Good corporate governance practices build confidence in capital markets. If Sri Lanka is aiming to become a high growth market, qualitative corporate governance practices should be promoted. Suren Rajakarier continues with the assessment methodology used since 2011, for corporate governance for the Business Today TOP 25 winners. The aim is to enhance good corporate governance practices in listed companies and to influence better transparency and accountability in public-listed companies which will result in the growth of the capital market and set an example for others to follow.

Background

There can be no better way to start this year’s assessment than to quote Mark Goyder (director of Tomorrow’s Company). This will definitely ring a bell in everyone’s ear, especially after the two elections and changes that have occurred in the country: “Governance and leadership are the yin and yang of successful organisations. If you have leadership without governance you risk tyranny, fraud and personal fiefdoms. If you have governance without leadership you risk atrophy, bureaucracy and indifference.” The quote aptly describes the challenges faced in the current context.

To many it is clear that good corporate governance makes good sense. Mervyn King (chairman of the King Report) stated, “The name of the game for a company in the 21st Century will be conform while it performs.”

The assessment this year has made modifications to recognise the ever-changing requirements for better governance through better processes in companies. It is also important to consider that good governance contributes to stability and equality in society. Adrian Cadbury captures this aspect as he was instrumental in drafting the Cadbury Code in the UK: “Corporate governance is concerned with holding the balance between economic and social goals and between individual and communal goals. The governance framework is there to encourage efficient use of resources and equally to require accountability for the stewardship of those resources. The aim is to align as nearly as possible the interests of individuals, corporations and society.”

There is no generally applicable global corporate governance model; therefore, Sri Lankan companies work within the parameters set out by a local code, regulations and certain expectations of shareholders. Assessment of corporate governance is a subjective area and a subject where you cannot satisfy the needs of all stakeholders. However, this assessment is performed with an aim to encourage better transparency,accountability, fairness and responsibility founded upon the concept of disclosure to improve trust and confidence of shareholders. Experience has also shown that having a good code of conduct and an admirable governance structure on paper is futile, if the leadership chooses to ignore the spirit of governance. What is important is the right tone at the top encouraging good governance practices and a corporate culture that embraces qualitative principles. The assessment tool has recognised some of the aspects described below to improve the rating mechanism.

Failure of ‘Tone at the Top’

After rumblings since early 2015, news finally hit the world in July of this year that 140-year-old electronics conglomerate and ‘pillar of Japan Inc’ Toshiba had inflated profits by a stunning $1.2 billion for seven years, with fabricated figures amounting to 30 per cent of the company’s ‘profits’ since 2008. The scandal ranks as one of corporate Japan’s biggest alongside the 2011 accounting fraud at medical equipment and camera-maker Olympus Corp. Few of the key reasons noted below point to a failure of ‘Tone at the Top”:

Weak internal controls

Toshiba’s internal control reports through to fiscal year 2013 have stated its controls were effective. The company’s auditor also submitted statements vouching for the reports. But recent investigations have found nine instances of suspicious accounting in infrastructure-related areas, including smart meters and electronic toll collection systems. After the news, Toshiba’s president, Hisao Tanaka, said, “Our internal controls didn’t always function perfectly due to the importance placed on budget targets.” This is a warning to audit committees who sometimes don’t consider internal control reports as important and fail to take action on matters highlighted, because they play along with the CEO on achieving targets.

“Governance And Leadership Are The Yin And Yang Of Successful Organisations.”

Weak independent directors

Toshiba was one of the earliest companies in Japan to open up its board to outsiders. Toshiba’s 16-member board included two former diplomats, one former Morgan Stanley banker and a university professor as independent directors. However, critics say the independent directors likely lacked the skills to contribute to strategy or rigour in oversight. Further, it is noted that former chief executives continued to exercise power, disrupting the exercise of power by other directors and weakening the role of independent directors. Generally, retaining former CEOs or chairmen in the board could weaken governance.

