Seizing the Opportunities amid the Winds of Change

There was much hope and renewed zest at the dawn of 2020. After all, the country had emerged from a challenging 2019 and its noticeable impact on many sectors. At the same time, Sri Lankans looked upon 2020 with great expectations. At the helm was a new leadership that had promised prosperity through a wide-ranging development agenda.

By Jennifer Paldano Goonewardane.

| 1 | Hayleys | 37.250 | ||

| 2 | Lanka Orix Leasing Company | 36.900 | ||

| 3 | Commercial Bank | 33.050 | ||

| 4 | Carson Cumberbatch | 32.800 | ||

| 5 | Vallibel One | 32.350 | ||

| 6 | Bukit Darah | 31.550 | ||

| 7 | Hatton National Bank | 31.050 | ||

| 8 | Expolanka Holdings | 30.100 | ||

| 9 | John Keells Holdings | 28.700 | ||

| 10 | Melstacorp | 28.100 | ||

| 11 | Sri Lanka Telecom | 27.000 | ||

| 12 | Sampath Bank | 26.400 | ||

| 13 | Richard Pieris and Company | 26.200 | ||

| 14 | Royal Ceramics Lanka | 24.450 | ||

| 15 | Cargills Ceylon | 24.050 | ||

| 16 | Dialog Axiata | 22.950 | ||

| 17 | Ceylinco Insurance | 22.450 | ||

| 18 | Distilleries Company of Sri Lanka | 22.400 | ||

| 19 | Hemas Holdings | 21.750 | ||

| 20 | National Development Bank | 18.850 | ||

| 21 | Ceylon Cold Stores | 18.050 | ||

| 22 | LB Finance | 18.000 | ||

| 23 | Dipped Products | 17.050 | ||

| 24 | Singer Sri Lanka | 15.750 | ||

| 25 | Lanka Walltiles | 15.550 | ||

| 26 | Seylan Bank | 15.400 | ||

| 27 | People’s Leasing and Finance | 14.550 | ||

| 28 | Nations Trust Bank | 14.350 | ||

| 29 | CT Holdings | 13.650 | ||

| 30 | LOLC Finance | 13.450 | ||

| 31 | CIC Holdings | 12.350 | ||

| 32 | Tokyo Cement | 11.900 | ||

| 33 | Ceylon Beverage Holdings | 9.350 | ||

| 34 | Central Finance Company | 9.100 | ||

| 35 | Lion Brewery Ceylon | 9.050 | ||

| 36 | DFCC Bank | 8.500 | ||

| 37 | Haycarb | 8.250 | ||

| 38 | Teejay Lanka | 8.000 | ||

| 39 | Access Engineering | 7.550 | ||

| 40 | Nestle Lanka | 7.350 |

Although in late 2019 the world felt the rumblings of a new virus, the full-blown pandemic of the 21st century plunged the world into navigating through unforeseen scenarios, demanding not just adjusting to the new reality, but for agile leadership and proactive measures.

Under a new operating environment, Business Today Top 40 2020/2021 is an apt acknowledgment to some of the most resilient organizations and their leaders who, despite extreme operating conditions, went the extra mile to demonstrate their commitment to fulfilling their obligations to multiple stakeholders. As Sri Lanka’s businesses came to grips with the numerous challenges before them at the beginning of the last financial year, just as they were recovering from a formidable 2019, they had to seek a new strategic direction to steer their operations. Among them are some of the most diversified conglomerates whose businesses thousands of people depend on for their livelihoods. One cannot underscore the impact of continued challenges in labor mobilization, the loss in productivity, and time lost due to the periods of lockdown. Despite this, Sri Lanka’s corporates took the helm to drive proactive strategy to achieve sustainable growth in the more resilient sectors while cautiously dealing with affected sectors.

This year, the Business Today TOP 40 2020 / 2021 is placing the spotlight of recognition on companies that have driven social and national interest in their business endeavors. Under the new standards, Business Today has replaced three earlier criteria with two new bars. This shift in the judging benchmarks is right on board. Those organizations recognized this time had shifted their governance and stewardship priorities to ensure business sustainability, health, safety, and employee well-being while providing uninterrupted serviceability to customers and their obligations to many stakeholders. One cannot but acknowledge the multiple scenarios that plunged the entire country into during the period under review. They ranged from uncertainty and loss of livelihoods to safeguarding the livelihoods of millions amid an economic landscape where the forex crunch and limitations to trading and restrictions on imports had to be analyzed against the potential to increase revenue and stay afloat.

