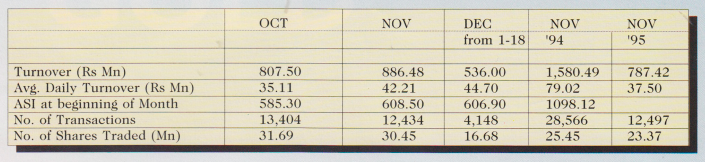

The market has been bearish during the last few weeks mainly on account of retail selling due to profit taking, and the retailers’ desire to get into cash during the current festive season. But, both turnover and volume remained healthy as active participation was seen from both local and foreign institutional investors. The All share Index (ASI) has dipped from a high of 632 on November 15, to the current level of 590. Although we expected the market to decline in December according to past experience, the market started to weaken from mid-November itself. This decline was due to the expectation of a lean month in December, and due to the corporate results for the quarter ended September 30 being below expectations. The average daily turnover which recorded 39% and 20% improvements in October and November respectively, continued to improve in December. The ASI declined from 606.9 at end-November to 590 by December 18. Although the budget had a initial positive reaction in the market, it could not be sustained. As we stated earlier the budget proposals were designed to ensure sustained long term development rather than provide an immediate boost to the economy. This is so even in the case of companies that benefited from the budget proposals, therefore, we will only witness improvements in the performance of specialised leasing companies and export manufacturing companies in the medium to long term.

The initial public offer of Lion Brewery Ceylon Ltd. was oversubscribed as expected, but the fact that the company could attract Rs 480 million in just two days, when it required only Rs 250 million speaks volumes of the potential of this company. It also augurs well for the market in that, even in the current depressed conditions an issue that is attractively priced will attract investor interest.

The corporate results released for the quarter ended September 30 were disappointing in most sectors except for the plantations. In the banking sector the two blue chip development banks DFCC and NDB didn’t record any improvements in profits over the previous quarter, although turnover increased. This was due to the decline in operating margins and the inability to book capital gains due to the depressed conditions in the stock market. In the commercial banking sector also, the earnings growth was minimal and only Sampath Bank and Commercial Bank recorded a respectable 11.8% and 9.5% earnings growth respectively. Seylan Bank, a top performer in the past, recorded a poor third quarter due to a massive 140% increase in its loan loss provisioning. LOLC the blue chip leasing company was one of the few companies in the finance sector to record an impressive 22% growth in profits for this period, in comparison to the same period last year. In the manufacturing sector the ceramic companies continued to record flat due to declining earnings. The only company in this sector to continue a record impressive growth was Royal Ceramic. The plantation sector, supported by record prices for tea, continued with the impressive performance seen in the last quarter. Further, relative calm on the part of the labour force and the moderately strong prices for rubber, the other major plantation crop, ensured that strong profit growth remained. The hotels and tourism sector continued to be affected by low arrivals, but if the relative calm that currently prevails continues through the rest of the peak winter season we expect an improvement in arrivals. This will ensure that this sector will atleast return to profitability for the current financial year, although we don’t expect a major revival for another one year.

Foreign activity continued to contribute to the market’s growth, with a marginal net inflow of Rs 15.2 million for November and a Rs 24 million outflow during the first two weeks of December. Foreign turnover accounted for 55% and 49% of the market turnover for November and December respectively, and this is certainly a healthy sign. Large quantities of stocks such as Grain Elevators, DFCC, Blue Diamond, Asian Hotels, LOLC and Kotagala Plantations traded during the last one month.

The Unit Trust Management Co., (which is a fund management company) a joint venture between the Bank of Ceylon, Carson Cumberbatch & Co., Unit Trust of India, HSBC Asset Management – Hong Kong and the Merchant Bank of Sri Lanka, launched its latest unit trust, the Century Growth Fund. The fund is structured for the more aggressive investor with upto 90% of the fund being available for investment in the equity market and even upto 15% of the funds being available for investment in unlisted securities. Considering that the stock market is at an extremely attractive level for long to medium term investors, we believe that the timing of launching the fund is most appropriate and investors can expect significant capital gains in the medium term by investing in this fund.

Market Outlook

The market continued to dip throughout December, but is expected to stabilise in January. The All share index has declined by only 2.5% in December, which is a marginal drop considering its upside potential. We maintain our view that the indices at the Colombo Stock Exchange will appreciate during the first quarter of 1997. The expected improvement in the Sri Lankan political and economic outlook, and the anticipation of improved corporate results will be the major contributors to this growth. In addition, regional factors will also play its role. Relative stability has emerged in the Indian sub-continent, and it is apparent that there is increased cooporation amongst the countries in the Indian sub-continent. This would result in overseas funds increasing their allocation to this region. India is expected to attract a bulk of these funds but Sri Lanka will benefit from both a trickle-down effect and some additional country allocations, although not of the magnitude witnessed in the first quarter of 1994.

We maintain our recommendation for investors to take a two-year investment horizon, but we are confident that investors will realise short term capital gains in selected stocks in the banking & finance, manufacturing and food & beverages sectors. The tourism sector is another potential investment area, provided Colombo and the major tourist destinations remain calm during the coming months. We advise investors to watch for buying opportunities in the following stocks:

Banking and Finance – NDB, LOLC, Mercantile Leasing.

Manufacturing – Richard Pieris.

Hotels – Ahungalla Hotels, Asian Hotels.

Food and Beverages- Ceylon Brewery, Ceylon Tobacco.

Conglomerates – Aitkin Spence, Hayleys, Colombo Fort Land & Building.