May 11, 2023. Justinas Baltrusaitis

In recent years, gold’s value has risen in the global financial markets as precious metal continues to rank among the highly sought-after commodity for investors and consumers alike. As a result, the world’s leading gold mining companies have ramped up their production efforts to capitalize on this lucrative trend amid prevailing economic uncertainty.

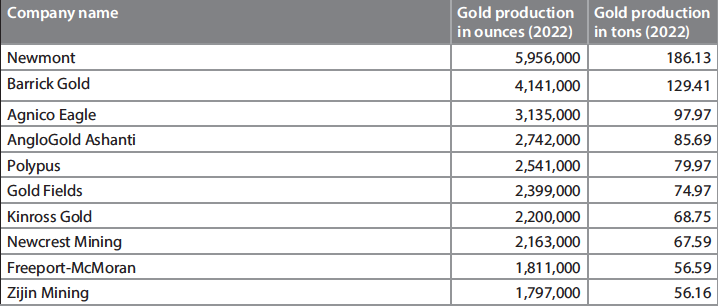

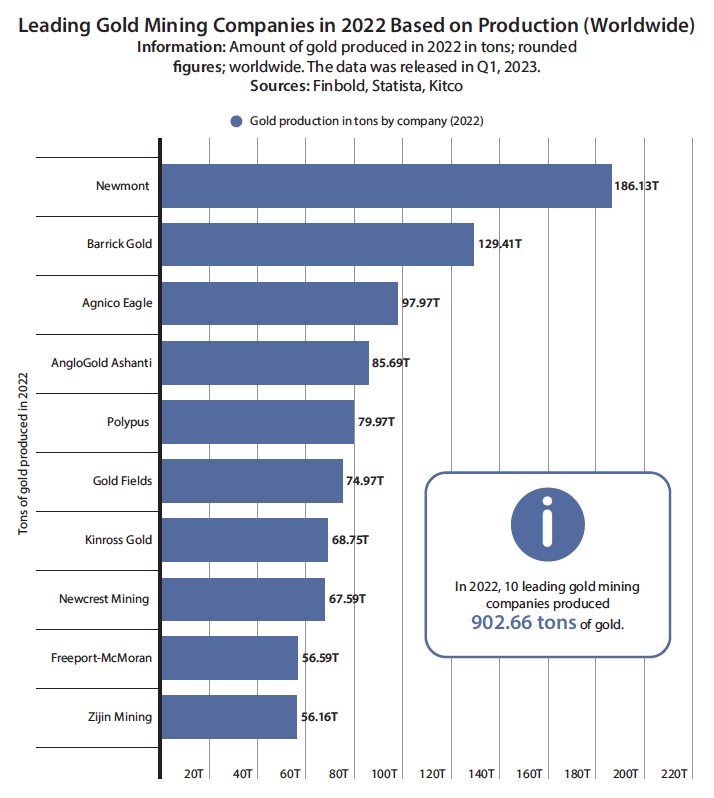

In this line, data acquired by Finbold indicates that the world’s leading 10 gold mining companies cumulatively produced 902.66 tons of the precious metal in 2022. Newmont (NYSE: NEM) led the way, which produced 186.13 tons, accounting for approximately 20% of the total gold produced by the 10 firms. Barrick Gold ranked second, producing 129.41 tons, followed by Agnico Eagle at 97.97 tons. AngloGold Ashanti claimed the fourth spot with 85.69 tons, while Polyus accounted for the fifth-highest production at 79.41 tons.

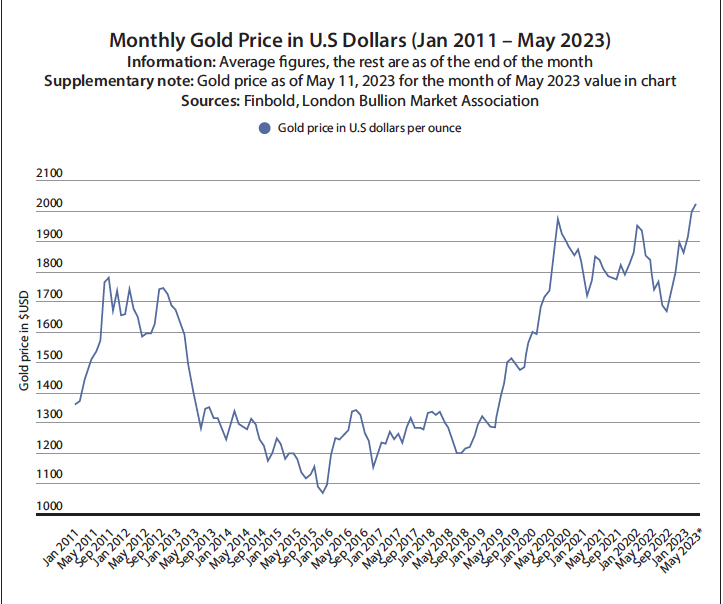

Elsewhere, prices of the precious metal have recorded steady growth in recent months, with gold value as of May 11, 2023, standing at $2,021.33 per ounce. The value represents a 6.55% increase from January’s $1,897.

Gold production sector resilience

The cumulative production by the highlighted companies highlights the resilience of the gold mining sector, which is still attempting to recover from the effects of the pandemic. At the same time, despite significant gold production by the major companies, the industry experienced rising costs in 2022 due to the extended effects of the pandemic and geopolitical events such as Russia’s invasion of Ukraine. These factors disrupted global supply chains and increased logistics costs amid a prevailing economic uncertainty.

In general, the company’s gold production is supplying a market that is also experiencing growth driven by several factors, such as rising investments and increasing jewelry consumption. Notably, Gold jewelry remains among the most significant growth factor for the precious metal. The investment sector has also witnessed a boom in demand spurred by the growth of products such as exchange-traded funds (ETFs).

Elsewhere, United States-based Newmont remains a leading global gold production industry player. This status is driven by factors such as the company’s size, operational efficiency, and expansive reach. One of Newmont’s strengths is its ability to maintain a diverse portfolio of mines across various regions. This approach helps mitigate risks associated with country-specific issues, including political instability or regulatory changes.

Newmont continues to grow its global footprint through strategic acquisitions. For instance, the company is working towards acquiring Newcrest Mining, an Australian-based rival. With a focus on maintaining its operational position, Newmont is poised to remain a top player in the global gold production industry.

Gold capitalizes on economic uncertainty

Against the backdrop of global economic uncertainty due to rising inflation, gold is recording a surge in value when other investment products and the US dollar are undergoing increased volatility.

Notably, in the face of financial turbulence and volatility, investors turn to gold to hedge against inflation. Gold tends to hold its value during periods of high inflation and often charts an inverse relationship to the dollar’s value, making it an attractive investment option for those looking to mitigate the effects of inflation.

Another factor driving the interest in gold is the potential for a recession among leading global economies such as the US. For instance, with the Federal Reserve predicting a “mild recession,” diversifying portfolios with gold is often considered an ideal investment strategy.

While traditional stock and bond markets can be volatile during a recession, gold remains steady, providing security within portfolios.

Looking ahead, the increasing demand for gold and its investment potential suggest that more production of this precious metal is likely. However, the prevailing economic uncertainty may have a negative impact on mining companies’ operations, particularly with regard to rising costs. Despite the potential challenges, the allure of gold as a valuable and versatile commodity continues to drive interest from investors and consumers alike.

Justin crafts insightful data-driven stories on finance, banking, and digital assets. His reports were cited by many influential outlets globally like Forbes, Financial Times, CNBC, Bloomberg, Business Insider, Nasdaq.com, Investing.com, Reuters, among others.