What began as Business Today TOP 10 in the mid-1990s has progressed to allow more corporates to enter the rankings, which until last year was Business Today TOP 30. With the change in criteria this year, Business Today increased the rankings to 40, thereby allowing more corporates that may not have been eligible before to enter the system this time. Further, several corporates recognized previously have not made it to the Business Today TOP 40 2020 / 2021 list due to the awarding criteria change. In addition to the holding company, their subsidiaries in the secondary market made it in through the new standards. Significantly, some of the subsidiaries had performed better than the parent company, thereby marking their presence for the first time in addition to the parent company in this year’s TOP 40 list.

What is noteworthy among the conglomerates present in critical sectors in the country is the resilience and the hardcore attitude to adjust the sails according to the wind to secure their bottom-line and meet the requirements of all stakeholders while supporting the country’s development drive. As significant as it is, this year’s list of winners includes several companies in manufacturing, a trend that departs from past lists where financial institutions dominated the awards.

As the Hayleys Group emerges at the top, it has recorded the highest profit of 14.05 billion rupees in its history of 143 years, a resounding victory for such a large conglomerate that employees over 30,000. The company owes this record to the stellar leadership of Hayleys, led by Dhammika Perera and Mohan Pandithage. They have left no stone unturned to explore the revenue sources and savings. They have been attentive to opportunities to rise from the crunch to navigate a challenging landscape. Except for leisure, the Group managed to consolidate its operations, knowing the threat of a future surge in infections. Thus, they managed to reopen their factories to avert job losses, thereby relieving the anxiety of employees, SMEs, and microentrepreneurs who were reliant on income derived from their operations.

At number 23, Dipped Products PLC, a subsidiary of Hayleys, leveraged the soaring demand for gloves amid the pandemic, helping it record the best sales and profit for the financial year. With a multi-product and multi-service portfolio, Singer Sri Lanka entered the Business Today TOP 40 2020 / 2021 as a retailer and wholesaler of consumer durables at 24. While navigating through the unprecedented challenges of the past year, the company retained its market position due to robust corporate governance practices and strong leadership provided by its major shareholder Dhammika Perera and chairman Mohan Pandithage. Likewise, Haycarb, a manufacturing subsidiary of Hayleys, marketing coconut shell-based activated carbon is on the Business Today TOP 40 2020 /2021 list for the first time at 37. It recorded the most robust financial performance of its 45-year history, marked by heightened profitability in a strong balance sheet.

Meanwhile, LOLC Holdings has managed to retain its number two position this year as well. Despite a challenging operating environment, the Group has delivered unprecedented bottom-line results of 57 billion rupees in Profit Before Tax, a Profit After Tax of 53 billion rupees, and a total comprehensive income of 83 billion rupees, a first for any corporate in the country. LOLC Finance has entered the fray at number 30 as a standalone entity, making it into the Business Today TOP 40 2020 / 2021 rankings. While high on its agenda was sustaining a high-quality loan book and managing non-performing loans, the company has recorded an impressive asset base and a profit after tax.

The rankings of financial institutions in this year’s Business Today TOP 40 2020 / 2021 show a movement in rating compared to the previous year due to the change in the selection and ranking criteria adopted this year and did not in any way suggest a reflection of reduced performance. Commercial Bank that emerged in the top position last year has changed rankings this year. So have Hatton National Bank, Sampath Bank, National Development Bank, Seylan Bank, Nations Trust Bank, and DFCC. For those financial institutions listed in this year’s Business Today TOP 40 2020 / 2021, the challenges apart from cooperating in the COVID-19 recovery process by granting working capital loans and providing concessions to affected sectors, including government-mandated debt moratoria, partnering and collaborating with the national economic development efforts of the government were virtually insurmountable. Towering over was also the rising quantum of non-performing loans, rising credit costs, and subdued loan growth. In this complex scenario, there was a need to acknowledge the existing state of affairs. Therefore, rather than single-mindedly focusing on profitability, the need to stand with the customers to support them to navigate through an unparalleled period in history is most admirable. Moreover, the situation drove financial institutions to manage their assets’ quality and liquidity, including revisiting strategic priorities in light of the challenging operating environment and stakeholder expectations.

