KPMG survey finds CEOs’ optimism based on technology, speed and talent

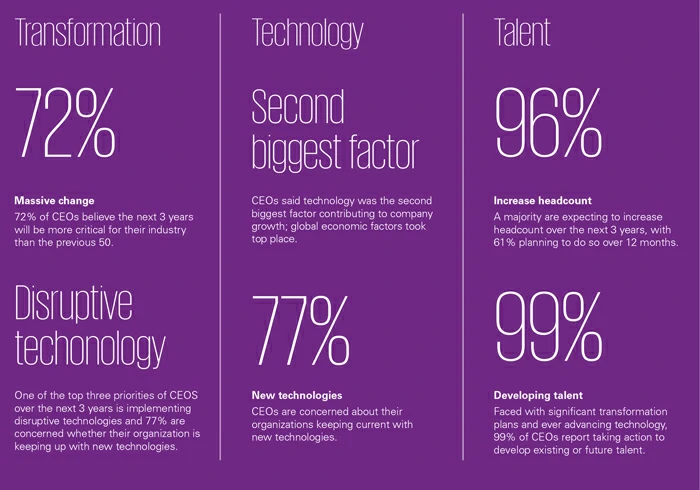

KPMG International released its 2016 Global CEO Outlook, revealing that while a majority of CEOs foresee the next few years to be challenging, with expected moderate economic growth, they are optimistic they can successfully manage through this environment. While 72 percent of top executives believe the next 3 years will be more critical to their industry than the previous 50, they are confident in their company’s growth prospects. Further four-in-ten CEOs say they are pinning their prospects on significantly transforming their operating model over the next 3 years, up 12 percent from last year’s survey.

About KPMG’s 2016 Global CEO Outlook survey

The survey targeted 1,268 CEOs in 10 key markets (Australia, China, France, Germany, India, Italy, Japan, Spain, UK and US) and 11 key industry sectors (automotive, banking, infrastructure, insurance, investment management, life sciences, manufacturing, retail/consumer markets, technology, energy/utilities and telecom). A third of the companies surveyed have more than US$10B in annual revenue, with no responses from companies under US$500M. The survey was conducted between 15 March and 29 April 2016. NOTE: some figures may not add up to 100 percent due to rounding

Highlights of KPMG’s 2016 Global CEO Outlook study

KPMG’s 2016 Global CEO Outlook study provides a vivid image of global CEOs’ expectations for business growth, the challenges they face and their strategies to chart organizational success over the next 3 years. The Key findings include:

– The vast majority of CEOs are confident in future growth over the next 3 years, with 89 percent feeling confident in their own company’s growth, 86 percent confident in their home country’s growth, 85 percent confident in the growth of their industry and 80 percent confident in the global economy.

– Almost half (48 percent) of CEOs say their company’s annual top-line growth over the next 3 years will be between 2 and 5 percent.

– CEOs expect the primary sources of growth to be from new products (28 percent), new customers (26 percent), new markets (25 percent) and new channels (22 percent).

