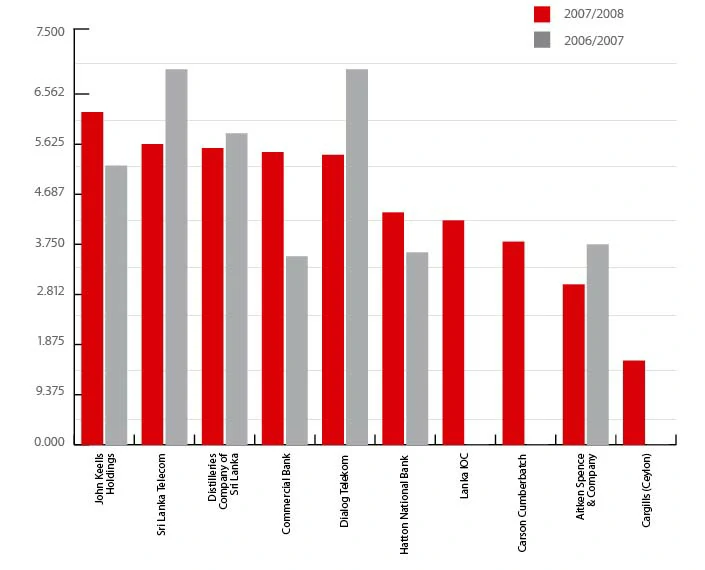

1 JOHN KEELLS HOLDINGS | 6.225

2 SRI LANKA TELECOM | 5.625

3 DISTILLERIES COMPANY OF SRI LANKA | 5.550

4 COMMERCIAL BANK OF CEYLON | 5.475

5 DIALOG TELEKOM | 5.425

6 HATTON NATIONAL BANK | 4.350

7 LANKA IOC | 4.200

8 CARSON CUMBERBATCH | 3.800

9 AITKEN SPENCE & COMPANY | 3.000

10 CARGILLS (CEYLON) | 1.575

picture

Business Today TOP 10 winners 2006 – 2007, after receiving their awards from President Mahinda Rajapaksa at Temple Trees The Business Today Top 10 award winners: (L-R) Sumithra Gunasekara, Director, John Keells Holdings; Mustanser Ali Khan, CEO, Ceylon Tobacco Company; Eran Wickramaratne, CEO, NDB; Thilak De Soysa, Chairman, The Bukit Darah; Harry Jayawardena, Chairman, Distilleries Company of Sri Lanka; Mathi K Parthipan, Managing Director, BT Options; President Mahinda Rajapaksa; Dr Hans Wijayasuriya, CEO, Dialog Telekom; Leisha De Silva Chandrasena, Chairperson, Sri Lanka Telecom; Rohan Fernando, Director, Aitken Spence and Co; Ravi Dias, COO, Commercial Bank; Keith Bernard, Analyst, Business Today Top 10 and Rajendra Theagarajah, CEO, Hatton National Bank

Business Today

proudly presents the TOP 10 Sri Lankan companies for the financial year 2007 – 2008.

Since 1998, Business Today has recognised and honoured the best corporate performers in Sri Lanka. The Business Today TOP 10 is chosen based on a selection process devised and refined by Business Today.

Based strictly on published financial information the Companies identified by Business Today TOP 10 have justified their business prowess by consistently outshining others in their performance.

In the Year 2007 Sri Lanka achieved a GDP growth rate of 6.4%. Although lower than last year’s growth rate of 7.4%, the achievement during the year is commendable in the context of increasing oil prices, high commodity prices and an escalating war in the North and East which at times spilled into the commercial capital, Colombo. The best-managed companies are not those that profit under ideal conditions, but those that can under conditions of uncertainty remain resilient, adapt and grow. It is in this backdrop that Business Today takes great pleasure in congratulating and saluting its TOP 10 companies for the year 2007/08.

Business Today, true to its reputation as the magazine of the corporate world has since 1998, a decade ago, regularly conducted its own survey of top corporate performers and recognised and honoured the best of the best. The annual survey is strictly based on published financial information of companies listed on the Colombo Stock Exchange. The Business Today TOP 10 company ranking has earned its place in the Sri Lanka business calendar, and it is with humble pride that Business Today presents its latest ranking of companies based on their financial performance during the year 2007/08.

