We continue with the assessment methodology used since 2011, for corporate governance for the Business Today TOP TWENTY FIVE winners in collaboration with Suren Rajakarier. Our aim is to further enhance good corporate governance practices in listed companies, and to influence better transparency and accountability in public listed companies, which will result in the growth of the capital market and set an example for others to follow. Good governance cannot be achieved through legislation only. It can be encouraged by recognising good practices.

By Suren Rajakarier

Background

“Organisations need to practice qualitative corporate governance rather than quantitative governance thereby ensuring it is properly run,” Mervyn King (Chairman: King Report)

The purpose of this analysis is to assess the extent to which the Business Today TOP TWENTY FIVE companies report the structures, strategies, policies and management systems they have in place for good governance, address environment and social issues, combat bribery and corruption.

The assessment focuses on how companies report on their approach to corporate governance and the efforts they are making to prevent or address misuse of resources.

There is no generally applicable global corporate governance model. Therefore, Sri Lankan companies work within the parameters set out by a local code, regulations and certain expectations of shareholders. Assessment of corporate governance is a subjective area and a subject where you cannot satisfy the needs of all stakeholders. However this assessment is performed with an aim to encourage better transparency, accountability, fairness and responsibility founded upon the concept of disclosure to improve trust and confidence of shareholders.

Experience has showed that having a good code of conduct and an admirable governance structure on paper is futile, if the leadership chose to ignore the spirit of governance. What is important is the right tone at the top encouraging good governance practices and a corporate culture that embraces qualitative principles.

“We Were Told To Push The Boundaries, So We Pushed The Boundaries. We Were Told You Wouldn’t Know Where The Limit Of The Boundary Was Until You Got A Slap On The Back Of The Wrist. We Found That Boundary, We Found The Edge, We Fell Off And Got Arrested”.

It is usually difficult to suggest if intentions are right or wrong. However, as in the case of NewsCorp, everything on paper was admirable but the corporate culture had started to change and the leadership chose to ignore it, this resulted in one of the oldest and respected UK newspapers being shut down. They had their own code of conduct and gave so much importance to governance. The seventeen directors of NewsCorp included nine who were nominally independent. The group’ concern for ethical conduct was reflected in a letter from Rupert Murdoch, Chairman and CEO, who said, “this public trust is our company’s most valuable asset: one earned every day through our scrupulous adherence to the principles of integrity and fair dealing. We have revised this ‘Standards of Business Conduct’ to make it easier to read and use, and to clearly outline what we should all expect of ourselves as colleagues. Each of us has the power to influence the way our Company is viewed, simply through the judgments and decisions we each make in the course of an ordinary day. It’s an important responsibility and I’m honoured to share it with you.” Apparently, this tone did not echo across the organisation!

A similar experience is the story of Kweku Adoboli, the rogue trader, who brought the Swiss banking giant UBS to its knees with losses of £7.5bn also supports the argument on culture. Adoboli told at his trial, “we were told to push the boundaries, so we pushed the boundaries. We were told you wouldn’t know where the limit of the boundary was until you got a slap on the back of the wrist. We found that boundary, we found the edge, we fell off and got arrested.” The prosecuting lawyer summed it well, “you played God in that bank, tearing up the rules and doing whatever you wanted. Rules were for other people: that was your attitude.”

Decent monitoring of compliance to governance rules may be required to enable all companies to up skill their boards to avoid nominal compliance. The above cases also raise concerns on the appointment and role played by Independent Directors.

Impact of independence of Independent Directors

Many questions come to mind, when assessing for level of governance; Do nomination committees really appoint directors to the banks and other PLCs? If they are nominated by the major shareholder can they be referred to as “Independent Directors”? What about the ‘fit and proper test’? Wouldn’t it be better for companies to have proper Independent Directors than to have nominees being called “Independent”?

One way of improving the governance framework in companies is by having more “Independent” directors on boards. Despite the view that directors who have no stake or share in the upside of the company may not be sufficiently motivated to add value, this method does improve governance. It is also important that such independent persons have the appropriate skill and experience. Because, you cannot ‘judge a fish by its inability to climb a tree’!