Weak nominations

An external panel is looking into the roles played by Mr Tanaka, chairman, Mr Sasaki, who was president from 2009 to 2013, and his predecessor, Atsutoshi Nishida, who headed the company from 2005 and remains an adviser to the company. They are said to have uncovered emails showing Mr Tanaka and Mr Sasaki instructing employees to delay the booking of costs to make the financial figures look better, according to media reports. Nominating former chief executives and chairmen impede efforts to change old business practices and also uncover frauds – in Toshiba’s case, the fabrication of accounts extended to over seven years. Nominating directors who will challenge the status quo is not considered favourably by most nomination committees because the ‘tone’ does not want to accommodate any noise.

What are the nomination committees of companies doing about evaluating performance of directors and recommending the capable ones? They need to do much more than just identifying and selecting potential candidates who are interested, well intentioned and generally aware of business trends. They need to consider if the veteran board members meet director competencies. Progressive companies assess director competencies and upgrade selection

criteria. The others would continue to use criteria which have nothing to do with competencies, but look at characteristics such as who doesn’t rock the boat, who won’t challenge the chairman, who always agrees with the CEO, who belongs to the old boys’ club, etc.

Failure to govern remuneration

Boardroom pay has long been a contentious issue. Are there adequate safeguards to address the risk of increased focus on personal interests of directors and executive, ignoring the interests of shareholders that is affecting the viability of the company? In the Sri Lankan situation, there is no external pressure or demand for companies to set remuneration policies that safeguard the company and its shareholders.

As such, executive remuneration is often seen as an issue. What should be done to get it right? The King III report recommended that boards should adopt a policy or a framework for the remuneration of their senior executives. As an expert advisory to the board, the remuneration committee should develop the whole framework via benchmarking with other organisations and getting input from experts. That makes a framework more informed than any shareholder could be, and hopefully, shareholders will accept the framework recommended by the board.

Global examples of RBS and Shell

In 2009 the news of the retirement package awarded to Sir Fred Goodwin, former chief executive of Royal Bank of Scotland, met a storm of protest. The most spectacular rebellion took place at the April AGM of Royal Bank of Scotland. The company’s remuneration report was rejected by more than 90 per cent of the votes cast, with the UK Treasury adding its own 70 per cent shareholding to the cause. As Sir Fred Goodwin discovered, tolerance of ‘rewards for failure’, excessive bonuses and of any elements of remuneration that couldn’t be justified by overall company performance was no longer acceptable.

In May 2009, blue-chip company Shell found itself in similar trouble. This time, investors focused on the use of a remuneration committee discretion that allowed pay-outs under a long-term incentive plan. Shell had narrowly failed to meet its comparative TSR target (third place for total shareholder return measured against a small group of five global oil companies), but the remuneration committee nonetheless allowed 50 per cent of awards to vest, justifying its decision on the basis of the company’s consistently strong financial performance. The TSR target had only just been missed, but the remuneration report was rejected by nearly 60 per cent of the votes cast.

Governance initiatives

In the UK it was claimed that pay structures (particularly bonuses) had contributed to a culture of excessive risk-taking among Britain’s banks, thereby helping to precipitate a major economic crisis. This was a similar view in the US, too.

The UK took the initiative to address the deteriorating situation and to improve corporate governance and reform remuneration practices, such as:

– The publication of the Financial Services Authority’s (FSA) Remuneration Code, requiring the United Kingdom’s largest financial institutions to ‘establish, implement and maintain policies, procedures and practices that are consistent with and promote effective risk management’

– The Walker Report on corporate governance of the financial services sector required:

– The remuneration committee should be directly responsible for the pay of not just directors but also of those regarded by the FSA as having a ‘significant influence function’ or who may have a ‘material impact on the risk profile of the entity’, giving the committee a greater control over a company’s pay practices.

– The remuneration committee should have oversight of remuneration policy throughout the business, though it will only set pay packages for the most senior staff.

– The remuneration committee should confirm in its report that it is satisfied with the way performance objectives and risk adjustments are reflected in compensation structures for senior management.

