December 7, 2022 Kris Lucas

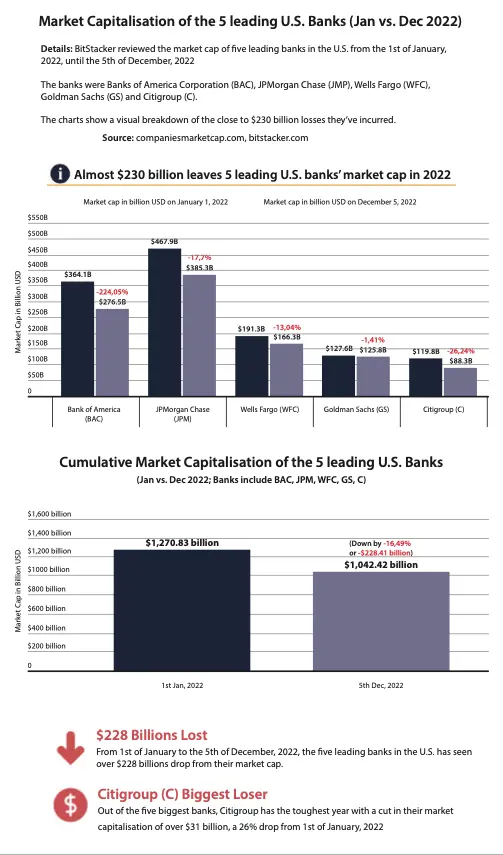

This year has seen almost $230 billion leaving the five leading U.S. banks’ market cap amid a period of economic uncertainty.

Research compiled by BitStacker. com reveals that Bank of America, JP Morgan Chase, Wells Fargo, Goldman Sachs, and Citigroup all saw their market capitalization shrinking in the period between January 1 and December 5, 2022.

The study monitored the market cap of these US banks over the course of the year from data gathered by companiesmarketcap. com. Overall, it showed that the five leading U.S. banks had experienced an average decline of 16.49% in market capitalization, which saw a total of $228.41 billion wiped off the value of these titans of the U.S. banking industry.

Big Losses in the U.S. Banking Industry

Citigroup was the hardest hit among the major U.S. banks in 2022. The company saw its market capitalization slipping from $119.83 billion on January 1 2022 to $88.39 billion on December 5, 2022. This was a massive 26.24% decline in value resulting from a fall of $31.44 billion in the bank’s market cap.

However, the Bank of America Corporation witnessed the greatest loss in market capitalization. The firm was valued with a $364.11 billion market cap at the start of the year, but this had shrunk to just $276.53 billion by early December. This represented an overall loss of 24.05% in value with the brand losing $87.58 billion in its market cap.

Close behind was the largest bank in the U.S. – JP Morgan Chase. This company saw 17.7% wiped off its market cap, equaling a loss of $82.64 billion. As a result, JP Morgan Chase had its value slashed from $467.97 billion to $385.33 billion from January to December 2022.

Elsewhere, Wells Fargo suffered a 13.05% fall in value as its market capitalization slipped by $24.95 billion. The brand was worth $191.31 billion at the start of the year compared to just $166.36 on December 5 2022.

Goldman Sachs suffered the least in terms of market capitalization shrinkage of the big five banks. The company has only seen its market cap fall by a mere $1.8 billion in 2022 representing a 1.41% fall in value. The market cap of Goldman Sachs was $127.61 billion at the start of the year and it was $125.81 billion at the time that the study was carried out.

Understanding Market Capitalization

Market capitalization, or market cap, is a tool used to measure the total market value of a company’s outstanding shares of stock. This provides investors with a picture of the company’s total size rather than its other indicators such as its sales or assets.

While market cap is traditionally used as a measure of whether a company was suitable for a takeover, it is now commonly used as an indicator of the overall health of the firm.

Large cap companies are usually seen as those with a market capitalization in excess of $10 billion. These are seen as safer investment opportunities as they usually have been around longer than small cap companies.

With the five largest U.S. banks all experiencing significant falls in their market caps, it paints a concerning picture of the state of the nation’s economy. With record inflation and numerous interest hikes, it remains to be seen how long it will be until these banks recover their previous market cap value.