Asgar Hussein

A Unit Trust can be defined as a pooled investment plan in which the capital contributions of investors are combined into a legally formed Trust Fund. The money is then invested by professional fund managers, acting on behalf of the investors, in a portfolio of marketable securities.

In return for their investments, the investors receive ‘units’ (shares) in the Trust Fund. The income derived by the Fund by way of dividends, interest and capital gains are divided among the unit holders in proportion to the number of units they hold, in accordance with the distribution policy of the Fund.

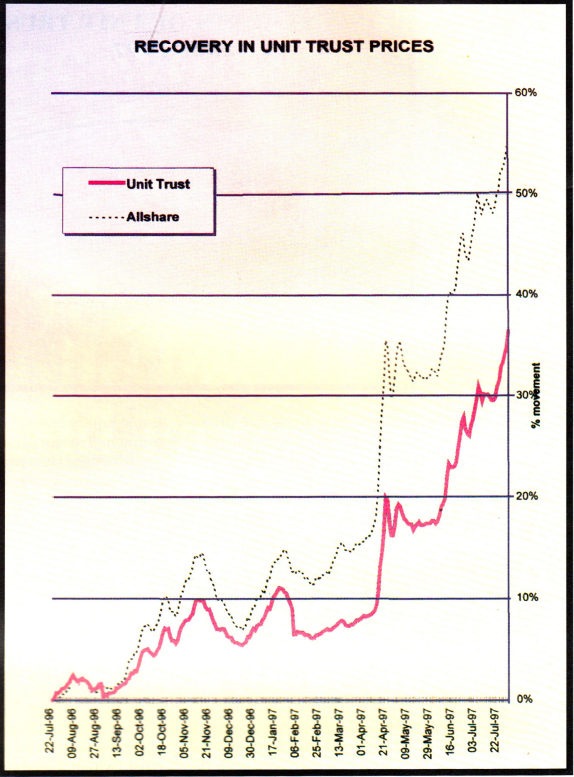

Sri Lanka’s unit trust industry has witnessed an upswing with the recovery of the stock mar ket. Unit prices have been rising this year, from an industry average of Rs 7.67 in April to Rs 9.61 at present, representing an increase of 25%. In other words, assuming that in April an investor invested Rs 100,000 equally in the 5 unit trusts in operation at that time, his investment would today be worth Rs 125,250.

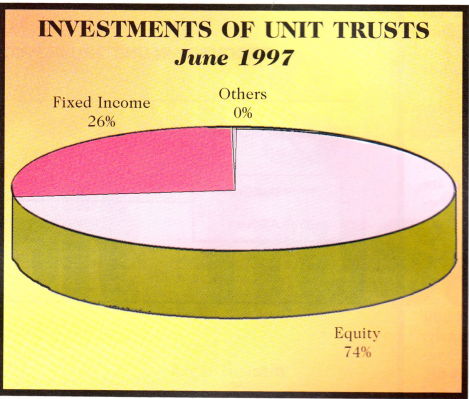

Since investments by unit trusts are predominantly in the stock market, any change in it will impact directly on unit prices.

The unit trust sector has reason to be optimistic, especially as the stock market has seen an upward

trend since September 1996. The All Share Price Index which was 559.20 in September last year, in- creased to 673.50 in April this year and now stands at 848.30.

Another encouraging factor is the decline in interest rates after the Government relaxed its tight monetary policy by lowering the Statutory Reserve Ratio.

Further, foreign portfolio investments are on the rise, while there have been better than expected corporate profit announcements. Also, the government’s economic policies appear more focused and the privatization process is gathering momentum.

Other reasons for the optimism include the introduction of new infrastructure (screen-based branding) at the Colombo stock exchange, and the introduction of two and four-year Government treasury bonds which would lead to the establishment of a long term yield curve for fixed income securities in Sri Lanka.

Nevertheless, the fund management companies are operating cautiously because the country’s markets are quite susceptible to the external shocks, thereby increasing the associated risks.

Today, there are six unit trusts in the island, namely, National Equity Fund, Pyramid, Comtrust, Ceybank, Century Growth Fund and NAMAL Growth Fund.

It is learnt that CTC Eagle Fund Management Company has obtained the initial approval by the Securities Exchange Commission of Sri Lanka (SEC) to form three unit trusts which are expected to be launched shortly.

