It is clear that the government has yet to get to grips with the nation’s inflation problem. The figure has been soaring into mid teen levels and the government’s economic gurus who used various formulas in the past to contain this situation, have not been successful.

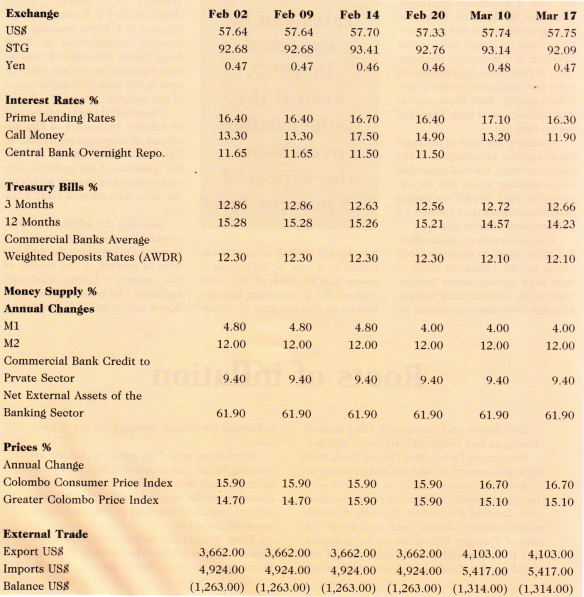

One of the formulas expounded by the government economists is that inflation could be controlled by controlling money supply. Deputy Minister of Finance, Prof G L Peiris in his keynote address at a seminar on the current state of the economy and future prospects held last month said, ‘we have been very vigorous in our handling of the monetary policy. We have contained the money supply. It has come down from 23 percent when we assumed office to around 12 percent today.”

‘The control of inflation is the primary objective of our government. We do not agree with people who argue that a little inflation is all right. Some people argue that a little bit of inflation can do no harm: it can do a certain amount of good. But we do not believe that is a realistic attitude to adopt. All inflation is harmful. It is not at question of how much inflation is acceptable. How much is too much? Inflation is like pregnancy, Either you have it or you don’t. You can’t have some of it but stop at a certain point. So the government has a very clearly defined attitude to the phenomenon of inflation,’ said GL Peiris, explaining the PA’s stand on this situation.

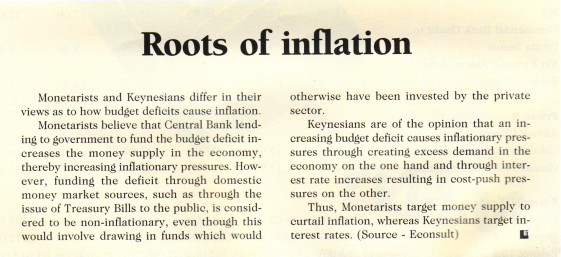

Meanwhile, economists speaking to ‘Business Today’ say that the government’s policy to combat this problem is still not very clear. The Central Bank strategy on one hand looked like a monetarist approach to economic management. Last year these economists found that the Central Bank was taking the position that inflation is a monetary phenomenon caused by an increasing money supply over and above an increase in real out put (real GDP).

Then the question was whether the Central Bank strategy of con- trolling the money supply was effective and whether it caused more harm than good? If the strategy was to be effective there should have been a clear indication that controlling the money supply would lead to reduction in inflation. However, empirical evidence did not support such a relationship economists say.

Despite what Prof Peiris said, economists now find that the government is not controlling the money coming in, but in fact is helping to create more liquidity in the money market. It appears that they have now shifted their position and have started targeting interest rates.

This was seen when Commercial Banks’ statutory reserve ratios were reduced from 15 percent to 14 percent with effect from January 1997. This has resulted in a reduction in lending rates by around 1 percent.

Hiran Mendis of Econsult told ‘Business Today’ that ‘scarcely a year ago, the Central Bank’s thinking was that interest rates had to remain higher than the rate of inflation. This was consistent with the idea that high real interest rates are required to attract savings and thereby encourage investments. Furthermore, a restrictive monetary policy was thought to curtail inflation.

Mendis says that government policy makers have defended a relaxation of monetary policy by arguing that inflation will be curtailed below 10 percent in 1997 from a high of 16 percent in 1996. However, by their own admission, lower reserve ratios will result in inflating money supply by around Rs 10 billion. Yet, curiously, rather than resulting in higher inflation, policy makers now expect inflation to reduce to below 10 percent levels.

The government has shifted its stance to one of targeting interest rates and loosening credit controls and away from targeting money supply and constraining credit to subdue inflation. This confirms the change in the government’s monetary policy stance to one consistent with a Keynesian approach. What can be inferred from this change is either that the monetary authorities no longer believe that inflation is a monetary phenomenon or that controlling inflation is not a precondition to promote economic growth. Both these contradict the ‘dogmas of faith’ preached not so long ago.

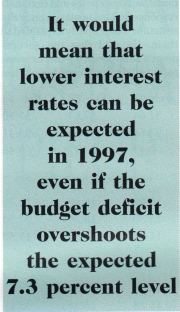

‘Whatever the logic of the argument and the justification of the chosen strategy, it would mean that lower interest rates can be expected in 1997, even if the budget 7.3 percent level ’ Mendis Said.

The Government meanwhile, has taken steps to obtain a credit rating for Sri Lanka, in order to help even private sector borrowings in the international market. Minister Peiris also announced recently that they have been succently that they have been successful in embarking on a floating rate note which was successfully marketed in Hong Kong, the Gulf and London. Fifty million US Dollars on a 3 month note was obtained at a rate of 1.51 percent above LIBOR. One of the main reasons the government has embarked on this exercise of obtaining hard currency through floating rate notes is due to the fact that they realise the need to access international capital markets for their infrastructure programmes.

Minister Peiris has pointed out that infrastructure development and raising of capital to subserve those objectives are very much in the mind of the government at the present time. Governor A S Jayawardena secretary to the Treasury, BC Perera PERC chairman, Dr P B Jayasundara and Minister GL Peiris meeting with banking communities in Hong Kong, Seoul, Bahrain and London have stressed on certain vital criteria in the economic performance of the country.

Three criteria were emphasised as reliable indicators of the adequacy of economic performance. The first of these was the volume, the quantum of the country’s foreign exchange reserves, which today is in the region of US$2.5 billion.

Secondly the infinitesimal proportion of resources that is needed to devote to servicing the national debt in relation to the totality of the country’s foreign exchange earnings. The proportion shows a figure as low as 12.5 percent for Sri Lanka. A noteworthy pointing to statistics the deficit is as low however is that despite 1996 being a bleak year, Sri Lanka’s debt service ratio being as low as 12.5 percent, in comparison with the entirety of the country’s foreign earnings, i.e. money received from agricultural exports, remittances from the Middle East etc.

The third criterion emphasised on was the current account situation that is deficit. Again, accord as 3.9 percent of GDP.

Minister Peiris says these three things which need to be taken together were not adequately known and acknowledged by the international banking circles and that their response was enthusiastic once the situation was properly explained to them. He said that the government’s ability to bring this exercise to a satisfactory conclusion has been possible notwithstanding one of the most open systems in this part of the world. ‘It is a genuinely free system. There is no element of protectionism. Repatriation of dividends, current account transactions and so on are permitted. Notwithstanding that backdrop, and the difficulties we went through last year, these achievements have nevertheless been possible,’ Minister Peiris said.