As the leisure sector and its subsidiary sectors, manufacturing, and the SMEs felt the most from the downfall, financial institutions responded exemplarily by rising to the occasion as partners in the national effort to rebuild the country. They responded positively to the call to implement relief measures and debt moratoria to help businesses recover. And the financial institutions that have made it into this year’s Business Today TOP 40 are those that have, despite the modest growth in the financial services sector, come up with new programs to offer working capital loans to uplift entities affected by the pandemic.

It is noteworthy that Commercial Bank, under the astute leadership of S Renganathan, its Managing Director/ CEO scored the highest ever single-year growth in deposits, thereby increasing its total asset base. Hatton National Bank, led by its Managing Director/CEO Jonathan Alles, despite the extreme volatility, managed to record a profit after tax, and an increase in the Group and Bank deposits, and an increase in the Group’s total assets. Priyantha Talwatte took office as CEO / Director at Nations Trust Bank at the peak of the pandemic-led crisis in the country. Nevertheless, he skillfully navigated operations to manage costs to record a growth in profits.

Non-bank financial institutions such as People’s Leasing and Finance have recorded the highest ever profit in the history of the Group by realigning its strategy to face an altered landscape. In contrast, the Central Finance Company registered profits due to a surge in deposits.

Ceylinco Insurance, ably led by Ajith Gunawardena, Executive Chairman / CEO, is the only insurance company always on the list. Ceylinco Insurance has continuously recorded robust performances as a leading entity in the insurance sector. Successfully ‘challenging the challenges’ of 2020, where regardless of the external impasse, its Life and General Insurance companies remained strong and sought after, leading Ceylinco Insurance to record a stunning consolidated profit after tax for the year ending 31st December 2020.

Bukit Darah has also demonstrated resilience in the face of a challenging year with a noteworthy operational performance. Witnessing the future course, the company, led by the farsighted leadership of the Selvanathan family, decisively adapted their businesses to the impact of challenging times to help them continue their support to all stakeholders. Accordingly, business sectors that directly interact with customers, such as beverage, oils, fats, and leisure, were negatively impacted due to lack of demand and access restrictions. However, on a standalone basis, the company was able to increase its revenue. Making it to the Business Today TOP 40 2020 / 2021 is also Carson Cumberbatch, which has managed to decisively execute business strategies across its diverse business segments, giving it a strong balance sheet for sustainability through turbulent times. Their subsidiaries – Ceylon Beverage Holdings and Lion Brewery, have also made it to the TOP 40 list for the first time as standalone entities.

As a young diversified conglomerate, Vallibel One, led by Dhammika Perera, a leading business visionary, has climbed in the rankings this year. The Group has managed to re-energize operations across all companies to post impressive growth in revenue. Contributing significantly in this regard are the conglomerate’s subsidiaries operating in the lifestyle space, namely Royal Ceramics Lanka and Lanka Walltiles, leading the top-line in revenue generation. Complementing this contribution was the company’s non-banking financial service, namely LB Finance, recognized as a separate entity in the Business Today TOP 40 2020 /2021 list of winners. And under Vallibel One, Royal Ceramics Lanka and Lanka Walltiles, and the non-banking finance sector have lent a massive 81.5 percent of the consolidated revenue. The two manufacturing businesses Royal Ceramics Lanka and Lanka Walltiles, recognized at this year’s TOP 40 awards, have contributed excellent profits, a dividend for the past investment made to the Tiles and Associated Products sector by the Group.

As a longstanding figure in Sri Lanka’s corporate landscape, Harry Jayawardena’s Melstacorp receives recognition for its stability across many sectors. Melstacorp’s position in the Business Today TOP 40 2020 / 2021 acknowledges its resilience and leadership direction to navigate the Group to support flailing businesses by stronger ones. This thrust is reflected best in the impact on Melstacorp’s bottom-line due to tourism. The non-leisure sectors in the Group that had recorded the highest profitability had enabled to buttress the loss incurred by the tourism sector. The Distilleries Company (DCSL), a subsidiary of Melstacorp, which at one point dominated the number one position in the early days of the corporate awards, has yet again entered the fray as a standalone entity. DCSL has sustained the Group’s performance amid the closures and disruptions to operations with a staggering revenue of 97 billion rupees.

