‘Business Today’ in its October issue, named 10 companies who excelled in their performance during the period 1995/96. In exclusive interviews with ‘Business Today’ several CEOs of companies who ranked amongst the ‘Top 10’ talk of their companies, progress and express views on the magazine’s selection criteria…

(We were unable to get interviews with Hayleys and DFCC, who also rank amongst the ‘Business Today Top 10’)

‘We Have a Hundred Year Record…’

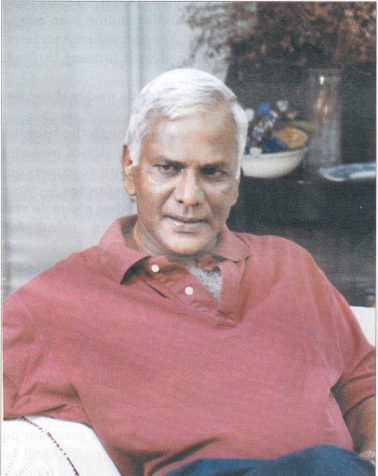

Rienzie T. Wijetilleke,

Managing Director,

Hatton National Bank

by Dinesh Weerakkody

‘Business Today’ has made a first by selecting the Top 10 companies in Sri Lanka based on their financial performance. What do you think of the Top 10 Concept?

I think the analysis is reasonably good. However, an analysis of this nature should also incorporate a few qualitative factors which are not reflected in the financial figures. As you know financial figures that are published does not rep- resent the true position of a firm. So what I suggest is that you join up the financial results with a qualitative analysis. Overall, any way I think the analysis is an excellent concept.

You spoke of the need to have qualitative factors. We did not want to incorporate any qualitative factors because of the subjective nature of qualitative factors, like for example market perception or employee perceptions. Please comment.

Yes, I suppose so, qualitative factors can be challenged, unlike financial figures which are published information and also would be subject to several varying opinions.

What do you think of criteria, on which the companies were awarded points?

I think you have covered the essential areas. As competitors we can’t grumble. I think Euromoney also use a similar set of criteria for their evaluation.

HNB according to our analysis has performed reasonably well in all our selection criteria thereby securing the top slot in our analysis. In your opinion what are the reasons you attribute to HNB’s transformation from an inward looking bank to a forward looking customer focused financial institution within a space of ten years?

I am not trying to get credit for myself. But there was an overall change in management in 1987. The then senior officers who were conservative in their outlook and old fashioned handed over the reins to me. When I took over the operations of the bank I had already gained several years of executive experience and also been instrumental in opening several branches in the early 80’s for HNB. So I knew the potential of the bank and I had a good idea about the resources the bank had. So from that point onwards it was a case of exploiting these resources and opportunities available also at the same time there was a change in the board and also the appointment of a new chairman who was also thinking in the same lines. The change of the government and Premadasa on assuming the Presidency and his vision for the country gave me an ideal platform to adopt a long term and a medium term strategy to make HNB a national institution. So that was the vision on which we started building upon. There were also plenty of opportunities available which were exploited to the hilt.

HNB over the last 10 years has made a great impact in the banking sector. Currently your bank has the largest deposit base among the private commercial banks which is around 37 billion. In your view what would you consider as your bank’s strengths, which have contributed over the years to your bank’s progress?

We have had a hundred year record. We have been at the grass root level of the economy through our Hatton Bank and the branches of Grindlay’s Bank we took over. We have had a good mix of staff and resource base. We have a good deposit mix as well as a good share holder base. Unlike some other institutions that came up at that time we did not confine ourselves to build our corporate image, we recognized the need to build up a national image at the same time which we knew in the long term would pay off.

HNB has had a tremendous growth in deposits in the last few years. In your view what are the reasons you attribute to your bank’s ability to mobilize deposits beyond the industry average?

The public and corporate image of a financial institution has a bearing when it comes to attracting deposits from the public. In the outstation it is the public image as you know we have several products and services which are really suiting the needs of the public. We have, because we are a customer driven organization, been able to identify the real requirements of our people thereby serving our customers with much care and consideration. We have a slogan which our staff follows. If you walk into any HNB Branch you will see this banner which says, HNB Friendly, Courteous and Caring. Today this slogan has absorbed into our service habit. Friendly and courteous is something everybody has in common. But caring has a deeper meaning. We have instilled in our staff the need to be caring and to show that we care for our customers. This relationship we have built with our customers has apparently brought them closer to the bank bringing us favourable results. We have also a good corporate image, you name any big company in Colombo they would have a relationship with us. We have maintained their requirements and needs which has benefited them and us.

Generally how do you compete in the market considering the limited market opportunities which is resulting in shrinking profit margins?

I must tell you we are a customer driven organization as a result we are very close to the market conditions. We are able to foresee things long before our competitors even understand them. For instance it was HNB who had the 1st Marketing and Corporate Planning Department among the Banking sector and it was as way back as the late 80’s Many banks have just be gun to set up planning units. HNB since the late 80’s has been in the business of planning ahead using re- search backed market intelligence. In fact we have set up so many departments which have been in existence for over five years that are being only set up now by our competitors. Even decentralization, when my branch network started expanding I started the process of decentralization which was completely different to the State banks. We went on a counselling and as

sisting exercise with our branch managers. We did not decentralize our departments but instead we decided to build up our human resources. We have paid a lot of attention to the development of our staff at every level. That is one of our plus factors for being able to stay ahead of our competitors.

Focusing upon and building up the human resources is in my view a key strategy for adding value to the value chain. In this context it can be said that HNB’s human resources has given you a competitive advantage?

To a great extent I think we are the only bank that sends a large number of our staff overseas for training, seminars and conferences. For a year on average we send around 100 executives on overseas training. Right now I have about 3 Senior Executives overseas receiving training. Our staff who go overseas get exposed to various situations and simulated exercises which on their return can be modified and adopted to suit our local conditions which give us a definite advantage.

Any other factors that you consider as strategic advantages?

Human resources is not the only advantage we have, we have a very good deposit. mix. Also we maintain a very good level of liquidity when compared with our competitors. As we mentioned earlier we have good corporate relationships and a national image in the rural sector. As for our IT over the years. has been developed in-house which has now turned out to our disadvantage. Because the imported banking software packages have become superior. We are now in the process of upgrading our IT programs in order to get a leading edge over our competitors.

So what you are saying is that by focusing attention and resources directly at specific market segments you can respond quickly?

Yes, by focusing our attention and resources directly on our market segments, we can improve our tailoring of service and respond quickly to the changes in our customer needs and market conditions. This is why I mentioned earlier we are a forward looking bank and that we plan well ahead.

