There is nothing boring about today’s insurance sector, which is driven by ‘InsurTech’. The word ‘FinTech’ has got on the vocabulary of every manager in the financial services sector, however, locally many are just developing some software patches to improve efficiencies in the back office-that should have been there in the first place and feel content about FinTech! Whereas FinTech in developed markets has crept into the front end of acquiring and servicing customers expediently, using technologies like machine learning, predictive behavioral analytics and data-driven marketing to engage with customers to make their automatic, unconscious spending and saving decisions better.

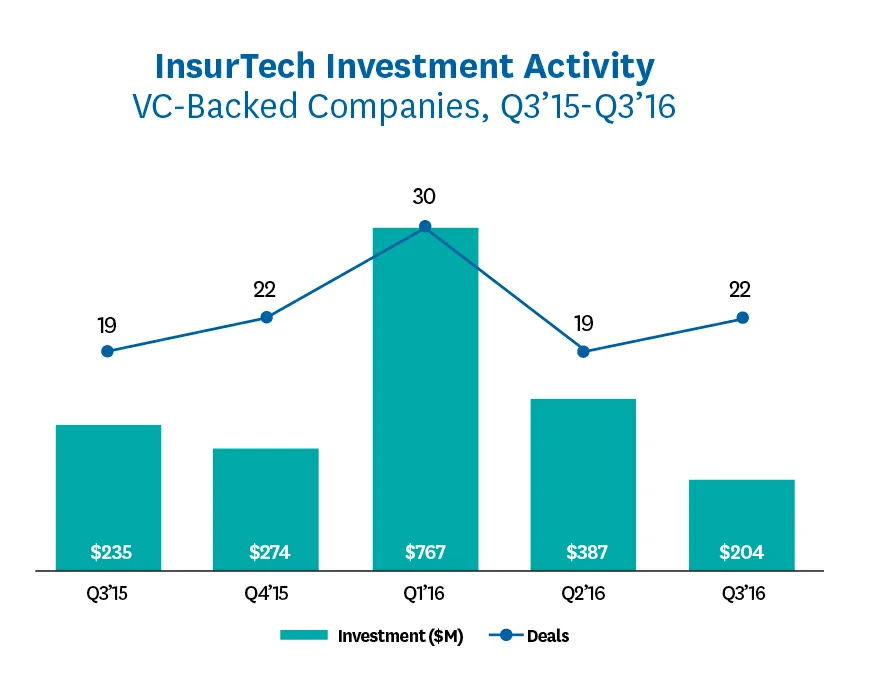

According to the ‘Pulse of FinTech’ report, a quarterly global update on FinTech VC trends published jointly by KPMG International and CB Insights, VC-backed InsurTech investments hit the $1 billion mark in the first half of 2016 (Source for the graph above).

Therefore there is certainly nothing boring about today’s insurance sector nor is there a shortage of funding for disruptors. On the one hand, change is being driven by nimble InsurTech start-ups and bold new ventures that leverage entirely new business models and technologies to disrupt the traditional insurance value chain. At the same time, changing customer preferences and the introduction of cutting-edge technologies are disrupting the way insurers interact with consumers and sell products. It is visible across the sector incumbents competing to introduce new technologies, from slick apps and automated advisors at the front end of the value chain through to robotic process automation and cognitive computing at the back.

Disruptions In The Local Market Will Be Very Slow If The Regulators Don’t Keep Pace With Industry Developments Globally. Inability To Assess Potential Risks Of Innovative Technology Will Only Slow Economic Growth.

Disruptions in the local market will be very slow if the regulators don’t keep pace with industry developments globally. Inability to assess potential risks of innovative technology will only slow economic growth. The insurance regulator has to keep pace with global developments and support the Industry to innovate and grow in the local market.

An InsurTech like Lemonade, the first so-called peer-to-peer insurance company, started by technology entrepreneurs, targeting smartphone users by offering ease-of-service transitions and cheap prices on homeowners and renters was able to debut in USA due to their appetite for smartphones and entrepreneurship not being scuttled by too much of regulations-of course there are pros and cons for the approach.