As repeatedly observed in the past, competition for a position in the Business Today TOP 10 ranking is intense and closely contested. This is evident by the feedback received during the last ten years of the ranking. Companies that regularly secure a place in the list have done so through sustained performance and pursuing a clear strategy. The Business Today Top 10 companies must surely be proud of their success; those aspiring for a place in the list should find inspiration and take a cue from the more recent entrants to the list. Companies who are and/or have been among the TOP 10 know what it takes to excel and must endeavour to hold or improve their position on the list.

Business Today is guided by the principle of allowing equal opportunity and a level playing field for all public quoted companies of acceptable and comparable size to seize a place in the ranking. The only condition being that the companies rate high on the Business Today disclosed criteria.

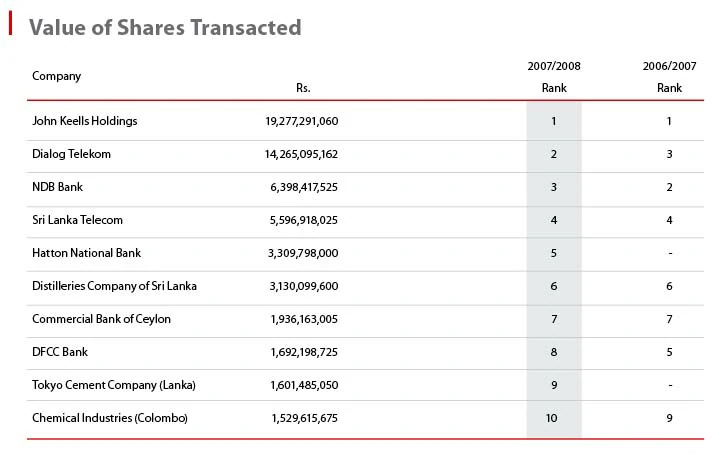

Established financial criteria used in the selection of the Business Today TOP 10 includes; Sales Turnover, Growth in Sales Turnover, Profits, Growth in Profits, Return on Equity, Earnings per Share, Market Capitalisation, Value of Shares Transacted and Value Addition. It may be noted that a high and growing top line performance by any company although necessary is not a sufficient condition to qualify as a top performer in the absence of profit.

As before, weights applied to the respective criteria are not disclosed for proprietary reasons. Business Today assures that weights are assigned to the aforementioned criteria after due consideration of significance of criteria and ensuring all business and industry sectors are equitably represented. Weights are applied uniformly without prejudice.

A simple observation of the latest Business Today TOP 10 ranking suggests, an increasing number of companies with diverse business interests occupying the ranking. However, there are conglomerates that were once the pride of Sri Lankan business, which had been part of the Business Today TOP 10 that are now trailing far behind. Business Today sincerely hopes that these conglomerates would come out from their cocoons and return to lead Sri Lankan business with renewed vigor into new vistas.

The presence of the leading telecom duo in the ranking order, adds to the attractiveness and high propensity for growth in the telecom sector. The earlier years of the Business Today TOP 10 ranking was dominated by companies from the financial sector. However interestingly, in the recent past Commercial Bank and Hatton National Bank are the only two banks consistently finding their presence in the Business Today TOP 10.

Business Today decided to consider Bukit Dhara Company and Carson Cumberbatch as one company for the Business Today TOP 10 ranking. The reason being that the two companies are so closely related that if Carson Cumberbatch enters the Business Today TOP 10 ranking, almost by default Bukit Dhara Company would find a place in the list probably immediately before or after Carson Cumberbatch. As Carson Cumberbatch was the better performer in terms of the Business Today TOP 10 ranking in the year 2007/08, Business Today chose Carson Cumberbatch over Bukit Dhara Company in the ranking.

As Repeatedly Observed In The Past, Competition For A Position In The Business Today TOP 10 Ranking Is Intense And Closely Contested. This Is Evident By The Feedback Received During The Last Ten Years Of The Ranking. Companies That Regularly Secure A Place In The List Have Done So Through Sustained Performance And Pursuing A Clear Strategy. The Business Today Top 10 Companies Must Surely Be Proud Of Their Success; Those Aspiring For A Place In The List Should Find Inspiration And Take A Cue From The More Recent Entrants To The List.

As a rule of thumb, the Business Today TOP 10 ranking could be viewed as a ‘Vision Board’ of Corporate Sri Lanka. A quick analysis over the years provides a general idea of the overall business trends in the country.

Prior to introducing the latest Business Today TOP 10 Companies, Business Today expresses its deep appreciation and admiration for the companies that have nurtured and shaped the Sri Lankan business landscape.