Commercial banks in developing economies have an important role to play, vis-a-vis lending to priority sectors. In this context what is HNB’s contribution to national development? We have contributed in many ways. As a private bank we have introduced a micro finance scheme which has been recognized by the World Bank. We started this scheme at the time when Premadasa started his Janasaviya Program. Actually it was my own brainchild. We realized that the Janasaviya Scheme would be going into the grass root level of our country and we did not want to get involved directly with the government agencies to support the Janasaviya recipients we decided to have an alternate scheme for micro finance. This program has been one of our Bank’s best achievements mainly because we had identified hundreds and hundreds of customers who were now growing with us in the out stations who are going to be the future entrepreneurs of those areas and who are going to have a long term relationship with our bank.

As you know savings is vital for our development cycle. In this context what are the products you have introduced to encourage savings in our country?

We began HNB’s Pathum Vimana Savings Scheme which we consider as our contribution to the savings habit in this country.

Most banks in Sri Lanka have invested large sums of money on technology. In my view new technology is revolutionizing the way business and people communicate, do business and would have profound implications on our Banking Sector. In your view how important is technology to our Banking sector?

As for technology it is becoming very important. When Bank of Ceylon introduced the Master card about five years ago, HNB did not think that the plastic cards would have such a significant impact. No doubt globally technology would be the key to the future. However in Sri Lanka in my view would take a little more time. But before that our banking services should spread into the rural sectors. Our rural people are not looking for technology but wanting only the basic financial services which we can provide with the existing level of technology. They are not interested in going to an ATM to collect cash. They are only looking for advise and support to improve their economic conditions. So we have to provide that kind of service on a broader basis before we think of any technological revolution.

So what you are saying is that the rural areas are under banked?

The village sector is being ignored. As result for the last few years, the village economy which should have grown much faster is stagnating. It is in this context that our bank decided that we should embark on a branch expansion program in the outstation to provide

banking services to the poor segment in the country. As I said before more than 40% of our population do not enjoy banking services. In this context, I am very happy that more and more banks are setting up operations in Colombo. Though people are saying that Colombo is over banked it is good for competition. When Colombo gets over crowded the banks in Colombo will be compelled to move into the outstations and branching out by that our rural people will have access to proper organized banking services. People think that our rural sector is not bankable. But HNB has discovered that the rural people are more bankable than they appear to be.

Talking about productivity. How comparable is your cost to income ratio when compared with the industrial leader Sampath Bank?

As you know Sampath Bank is still relatively small and they commenced on a superior IT platform, we started off on a manual system and we had already expanded our selves into thirty or forty branches by the time Sampath came into being. It is relatively easy for a new organization to build up high levels of technology at the outset which N.U Jayawardane wisely did. However Sampath Bank has expanded very slowly. When you are slow you can be small and beautiful. When you are big you can’t maintain the same levels of productivity. In the last three years we have gone on a rapid expansion program. When we open a branch we spend around 7 million to set up the branch. In the future a branch would cost around 10 million. As you know we already have 85 branches. Those days a branch would take at least 18 months to break even. Today we get a branch to break even in 6 months. So this is something we have achieved at the expense of productivity. Gradually all our branches are becoming very productive. The advantage I have over Sampath is that despite their superior cost to income ratio, I feel in the long term I am on stronger footing because what we have already spent on our branch network Sampath has yet to spend and they will have to spend more.

Then what is the possibility of larger banks swallowing up the smaller to achieve economies of scale.

It has to happen. We tried to do it with Commercial Bank.

But Commercial Bank is on par with HNB?

It will happen. There could be a situation where the smaller financial institutions go down the drain due to mismanagement. Some of the smaller Merchant Banks are taking far too much of risks which I feel in the long term is not healthy at all. In that context, there is no question in the coming years there will be acquisitions and mergers of institutions with bigger institutions.

As a final question what are your expansion plans?

People are asking me why I don’t have foreign branches. My answer to them is that I need an investment of around 7 million dollars and today the world is one market you don’t need to be physically present in a country to do business. I have 75 very strong correspondent banks right across the globe with whom I do good business and I am able to compete with the foreign banks on the same terms because of our relationships with the outside world. So our plan is to become very big in Sri Lanka. In fact to become the biggest bank in Sri Lanka by the year 2000, surpassing the two state banks. Therefore, acquisitions and mergers will be very much a part of our strategy.

‘We are a consumer driven business …’

Gottfried Thoma,

Chairman & Managing Director, CTC

by Keith D Bernard

As the Chairman – Managing Director of Ceylon Tobacco Company Ltd. one of the best managed and most admired companies in the country, you also bring with you a wealth of international experience to Sri Lanka. What advice would you offer to the improvement of the ‘Business Today’ magazine and its Top 10 ranking?

‘Business Today’ is a good magazine. The presentation, layout and content are very good. I support the initiative taken by ‘Business Today’ to do its own Top 10 ranking in the country. The criteria used for the ranking is acceptable. Perhaps you could disclose the weights used later on as you establish yourself as the number one business magazine in the country. Once you are perceived as the authoritative source for the Top 10 ranking it’s very unlikely that anyone would dispute the criteria or weights used. I would like to see people making references to companies in terms of the ‘Business Today Top 10’ just like they make references to the Fortune 500.

Looking through the list of companies that made it to the ‘Business Today Top 10’, I observe that four out of the ten have links to manufacturing. Out of these four only two companies are exclusively involved in manufacturing of which you are one. What comments have you to offer?

The world has witnessed a transition from agriculture to manufacturing to service. Sri Lanka is experiencing a jump from agriculture to service. Unemployment is not being addressed. This has to be done through the wealth creating process. For example, according to an independent survey. Ceylon Tobacco is responsible for over 300,000 direct and indirect jobs created in Sri Lanka. This is a very significant contribution to the wealth creating process in the country.

While walking through your corridors today I noticed that you have very prominently displayed sign boards carrying messages like “The customer says, I pay your wages’ and ‘Quality is your responsibility too’. Has your commitment to consumer orientation and quality been well received by your employees?

We have been successful in inculcating in our employees the importance of consumer orientation and quality. That is fundamental to us. We have a very good employee-employer relationship. For the last six years we have not had a single case of industrial action or strike. Our employees are convinced of the importance of consumers and quality. We are a consumer driven business and we believe that if consumer demand is not met by us someone else will satisfy it.

In today’s world where tobacco giants are being tried in lawsuits on health related allegations, and where governors of States are banning cigarette sales in their respective States and health authorities are warning the public of health related perils inflicted by close association with tobacco products, don’t you find yourself presented with constantly threatening forces and a shrinking market in the longer term?

All we say is that people in today’s world have the freedom of choice. People smoke because they enjoy it and they want it. Cigarettes are also a legal product.

In Sri Lanka regulations state that no one under the age of 18 should be permitted the purchase of cigarettes. We remind our distributors and retailers of the regulations but whether the regulation is enforced at the retailer level is questionable. We consider anyone over the age of 18 to fall into the adult population category. About 30% of the adult population in this country smoke and most of them are over 30 years of age. We are convinced that we have a sustainable market.