In the US, healthcare business post Obamacare paved the way to healthcare related InsurTech companies like Oscar, Collective Health and League to disrupt the value chain by directly accessing customers and enhancing their experience, as briefly clarified below:

Oscar is called a health insurance company that employs technology, design, and data to humanise health care. It is reinventing how to manage care, process medical claims, control healthcare costs, and provide transparency. With all the complexity hidden behind an easy experience for members, it’s making the healthcare system simple, smart and friendly.

Collective Health is a software and services company working to create a better healthcare experience. They assist companies in the U.S. to take better care of their people with a complete health benefits solution. They are bringing together the best medical, pharmacy, dental and vision networks.

League enables employers to provide their employees with health spending accounts, wellness accounts and group insurance plans, all delivered through a mobile-first platform. Users of the League App find health professionals, book appointments or speak to their team of advisors to get health tips. The League digital wallet allows users to pay for services from their phones.

$ 4.8+ Trillion Global Insurance Annual Net Premiums

Similarly, there are InsurTech companies providing online services (ZhongAn, an Internet insurance company, in Shanghai), policy comparisons (Policybazaar in India) and aggregators who are all breaking into the insurance sector using technology. The value chain is being disrupted, not only by new players entering the market, but also by traditional players trying to capture a greater share of the market. There are also reinsurers taking steps to move further up the value chain and ‘play direct’. And as they seek out new partners and routes to market, traditional insurers are starting to feel the pressure.

The CB Insights blog item also lists partnerships between InsurTech companies and P/C insurers and reinsurers. Among them are: Munich Re’s partnership with Slice Labs Inc. Liberty Mutual’s partnership with home security start-up Canary, Amica Mutual’s partnership with a weather data sensor start-up, Understory.

Understandably, insurance company CEOs are concerned about all this disruption. In a recent survey of more than 100 insurance CEOs conducted by KPMG International, two-thirds admitted they were concerned or very concerned about the threat from new entrants. Almost 80 percent of respondents said they are concerned they might not be staying competitive when it comes to new technologies. A similar number said they were worried their products may not be relevant in the next three years.

23% Market Share Of Top 10 Global Insurance Companies

Rather than reject innovation due to the absence of regulations or for the lack of understanding the potential risks, the regulators should use professionals to help them understand the risks and encourage innovation. For example, Monetary Authority of Singapore (MAS) has outlined a framework for driving the country’s FinTech industry, by supporting FinTech with a conducive regulatory environment and ecosystem.

$ 4.74 Billion Invested Up To 2016 In InsurTech Across 470 Deals

MAS will use a regulatory sandbox that would enable financial institutions to test products under less stringent laws which provides an environment where experiments could fail ‘safely and cheaply’ without widespread adverse consequences, to the market. Applicants would be reviewed and approved to proceed with the sandbox by MAS. The regulatory sandbox guidelines outlined how start-ups or financial institutions could go about testing FinTech products and services that were likely to be regulated by MAS.

Under this ecosystem MAS is planning to use the blockchain technology to pilot a system that could be used to issue and transfer funds between the participating banks. The pilot system would allow the participating banks to deposit cash as collateral with MAS in exchange for MAS-issued digital currency, which could be redeemed later for cash. The banks then would be able to pay each other directly using the digital currency, instead of sending payment instructions through MAS.

156% Increase In VCs Investing In InsurTech

Innovation can be managed with a similar governance framework alongside a conducive regulatory environment to encourage other competitors who are ready to invest in InsurTech to benefit the consumers and help the insurance sector expand. Insurance CEOs in Sri Lanka need to start by understanding the trends now disrupting the market and assessing where their organisation will operate in the next five to 15 years and what will it take to win in this technology driven future environment. Existing insurers who are not willing to innovate will have to improve their processes to stay in contention with the InsurTech companies. Some insurers in Sri Lanka have realised that they have to defend their territory and are now investing in new and disruptive technologies. However, the winner will not be the one with the newest tools-it will be the one who knows how to harness the right capabilities together to execute on their business and customer outcomes.

Writer Suren Rajakarier is a partner at KPMG in Sri Lanka and is also leading the insurance practice with a passion for enabling change.