With a view to promoting good corporate governance practices in listed companies Business Today in collaboration with the writer used an assessment methodology for corporate governance of the Business Today TOP TWENTY winners. This assessment methodology was based on disclosures made by companies in their annual reports being rated against the basic requirements in Sri Lanka and best practices noted in the UK Code and King III of South Africa. This report should be taken in the right spirit for improving management control, transparency and accountability in public listed companies which will result in the growth of the capital market. The challenge however is to fill the ever widening expectation gap of stakeholders.

BACKGROUND

Assessment of corporate governance is a subjective area and a subject where you cannot make everybody happy. There will be pros and cons to the argument. However this assessment is performed with an aim to encourage better transparency, accountability, fairness and responsibility founded upon the concept of disclosure to improve trust and confidence of shareholders.

What is meant by the term “corporate governance?” It is basically the systems and processes established by corporate entities for ensuring proper accountability, probity and openness in the conduct of their business. There is no generally applicable global corporate governance model. Therefore, Sri Lankan companies work within the parameters set out by a local code and regulations and certain expectations of shareholders. Corporate governance is also considered part of a company’s general risk management culture and practices. Corporate governance issues may also arise in relation to management and strategy as well as its’ legal structure and ownership, and such issues are not addressed in this assessment, due to limitations in the scope of desk-top reviews.

In order to assess the general level of compliance with principles it is useful to understand developments and requirements in some of the other leading countries in the area of corporate governance.

The Environment In UK

Corporate governance has been very much in the spotlight in the UK since the Cadbury report. However, the current UK corporate governance environment does not exist in isolation, as there have been significant influences from Europe and the US. In particular, the collapse of Enron and WorldCom in 2002 has meant issues of corporate governance remain highly topical especially with the advent of Sarbanes & Oxley Act.

The UK Corporate Governance Code 2010 is a set of principles of good corporate governance aimed at companies listed on the London Stock Exchange. It is overseen by the Financial Reporting Council and its importance derives from the Financial Services Authority’s Listing Rules. The Listing Rules themselves are given statutory authority under the Financial Services and Markets Act 2000 and require that public listed companies disclose how they have complied with the code, and explain where they have not applied the code – in what the code refers to as ‘comply or explain’. The Code adopts a principles-based approach in the sense that it provides general guidelines of best practice. This contrasts with a rules-based approach, which rigidly defines exact provisions that must be adhered to.

Important changes to the codes in UK and South Africa include;

i To improve risk management, the company’s business model should be explained and the board should be responsible for determining the nature and extent of the significant risks it is willing to take.

ii Performance-related elements of remuneration should constitute a substantial portion of the total remuneration package of executives in order to align their interests with those of the shareowners, and should be designed to provide incentives to perform at the highest operational standards.

iii To increase accountability, all directors of FTSE 350 companies should be put forward for re-election every year.

iv To ensure a balance of power and authority in a company, there should be a division of responsibilities such that no one individual has unfettered decision-making powers. The chief executive officer of a listed company cannot also hold the position of chairman.

v To help enhance the board’s performance and awareness of its strengths and weaknesses, the chairman should hold regular development reviews with each director and FTSE 350 companies should have externally facilitated board effectiveness reviews at least every three years.

vi The positioning of internal audit as a strategic function that conducts a risk-based internal audit and provides a written assessment of the company’s system of internal control, including internal financial controls.

vii For related-party transactions, depending on the percentage ratio of a related-party transaction, a company is required to (King III):

- inform the stock exchange of the details of the transaction prior to completing it, publish details of the transaction and provide confirmation that the terms of the transaction are fair and reasonable; or

- announce the transaction, provide the stock exchange with a copy of the agreement, and obtain shareholder approval and a fair and reasonable opinion from an independent professional expert.

ASSESSMENT APPROACH

Though a corporate governance assessment can be done in several stages, this exercise is limited to a desk-top compilation of corporate governance profiles of the companies in the Business Today TOP TWENTY. The points system used evaluates the quality of corporate governance policies, compliance with local requirements, management controls, performance, and disclosure along with some of the best practices identified through research.

Aspects from the UK and South African codes that were used include;

Disclosure of a formal policy prohibiting dealing in its securities by directors, officers and other selected employees for a designated period preceding the announcement of its financial results or in any other period considered sensitive as established by the board and implemented by the company secretary.

Whether a definitive set of standards and practices is implemented in the company based on a clearly articulated code of ethics and disclosure is made of adherence to the company’s code of ethics. The disclosure should include a statement as to the extent the directors believe the ethical standards and the above criteria are being met.

Committees of the board – the minimum required of a listed company are an audit committee and a remuneration committee. In establishing board committees, the board must determine their terms of reference, life span, role and function. It must also create reporting procedures and proper written mandates or charters for the committees, and ways of evaluating them. Existence of a nomination committee also was considered for Sri Lanka.

The audit committee should comprise a majority of non-executive directors and the majority of its members should be financially literate. The chairman and majority of directors in the committee should be independent as well. The period of service of nine years as director was also used in the determination.

Company secretary – King III states that the company secretary must provide the board as a whole and the directors individually with detailed guidance as to how their responsibilities should be properly discharged in the best interests of the company. To this end, the company secretary must: be responsible for inducting new or inexperienced directors; assist the chairman and the chief executive officer in determining the annual board plan; guide the board and individual directors in the proper discharge of their responsibilities; and act as a central source of guidance on matters of ethics and governance.

Further, as certain companies were also reporting on the GRI framework in their sustainability reports, the assessment also considered two aspects included in the GRI Reporting Framework in relation to information disclosed in respect of bribery and corruption and involvement in public policy-making. A Sri Lankan Auditing Standard also places responsibilities on management and auditors with regard to fraud and therefore the topic was considered important.

