November 3, 2022 Justinas Baltrusaitis

In 2022, the global economy’s growth has slumped significantly, with the high inflation and resulting interest rates impacting the stock market. Consequently, some of the most successful corporations in the world are reeling from the effects of depressed markets as they report a massive loss of capital.

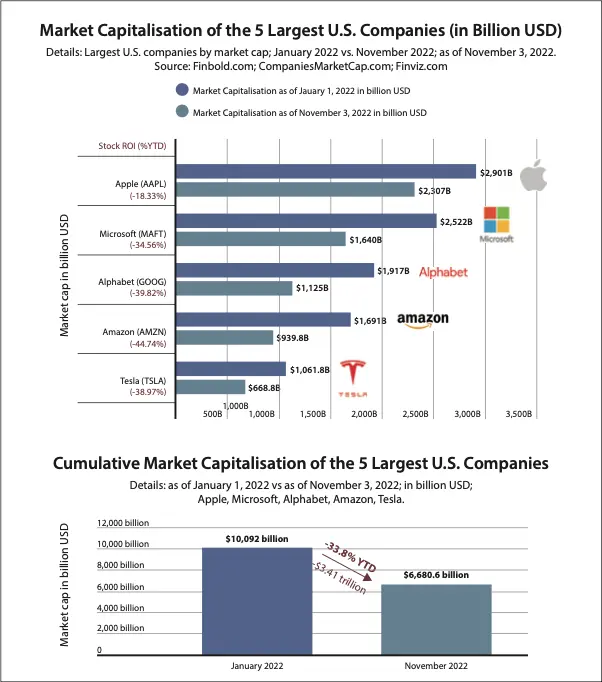

In particular, data acquired by Finbold on November 3 indicates that the cumulative market capitalisation of five leading companies in the United States has recorded outflows of $3.41 trillion or a drop of 33.8% in 2022. Notably, at the start of the year, the companies had a total market cap of $10.09 trillion, dropping to $6.68 trillion as of November 3. In particular, Apple (NASDAQ: AAPL), the largest company by valuation, began the year with a market cap of $2.9 trillion before dropping 18.33% to $2.3 trillion as the electronic giant registered the smallest drop in valuation among the selected companies. Microsoft’s (NASDAQ: MSFT) capitalisation dropped by 34.56% from $2.5 trillion to $1.64 trillion. Elsewhere, Alphabet’s (NASDAQ: GOOG) valuation has plunged from $1.9 trillion to $1.1 trillion or 39.82%.

Electric vehicle giant Tesla’s (NASDAQ: TSLA) current valuation of $0.66 trillion represents a drop of 38.97% from the $1.06 trillion recorded at the start of the year. Lastly, e-commerce behemoth Amazon (NASDAQ: AMZN) recorded the biggest drop year-to-date in valuation by 44.74% from $1.69 trillion to $0.939 trillion.

Macroeconomic factors triggering drop in valuation

Interestingly, the highlighted companies emerged as global case studies after exhibiting strength amid the crisis that rocked the global economy due to the coronavirus pandemic that tested most businesses’ sustainability. The latest drop in valuation can mainly be linked to existing market conditions led by the Federal Reserve tightening policies and higher inflation resulting in high volatility for the stock market.

At the same time, the valuation has taken a hit from the other market fundamentals, such as corporate revenue and earnings, that have fluctuated across the year. However, most companies have maintained substantial incomes, but the question is on sustainability.

With the companies drawn from the tech sector, recent revenues have performed above average, considering the inflationary environment alongside a drop in corporate confidence amid soaring levels of uncertainty for investors. Generally, the performance of the companies has been impacted by other elements, such as slowing down in personal computer sales, digital advertising, and e-commerce.

Amid the volatility, investors have exited the market, opting to remain cautious in return inflicting further pain into the stocks of the companies that have long been considered market leaders. The investor activity has resulted in only three firms retaining the elusive $1 trillion capitalisation despite taking a hit from the economic outlook. Overall, the tech giants have lost their status as stocks where investors could seek refuge in periods of market uncertainty.

Additionally, the correction in valuation is also attributed to foreign exchange and supply shortages, alongside broad-based demand weakness. It is worth noting that the drops that aligns with the ongoing stock market downturns occurs periodically after a significant bull run; in this case, the rally happened during the pandemic.

Notably, a section of the market believes that the current valuation of the tech stock should not be a cause for alarm. There is a general argument that the stocks have enjoyed an abnormally stretched valuation and strong outperformance compared to other sectors. For instance, Tesla stock has been a center of debate regarding its actual value, with analysts projecting that after the pandemic-inspired rise, the company stared at a possible crash.

Explaining Apple’s resilience

Although Apple has not been immune to the current market shocks, the company has again highlighted its resilience based on its ability to retain a market cap above $2 trillion. The strength can be linked to several factors led by the strong cash flow growth, robust potential growth areas, stock-based compensation, and the multi- faceted business model.

Additionally, Apple continues to express its ability to design appealing products with the attached status symbol. Based on the stock’s resilience, it can be argued that Apple is benefiting from solid business fundamentals unlikely to be significantly hurt by macroeconomic factors unless something highly disruptive hits the market.

The future of tech stocks

In general, for most companies to regain their valuation, it will depend on how the economy performs, despite the prevailing fears of a recession. The tech giants might find relief if the stock market activity recovers, depending on how the Federal Reserve handles the tightening policies.

In the meantime, the companies need to work towards sustaining their valuation, considering that the metric is vital in attracting investors and highlighting their growth potential.