Through this assessment, it was noted that there are only few companies who have led the way in seeking out proper independent persons to their boards. It’s time that all PLCs introduce competent, younger and newer directors to their boards to infuse fresh ideas and new thinking, which may improve independent thinking as well.

“Corruption Is The Enemy Of Good Governance And Of Development”

However, true independence and effectiveness of an “Independent” director can only be measured by the director’s engagement in the boardroom and the freedom and willingness to leave the board if he is forced to compromise on the principles of good governance and not merely through the application of rules. Whether the director is old or young is not the key, as long as they have the freedom to express their views without being held back by their past baggage. The older you are the more baggage you carry.

Share distribution among Shareholders

One of the qualifying criteria for the Business Today TOP TWENTY FIVE is the volume of shares traded during the year. The companies with the highest trading record also reflect that there is adequate public interest and public float, which has allowed the stock market to flourish. It’s a reasonable assumption a sizeable public float is a necessity for a transparent, liquid market and greater the public float, the less potential there is for market manipulation.

Sri Lanka’s market, due to its small size, generally reacts sometimes well ahead of a stock exchange filing. Index heavy weight John Keells Holdings (JKH), one of the most liquid shares listed on the Colombo bourse is a hot pick amongst foreign investors and continues to be number one on the Business Today TOP TWENTY FIVE, for consecutive years. Blue chip banks such as Commercial Bank, HNB, NDB and Sampath Bank were within the top ten traded shares, on the list. Whilst, local units of foreign multinationals like Nestlé, Ceylon Tobacco and Chevron, which are relatively illiquid, were also able to get to the final list.

It is generally understood that a low free float reduces the depth of the market. If the supply of shares is limited it would lead to sharp price movements given strong buying in those counters, susceptible to manipulation. Though, a higher public float of shares does not have direct relevance to good governance rankings, it could reduce the impact of insider trading, improve appointment of independent directors, improve transparency in reporting and encourage better compliance with governance codes.

Deter Insider dealing

Companies should be mandated to disclose an insider dealing policy, which establishes the rules and procedures, to minimise risks of entering into insider dealings with the Securities by persons discharging managerial responsibilities. Such restricted persons should include the Members of the Board of Directors, CFO and Heads of Divisions. Companies ‘owned’ by these restricted persons also should be covered by the rules.

This Assessment Should Help Corporates In Sri Lanka To Appreciate And Know Why They Are Required To Follow ‘Good Principles’ Of Governance And Highlight The General Level Of Compliance.

Restricted Persons should be prevented from trading/dealing in Securities of the company and not be permitted to enter into any dealing with the Securities prior to obtaining clearance in accordance with the rules and procedures. There could be defined circumstances where clearance can be obtained for acquisition or disposal, for example transfer of securities within the family, rights issues or for gifting.

The policy should have a strict “prohibited period” for buying or selling by any Restricted Person. A Restricted Person should not be given clearance to deal with the Securities during a “prohibited period” or where the investment is of a short term nature or for trading purposes. Any such policy should also include a consequence for non compliance.

If non compliance is at the highest level then they should be reportable offenses to the SEC. SEC should have sanctions built into the law to make a serious commitment to prevent insider dealing with an efficient enforcement framework.

Any significant shareholder who is also on the Board directly or represented by nominees should be subjected to such restrictions to prevent manipulation of prices- downwards or upwards. However, many companies have not even attempted to disclose such policies in their Annual Reports.

Bribery and Corruption

“Corruption is the enemy of good governance and of development”

Whilst, bribery and corruption remain endemic problems in many countries, weakening governance and posing a major impediment to development, locally businesses have resigned to the state that it’s a cost of doing business. Though there is limited focus and disclosures on the issue of bribery and corruption, Corporates should pay more attention to reduce such occurrences. We need to find a mechanism in Sri Lanka to encourage leading companies to disclose policies and measures they are taking to combat bribery and corruption. This aspect of disclosure has not improved.