John Keells Holdings is Business Today’s number one Company for the year 2007/08. The Group has consistently secured a position in the Business Today TOP 10 and has occupied the number one position before. Although challenged by other business conglomerates and super performers for the top place in the rankings, the Group never paused in its pursuit of superior performance. Business Today has previously identified the John Keells Holdings as a worthy benchmark for all progressive businesses in Sri Lanka and is pleased to note that the Group’s reemergence as the number one Business Today TOP 10 company substantiates that conviction.

An important element that sets the John Keells Holdings apart from most other companies is perhaps the Group’s advantage of having a strategic human resource capability. The Chairman of the Company, in his message in the 2007/08 Report to the Company’s shareholders states, “A key strategic priority at the board level is to build and scale up an organisation with the capability and the capacity to deliver our vision and objectives, while preserving the values of John Keells Holdings”. Recognising human resources as critical to its success and deliberately investing substantially in the development of that resource has probably contributed in large measure to the John Keells success story. Therefore it may well remain a durable source of advantage in sustaining the Group’s position of excellence.

In the year 2007/08The John Keells Holdings reported an after profit tax of Rs 5.12 billion based on reported revenue of Rs 41.81 billion.

The Group’s Transportation sector made the largest contribution to the stellar performance making up 53% of the post tax profit. The significant impact of the transportation sector on the overall performance of John Keells Holdings presumably renders the company vulnerable to any material adversities in that sector. This may come to bear in the ensuing year due to the contingency associated with the bunkering operation of the Group.

The leisure sector in the country came under stress due to less than desired macro conditions and travel warnings issued by countries, particularly in the West. This affected the local leisure related business of the Group. Furthermore the Company’s Maldivian resorts were only partially operational due to extensive refurbishment work. The result was a setback in the Group’s leisure sector.

Performance of the Group’s Property, Consumer Foods and Retail, and Information Technology sectors declined, but the Financial and Plantation Service sectors of the Group reported encouraging results.

John Keells Holdings is a professionally managed Group and has done Sri Lanka proud in the past. Although it may inevitably encounter internal as well as extraneous challenges as most large and small businesses do, they are well set and poised to stay defiant and emerge stronger than before.

Sri Lanka Telecom once again held its position at number two in the rankings, demonstrating its power to remain as a telecommunication giant. A decade since privatisation, Sri Lanka Telecom has progressed from a one time State owned and managed bureaucratic institution to a modern dynamic ‘Blue Chip’ on its way to setting the latest trends in ‘Information and Communication Technology’ and leading Sri Lanka business beyond the country’s shores. Sri Lanka Telecom offers a complete range of services covering voice, mobile, broadband, Internet and data. It is unique in that it provides services to all other operators in the country.

In true characteristic of a company determined to leave its footprint on the global telecommunications landscape, the company has aggressively invested in developing the telecommunication infrastructure within the country and in several regional and global initiatives to the tune of Rs 103 billion since privatisation. The payoff of these investments is evident from the position commanded by Sri Lanka Telecom as a business entity and its strength as a major player in the Sri Lanka telecom industry. Of course most importantly generating a healthy stream of foreign exchange amounting to approximately Rs 67.44 billion.

Notwithstanding a significantly high refund of Rs 1.4 billion to customers that directly affected its bottom line during the year, Sri Lanka Telecom reported a profit of Rs 5.6 billion based on reported revenue of Rs 43.2 billion.

As the national telecom service provider Sri Lanka Telecom together with its mobile telephone service arm, Sri Lanka Telecom Mobitel, have built a credible reputation and a solid foundation that can be potentially used to make Sri Lanka a leading telecom centre in the region.

Distilleries Company of Sri Lanka maintained its position in the Business Today TOP 10 ranking at number three. Another privatisation success story as repeatedly referred to by Business Today, the Distilleries Company is today a major conglomerate with diverse interests spanning beverages, plantations, financial services, telecommunications and healthcare and through its associated companies; logistics, infrastructure and leisure.

The consolidated turnover of the Distilleries Company of Sri Lanka reportedly grew by 21% to Rs 56 billion and after tax profit grew by nearly 14% to Rs 4.2 billion.

As the leader of the local liquor segment in the country, the beverage sector of the Company continued to contribute chiefly to the Group’s profit. The Financial services and the Telecommunications sectors of the Group performed moderately well in the face of intense competition. In the Healthcare sector, further to restructure and rationalising exercises, marginal improvements were reported and hope of turnaround was expressed by the management of the Group. Influenced by healthy world tea prices the Plantation sector of the Distilleries Company of Sri Lanka reported significant improvements in profitability.