Top concerns and priorities

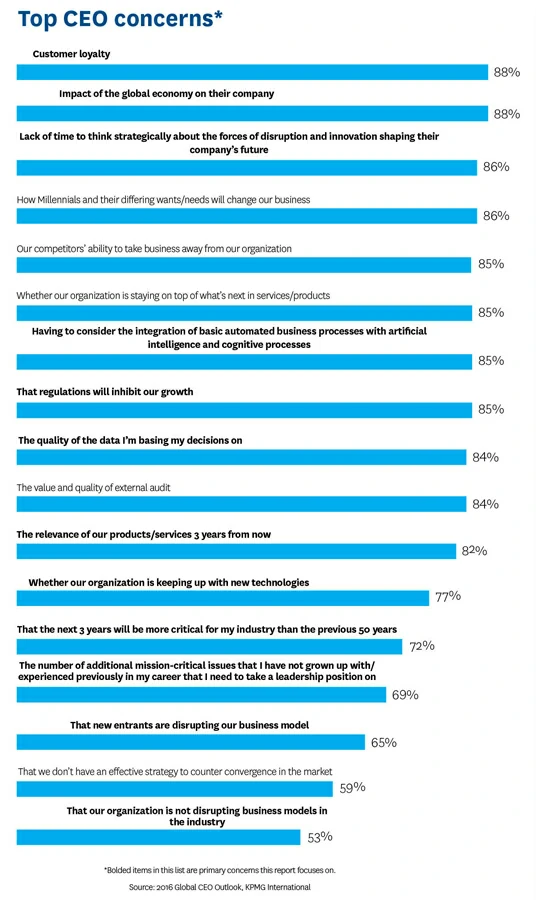

The annual study by KPMG International, of nearly 1,300 CEOs from companies across 11 industries in 10 countries, found that CEOs are concerned with a number of critical issues – many of which they indicate they have not previously experienced in their careers. The most pressing concerns for CEOs are:

– customer loyalty (88 percent)

– impact of the global economy on their company if global economic growth is less than they project (88 percent)

– lack of time to think strategically about the forces of disruption and innovation shaping their company’s future (86 percent).

Importantly, 65 percent is concerned that new entrants are disrupting their business models and more than half (53 percent) of CEOs believe that their company is not disrupting their industry’s business models enough.

Suren Rajakarier, Head of Audit & Financial Services at KPMG in Sri Lanka noted that “the disruptions caused by new technologies and technology companies is making life for CEOs more challenging. In the financial services space it is understood that the industry’s current operating models are no longer sustainable into the future. Banks which were focused on creating customer experience with their brick and mortar networks are challenged by the mobile and digital channels and this disruption has impacted the financial services industry on a global basis. A challenge that lingers on as a result of the global financial crisis is the regulatory pressures and increased oversight.”

The level of concern about new and unfamiliar challenges, is evident from the shift in top risks identified by the CEOs. For example, cyber risk rose to the top in the 2016 survey, whereas it was not among the top five risks in 2015. Seventy-two percent of CEOs believe their organization is not fully prepared for a cyber event. CEOs also voiced their concern with their company’s level of data and analytical sophistication, as well as their ability to connect with customers through digital channels. Less than a third (30 percent) believe they are currently a leader in data and analytics.

The top strategic priorities over the next 3 years of the CEOs surveyed are:

– fostering innovation (21 percent)

– having stronger client focus (19 percent)

– implementing disruptive technology (18 percent)

– developing and/or managing talent (18 percent)

– stronger marketing, branding and communications (17 percent).

Despite innovation being the top priority for their organization and that nearly 8 in 10 (77 percent) say it is critical to include innovation in their strategy with clear targets and objectives, less than a quarter (23 percent) of CEOs say that innovation is at the top of their personal agenda.

“Based on knowledge of global progress, there is recognition within organisations in Sri Lanka also that they need to do something; they need to innovate. However, they may have to create a department off to the side, because it’s a challenge to make a creative solution work well if it is set the same sort of performance metrics and requirements that the rest of the organisation runs on – it gets stifled,” says Suren Rajakarier.

CEOs stake future on transformation, technology and talent

In light of the shifting business environment, almost half (41 percent) of CEOs indicated that their company will likely be transformed into a significantly different entity in the next 3 years. That number has risen markedly from the 2015 survey, in which 29 percent of CEOs held that opinion.

In line with expectations of economic and revenue growth, a growing number of CEOs plan to increase talent over the 3 year period. Ninety-six percent expect to increase their headcount over the next 3 years, up from 78 percent in last year’s survey. A solid majority (61 percent) plan on hiring within the next 12 months. However, most report some levels of skills gaps emerging, with over 50 percent of the CEOs reporting skills gaps in key business functions.

Technology also featured prominently in the CEOs’ transformation plans, with these executives stating that it would be the second largest factor contributing to company growth – after global economic factors and ahead of domestic economic conditions. The CEOs highlighted new technology as a key enabler to achieve and accelerate their progress, with 18 percent saying that implementing disruptive technologies will be a key priority. The CEOs reported that they will devote significant investment to technology over the next 3 years, with 25 percent planning to increase data analytics capabilities and 22 percent planning investments in cyber security solutions. Technology-related risks are also top of mind for CEOs, with cyber security (30 percent) and emerging technology risk (26 percent) accounting for two of the top three risks they are concerned about.

To view additional information about the study, please visit kpmg.com/CEOoutlook. You can also follow the conversation @KPMG on Twitter, using the hashtag: #CEOoutlook.