January 18, 2023 Kris Lucas

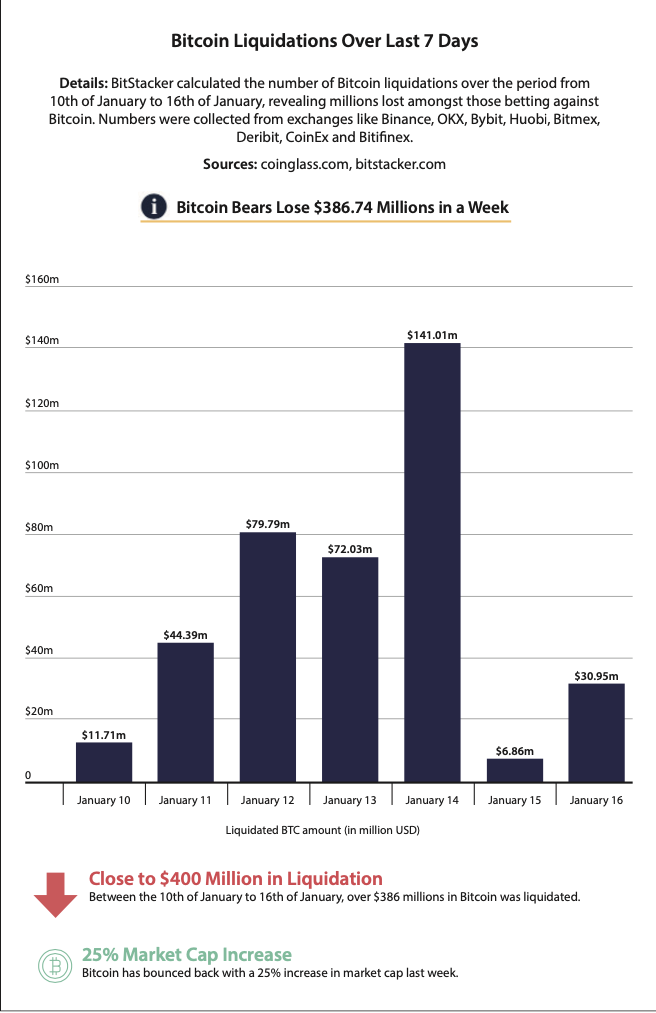

A recent study found that traders who bet against Bitcoin lost hundreds of millions of dollars in a week. The report issued by BitStacker revealed that $386.74 million in Bitcoin short positions was liquidated in seven days from investors who were trading at exchanges such as Binance, OKX, Bybit, Huobi, Bitmex, Deribit, CoinEx and Bitfinex. These figures were compiled from data covering the period from 10 to 16 January 2023.

Tough Week for Traders Betting against Bitcoin

The worst day for Bitcoin liquidations came on 14 January. That Saturday saw traders betting against Bitcoin losing $141.01 million and it built upon a growing trend for investors to lose when shorting the cryptocurrency.

This compares to just $11.71 million in liquidated Bitcoin of traders betting against the crypto coin on Tuesday, January 10. However this amount had grown to $44.39 million the following day.

Thursday, January 12 saw traders losing $79.79 million by betting against Bitcoin, and while this amount briefly dipped to $72.03 million the next day, it set things up for the huge fall on Saturday.

The trend was reversed on Sunday, January 15 where the overall liquidated Bitcoin amount was just $6.86 million, although the figure had started to rise again on Monday, January 16 where $30.95 million was lost by traders betting against the cryptocurrency.

The Risks of Short-selling Bitcoin

The fact that traders lost close to $400 million in one week typifies the risks of the short-selling trading strategy. This is where a trader will bet that the value of an asset will fall. Such a strategy is the direct opposite of the typical investment strategy where a trader would invest in an asset with the expectation that the asset’s value would rise over time.

A short-selling strategy is favored when an investor looks to make a large gain over a short period of time. However, the volatility of cryptocurrencies and lack of regulation has made this a risky strategy.

Short selling is only possible when a trader uses various derivatives and products that lets them position themselves to benefit from the fall in value of a particular asset.

This largely comes in the form of leveraged trading which is where a trader will borrow third-party funds to buy an asset such as Bitcoin. Doing this allows the trader to increase the size of their position in the hope that their speculation would lead to larger gains.

Leveraged trading requires the investor to put up what is known as an ‘initial margin’ which can either come in the form of regular funds or cryptocurrencies and it acts as a kind of insurance for the lender should your trading backfire.

This is essentially what happened in the week where traders who bet against Bitcoin lost hundreds of millions of dollars. These traders had their leveraged positions forcefully closed because they had lost their initial margins. All of this happened because Bitcoin has been showing some impressive gains since the start of 2023. The cryptocurrency managed to break the $21,000 mark on Monday morning which is a startling improvement on the $16,000 that it was trading at when the year began.

Those traders betting against Bitcoin will have been expecting the crypto coin to continue the decline in value that it suffered for much of 2022. However, with Bitcoin enjoying a market cap rise of almost 25% in one week, it further emphasizes the risks of shorting cryptocurrencies.