Segregation of roles of Chairman and CEO

Today, due to better enterprise risk management processes and governance responsibilities dictated by regulations, boards are challenged to be more effective and engaged than in the past. However, the culture set by the Chairman is a critical determinant of board effectiveness. For example, a director may come to a meeting without reading the respective board papers, open the envelope only when the meeting starts and could participate in the discussion in an unhelpful manner. The cultural ground rules, which dictate director attention, constructive challenge, risk appetite, and decision-making processes are critical to a board to be more effective and cannot be voiced by a CEO who is also the chairman?

The chairman should be held responsible to understand the strength of his board and to instill a constructive culture to have an effective board. Social and regulatory pressures on boards for fundamental change are substantial and well justified. Boards should transition from the ‘old-boys clubs’ to a responsible body that is accountable to its stakeholders. They are moving towards independent professionals headed by a non executive chairman. The better boards now believe the CEO works for them and execute their strategies effectively and transform teams to work within a high performance culture. Within the TOP TWENTY FIVE, in six companies the Chairman and CEO roles are held by the same person.

Assessment approach

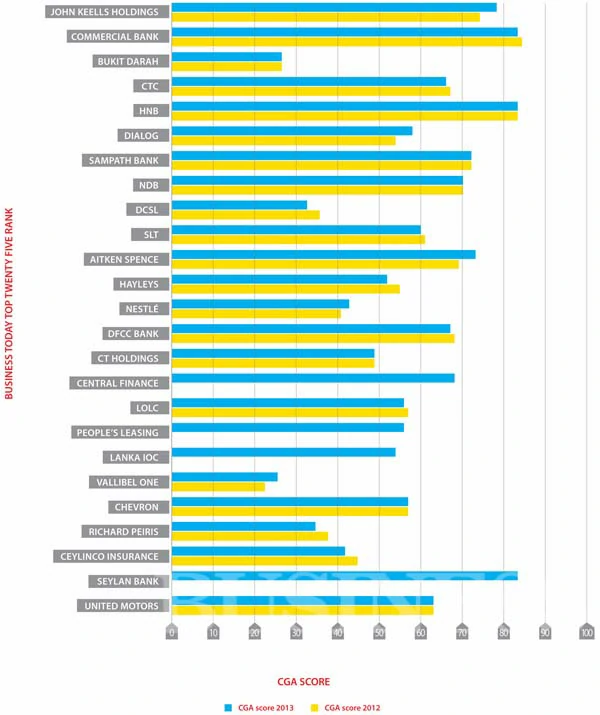

Corporate governance assessment can be done in several stages. This exercise is limited to a desk-top compilation of corporate governance profiles of the companies in the Business Today TOP TWENTY FIVE. Companies are scored from 0-100 based on their disclosure of information important for investors and the general public, like, corporate governance policies, level of compliance with local regulations, management controls, performance and what they are doing to prevent corruption along with some of the best practices identified through research. In the scoring, 100 is most transparent, and 0 is least transparent.

This assessment does not conclude that companies with better scores (based on disclosures) will make better results or vice-versa or in fact are better governed. Some of the issues in

Sri Lanka, where companies do not focus on transparency may relate to;

• Concentration of ownership

and presence of a controlling shareholder.

• Directors are related parties to the controlling party to primarily protect the nominator.

• Level of financial literacy of audit committee members.

• Inadequate capital market regulation and/or monitoring mechanism.

• No consequence for non compliance.

Findings and Conclusions

Corporate governance disclosures have improved by only a negligible level since the commencement of this review in 2011. This is proof that voluntary codes or compliance requirements will not achieve the desired results in our culture. This is not due to a lack of awareness by the Companies but also due to an impotent monitoring system over the listing requirements of companies. Lack of monitoring does not help in improving compliance above the minimal level of ‘tick a box’ approach. Therefore, similar to last year, 56 percent of companies in the above list are below the 60 percent level of compliance. Some of the common deficiencies continue to be; level of independence of Independent Directors, lack of a strong framework for related party transactions and avoidance of conflicts of interest, non-disclosure of a formal policy prohibiting dealing in securities by directors and officers, not fully recognising the role of a company secretary, the strategic importance of internal audit and board balance between executive and non executive directors, non disclosure of policy on bribery and corruption. Improvements were noted in the number one company on the list – John Keells Holdings and Seylan Bank at number 24.