In part would you agree that your success lies in the fact that you enjoy a monopoly position in Sri Lanka?

That is not accurate. Until the 1960’s we were faced with competition. In the late 1950’s we bought over Rothman and Godfrey Phillips who had been operating in Sri Lanka. We started the outgrower scheme. We owned no land but provided credit to the tobacco farmers and bought back their produce. In the process we created employment.

Today we are faced with a different kind of competition. We are in competition with international brands that are smuggled into the country. About 81.9% of the price paid for a local cigarette by a consumer goes to the government by way of taxes. Smuggling means that the illegal products can be 81.9% cheaper than ours. This also means higher margins throughout the distribution chain and a cheaper product for the consumer. This is a revenue loss to the government as well. Smuggled cigarettes are publicly displayed. This reflects a violation of the law of the country and a lack of respect for it. Cigarettes that we import prominently display the health warning in all three languages.

Earlier on, you mentioned your conviction of a sustainable market despite the counter forces that are mounting against the industry. What growth strategies are you planning to stay on top of the game?

Our vision towards the year 2000 is Total trade and consumer satisfaction through world class performance in all aspects of the business’ in essence, ‘A passion for excellence’. We hope to achieve this through our mission which is to ‘Achieve world class standards

in products and services to ensure consistently superior trade and consumer satisfaction”.

Towards this end a major refurbishment is carried out at our factory. We started the process in 1992. All old plant and machinery are being replaced with State of the Art Technologies to match the challenge ahead. A substantial investment of over Rs 300 million is being infused into the refurbishment plan. The underlying objective is to increase productivity and be more competitive.

Competitive against whom?

Primarily against countries in the region. It is important that we improve our productivity and consequently cost competitiveness through a higher throughput. What happens if SAFTA comes in? We don’t want to be taken unawares. We have to strive to be highly competitive against the region, especially in the areas of cost, quality, attitude etc. Other companies in Sri Lanka should also be conscious of the implications of SAFTA when it comes into effect. Management of all companies should be equipped to meet the challenge. If well planned for the event we can actually find inroads into the regional markets instead of allowing competitors from the region to penetrate our market. At present, domestic industries are not cost competitive when compared to Indian costs of production. Look at the price of Indian chillies. It’s half the price of the local cost of production.

How are your sales fairing under your present cost structures?

We have complete control of our internal cost structures. Our refurbishment can effectively bring-down our internal cost of production over the medium to longer term. What is beyond our control are the government levies. As we mentioned earlier, nearly 82% of the price of a cigarette consists of government taxes.

For example a pack of John Player Gold Leaf in Sri Lanka in dollar terms costs around US$1.5 per pack where as in Pakistan it will only cost US80.6 and in Bangladesh the same pack will cost about US$0.7. In India the cost will be even lesser.

Affordability is the driving force for cigarette purchases. With real income of people belonging to many business sectors in the country dropping, disposable income of many have dropped. This has a detrimental effect on our business. Cigarettes smugglers who don’t have to pay government taxes have had a feast at our expense. If we reduce the price of a cigarette by about Rs 2 we are confident that the demand for our products will go through the roof. The government may be able to collect higher revenue as a result of a higher turnover volume. Our sales this year have declined by about 10%. This also means a 10% loss of revenue from cigarette levies by the government. In the process smugglers have got away with a substantial portion of revenue paying no taxes.

There is also a trendy and image conscious consumer segment in the market. If you can’t compete on price can’t you appeal to this segment with a different market positioning strategy?

We import the Benson & Hedges brand to cater to this segment. The problem however is that this is only a very small percentage of our consumer population and our continued growth hinges on the larger segment who are price conscious. The increased sales of “beedi” in Sri Lanka is a reflection of a switching segment.

You also export. Can’t you augment the loss of domestic sales with an increase in exports?

Yes, we export to the Middle East and we have been very successful in the export markets. In these markets we have to compete with an extensive line of brands. Competing in these markets requires a total dedication to cost and quality and we are making great strides in this direction.

Sri Lanka has secured a niche in the world for quality tea. Do we have any advantages in the quality of our tobacco that we may be able to capitalize on positioning our cigarettes in the world market?

There are no quality related advantages in our tobacco. What we can say is that a unit of a similar grade of tobacco will cost less in India than in Sri Lanka. Cigarette producers in India have a natural price advantage compared to us. The Sri Lankan tobacco farmers have to be assisted to increase their productivity and yields.

Are you pleased with the management of the economy by the government?

We welcome the initiatives taken by the government. We share the view that growth should be led by industry. There are less restrictions and the government is open for dialogue. This is important. If businesses grow the country will also grow.

Interest rates have dropped and this is a conducive condition for investment.

We are however concerned about the decline in real income. As mentioned already this together with the high government levies on cigarettes has had the effect of reducing our domestic sales by about 10% although the export front is good and is showing great prospects.

‘We believe our employees are our future…’

Amitha Gooneratne,

Managing Director,

Commercial Bank

by Keith D Bernard

Commercial Bank has done well to secure the third position in the ‘Business Today Top 10’ ranking. Are there any comments and suggestions that you would like to make?

I am glad that ‘Business Today’ took the initiative to carry out a Top 10 ranking in Sri Lanka. The criteria used for the ranking are fair and they cover a broad spectrum. If the banking sector alone is looked at, then there would be other criteria that will need to be considered because in banking capital adequacy and the ability to withstand a crisis are perhaps more important than some other factors that concern the non-banking sectors. It is nevertheless important that ‘Business Today’ continues the ranking on a regular basis. Say once a year.

Commercial Bank secured the number three slot in the Business Today Top 10 ranking on the basis of your 1995 performance. You must be very pleased with your performance in that year?

1995 was a good year for us. We have followed it through with a better performance in 1996. You will notice that there has been a substantial improvement in the 1996 financial year.

With the present intense competitiveness in the banking sector, what have been the main factors that have placed you in the forefront of the indus try?

We have been very conscious of our strengths. Trade Finance has been a key area of activity for us, so we built on that strength. We also enhanced our image island-wide and offered our services through the branch network. Our market share in the export sector is around 14% and this has been key to our growth. In the last few years the export sector has been buoyant. The tea sector in particular has been booming and we have financed this sector. This has had a very favorable spill-on effect on us.

It is important for any business to understand its core competence. It is equally important that businesses continuously monitor their business environments and adapt to meet the challenges posed by new changes. You have been particularly successful in Trade Financing. Do you plan to continue your focus on this area of activity, despite the fact that you are in an industry in which change and novelty of service offerings is the name of the game?

The scene is rapidly changing. In the years to come banking is going to be a volume activity. Margins are being squeezed. So we are moving into retail banking where the margins are higher, while strengthening our core competence in Trade Finance.

