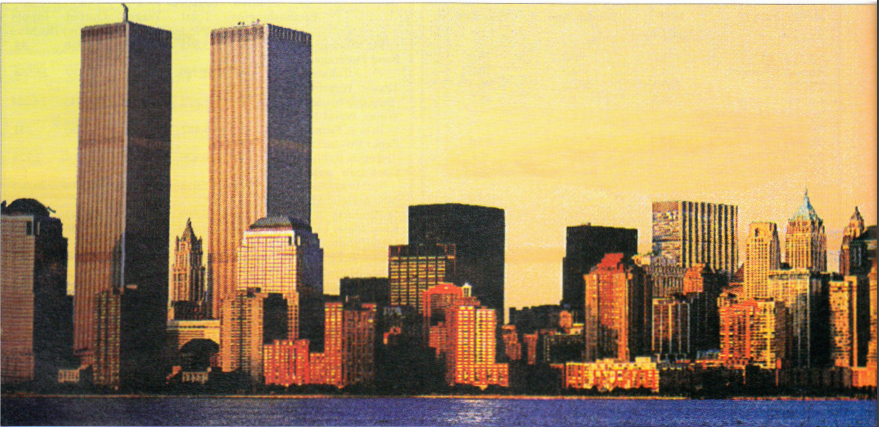

Asian players have traditionally regarded property as a watertight investment tool. Investors have preferred to sink their cash into bricks and mortar rather than play the more risky currencies and stocks. And as property prices in some parts of Asia go through the roof, investors are diversifying their portfolios and moving into overseas property in a big way. Some 79% of investors buying London properties come from Asia, and some 30% of London landlords are Asian residents. In Australia, Singaporeans remain the largest foreign investors, and experts estimate that in the last three years Singapore investors have ploughed some US$500 million into China’s fledgling property market. But are these investments really as safe as houses?

Look Before You Leap

Barry Lea, regional marketing director with Hill Samuel in Hong Kong, identifies two types of overseas property buyer. There are those people buying from Asia for investment purposes, and there are those who are buying with an eye to occupation perhaps by themselves or their family, sending sons and daughters overseas to schools and colleges and universities.”

If you are buying with an eye to reaping capital gain and rental yield, it is essential you look at how the political and economic winds are blowing in your country of choice. You also need to look at the overall price trends in the property market. Have an idea of the geography of your chosen country. Properties can be easy or difficult to rent out, or sell, depending on location and other factors. Different types of property may carry their own individual problems. Before deciding on whether to buy a flat, a house, a castle or a condo, furnished or unfurnished, a new or an existing property, check out all of these issues.

Beware of oversupply in the market. Property prices in China, for example, are currently climbing, but experts reckon capital values could plummet by 5 and 15% over the next 12 months. They see an extra 60 million square meters. of commercial and residential space coming on line by the end of this year. And that will depress prices.

Other countries in Asia are fast getting wise to property speculators looking to make a fast buck. In Malaysia, for example, the government has introduced measures to curb speculation. Foreigners have been Breakout stopped from buying houses costing less than M$250,000 and a 30% Property Gains Tax has been slapped on property sales by foreigners. Similarly in China, any sale of real estate will be subject to the Land Appreciation Tax if it is sold within five years of the purchase. That tax runs from 30 to 60%. And rental income is subject to a 20% tax.

A Roof Over Your Head

If you are buying with an eye min to immigration and occupying the property yourself, then the criteria will be different. It is likely that your fore- most concern will be the amenities. Allan Leung, managing director with Colliers Jardine in Hong Kong, says the things to look at include the neighborhood, school, the transportation network, and your family’s requirements.

Getting the Job done

So once you have decided what kind of property you want to buy, how do you go about organizing such a long-distance transaction?

Developers have fast cottoned on to the potential of the cash-rich Asian investor. In countries where the property markets are flagging. the Asian buyer is seen as a means to bolster that market, and in many cases save some of the country’s developers from bankruptcy. As in any industry, there are sharks about, and it is important to check the credentials of the developer.

Developers use an array of tools to advertise their wares. These range from property exhibitions to glossy magazine advertisements. Experts agree that one of the biggest mistakes a buyer can make is to buy, site unseen. Leung says it is too easy to fall into the trap of believing all the marketing speak. ‘A glossy brochure does not necessarily reflect the quality of the finished product,’ says Leung. And do not be fooled by fantastic guarantees of rental returns.

Consumer protection laws vary from country to country. In Asia, legislative protection for consumers against misleading advertisements or information from agents is somewhat restricted, although it may be that the country where the property is being developed has adequate consumer protection. Canada has the Home Warranty Program, which protects the consumer right through to after sales service.

Buyers should make time to visit the prospective site. Alternatively, have someone in that country who you can trust to work on your behalf. If neither of these options is feasible, hire professionals in the market. Again it is vital to hire an established agent, and here you should be looking at an international operation, an agent that has branches both locally and in the country in which you intend to buy. The two branches will be able to cooperate in checking the property and making sure there is no discrepancy between the price. Some developers have been known to up the price by as much as 10%.

They may justify this by saying the premium is necessary to cover overseas marketing expenses.

Make sure you are shown a se lection of properties. And never be afraid to negotiate on the purchase price. Hire a building inspector to check over the state of the foundations, and a real estate lawyer, too.

If you are looking to buy an existing property, there is a lot of money to be made from doing up

a dump for resale. But there is usually more paperwork involved than when you’re buying a new development, and such tiresome, time consuming exercises as surveys and title searches.

Costs

An agent can help negotiate the maze of paperwork associated with the costs of the purchase. On top of the purchase price, there may be associated costs, such as sales commissions, legal fees, valuation fees and arrangement fees if you require a loan to finance the transaction. Then there could be the associated insurance costs, and stamp duty, which varies from country to country.

If you plan to rent out the property, you may need to budget for renovating the place in order to get the best possible rental price. You may also need to furnish the property. There will be insurance costs and future maintenance costs. Remember that tenants can be an intolerant breed. They are unlikely to put up with a cracked window or an overgrown lawn for long. All these costs can represent as much as between 5 and 10% of the purchase price.

Experts advise putting rental transactions into the hands of a professional management agent who can look after your interests. ‘It is false economy to try and do it yourself from a distance and save fees,’ says Leung.

Getting A Loan

Unless you are in the position to hand over a wad of cash for the property, you will need to shop around for a mortgage. But remember that paying cash can sometimes mean the buyer pays too much, because no bank valuation is made on the property. Banks, mortgage companies, mort- gage brokers and developers all offer loans. You will usually need at least 10% of the purchase price as a downpayment. Besides the usual considerations, such as interest rates, take a good look at what type of mortgage is best for that country’s economy. You may be on to a winner or a loser, depending on whether you opt for a fixed or variable rate.