In summary good governance should be ‘in principle’ and not about simply meeting the code requirements or rules. Attitude for implementation should be to strengthen the value system in the company. Some factors that may require further attention are:

z Diversity and nomination committees:

Most boards reflect the majority shareholder interest rather than the broader stakeholder interests in how and who they recruit into their ranks. Boards should establish a proper nomination committee to encourage diversity in appointing the right people to its board. This may focus on the composition of women, professions and age of new directors taking into account the most appropriate skills and competencies, experience, organisational ‘fit’ and the market profile of the business.

z Remuneration policy:

It is common knowledge that remuneration and incentive schemes can promote fraud and misreporting if not designed and controlled well.

In an increasing number of countries it is regarded as good practice for boards to develop and disclose a remuneration policy statement covering board members and key executives. Further, it is considered a good practice to establish a remuneration committee with independent directors to manage the policy and employment contracts for board members and key executives.

z Evaluate Board performance

Examine directors’ confidence in the integrity of the enterprise,

the quality of the discussions at the board meetings, the credibility of reports, the use of constructive professional challenge, the level of interpersonal cohesion and the degree of knowledge. In evaluating individuals, go beyond reputations, resumes, and skills to look at initiative, roles and participation in discussions and energy levels. Eleven companies in the TOP TWENTY FIVE had over 12 board meetings during the year and five companies had only two to four meetings for the year.

It appears that these TOP TWENTY FIVE companies seem to be having an ability to produce consistent results which also indicates that the Board’s are able to drive a higher quality of earnings. Better disclosures will provide that confirmation to others and motivate companies to improve their governance practices. Generally, poorest quality of earnings is associated with weak corporate governance, and companies with poor-quality earnings underperform the market. A number of studies have shown that good governance may indicate less expropriation of corporate resources by management. Also employees and suppliers are more loyal believing their relationships will be more prosperous; they will be treated fairly; and the relationship will be long term. These good companies are able to attract good quality investors who may not interfere in operations.

This assessment should help corporates in Sri Lanka to appreciate and know why they are required to follow ‘good principles’ of governance and highlight the general level of compliance. This publication also serves as recognition of corporates who are striving to demonstrate good governance and transparency in their disclosures.

© Assessment tool development and technical input by Suren Rajakarier FCA, FCCA, FCMA (UK), CGMA. Head of Audit – KPMG Sri Lanka.

Principles and disclosures

considered in this assessment include

1 Segregation of the roles of Chairperson and CEO and non executive role of Chairperson.

2 Criteria for Non Executive Directors (NED) and independence policies.

3 The inclusion of an integrated report that focuses on economic, environmental and social impacts and third party certification.

4 Extent of disclosures about participation by the directors at meetings and any related procedures that improve governance practices.

5 Disclosure of a formal policy prohibiting dealing in its securities by directors, officers and other selected employees for a designated period.

6 The positioning of internal audit as a strategic function that conducts a risk-based internal.

7 Whether a definitive set of standards and practices is implemented based on a clearly articulated code of ethics and disclosure to its’ adherence.

8 Committees of the board, reporting procedures, existence of written mandates or charters for the committees and ways of evaluating them.

9 Disclosures made with regard to performance appraisal of the Board of Directors and CEO.

10 Composition of the audit committee with a majority of non executive directors and financially literacy of its members.

11 Role of the Company secretary – disclosure of the role and assistance provided to the Board. Importance of this role to act as a central source of guidance on matters of ethics and governance.

12 Disclosure of the process in place for related party transactions to avoid conflict of interest and to comply with requirements for the transactions and rationale for transactions.

13 Contents of the audit reports.

14 Disclosure of the business model operated by the company along with a detailed risk management report, which sets out risk mitigating strategies used by the company.

15 Aspects included in the GRI Reporting Framework in relation to information disclosed in respect of bribery and corruption and involvement in public policy-making.