Logistics being the key driver of its business growth, Expolanka Holdings documented outstanding financial results for the year under consideration. Re-joining the Business Today TOP 40 2020 / 2021 ambit, the Group achieved an impressive ranking of number eight, coming within the first 10 for the first time.

While the John Keells Group has felt the impact to its bottom-line due to disruptions to many of its operations in the leisure industry, property and bunkering business, the positive performance in the retail, IT, plantation, and financial services has helped the company weather the vicissitudes. The manufacturing sector was relatively resilient, demonstrating a rebound to its earlier levels. Ceylon Cold Stores, representing beverages and frozen confectionary, rebounded in the year’s fourth quarter, delivering a resilient performance. It went on to record a growth in its profit after tax against the previous year. The Group continued investment in refurbishing its portfolio of leisure properties. It increased the outlets of the supermarket business, enhancing the capacity and capability in the frozen confectionery and insurance businesses. Despite the downturn, the Group retained its large workforce and continued its sustainability management framework to ensure that sustainability considerations remained an integral part of all business operations.

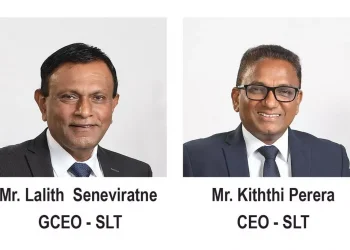

Sri Lanka Telecom, led by Group Chairman Rohan Fernando and Group CEO Lalith Seneviratne, saw through a financial year where the company executed the brand unification of SLT and Mobitel. It was a year of unparalleled scenarios. First, the Group recorded historical achievements on all fronts and posted the best-ever net profit of 7.9 billion rupees for the financial year of 2020. Second, the Group leadership is pleased with the new working relationship with the trade unions where teamwork has replaced conflict. It was a year with the least number of disputes between the management and the staff. This departure in the working relationship, for the administration, is an example to other state and state-dominated institutions, as the work ethics of its employees has shifted to one of engaging in cost-saving programs, which the management describes as ‘going beyond their call of duty.’ SLT stands tall as the only state entity working efficiently, similar to a private corporate while generating stupendous profits to conduct its operations without depending on the state kitty. SLT has been one of the significant contributors to the country’s shift to using digital platforms in vital spheres of life, including provision for tailor-made digital media with simplified applications for ease of operation in education, health, agriculture, judiciary, and MSMEs. While investing robustly in new technology and infrastructure, the Group has constantly supported many socially responsible projects during this pandemic hit era.

The positive impact of the new working environment embraced by all sectors gets accrued to companies operating in the telecommunications space is further augmented by Dialog Axiata. Dialog sustained its performance in 2020, recording growth across its core business segments to achieve a consolidated increase in revenue and profits.

Cargills Ceylon, a significant subsidy of CT Holdings operating in the FMCG sector, has entered the Business Today TOP 40 2020 / 2021 for the first time at number 15. An iconic brand synonymous with the Page family and driven by Ranjith Page, Cargills has contributed overwhelmingly to the Group’s performance despite the hindrance to its core operation in food retailing that demands daily interaction with customers and suppliers. In maintaining a stakeholder focus in the given circumstances, the Group continued to source from farmers within its network, thereby honoring its commitment to sustain livelihoods and contribute to the government effort to rebuild the nation and restore lives.

Climbing up in the rankings to number 13, Richard Pieris and Company, which has held several positions in the Business Today TOP 30 previously, has recorded the highest-ever profit earned by the Group. Operating under the prudent leadership of Dr. Sena Yaddehige, Chairman, CEO, and Managing Director, who took the helm of a native company with a legacy to turn it into a diversified conglomerate working through a progressive business lens. At number 19, Hemas Holdings has seen its rankings change over the years. The Group leveraged the strength of its pharmaceutical and hygiene products to record a growth in revenue and operating profit led by an aggressive focus on cost management and cash conservation. Against a backdrop of a complete halt to construction projects and production plants in the first wave of the pandemic, and continuous disruptions, Access Engineering, a name synonymous with the leadership of Sumal Perera, is the only construction-related company to re-enter the list after last year’s absence. Nevertheless, Access Engineering was able to continue business and perform satisfactorily through a concerted effort of rigorous planning.