Recent corporate governance reforms in South Africa

The concept of corporate governance was formally introduced in South Africa in March 1992, with the formation of the King Committee on Corporate Governance. The King Committee produced its first report in March 1994 (King I). King I went beyond the financial and regulatory aspects of corporate governance in advocating an integrated approach to good governance in the interests of a wide range of stakeholders, having regard to the fundamental principles of good financial, social, ethical and environmental practice.

Its second report, King II, incorporates a Code of Corporate Practices and Conduct in South Africa. This code sets out principles which all companies and their boards and directors should observe in conjunction with other statutes, regulations and authoritative directives regulating the conduct of companies, boards and directors. A further development in this area resulted with the framework called King III which is principles-based and there is no ‘one size fits all’ solution. Entities are encouraged to tailor the principles of the Code as appropriate to the size, nature and complexity of their organisation. This is good news for companies in South Africa as it avoids some of the pitfalls seen in the United States where a ‘one size fits all’ approach was initially adopted. King III has opted for an ‘apply or explain’ governance framework. Where the board believes it to be in the best interests of the company, it can adopt a practice different from that recommended in King III, but must explain it. Explaining the different practice adopted and an acceptable reason for it, results in consistency with King III principles.

FINDINGS AND CONCLUSIONS

This Assessment Should Pave The Way For An Organisational Review Or Study To Understand Whether Boards Just Follow The Governance Rules For Disclosure Purposes Or Do Much More Than That. This Can Be Done By The Colombo Stock Exchange Or The SEC Or By Independent Bodies.

This is not to say that companies with better scores (based on disclosures) will make better results or vice-versa or in fact are better governed. The collapse of once-great companies like Enron, Lehmans, Merryl Lynch and WorldCom has riveted attention on their boards. Like most boards, these giants are supposed to have followed all the rules, ie, directors attended meetings regularly, had lots of personal money invested in the company, had audit committees, nomination and remuneration committees, and ethics codes.

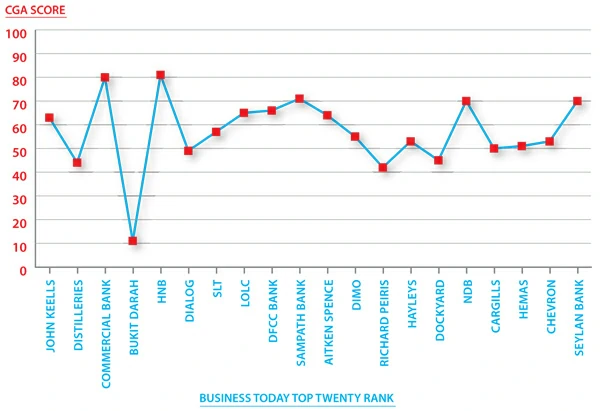

Therefore, this assessment should pave the way for an organisational review or study to understand whether boards just follow the governance rules for disclosure purposes or do much more than that. This can be done by the Colombo Stock Exchange or the SEC or by independent bodies. The above scores are better for Banks only because the Central Bank of Sri Lanka has mandated several procedures in order to strengthen the Banking sector. Maybe the other regulators can take a cue from the financial sector regulators.

GRI G3 Standard

SO2 Percentage and total number of business units analysed for risks related to corruption.

Efforts to manage reputational risks arising from corrupt practices by employees or business partners require a system that has supporting procedures in place. This measure identifies two specific actions for ensuring the effective deployment of the reporting organisation’s policies and procedures by its own employees and its intermediaries or business partners.

SO6 Total value of financial and in-kind contributions to political parties, politicians, and related institutions.

The purpose of this Indicator is to reflect the scale of the reporters’ engagement in political funding and to ensure transparency in political dealings and relationships with the reporting organisation… (amended)

Jeffrey A Sonnenfeld in the classic HBR Review article “What Makes Great Boards Great” stressed that “The best boards know how to have a good fight” and described the idea in brief as; “They’re robust social systems: Their members know how to ferret out the truth, challenge one another, and even have a good fight now and then, foster open dissent. The willingness to challenge one another’s assumptions and beliefs may be the most important characteristic of great boards – indicating bonds strong enough to withstand clashing viewpoints. Don’t punish dissenters or forbid discussion of any subject. Probe silent board members for their opinions and the thinking behind their positions.”

“Don’t raise your voice, improve your argument”- Desmond Tutu

The above Corporate Governance Assessment method for the above reasons has given higher weights for Independence of members, number of meetings for discussions, separation of chairman and CEO, audit committee terms and composition, oversight of related party transactions and steps taken to avoid conflicts of interest, policy on fraud and political donations. The criteria are based on current and better practices in other countries and therefore the findings show that generally compliance in this area is for minimum requirements introduced by regulators and is not voluntary for the purpose of improving Governance. This assessment should help corporates in Sri Lanka to appreciate and know why they are required to follow ‘principles’ of governance and highlight the general level of compliance. This way one can avoid the mentality of ‘ticking the box’ and complying with rules only to say it’s right and instead implement good practices to achieve the objectives of good corporate governance.

This Assessment Should Help Corporates In Sri Lanka To Appreciate And Know Why They Are Required To Follow ‘Principles’ Of Governance And Highlight The General Level Of Compliance.

© Assessment tool development and technical input by Suren Rajakarier FCA, FCCA, FCMA (UK), Head of Audit at KPMG Ford Rhodes Thornton & Co.

| Range | Rating |

| 40-49 | Basic disclosures |

| 50-59 | Rule based compliance |

| 60-69 | Acceptable level of compliance |