With emerging challenges within the country as well as globally, the Group would, just as all other businesses, be expected to deliver under pressure. Thus the entrepreneurial spirit of the Distilleries Company of Sri Lanka may well be put to test.

Commercial Bank of Ceylon, the globally respected, locally trusted name in commercial banking found its way up the ranking to number four from number seven last year. The elevation in position was mainly because of a substantial growth in profits emanating from operations both in Sri Lanka as well as Bangladesh.

Commercial Bank reported a post tax profit of Rs 4.2 billion in 2007, a growth of 47% over the previous year. Reported turnover was Rs 35 billion, up by 44% over the previous year.

Having established itself as a leading name in the Sri Lankan banking sector and achieving a position of significant strength among banks in Sri Lanka with a network of 163 branches and 291 ATMs distributed around the country by the end of 2007, Commercial Bank has endeavoured to grow and expand its presence in Bangladesh. Since four years of operations in Bangladesh, the Bank is fourth in terms of profitability among foreign banks operating there and first among regional banks.

Commercial Bank is fundamentally strong and stable, but will be called upon to weather the effects of the global financial crisis taking the world by storm. Given the Bank’s ability to absorb shocks and relative safe guards in place, Commercial Bank would in all likelihood remain strong though marginally shaken.

Dialog Telekom, Business Today’s last year top company fell four places to number five this year. Dialog Telekom, the number one mobile telephony company in Sri Lanka, during 2007 reportedly grew its subscriber base by 37% to reach 4.3 million. According to the company this fuelled a YoY revenue growth of 24%.

In a backdrop of a total mobile telephony subscriber base of 8 million as at end 2007, the market position enjoyed by Dialog Telekom was appreciatively strong, but the increasing number of operators and intensity of competition among operators is forcing prices in favour of customers and demanding huge investments in infrastructure and service innovations. The cumulative effect is shrinking margins and prevailing high cost of capital impacting on profits.

In 2007 the Dialog Telecom Group reported a post tax profit of Rs 8.97 billion and a turnover of Rs 32.5 billion.

The time ahead will see more growth in the mobile telephony market where existing and new players may intensely fight for a piece of the market. Dialog Telekom enjoys a comfortable lead at present, but the company no doubt endowed with good foresight would wake up to the emerging challenges and revisit its business model and adjust its plans in the light of the new reality.

Hatton National Bank, in the same position of number six as last year reported a 36% growth in post tax profits under challenging industry and macro conditions. Another local bank with a distinct and credible reputation for strength and stability, Hatton National Bank has in the recent years embarked on a programme of upgrading and expansion. The Bank has a wide presence in the country through its network of branches and ATMs and maintains a thrust towards expanding outside the traditional urban centres.

Hatton National Bank has ventured in to overseas markets where either a strong Sri Lankan Diaspora is present or where opportunities are presented. The bank is in the process of evaluating new overseas markets and establishing alliances with overseas partners in strategic segments.

With a view to realising the synergies of two leading corporate giants from the financial sector, Hatton National Bank combined with DFCC Bank to set up an investment bank to host an array of investment banking products and services. Having obtained necessary regulatory clearances the new venture with an initial capitalisation of Rs 500 million expects to offer a range of products encompassing stock brokering to fixed income securities and corporate finance/advisory services.

Cognizant of a major challenge in the form of losing valuable professional and skilled talent to overseas markets, Hatton National Bank has adopted a policy of offering employees who opt to take hiatus or work overseas for three to four years, the option of rejoining the Bank upon return if they so desire.

Hatton National Bank is reasonably poised to fend against local and global financial challenges. The Bank is known to follow sound lending practices and has proved in the past that it has the required asset strength to cover against contingencies. All indications are that the economic and regulatory pressures faced by local banks would continue, and Hatton National Bank will be called upon to maintain its defiance and muster its strengths to hold and grow its position specifically within the banking sector and generally within the corporate sector in Sri Lanka.

Lanka IOC enters the fray at number seven for the first time in the Business Today TOP 10 ranking. The company did so by reporting its highest net profit of Rs 2.3 billion and turnover of Rs 44.8 billion. The company also achieved a pay-in of Rs 340 million through successful hedging transactions during the year. Earnings were enhanced due to a build-up of inventories at comparatively lower prices.