Substantial investments are going in to increase our network. Branching out has been very significant to our expansion in the retail banking area. Now we have 46 branches and by the end of the year we plan to open four more branches.

Our IT has improved and the investment will pay back. Customer expectations today are very high. All branches are on automated tellers. We have the largest ATM network in the country. We will continue to build on it.

The limited availability of dedicated data lines had been a constraining factor for online Wide Area Networking in the past. The emergence of new telecom operators must be a very complementing factor to your IT plans?

We have been fortunate in securing dedicated data lines to facilitate our IT network. We have also obtained back-up lines from operators like Lanka Bell. Radio frequencies are used for some of the data communication between our metropolitan branches.

There is a lot of publicity being given to your latest ComServe facility. This must be part of your strategies of coupling IT with banking to provide a much more efficient and quality service to your corporate customers.

You are correct. ComServe was introduced last month as an online solution to total cash management. Initially we have offered the service to only our large corporate customers. As time goes by it will be made available to all other customers.

Isn’t ComServe similar to Hexagon, which Hong Kong Bank introduced?

Yes, it’s similar to Hexagon of the Hong Kong Bank. Deutsche Bank introduced a system called DB Direct.

How does ComServe work?

The customer’s only investment is the PC and the Rs 5,000/- monthly payment to the bank for the facility. The modem and connection is provided by Commercial Bank. The customer has online banking facilities like funds transfers, balance inquiry, status of cheque, stop payment, wire transfers, letters of credit, account history, rates. of interest and exchange, order supplies, messaging the bank etc.

The switch facility is now quite wide spread internationally. As a local bank that considers IT to be a part of the way you do business, have you any plans of connecting to the international switch network?

Sri Lanka will move into the international switch facility. The local banks will be better off with this facility. Of course it will have to be a combined effort between all the players.

In Sri Lanka all Commercial Banks have opted to have ATM’s for the exclusive use of their customers. Have you considered the feasibility of setting up ATM’s that provide access to customers of two or more banks? This can enhance the service offerings and also save costs for the banks. After all, business does not necessarily have to be a win-lose game, it can be better with a win-win situation.

Various banks have talked about having a common switch. It has not worked out because of selfish reasons. A common switch in Sri Lanka is not far away and we are not averse to it.

Correct me if I am wrong, the general impression about Commercial Bank among the local business community is that it is not aggressive in promoting itself but rather takes a laid-back attitude and plays a follower role. What have you to say about it?

This impression may be partly a result of our relatively low expenditure on media advertising and the slower pace of opening branches in the past. The reason for delays in opening branches is because, wherever we open, we want to offer a comparable service to what customers could enjoy at our Colombo branches even including ATMs. Until recently non- availability of telephone lines too played a part in such delays. These have now been largely corrected and image building and branch opening programs are very much in place.

But you run the risk of losing market share by lagging

Yes, but that is only temporary. Once we get there, we can offer more value to customers and provide the technological benefits to them.

Considering your Bank’s commendable performance in the recent years, the Standard Chartered Bank I am sure would have had the foresight to know that they could have realized the benefits of their investment in you in the longer term. Under such circumstances why did they divest their investment in Commercial Bank?

The disposal of their investment in us was a result of a global corporate policy of the Standard Chartered Bank. They decided to dispose of any investment that didn’t give them a controlling interest. Their investment in us was a 40% stake. That was insufficient to give them a controlling interest. Another reason was that local banking regulations don’t permit directors of any bank, representation on boards of competing banks. In line with this regulation no directors of the Standard Chartered Bank could have any representation on the Board of the Commercial Bank.

Normally no single investor can own more than a 10% stake in a bank. A 15% maximum is allowed under special circumstances. How did the DFCC Bank manage to secure a 29.5% interest in Commercial Bank when such regulations are in effect?

A 15% ownership is allowed under special circumstances. But the Monetary Board can also use its discretion to allow a higher ownership if it is in the national interest. This is how the DFCC Bank was successful in securing its 29.5% stake in Commercial Bank.

Does the present economic framework provide a healthy business environment for you to operate in?

The government regulatory bodies are stimulating a higher mode of activities. Domestic credit expansion is on the increase. In the months to follow we expect the economic activities to pick up.

A key to success of any business lies in the quality of its human resources. You must be rich in this resource to have come where you are today.

Certainly employees are the most valuable resource we have. They are more valuable than our technology. We invest much in training staff and giving them the necessary skills for their career progress. Even this morning I addressed an in-house seminar on TQM and this is the 17th work shop in this series. In terms of remuneration we are about the highest among local banks. We also have a comprehensive retirement package including a recently introduced Widows and Orphans Pension, (W&OP). The very low staff turnovers seen recently adequately show that employees too appreciate this. All this is done because we believe that our employees are our future.

‘The latest C.T. Smith analysis shows we have enormous growth potential’

G Ranjit Fernando,

Director/General Manager, NDB

by Keith D Bernard

What is your opinion about the Top 10 ranking done by ‘Business Today”?

I am very pleased. It is not a question of why we are not number one in the ranking, but the fact that ‘Business Today’ had taken the initiative of conducting this commendable task. This is only the first attempt. I firmly believe that it should be continued.

Are you pleased with the criteria used in the exercise?

Yes, I think it is a reasonable set of criteria. I strongly support the use of a combination of criteria instead of simply sales turnover. Sales turnover does not say much. I can name several private and public enterprises that boast of high sales turnover but at the same time suffer from very high losses. We would however wish to know the weightage given to each factor.

Looking through the comparative performance indicators I observe that in 1995, profits of the National Development Bank have declined. Is the next year a better one for you?

1995 was a bad year for most companies in the country. We have certainly improved our overall performance in 1996. You will see that when ‘Business Today’ does its next analysis.

How do you compare yourself with your sector?

Our closest competitor is DFCC. We do spend time on competitor analysis. But we commit more of our time and resources to continuously improve our position irrespective of the competition. We very carefully study our financial indicators on a regular basis. The analysis done independently by many brokers confirm our view that the Bank has enormous growth potential.

The C.T. Smith analysis shows that your P/ E and Market to Book ratios are relatively low. Doesn’t that make you susceptible to a possible hostile takeover attempt?

Definitely not. We are insulated from a takeover attempt for three reasons. Firstly, the regulatory frame- work does not permit a controlling interest of more than 15% by any single investor. A maximum 15% controlling interest is permitted with special permission. Secondly, our main shareholders are institutional investors, and thirdly, we maintain a very high capitalized value. Another point I like to make is that what we have achieved todate represents only a fraction of our potential. We are on course and we are very confident that our future growth rate will be substantial. For example look at our profit and activity pattern. With the exception of just one year (1994/95) our performance has been on a steady incline. Upto 1989 we were a tax free entity and that’s why you see a single profit line upto 1989. That was also the point in time when we changed course. Since 1989 we have experienced constant growth and we expect the profit curves to take a steeper incline in the years to follow.