Meanwhile, Sri Lanka’s Pioneer Fund Management Company, National Asset Management Limited (NAMAL), have been promised a license by SEC to start their third unit trust which will be called NAMAL Income Fund. It is expected to be launched within the next three months.

Only recently, NAMAL launched the NAMAL Growth Fund, which the company’s chairman CA Coorey said will ‘seek to provide an opportunity for a wide cross section of investors to benefit from the recovery of the stock market by investing in a portfolio of stocks carefully selected for their earning potential by professional fund managers at NAMAL.

It was NAMAL which introduced the first unit trust to Sri Lanka, the National Equity Fund (NEF) in 1991. The NEF is the largest unit trust in the island with 17.000 unit holders of an industry total of 25,000.

Since 1992, the NEF has paid a cumulative dividend of Rs 6 which is the highest among the unit trusts. It is today the only fund in excess of Rs 1 bilion

According to the general manager of NAMAL, Nihal Dissanayake there are several benefits from investing in unit trusts. He says professional fund managers will manage the investors’ money at very reasonable cost, and the unit trust will invest in a wide variety of instruments to reduce risks of their investments.

He notes that in direct share investments, one needs a considerable amount of money to get such a diversification. Therefore, investing in unit trusts is the solution for small investors who want to diversify their investments.

Another benefit is that investors’ investments can be encashed at any time as the fund managers are obliged to purchase them back from the investor. This is a notable advantage because the fund managers have to buy back the investment at prevailing rates (which are published on а daily basis), whereas if the investor invests in the stock market, he might not get the deal price and buyer for the stock, should he decide to sell.

The unit trust industry has been structured in such a manner that investors’ interests are protected. Every unit trust is legally required to have a trustee whose function is to safeguard the interest of the unit holders and the property of the trust. This responsibility of the trustee is separated from that of the fund manager who concentrates on investment functions. Therefore, the fund manager is considered an investment specialist while the trustee becomes guardian. This approach minimizes the risk of mismanagement.

Further, since the SEC has intensely scrutinized the fund managers before appointment, it is assured that their financial status is secure, they possess a minimum share capital of Rs 25 million and have the ability and the credibility to run Unit Trusts. The asset managers are compelled to report their financial positions every month to the SEC which acts as the watchdog.

It is pertinent to mention that the unit trust code is strictly adhered to by the fund managers and the trustees, while the SEC has been entrusted with the responsibility of ensuring its compliance.

Chief executive officer of the unit trust Management Company, Dheerendra Abeyaratna, said that a major problem they encounter in promoting unit trusts is that small investors are discouraged by the ‘volatile’ kind of return from unit trusts. This attitude can be corrected through an awareness campaign.

He points out that most people who have put their money in banks do not get sufficient interests to cover inflation, whereas if they invest in unit trusts, they would get above-inflation returns in the long term.

The Unit Trust Management Company are the fund managers of Ceybank Unit Trust and Century Growth Fund.

Abeyaratna believes that Unit Trusts will be the preferred way of investment in the future since investors will get a higher return than any other alternative product, provided they hold on to their investments in the medium to long term.

He observed that unit trusts mobilize savings spread over the is land and channel it to capital market development.

Nihal Dissanayake says that when an investor comes to NAMAL, they could offer to place his investments in the National Equity Fund, the NAMAL Growth Fund, or Government Treasury Bonds with zero risk because these are gilt-edged Government Securities. He says NAMAL also manages large equity portfolios of institutional investors.

Elaborating on the advantages of getting involved in so many activities, he said that if investors come to NAMAL with large sums of money, they could be offered a mixed range of products so that their invest- ments would be safer as diversification reduces the investment risk level further.

Dissananyake says that many people desire to invest in the stock market, but refrain from doing so because they lack the necessary knowledge or contacts, or else are unable to devote their time. Then there are those who fear venturing into the stock market as they have ‘burnt their fingers’ when the market came down. For such people, investing in a unit trust (which invests upto 80 or 90% of the funds in the stock market) will prove helpful.

Fund managers employ researchers who study listed companies by gathering, processing and interpreting corporate information to help in taking investment decisions.

Meanwhile, it is learnt that the Unit Trust Association of Sri Lanka is calling on the government to accept the ‘conduit principle’ in taxing Unit Trust incomes, so that double taxation can be avoided. unit trusts expressed confidence that their proposal will be accepted soon.

The association is also seeking assistance from the government to popularize the unit trust concept, especially in the out stations. An awareness is already being created as there is a lesson on unit trusts in the Advanced Level Commerce Syllabus.