March 16, 2023. Justinas Baltrusaitis.

For several months, the global economy has been grappling with the threat of recession, with investors remaining on the edge as various investment products struggle to live up to expectations. The stock market has been among the most hit products, as highlighted by capital outflow in the market cap of specific companies.

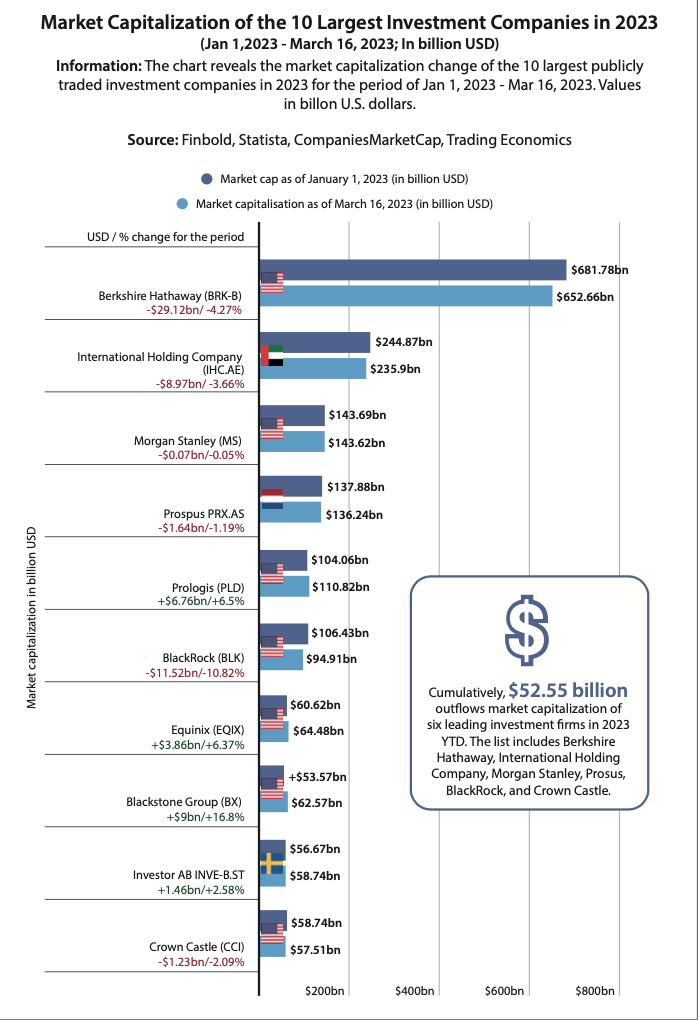

In particular, data acquired by Finbold indicates that as of March 16, the world’s six largest investment firms recorded a cumulative outflow of $52.55 billion from their market capitalization in 2023. Among the affected companies, four are based in the United States and account for almost 80% of the lost capitalization.

U.S.-based investment giant Berkshire Hathaway (NYSE: BRK.A) accounts for the highest loss of $29.12 billion or 4.27%, with the firm’s current market cap standing at $652.66 billion. BlackRock’s (NYSE: BLK) market cap of $94.91 billion represents year-to-date losses of $11.52 billion or 10.82%.

International Holding Company has the third-highest losses at $8.97 billion, followed by Prosus with an outflow of $1.64 billion. Crown Castle (NYSE: CCI) ranks fifth with a market of $57.51 billion after recording an outflow of $1.23 billion. Elsewhere, U.S. banking giant Morgan Stanley (NYSE: MSCI) has the least losses of $0.07 billion.

Economic uncertainty takes a toll on investment firms’ market cap

The capital outflow from the highlighted companies indicates a broader change in the investment landscape, with many investors seeking more secure and reliable options in the face of the current market conditions.

Overall, the plunge in market cap is a direct impact of investors’ rising level of uncertainty due to persistently high global inflation, change in monetary policies, and interest rate hikes by various central banks. The elements have culminated in concerns about a worldwide recession as investors partly dump stocks in search of products to cushion against inflation.

Indeed, market conditions have resulted in the changing fundamentals of the affected investment companies. Most firms have recorded a negative shift in key underlying fundamentals such as earnings and revenue. As fears of a recession remain rife, the situation could further hurt metrics such as corporate profits, putting downward pressure on valuations, and investors will likely pay less for companies with eroding incomes.

The case of Berkshire Hathaway

The performance in the market cap can also be tied to the type of product a specific company is exposed to, considering that some investment firms have managed to record capital inflow despite the market conditions. This is the case of Warren Buffet-led Berkshire Hathaway. The company has a heavy insurance exposure and concentration in financial stocks, with the product, returns remaining mainly negative since they are market-dependent and prevailing conditions have not been conducive.

The situation could worsen for the firm as the U.S. financial market faces increased uncertainty triggered by a crisis in the banking space that saw three lenders go out of business in a matter of days. In this line, banking stocksremain under pressure as questions linger over their ability to sustain possible mass withdrawals.

What the future holds

From the data, United States investment companies are among the most hit with capital outflow. Besides the inflation and interest rate hikes, the companies have been impacted by the policy changes at the Federal Reserve. The firms are feeling the effects of the Feds pivoting to tighter monetary away from the emergency policies initiated to stabilize the economy during the pandemic. The policies also pushed investors into buying stocks and other riskier assets.

Meanwhile, investment firms are likely to recover with the possibility of a stock market turnaround that has been projected to occur later in the year if inflation is controlled. Notably, there is no guarantee that the recovery will go as expected, especially with other sectors of the economy faltering.

At the same time, with rising interest rates emerging as the most damaging factor for the stock market, investment firms will look at a possible easing of policies to trigger growth.

Given the high level of uncertainty, clients hoping to take a stake in the investment companies are likely to refrain from making significant alterations to their strategies and, instead, await a rally that could take more time than anticipated to materialize.