How are you gearing-up for this planned growth?

The management is being strengthened. We recently expanded our second tier management level. We are expanding our branch network. Our venture cap-

ital company and our fund management company our number one in their respective fields. In brokering we are within the first five in the country. We expect these to lead to significant synergistic realizations.

Are you hoping to introduce any new credit schemes in the foreseeable future?

Yes, we are introducing two new credit lines targeted at the small and medium sized industries. The low cost funding via the Small and Medium Assistance Program (SMAP) is already operational. These credit lines are funded through a US$50 million loan raised in the international market. Another scheme targeted at micro industries is planned with funding through Japanese aid (OECF).

How do you plan to disburse funds under these assistance programs?

Just like the SMI program-through the banking network in the country. The second tier of management is also strengthened to support future expansion.

Focusing on one of your major resources – your management and staff personnel, what plans do you have in mind for them?

Our human resources have been a key to our success to date and will be a key to our future success as well. Considerable emphasis is going into training. Starting this year we intend to launch a program on focused training. Career paths of our people will be identified and they will undergo a program of focused training. In time to come everyone of our employees will know where they will be in five years time. We have planned a huge investment to support this program.

What are your impressions of the business climate in the country?

In the recent past the business sector had signalled positive signs of recovery and improvement. It is very unfortunate that every time business takes an upturn we experience some disturbance like the recent bomb attack. Of late though, I believe businesses have begun to expect these set backs. Our private sector is more resilient now. I am, confident that business will bounce back. How do you interpret the management of the economy by the government? Interest rates are down and inflation is controlled. Fundamentals of the economy are based on sound micro and macro economic policies. We foresee infrastructure development and we are well positioned to enter this field when it takes effect. Overall we are confident of achieving a sustainable level of growth in the longer term.

‘Our first quarter results this year were 170% over last year’s…

‘ Ken Balendra, Chairman, John Keells Holdings

by Dinesh Weerakkody & Keith D Bernard

As you know John Keells Holdings was selected by ‘Business Today’ as a Top 10 Company based on the 95/96 figures. What do you think of the ‘Business Today Top 10’ analysis?

I glanced through it and it seems well done. The basis of it can of course be argued but still it is an analysis done on some basis and I think analyses such as this are indeed very good for the private sector. A point that I would like to make is that maybe it should be more timely. We are really looking at the last set of lists that we produced in respect of 1995/96. Generally listed companies put out their reports by end August and in any case the Stock Exchange insists that the annual reports should be out by end September. So on that basis you should be able to come out with your findings by December of the year rather than make it historical. But overall, yes, I think it is well done, it’s a good thing and you should continue with it.

What do you think of the criteria?

Well, the criteria are acceptable but you have not indicated the weightage given to the criteria but generally the criteria are on the correct lines. Without the weightage given for the respective areas I would not be able to comment about our performance. But if I were you I wouldn’t give the weightage because it can start a major debate and would be subject to varying opinions.

Should we have introduced qualitative factors such as market perception, employee perception etc.?

Yes, definitely. Could be added in for the future.

Don’t you think it could result in a big debate amongst the competitors?

Yes, but still I consider it as important. For instance you would have to get “market perceptions” done by a good research company. Attitude amongst employees about the company and also the public perception are both very important aspects. All you have to do is to get a good market research agency to do an independent survey and then give the weightage you think it deserves.

What do you consider John Keells’ major strength in relation to your competitors?

Well, our major strength as I’ve always said is, firstly our people, secondly our people and thirdly our people. Our biggest strength is the fact that we have the best team by far in Sri Lanka. Thereafter the diversity of businesses that we are in and in most of these businesses we are market leaders and thirdly the financial strength of the group following the global depository receipt issue of 1994 and the rights issue of that time together with the profitability of the company there- after. The financial base is very strong and we have been able in the last 4 years to continue with our in- vestment plan and we have invested substantially over the last 4 years. This involved an inland container depot which cost Rs 500 million where we have two partners, one a Singaporean Group, and the other the Malaysian Shipping Corporation. Between the two of them they have 25% each, we have bought an island resort in the Maldives to add to our leisure sector activities, we have gone in heavily into the plantations sector-3 companies together with joint venture partners and strategic alliances. Coming back to the strengths you were talking of, I said about the people, the fine teamwork, the diverse businesses, financial strength and on that line would be the fact that we are very comfortable with strategic alliances. We’ve got several strategic alliances or joint venture exercises which have all proved to be successful.

The concept of strategic alliances, is that your vehicle for diversifying?

Initially it was not, we were doing it on our own, but over the last 4-5 years wherever possible we have gone into strategic alliances with people locally as well as from abroad. Basically, this was not for money but for technical input and market. And of course the most exciting one is going to be the Colombo Port which hopefully we will undertake next year. That will be a massive exciting project because the development of the Colombo Port will take Sri Lanka to a different place. If you remember, Singapore first developed its port and everything else developed around it. It is a major investment and we would be the single largest shareholder of the Company which would be incorporated to do the development in three stages. The first stage is the refurbishment and enlargement of the Queen Elizabeth Quay, which would cost in excess of 200 million US dollars.

How have you cultivated a cult among the local potential employees that John Keells Holdings is the best employer in Sri Lanka?

What I think is, it is more to do with word of mouth. Because every year we recruit youngsters and they are in touch with other potential employees of the same age group who are looking for jobs. We haven’t done anything special, it would be word of mouth and of course, the general public perception. We are able to attract the best.

Generally, how is your compensation packages. Is it higher than the industry norms?

We always review it and try to keep it within industry norms and we also have a ‘share of profit’ scheme which is attractive. We do an annual survey through one of the audit firms for the companies to keep abreast. We try to keep within the industry norms or one step higher.

Is it a misconception that John Keells does not employ people from the rural sector?

Yes. This is a very wrong statement. We were the first, five years ago to take a dozen graduates with out any knowledge of English, on the basis that they were very clever capable people and I repeat they are capable. To get into a local university is more difficult than to get into universities abroad. Their lack of English is because of a wrong educational system. So we took a dozen and at that stage we paid the same salary we would have paid an Oxford or Harvard graduate. To me, we do business with Japanese and Germans who murder the queen, so what is wrong if

a Sri Lankan messed around the odd word or two.

What are your main lines of business at the moment?

If you read our annual report, we have broken it up into 10 different sectors. As far as our contribution to the bottom line is concerned the performers are the plantations, food & beverage which is Keells & Ceylon Cold Stores, transportation which is the shipping agency businesses who are very big contributors, tourism used to be a very high contributor to the bottom line but last year it was a disaster, this year we are expecting it to show a marked improvement despite the Colombo bomb. But the fact that we are diversified means that invariably when one sector goes down some other sector does well. And if you look through our progress (we give a 10 year summery of profitability) you will see that there has been a very steady growth. Our first quarter results this year were 170% over last year’s corresponding figure.

