond USD 3,000. However, interest in the commodity reached another level at the beginning of August.

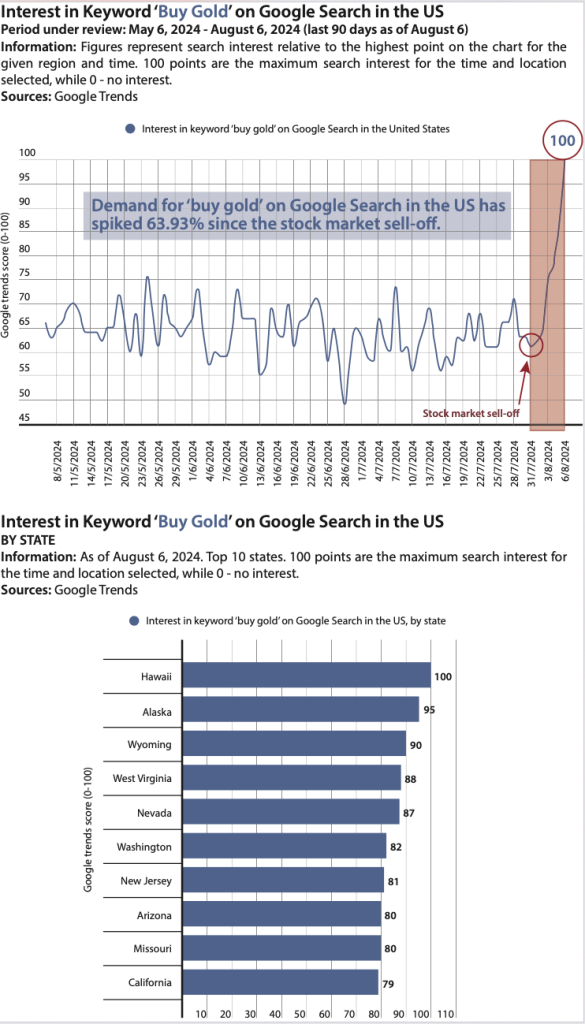

Indeed, Finbold’s research found that between July 31 and pre-market on August 6, interest in the ‘buy gold’ search term rocketed 63.93 percent from 61 to 100 on Google Trends. The figure is also substantially higher than at any other time during the period under review, which covers the 90 days between May 6 and August 6, 2024.

Such a rapid increase in curiosity about investing in bullion can be linked to a recession panic that started with the Federal Open Market Committee (FOMC) meeting on the last two days of July and was reinforced by the jobs report on Friday, August 2.

Hawaiian investors most interested in buying gold

While the beginning of August sent interest in buying gold rocketing across the US, nowhere is the search trend more pronounced than Hawaii.

In fact, on Google Trends’ scale, search interest in Hawaii stood at 100 at the time of publication. It is closely followed by the second-newest state, Alaska, at 95, and Wyoming, at 90.

In California, the home to the highest number of American billionaires and millionaires, buying gold has been a popular topic in August, though not as popular as in nine other states – the aforementioned three, as well as West Virginia, Nevada, Washington, New Jersey, Arizona, and Missouri.

On the other hand, investors and traders in Vermont appear the least interested in buying the commodity amidst the ongoing recessionary panic. Maine, Montana, South Dakota, and New Hampshire are no keener, with all reading less than 60 on Trends.

Why fear is driving investors to buy gold

A major reason for the rocketing of interest in the search term ‘buy gold’ is the precious metal’s role as a safe haven for wealth in times of crisis.

For centuries, gold has been seen as the backbone of many currencies found around the world and has been coveted and prized by countless civilizations for centuries. Such a history, along with its performance in the 20th and early 21st century markets – including through events like the Great Recession – has solidified the commodity’s role as a store of value.

The reputation is further reinforced by gold’s being a tangible asset in finite supply—and one that is ever-harder to extract as more reserves get depleted— and therefore not susceptible to inflation in the way most other currencies and assets are.

In recent years, the precious metal received yet another backing for its value – its industrial use in electronics.

Indeed, though gold is still mostly used as an investment vehicle or a key component of jewelry or other prestige items, the commodity is being semiconductor industry and has played a critical role in the ongoing artificial intelligence (AI) boom.

Still, while such an industrial use has helped drive gold’s rally, it also presents a risk to its stability. Should the manufacturing demand for the metal dwindle due to a bubble bursting or an alternative being funded, the price of the commodity could also diminish.

Why investors are seeking a safe haven

No matter the factors contributing to gold’s role as a store of value, the search trends reveal gold continues boasting such a reputation well into 2024.

Such interest has been driven by a convergence of factors, which started on July 31 as the Federal Reserve simultaneously all but promised to lower interest rates in September and warned of cracks in the labor market.

Cracks were confirmed on Friday when it was revealed that the US economy created approximately 60,000 fewer jobs than anticipated. The news led to a massive daily and extended session sell- off that affected stocks and cryptocurrency markets alike.

Recessionary fears seemingly reached a boiling point by Monday, August 5, as both the Japanese and the Taiwanese stock markets had their worst day in decades. While the US markets also took a beating, their close proved better than their opening, though fears of a crash have not yet been removed.

Andreja is a skilled finance news reporter, copywriter, and screenwriter with a growing fascination for finance, especially in the wake of the retail investing boom. He has since committed himself to providing rigorous coverage of financial news and the exploration of intricate financial concepts.