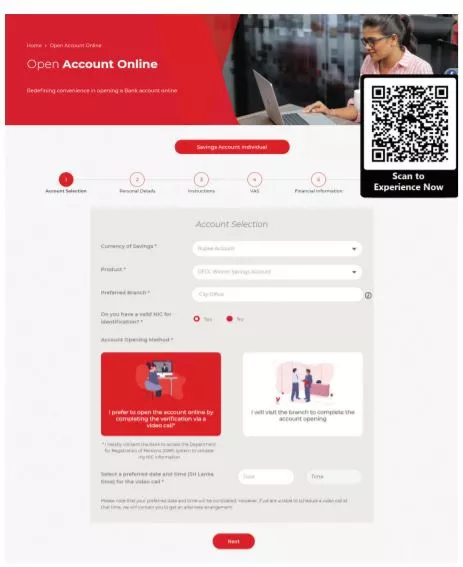

DFCC Bank moves forward by implementing the non-faceto-face onboarding process based on the guidelines issued by the Central Bank and accessing the database of the department of registration of persons to verify customer national identity card information. This initiative was timely, and the present outbreak of Covid-19 phase three minimizes the risk of spread or contagion since customers can onboard from the safety of their home using any device of their choice.

The introduced Non-Face to Face (NF2F) digital account opening process includes video verification using the ”DFCC Video Chatz” video banking service hosted on the Bank’s cutting edge trilingual website. Resulting from the recent guidelines issued by the Central Bank of Sri Lanka (CBSL), DFCC Bank has developed this fully integrated and seamless customer onboarding process. This process allows customers to open accounts digitally online without step ping into the bank branch anytime from any place. The National Identification Card data stored in the Department for Registration of Persons’ system is integrated to facilitate this seamless process digitally. It allows customers the convenience to open savings accounts, Foreign Currency (FCY) Accounts, Fixed Deposit (FD) accounts, and Special Deposit Accounts (SDA) virtually. Following this process, the applicant will be able to choose a convenient time for a video call with the Bank representative for the verification process to fulfill CBSL guidelines on the e-KYC process. In addition to driving greater customer convenience, which enables customers to open accounts in the comfort of their home or office, this initiative also supports one of the Bank’s sustainability strategies of moving towards a paperless and eco-friendly environment.

Lakshman Silva, CEO, DFCC Bank said, “In an era where digital transformation is something that the banking industry is now embracing. The Non face to face (NF2F) facility offers customers the utmost convenience they have never experienced before. As we are at the forefront of technological innovation, our solution will certainly be recognized as a benchmark in the industry. The launch of the NF2F facility further reiterates the Bank’s position of becoming one of Sri Lanka’s most customer-centric and digitally-enabled Bank. The user-friendly interface means that customers are given the option to open accounts by completing the online form from any device, including smartphones, tablets, and desktop computers. Therefore, this platform offered the convenience of opening an account at their preferred branch, without ever having to visit the branch in person.”

DFCC Bank accounts that can be opened through this state of the art Digital onboarding feature include – Winner Savings Accounts, Extreme Money Market Accounts, Float Money Market Accounts, Supreme Vasi Savings Accounts, Mega Bonus Savings Accounts, Garusaru Savings Accounts, SDA Normal Savings with FDs, SDA Supreme Vasi Savings with FDs and SDA Extreme Money Market Savings with FDs. In terms of Foreign currency accounts, this facility allows for Personal FCY Accounts, FCY SDA Savings Accounts with FDs, FCY SDA Supreme Vasi Savings with FDs, and FCY SDA Extreme Money Market with FDs as well. Acceptable currencies in which these FCY accounts may be maintained include USD, GBP, JPY, CHF, CAD, AUD, SGD, EUR, and CNY. DFCC Bank was ranked amongst Business Today’s Top 30 Corporates in Sri Lanka.