Generally what strategies do you adopt to keep abreast of competition?

Market intelligence is always there and we know what our competitors are planning to do and we have been able to counter them very intensively.

Is this limited only to marketing?

In the goods that are sold locally i.e. soft drinks, processed meats etc. are on the marketing side. We attach a lot of importance to marketing. In the ultimate analysis everything boils down to marketing. Any business, such as getting a new account, say on our tour operating side or whatever, it is marketing.

Initially you were well known in brokering. Then you successfully diversified into several other sectors and maintain market leadership positions in some of these. What do you consider to be your core business today?

Yes. We are 130 years old. We started off as produce brokers. Today we have diversified into 60 odd companies broken up into 10 sectors and it is very difficult to say which is our core business. They have their ups and downs. For instance, tourism was a massive investment. 3 years ago they were the biggest contributor, but because of the problems they have stopped. The plantation sector is doing very well, we are very happy with our investment in that sector. Transportation is steady and big. Food & beverage has tremendous potential, the consumption of soft drinks and ice creams is very high and we are getting a substantial market share. Those are all the things that would go up with the improvement in the economy we expect. We are very bullish about the future of Sri Lanka despite the on-going North East war and on the basis of that we have made very substantial investments and we continue to do so. This year’s economy despite the recent bomb that has shaken perceptions a little bit, is very sound anything in excess of a 6% growth and we are looking at a drop in the budget deficit. Commodity prices are doing well, garment industry is doing well, tourism is doing much better. So all indications are that we are ready to go. Of course there is this psychological barrier of the north east war and bombs going off every so often in the city. If we can by some good fortune have this war situation behind us, then this country will sprint towards whatever we want. I would say it will sprint towards the Malaysian situation. And even though Malaysia has got a whacking it is perhaps the role model for Sri Lanka to follow. If we can at least contain the war then we are talking in terms of an average spending of 12% GDP on the North East war. We can never eliminate that, even if there is a cessation of hostilities, we would have to spend at least half of it. But still take 3 1/2% off the GDP deficit, then we are probably looking at 4 – 4 1/2%. In a country’s economy, the first thing as you know is the budget deficit. Last year it was around 8%, this year it is probably down to about 7 1/2% and if we can save another 3 to 3 1/2%, then we are comparable to any country in the world.

People are saying the private sector is not doing enough for the country and also not socially responsible. In fact in South Africa it was the private sector that came in a big way to resolve the apartheid issue. In that context, should not the private sector take on a greater role in managing the affairs of this country.

I am the vice chairman of the Ceylon Chamber of Commerce which is the oldest chamber. For instance at the last budget, we came out strongly that it was a very good, development oriented budget and they had taken on vote seven of the suggestions made by the private sector using the chamber. And there’s a constant dialogue with the private sector and private sector inputs are taken into consideration when coming to a decision on the economic side. Earlier the private sector was critical that the government was focusing only on the North East war. We were understanding of the need to focus on the war but also we required the government to put the economic side on a parallel with that. And in the last two years the government had done that. The last budget was a clear indication that the economic side has been dealt with very effectively. We are not critical, we are being complimentary really. As far as the question, why the private sector is not doing anything about the war, the private sector has repeatedly stated that there should be a bipartisan attitude by the political parties with regard to national issues. We spelled that out at the AGM of the Ceylon Chamber last year. You can’t bring political issues into everything.

What is your outlook for 1998?

Very Bullish, we are expecting a growth rate of in excess of 6% in 1997. I strongly believe that our economic fundamentals are very strong. Look, the Budget deficit is down, inflation is down and tourism is picking up. As for JKH, we are looking at ways and means to develop our strategic alliances which we have moved into. We also look for new avenues for diversification. As mentioned to you earlier Commercial Banking also may be another area we are looking at from a strategic view point.

‘We wanted to create a bank devoid of any ethnic slogans’

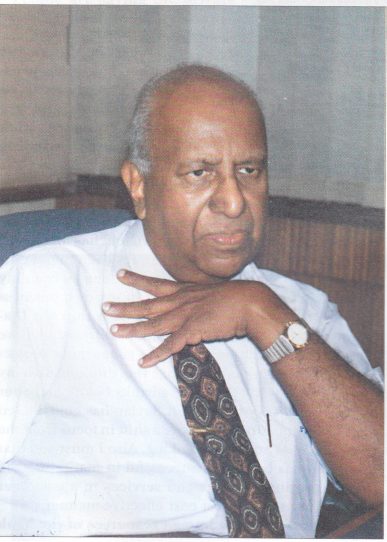

Lalith Kotelawala,

Chairman, Seylan Bank

by Dinesh Weerakkody

What do you think of ‘Business Today Top 10’ concept?

I think it is an excellent concept. I am also happy with the way the analysis has been concluded. Also, I wish to congratulate “Business Today’ for selecting the Top 10 Companies in Sri Lanka based on their financial performance.

What would be the benefit of such an analysis for an organization?

Such an analysis is very useful and encouraging for business houses because the selection has been done by an independent body. I think such an analysis was long overdue.

Any comments about the independence of this analysis?

My view is that an analysis of this nature should be unsolicited, independent and no company should pressurize the magazine editor during or after the selection.

Then are you happy with the criteria used?

I think the eleven criteria used is very representative.

Should such an analysis be conducted yearly?

Like the Fortune 500 I think it should be an yearly affair and should be tied up with an awards ceremony.

When compared with the other companies in the Top 10 listing Seylan Bank has not even completed ten years of operations. What are the reasons you attribute to your bank’s extraordinary growth?

The formation of the bank commenced during the JVP insurrection in 1989. We wanted to create a bank devoid of any ethnic slogans. In fact one bank was promoted on the basis of a Sinhala Buddhist bank. I was appalled by it. Because Ceylinco philosophy has been one of justice and fair play. So with that in view we floated the Seylan Bank and called it the bank with a heart. So the foundation of the bank was based on love and not hatred. We have continued with this policy. We have employed people on merit. If you ask me how many Muslims or Tamils we have, I would not know, and we don’t want to know either. We recruit and promote on performance and that is one of the major reasons for our bank’s success.

Also, I feel that Seylan Bank has revolutionized the Banking System with the extended hours concept and branch expansion programs. Please comment.

I wanted the banking hours extended, in fact, I can remember the then senior managers were horrified with the very idea also when I asked them how many branches they intended to open, they said that in the first year 2 and second year 3.

In fact we have opened on average 1 Branch every month. Recently as you know Seylan Bank was listed in the Asia-Week 500 top Banks listing. In fact I attribute the growth in deposits to our large Branch network.

I suppose your Ceylinco experience would have helped you in your expansion?

Definitely yes, we had already got our presence across through Ceylinco Insurance and The Finance.