As one of Sri Lanka’s leading conglomerates with ventures in agri-business, livestock, health, and personal care, CIC Holdings has entered the Business Today TOP 40 2020 / 2021 for the first time tabling its best-ever profit after tax in the year under review. That reflects an impressive two-fold year-on-year growth, while the Group declared dividend to its shareholders, the highest ever return distributed to shareholders in its history of over five decades.

Despite the exposure of the construction industry to never before seen challenges in the past year, Tokyo Cement that re-joined the race last year, has reported the best financial year of its history, with the highest revenue and profit to date. This achievement is a result of strategic investment in production reengineering and capacity expansion undertaken over the years. The members of the Gnanam family, who serve in this once family-owned business, are known for their immense contribution to supporting community welfare and environmental conservation, which the company laudably continued during the year under review.

Just as was expected, the corporates have adjusted unprecedently to the pandemic-driven new operating environment. As the pandemic scenario unfolded, they adopted a stakeholder focus. This stakeholder-centric view guided every activity as they sought and seized opportunities identified through a stakeholder perspective. However, the impact of repeated pandemic waves, just as many of them were reopening and adjusting to work robustly in a new reality, is not lost on these organizations’ annual report disclosures. The degree of uncertainty is acknowledged extensively. So is the demonstration of their ability to respond proactively, positively, and optimistically to adjust their sails to the unpredictable winds of change. The versatility of the leadership in the conglomerates listed demonstrates the full throttle to seize the opportunities as they work towards stimulating and initiating the drive for economic growth in a post-pandemic era.

What is also admirable in their performances in a changing business landscape is the commitment of those companies to embrace key sustainability goals while focusing on creating equal opportunities in the workplace.

As listed companies, the TOP 40 organizations recognized this year by the Business Today magazine maintain a high profile given their visibility. They carry with them a higher value than others. With such recognition and visibility, these corporates attract the crème de la crème of executives and employees. They sustain their statuary obligations, providing a vital source of State revenue. It is time for Sri Lanka to augment its portfolio of listed companies to harness the advantages of a robust capital market.

At the end of the day, when a country is on a recovery trajectory to put its economy on track, all sectors have to contribute decisively. The government explicitly called upon the corporates to play their part, and they did so to varying degrees. However, as acknowledged at this year’s Business Today TOP 40 2020 / 2021, the companies recognized have made their mark solely based on their contribution to the national cause and not so much on their bidding strength in the stock market. The companies in Business Today TOP 40 2020 / 2021 have been the most ardent champions of the country’s rise through this austere period.

As BT Options concluded the Business Today TOP 30 2019/2020 rankings last year amid the pandemic, it highlighted the necessity to revise the selection criteria when performing the analysis for 2020/2021. And in keeping with that observation, Business Today has concluded this year’s edition of the rankings under two new criteria, which has allowed new corporates to project their stories of success. BT Options extends its heartiest wishes to all the corporates that have successfully entered the rankings for 2020/2021. They are a true testament to the strength and sagacity of the private sector in Sri Lanka.

And as the corporate journey continues, we see that the country is gradually adjusting to a new working order, where the corporates have embraced a gung-ho attitude. Against this backdrop, it’s hoped that they will become stronger with the support of Finance Minister Basil Rajapaksa, who has pledged to provide a business-friendly environment in the country, focusing on development and economic revival. As a strategist with a positive attitude in all circumstances, Basil Rajapaksa is sure to leave no stone unturned to ensure that the vistas of prosperity will be ushered in through supportive policies to create a more robust private sector. He also carries a vision for Sri Lanka. Even amid a challenging landscape, he envisages developing entrepreneurship in the country, as stated in the budget speech. Accompanying this prospect is to drive investment in technology and renewable energy while cutting down public sector waste. As the country marches forward in a new economic reality at this critical juncture, everyone hopes that the Finance Minister’s political perceptiveness will shine through.

A must mention appreciation goes to Keith Bernard and Shiron Gooneratne, who have been a part of this listing throughout the years. We cherish their invaluable support and guidance.

KPMG Sri Lanka assisted in tabulating the Data.

Editorial Team Jennifer Paldano Goonewardane, Imara de Chickera, and Swetha Ratnajothi.