February 28, 2023. Justinas Baltrusaitis.

Gold has remained a vital element in the financial reserves of nations, and its allure shows no signs of waning. This is illustrated by the fact that a considerable proportion of gold is held by a subset of central banks relative to total foreign reserves.

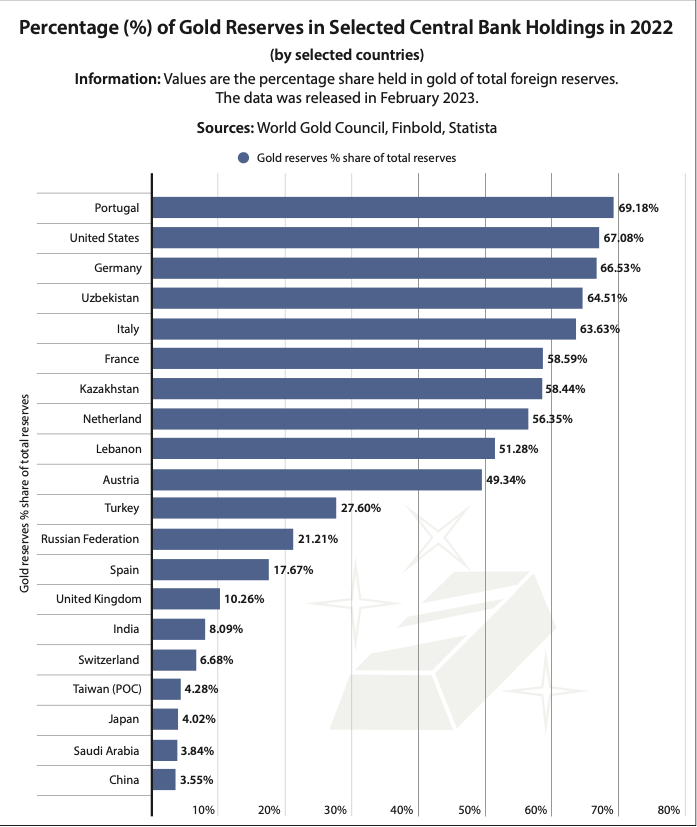

In this line, according to data obtained by Finbold on February 28, Portugal accounts for the highest gold share ratio to total foreign reserves at 69.18%, followed by the United States at 67.08% in 2022. Germany’s ratio ranks third at 66.53%, while Uzbekistan is fourth at 64.51%. Italy occupies the fifth spot at 63.63%.

Elsewhere, among the selected countries, China occupies the 20th position with a ratio of 3.55%. Overall, the top 20 countries are dominated by European nations, accounting for over 50%.

Drivers behind gold reserves

Although the highlighted countries have varied gold reserve ratios, the motivation driving the accumulation for countries like Portugal, China, and the U.S. remains the same. Notably, gold is a historical safe haven for many economies. The asset also acts as an option for diversification of reserves, store of value, collateral for loans, and international settlement option. Gold remains an important part of central bank reserves, but the percentage of reserves held varies widely across countries.

China’s gold holdings are still relatively low compared to other major economies. However, the Chinese government has been steadily increasing its reserves in recent years. This is, in part, a strategy to diversify its foreign exchange reserves away from the U.S. dollar, the dominant global reserve currency.

It is worth noting that China has historically been known to accumulate its gold covertly; hence uncertainties remain regarding the total reserves held by the country.

U.S. dominance in gold reserves

Notably, the U.S. remains a dominant player, driven by several elements such as historical factors, the dollar’s role in the global financial system, a strong economy, and political stability. However, it remains to be seen if the country will hold the position for long.

The role of gold for central banks has been elevated following the overflowing effects of the pandemic. With the rising inflation, the importance of gold as a safe- haven asset and store of value has increased. This is evident in the decision of many banking regulators to continue to purchase the metal, despite the fluctuations in its demand over time.

Furthermore, the appearance of global spikes in government debts and inflation concerns has further emphasized the significance of gold in national strategies. With the stock market witnessing increased historical lows, central banks view gold as the perfect option to guard the economy in the event of a similar crisis.

At the same time, gold’s relationship with the U.S. dollar is an added element of appeal to the precious metal. In this line, when the dollar dips, as recently witnessed, the value of gold typically rises, enabling central banks to protect their reserves amid market volatility.

The future of gold reserves

Gold’s rising importance has seen more central banks, mainly from Europe, enact policies to aid the buffering of reserves. Overall, the significant share of gold reserves in the region has been an effort to strengthen the financial system’s stability during geopolitical uncertainty and global structural changes.

Looking ahead, the gold reserves held by the highlighted central banks are likely to keep increasing, with the asset having proven its resilience as the global economy grapples with high inflation.