Then, is it correct to say that Seylan Bank benefited from the Ceylinco goodwill built over a period of 50 years?

Yes, In fact the first Ceylinco group company was established in 1939 and it was the 1st registered Sri Lankan company. The Finance commenced one year later.

What do you consider your Bank’s strengths when compared with the other domestic Banks? On a stand alone basis our bank has many strengths. One is that I have an excellent Board of Directors. People of immense experience and integrity. I think we have one of the best Boards among the local Banks. Their inputs have been very valuable because they are from different professions. We all have had a common vision for the Bank and this has been our driving force. Secondly, we have selected good staff. A lot of young people mixed with very experienced bankers. But, most of all what is special about our Bank is our Ceylinco philosophy and our business experience which has helped us to create a bank which is totally customer driven.

What is the recipe that has given prosperity and success to your bank and are you going to stick with the winning ways?

Innovative Product Development backed by a customer focused culture with a focus on human resource development has been our recipe for business success. A very customer friendly approach has been our strength. Our philosophy has always been to put our-selves in our customers’ shoes. This comes from my own experience that I have had in my own business career. In fact I remember when we set up our Diamond Cutting business the amount of resistance we had from the traditional banks to support our project and I was determined to change this thinking with my Bank. I always say there were banks before and after Seylan. I am very happy that Seylan has contributed through competition to create a shift in focus from the traditional way of doing banking. Also I must add that our bank has been very successful in marketing and re-engineering products and services in a customer driven culture in a most cost effective manner.

You spoke about the human resources of the bank and its contribution to your bank’s extraordinary growth. What are the attributes you have looked for in your human resources when selecting them?

Our recruitment and selection procedure is a long and well documented process. We advertise all our positions and the final selection is only on merit. We have also looked for loyalty and commitment when recruiting which I consider as most important. The key issue here is to select and develop a set of core managers who can manage the bank’s growth and make the necessary fundamental changes to our strategy when required.

Moving on to Trade Unions. Is it true that all your companies including Seylan Bank have in-house unions?

Yes, even Seylan has an in-house union.

Can it be argued that the primary advantage of having an in-house union is that a company benefits by way of lower costs for pay and fringe benefits.

No I don’t think so. The in-house unions concept has been a rewarding experience both for the group and for our employees.

As a final question what is your bank’s outlook for the coming years?

I cannot tell you what our strategies would be in the face of stiff competition. However, Seylan Bank will continue to apply the business policies and strategies which it has followed in the past. We feel that our most pressing need is to steadily develop our information technology. We hope to take significant strides in the coming years in this sphere.

Continued attention will also be paid to human resource development and innovative product development.

‘We are well positioned to play a vital role in taking the country forward…’

Chandra Wijenayake, Chairman, Central Finance

by Keith D Bernard

You are a prominent businessman in Sri Lanka with representation at Board level in about 60 companies in the country. You also chair about 6% of the Boards of all Quoted Public Companies in Sri Lanka. What insights have you to offer Business Today”?

I find ‘Business Today’ a very interesting business magazine with good content. I hope you maintain the quality of the magazine and continue with the ranking. Turnover is not the sole criterion that determines the success of a business and you have done well in considering a list of 11 criteria in carrying out the ranking.

Although you did well in most other categories considered for the ranking, I notice that you didn’t make it to the Top 10 profit earners in the 1995/96 financial year.

You will observe from the accounts published for the year 96/97 there has been a 50% increase to Rs 150 million. As a policy we have been very prudent in our financial reporting. The main reasons for the low profits have been the provisions we have made against debts from Government institutions. We offered facilities for the purchase of 400 buses to the Transport Board and for the last three years we have been negotiating the recovery of these debts. You may have read about this in our annual reports. The Government however has recognized the debt and we should be able to recover it in due course. On settlement of debts by the government we will also be able to reverse the provisions. We also made provisions in the accounts to recognize the fall in value of our investments as a result of the drop in the stock market. With maximum provisions having been made from 1997/98 onwards we expect a return to growth in profits as in the past.

Under very trying market conditions what niche did you carve out to establish your competitive position?

Central Finance was established nearly 40 years ago as a hire purchase company. Its core business was in affording finance to the goods and passenger transport industry. In the last decade or so this sec- tor has been almost entirely replaced by leasing. CF being a Kandy based company recognized the advantage of its geographical position being able to better service the neighbouring provinces and capitalized on it. In fact it has been the catalyst for the largest sin- gle concentration of motor vehicle dealers in the island. CF with its annual turnover of over Rs 4 billion is largest in the business of instalment credit.

In this competitive sector what factor do you attribute to be your key to success?

Our customers are our number one factor to success. We have a very loyal customer base. We have been able to win customer confidence mainly due to our customer orientation. We consider good customer relations as our top priority. Our success was built on our ability to offer assistance to customers who did not have access to banks. The risk has paid-off. We are a one stop service centre to our customers. We maintain very flexible service operations. Our employees are trained to take care of customer needs. Customer requests are normally taken care of within 48 hours. You will be surprised to see the cross section of people I meet personally in my office. From top to bottom, we emphasis good customer relations.

Another factor to our success has been our diversified strategic investments that have paid off. We have about 30 strategic investments. Strategic investments are part of our corporate policy.

What emphasis would you place on your management and staff input as a valuable source to your success?

A considerable input to our success comes from our management and staff. We have a very strong Board of Directors. We have been very selective in recruiting people at Board level. We have a very efficient and loyal management and staff team. Staff turnover at Central Finance is very low. The staff at the Kandy head office in particular are very stable. On our part, we pay considerable attention to our management and staff needs and have committed substantial investments to train them.

You rank high in the categories of Shareholder Re turns in terms of earnings per share and dividends per share.

Our issued capital is not very large. It’s around Rs 30 million. The initial issued share capital was Rs 1 million. Today it has grown to Rs 30 million as a result of bonus issues made at various times.

What are your views on the Political and Economic situation in Sri Lanka?

Economic fundamentals are good. The financial sector is healthy. The plantation and garment manufacturing industries are doing exceptionally well and exporters are faring reasonably well. The economy was on an upturn until last week. Businesses will recover from the shock. We expect an increase of about 40%-50% in profits.

The ethnic conflict unfortunately continues to bleed the country. I am concerned about the social factors that can affect the country in the foreseeable future. National Service is a reasonable solution to this problem. A mix of cultures, ethnicities, religions, social backgrounds etc. can resolve some of the future social issues.

Do you agree that infrastructure development is a present crisis which requires immediate attention if rapid growth is to be achieved by Sri Lanka?

Infrastructure development is an urgent must. For instance manufacturers of perishable products based in the provinces cannot get there goods to Colombo in time because of infrastructure inadequacies. A sound infrastructure is imperative for our future development and the first priority should be highways.