– It must also report whether it has the power to enhance an executive’s benefits in certain circumstances such as termination of employment or a change of control.

– A revised UK Corporate Governance Code from the Financial Reporting Council. Some of the changes focus on aligning reward with the sustained creation of value, including:

– Greater emphasis to be placed on ensuring that remuneration policies are designed with the long-term success of the company in mind, and that the lead responsibility for doing so rests with the remuneration committee; and

– Companies should put in place arrangements that will enable them to recover or withhold variable pay when appropriate to do so, and should consider appropriate vesting and holding periods for deferred remuneration.

The remuneration committee reports in the annual reports of the Business Today TOP 25 will have to be a lot more descriptive and informative, to be useful.

Financial illiteracy

In audit committeesIt is still a challenge to see a majority of audit committee members being financially literate. Some of the benefits of using non-executive-independent directors is lost if they are unable to understand financial risks, controls and root causes for failures. Financial literacy means not only understanding what the financial statements represents, but more importantly encompasses understanding the effect those judgmental areas of accounting can have on any set of financial statements, and how management judgments can be abused to manipulate financial statements.

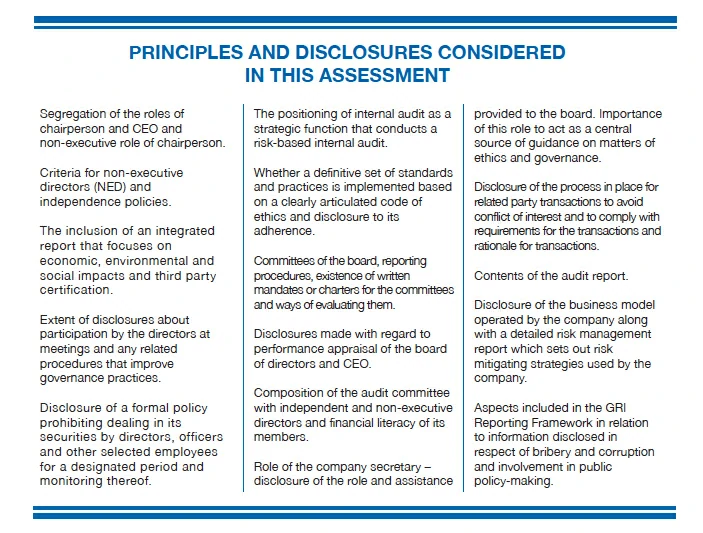

Principles And Disclosures Considered In This Assessment

Recently, the German manufacturer Volkswagen was found to have falsified US pollution tests on 500,000 diesel engine vehicles, by installing software (‘defeat devices’) to make them appear cleaner than they were when being tested. Though this is part of operations and may not be within the ambit of the audit committee’s responsibilities, it will have a significant financial impact on the company.

The audit committee of VW had the following two responsibilities on its TOR:

– Identifying the principal financial risks of the Company.

– Overseeing reporting on internal controls of management and ensuring that management has designed and implemented an effective system of internal controls.

| Range | Rating |

| 40-49 | Basic disclosures |

| 50-59 | Rule based compliance |

| 60-69 | Acceptable level of compliance |

| 70-79 | Good governance process and disclosures |

| 80- 100 | Best practice |

This is a good test case on how much audit committees understand the impact of risks on its business operations and the related financial implications.Assessment approachCorporate governance assessment can be done in several stages. This exercise is limited to a desk-top compilation of corporate governance profiles of the companies in the Business Today TOP 25. Companies are scored from 0-100 based on their disclosure of information important for investors and the general public.In the scoring, 100 is most transparent, and 0 is least transparent.

Assessment Approach

Corporate governance assess-ment can be done in several stages. This exercise is limited to a desk-top compilation of corporate governance profiles of the companies in the Busi-ness Today TOP 25. Companies are scored from 0-100 based on their disclosure of information important for investors and the general public. In the scoring, 100 is most transparent, and 0 is least transparent.