The revision of the retail price six times, during the year by the Sri Lanka government as acknowledged by Lanka IOC, helped the company tide over the exposure risk and return a handsome profit.

Lanka IOC with its entry to the local market set the trend of modernised fuel stations in Sri Lanka complete of utilities and service facilities. Mindful of the constant revamping of fuel stations distributing products of Ceylon Petroleum Corporation, Lanka IOC has ensured that fuel stations carrying its logo are upgraded and maintained so that customers visiting the stations can expect the high quality services Lanka IOC has initiated.

It is common knowledge that the world oil industry is experiencing volatility. In Sri Lanka too oil pricing is a debated issue with wide public interest, therefore rendering Ceylon Petroleum Corporation and Lanka IOC vulnerable to price sensitivities. Given the situation of dependence on a product over which the company may have little influence in pricing, Lanka IOC’s ability to maintain its position under present conditions, may lie in the balance.

Carson Cumberbatch, subsidiary of the Bukit Dhara Company that occupied tenth position in the Business Today TOP 10 last year, secures eighth position in the ranking this year. Proving its corporate strength, Carson Cumberbatch re-enters the Business Today TOP 10 after a lapse of two years from number 10 in 2004/2005 to number 8 in 2007/2008.

The company reported the best performance in its history by recording a post tax profit of Rs 3.56 billion, an astounding improvement of 89% over the previous year.

As noted by the Chairman in his statement to the shareholders, “The Carsons Group in its vision statement formulated more than a decade earlier, recognised the potential of “Asia” as its future playing field and built up a regional business presence that will add value to shareholders well into the future”. In line with its vision, today the company has a presence in Sri Lanka, its home base, where most of its core businesses are concentrated. Additionally the Company is present in other parts of Asia such as Malaysia, Indonesioa and Singapore where its oil palm plantation business is focused and India where the company has investments in several brewery projects.

The oil palm sector of the company must be credited for contributing largely towards the overall performance of Carson Cumberbatch. The oil palm sector benefited greatly from positive market conditions coupled with efficiencies in yield and productivity. The beverage sector of Carson Cumberbatch performed well but the Group met with setbacks in most of its other business sectors such as investments, real estate and leisure. These sectors are unlikely to show improvement in the ensuing year, and together with declining palm oil prices in the world market, Carson Cumberbatch may well prepare to harness its innate and inculcated management prowess to profit in spite of adversity.

Aitken Spence & Company secured ninth place in the Business Today TOP 10 ranking. A lead player in the leisure sector, Aitken Spence & Company had to grapple with unfavourable industry conditions worsened by high borrowing costs, high fuel costs and rising inflation – a recipe for disaster for any leisure sector operator. Despite unfavourable conditions surrounding the local leisure related business, performance of overseas properties in India and Maldives together with management income from hotels in Oman helped improve the bottom line.

Disadvantages of the leisure sector were mitigated by wealth creating operations in the form of port management services, cargo logistics, money transfer activity, plantations, and power generation, IT etc.

As claimed by the company, overseas expansion remains critical to the evolution of Aitken Spence & Company. As a regional and global player, the Company is steadfastly committed to explore opportunities in power generation, tourism, logistics and Information Technology as focal areas of growth and consolidation.

Aitken Spence & Company reported a net profit of Rs 1.8 billion for the year ended in March 2008.

Cargills (Ceylon) enters for the first time to the Business Today TOP 10 ranking at tenth place. Coincidentally the Organised Food Retailer, enters its 25th year of operations having evolved from its original four department stores to the present fastest growing and largest retail chain in Sri Lanka. As at 31st March 2008, Cargills reportedly prided itself with 116 outlets spread across 19 districts.

Cargills owns and operates its own manufacturing and distribution arm. The company also owns the KFC franchise in Sri Lanka, and introduced the first KFC drive-thru in the South Asia region.

The company with good foresight began an out-grower programme and invested in farmer development. As part of the programme farmers are educated on agricultural science and technology with a view to reducing the cost of food production and enhanced productivity. Cargills continues to grow its farmer base and has expanded into the Eastern agricultural sector, thus making available to them the best practices and the best prices in the market.

The Business Today TOP 10 companies have been selected on the basis of their financial performance by Keith Bernard and Shiron Gooneratne, with the assistance of KPMG Ford Rhodes, Thornton & Co.

Business Today thanks all past and present voluntary contributors, including Dinesh Weerakkody who opted out of the selection process in the interest of independence, for making the Business Today TOP 10 a reality.