If opportunities permit Central Finance will get involved in infrastructure development. We are well positioned to play a vital role in taking the country forward if the macro conditions are favorable.

‘The actual number making a living from the activities of DCSL is so large it is difficult to calculate…..’

Dr. V.P. Vittachi-Chairman,

Distilleries Company of Sri Lanka Limited

by Dilki Wijesuriya

‘On the face of it the ‘Business Today Top 10 analysis appears to be a fair assessment’ says Dr. V.P. Vittachi, chairman, Distilleries Company of Sri Lanka Limited.

Distilleries Company (DCSL) which ranks amongst the ‘Business Today Top 10’ 1995/96 has in the last financial year 1996/97 recorded a profit after tax of Rs 305 million which is higher than the Rs 254 million figure of the previous year. The Company has also diversified its holdings with its foray into the plantations sector. DCSL acquired the controlling interest of Balangoda Plantations Limited (BPL) on September 27. The total investment was Rs 430 mil lion for a 51% shareholding. Consisting of 22 estates BPL has 49 years unexpired leasehold of 12,182 hectares i.e. 5,277 hectares of tea, 1,362 hectares of rubber and 5,543 hectares of other crops. A sister company of DCSL Milford Exports (Ceylon) Ltd acquired the debentures of BPL which will be converted to shares after 2 years. DCSL continues to hold 6% convertible debentures of Madulsima Plantations Ltd. which on conversion will give the company a 31% stake. Chairman of DCSL says that his board of directors are all of the view that these substantial investments in the plantations sector would contribute greatly to the future profitability of the company.

However the company’s recorded turnover for the current financial year reached as high as Rs 8.6 billion which DCSL partly attributes to the unprecedented increases in duty on liquor and the introduction of the Excise Provisions Tax.

Says Vittachi ‘Governments are keeping the taxes so high that they themselves are actually losing around Rs 5 billion in taxes every year. To use an economics term, it is a case of ‘diminishing returns’, you keep raising taxes and you increase your earnings but at a certain point you raise the tax and get less money and that is the point of diminishing returns. This point has passed long since and yet the government continues to raise taxes. So the ‘kassippu’ (illicit liquor) merchant thrives and the government loses revenue. DCSL’s market share is around 75- 80% of the legal liquor market.

According to DCSL’s 1996/97 annual report the increase in taxation on liquor during the year was approximately 25% resulting in a total tax from a bottle of Extra Special Arrack reaching Rs 137.15 from Rs 109.22 at the beginning of the year. At present the state collects 78% of the Rs 175 paid by the consumer of the so-called poor man’s drink. ‘It appears that the recent increase in hard liquor prices was done to enhance the price gap between beer and hard liquor. While we accept the reasoning behind the move, we believe the state would have received a higher tax income if it had reduced the taxation on beer further rather than increasing taxes on hard liquor. After the latest wave of increases in taxes on hard liquor there is a marked reduction in sales of tax-paid liquor. The reductions appear to be sustaining, unlike in the case of previous increases and this may be an indication that the increases in liquor prices have surpassed the level of consumer endurance. A combination of factors such as some segments demoting themselves to illicit liquor due to higher prices and the increase in production and sale of illegal liquor (imitations) due to increased profitability, may also have contributed to the drop in sales’ Vittachi says.

Another reason for the drop in sales is attributed to the government’s policy of renewing liquor retail licenses on a calendar month basis. March and December are rated as the best months for the liquor industry and the resultant state revenue. As the licenses are discontinued in December the licensees who are uncertain of renewal turn to the sale of tax unpaid liquors. Demand being greater than in a normal month and legal manufacturers curtailing supplies for fear of bad debts, the official sales drop substantially. From DCSL’s point of view, if licenses need to be renewed for 12 month periods they should be made valid from July to June thereby cushioning the two most important months for excise revenue.

Not being allowed to have their own retailing outlets is another problem DCSL is faced with says Vittachi. ‘I don’t know the thinking behind it but the government doesn’t allow us our own retail outlets with the result that others can plant imitations and sell it as our stuff. We have been constantly accused of adulterating our liquor but the trading practices adopted by DCSL have not only ensured the sale of tax-paid hygienic liquor in most of the wine shops but have also assured the state of large increases in tax payments. But there are unscrupulous illegal manufacturers producing liquor using DCSL labels and bottles (imitations) and selling it as our product. If we could have our own retailing outlets we can guarantee the prevention of illicit liquor passing on to the consumer.’

Asked about the human resources strength of the company Vittachi says ‘although the employees working for the company numbered 1352, the actual number making a living from the activities of DCSL is difficult to calculate because it is a spin-off i.e. there are the toddy tappers, toddy contractors etc. Of course when we bought the controlling interest of DCSL, the condition of sale was that we must

take over all the staff as well. As a matter of fact we are. somewhat overstaffed but we have kept to our side. of the bargain and continue to keep the excess staff on our payroll. However, the absence of any labour unrest after the privatization of DCSL shows that employees appreciate the Company’s policy of rewarding good work and commitment towards company objectives.”

In keeping with the Company’s expansion plans DCSL has entered into a joint venture with Group Pernod Ricard of France who is the 6th largest liquor producer in the world, to incorporate Periceyl (Pvt.) Ltd. The new Company which has already commenced manufacturing will produce four higher end products namely ‘House of Tilbury’ whisky, ‘Galerie’ brandy, ‘Black Jack’ gin and ‘Black Opal’ arrack, the first brands to be produced in Sri Lanka. Chairman of Distilleries says ‘Due to this historic partnership Sri Lankan consumers would enjoy international products of the highest quality at reasonable prices (prices range from Rs. 330 for arrack to Rs 475 for whiskies and brandies). Also 10 other group products will be imported and sold until the markets develop to levels which make them economically viable to be produced in Sri Lanka. The imported products are anise based products, ‘Pernod” & Ricard’, ‘Soho’, liqueur, ‘Dubonnet’ Wine, ‘Clan Campbell’ scotch whisky, John Jamesons’ Irish whisky, ‘Abelour’ scotch whisky, ‘Havana Club’ rum and ‘Wild Turkey’ bourbon.”

Periceyl (Pvt.) Ltd is a BOI approved company, in which DCSL has a 50% stake. The balance 50% is held by Santa Lina of Mauritius who is a member of Group Pernod Ricard.

Vittachi, when asked if the fact that both the cigarette manufacturing giant and the largest liquor manufacturer in Sri Lanka, Ceylon Tobacco and Distilleries Company being amongst Business Today’s Top 10 companies says something of our culture said ‘I do not think culture is something that should be discussed by the chairman of Distilleries but it is true that many people like to drink and also many like to smoke. Arrack is a very popular drink and many people who cannot afford a decent clean bottle of Arrack resort to ‘kassippu’ which is available for around Rs 60 a bottle. According to what I have read of course, Sri Lankans rank amongst the greatest drinkers.’