This assessment does not conclude that companies with better scores (based on disclosures) will make better results or vice versa or in fact are better governed. Some of the issues in Sri Lanka, where companies do not focus on transparency relate to:

– Concentration of ownership and presence of a controlling shareholder.

– Directors are related parties to the controlling party to primarily protect the nominator.

– Low level of financial literacy of audit committee members.

– No consequence for non-compliance.

– Boards are allowed to pass resolutions and make directors independent or keep them at 70 years of age.

Findings and conclusions

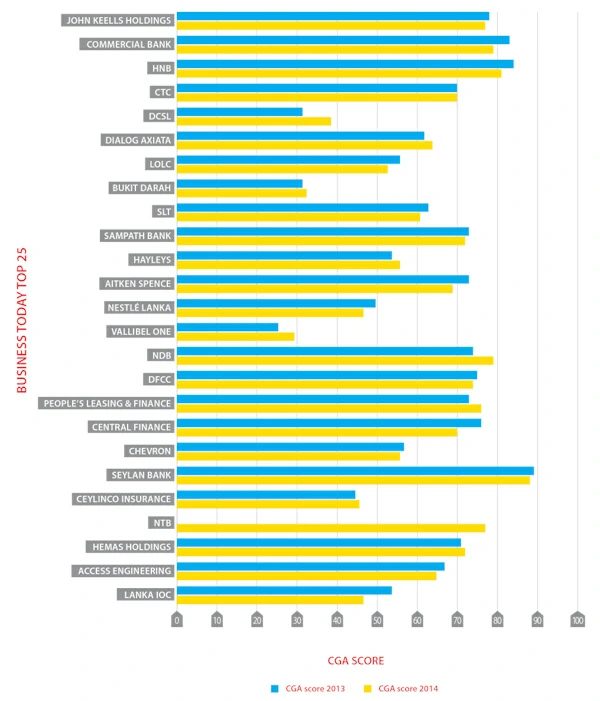

The slow improvement in scores over the years is not due to a lack of awareness by the companies but due to a weak monitoring system over the listing requirements of companies. Lack of monitoring does not help in improving compliance above the minimal level of a ‘tick box’ approach. This year, 36% (40% in 2014) of companies in the above list are below the 60% level of compliance. Some of the common deficiencies continue to be standard template type of disclosures in the board sub-committee reports, level of independence of independent directors, financial literacy and composition of audit committee members, lack of a strong framework for related party transactions and avoidance of conflicts of interest, non-disclosure of a formal policy prohibiting dealing in securities by directors and officers, not fully recognising the role of a company secretary, the strategic importance of internal audit and board balance between executive and non-executive directors, non-disclosure of policy on bribery and corruption. As there was no significant improvements noted, the criteria were made more stringent to reduce marks for minimal compliance. Therefore, only 36% of the companies were able to improve their scores this year.

The average scores for the five years over which this assessment has been carried out is given below:

After adjusting for the 2011 results due to only 20 companies being rated, there has been an 8% overall increase in quality of reporting. More companies have reached the 60% level and this augurs well for the Sri Lankan capital market.

| 2011 | 2012 | 2013 | 2014 | 2015 | |

| Average score | 57 | 55.08 | 57.16 | 61.72 | 62.24 |

| Net change in points earned | n/a | +19 | 0 | +72 | -13 |

The corporate governance code being voluntary may have something to do with the slow traction. It’s time that listed companies are influenced by the regulator to comply or explain to a higher level of qualitative governance to improve integrity of the market. Hope these companies will follow Thomas Jefferson’s advice: “In matters of style, swim with the current; in matters of principle, stand like a rock.”

The Business Today TOP 25 companies seem to enjoy an ability to produce consistent results which indicates that the boards are able to drive higher quality of earnings. This publication serves as a recognition of corporates who demonstrate good governance and transparency in their disclosures and congratulations to the boards and managements of these companies for continuing to be outstanding, helping to improve business confidence and bringing global recognition to our capital market.

© Assessment tool development and technical input by Suren Rajakarier FCA, FCCA, FCMA (UK), CGMA. Head of audit – KPMG Sri Lanka.