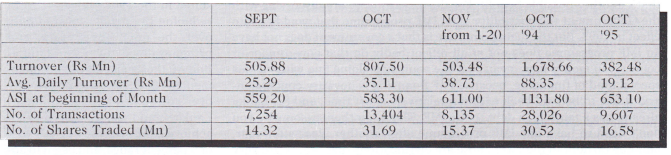

The market maintained its positive outlook seen in September and October through to November, al though a marginal dip was seen in the last few days. The All share In dex (ASI) has now appreciated 12.5% since August and this is wel come considering the fact that from January to August the market lost 16.4%. Overall, we maintain our view that barring some unforeseen disasters the worst is over, and im provements in both the economy and the market are expected during the first quarter of 1997. The aver age daily turnover which recorded at 39% improvement in October con tinued to improve in November. The ASI also moved up from 580.7 in end-September to 608.5 by end-October to 622.80 as on November 20,

The initial growth in the market was fuelled by the plantation sector while the Banking and Finance sector carried on this momentum, with most other sectors also recording improvements. Thereafter, the bud get which was considered by many analysts and business executives as supportive of growth helped to maintain the market’s optimism. Further rumours of corporate take-overs and relative quietness on the military front maintained the market’s growth momentum. During the last few days we have witnessed a 1.5% decline in the ASI mainly on account of some poor corporate performance, strike by employees of Shell Gas Lanka (which has now been resolved) and fears of a terrorist attack on either a military or civilian target. Plantation company stocks didn’t witness the growth seen during the last month, as they appear to have reached a short to medium term peak (i.e. Kegalle -1% Kelani Valley 12% and Kotagala 7.7%). The main reason being that the Commonwealth of Independent States (CIS), one of our largest buyers of tea, imposing a 30% duty on packeted tea exports from the current 10%. Over 95% of our tea exports to the CIS countries are in the form of packeted teas, and this will certainly affect the demand and the prices of our teas. But the plantation companies are expected to record extraordinary profits for the period ending September 30, 1996. Another top performer was the Banking sector but its growth was slower than what was witnessed in September and early October. Blue chip stocks such as DFCC (7.0%), NDB (7.7% and LOLC (17.2%) were the top gainers in this sector during the last one month. Retail driven stocks such as Vanik, Merchant Bank and Seylan Bank remained static as retail profit taking was witnessed in mid-November. Manufacturing sector companies which recorded impressive gains during September and early October were unchanged in November but are expected to show improvements in early 1997, with the expectation of better corporate results for the quarter ended December 31.

Foreign activity continued to contribute to the market’s growth. Although a net outflow was recorded for October, a net inflow of Rs 66 million was witnessed during the first two weeks of November. Foreign turnover accounted for 48.7% and 60.0% of the market turnover for October and November, respectively. Although this is less than the 64% recorded in September in rupee terms, it is a 20% improvement in October. Large quantities of much sought-after stocks such as Sampath Bank, John Keells, Aitkin Spence, DFCC and Ceylon Brewery traded during the last few weeks. Speculative stocks such as Seylan Bank, Blue Diamonds, Forbes Ceylon, Vanik Inc., Asia Capital also witnessed investor interest.

There were no new privatisations completed on the floor of the

Review

Colombo Stock Exchange in the last month but the program is well on track. We expect the remaining plantation companies to be privatised in the next one year, under the new procedure of direct bidding by shortlisted companies. There appears to be a massive interest in the controlling stake in these companies, with many large Sri Lankan conglomerates showing keen interest. Large scale privatisation such as a sale of 35% stake of Sri Lanka Telecom at an expected price of USS 300 for a 35% stake and management control, and the sale of the national carrier Air Lanka are expected to bring in the bulk of the proceeds from privatisation next year.

Government Budget for 1997 and the Economy

The third budget of the Peoples Alliance was presented in Parliament on November 6, 1996. The budget did not contain any surprises, and is considered as investor- friendly, but it did not have any bold moves by the government to give an immediate boost to the economy. GDP growth for 1996 is estimated at 3.7% and is the lowest recorded in recent years, therefore, there is an urgent need to jump start the economy. In our opinion the budget proposals are aimed at sustainable long-term development rather than addressing the immediate concerns of the economy. Although we believed that the envisaged borrowings to bridge the budget deficit of Rs 83 billion, by way of foreign borrowings of Rs 30 billion and domestic borrowings of Rs 55 billion were optimistic, the pledge of USS 860 million at the recent aid group meeting is a very positive indicator.

Impact of the Budget on the Market

The proposal to restrict depreciation allowance to income from leasing will benefit the specialised leasing companies i.e. LOLC, Mercantile Leasing and Commercial Leasing as they would be able to compete on equal terms with banks and other financial institutions involved with leasing. Ceylon Tobacco will gain as the government has taken steps to reduce the incidence of cigarette smuggling. The decision by the government to freeze the provisions for motor vehicle purchase will have a negative impact on the profitability of companies in the motors sector Le. United Motors Satosa Motors, Associated Motor ways and DIMO’s. Manufacturing sector will benefit from the liberal depreciation allowances proposed in the budget, and export companies will gain further from the removal of restrictions on overseas borrowings This will enable these companies to reduce the high cost of borrowings and may in the long term bring down the cost of funds. Banks may get affected as this will reduce the interest spread. The 10% increase in the government levy on sprits and hard liquor will benefit Ceylon Brewery whose products do not come under this classification.

Market Outlook

The bid by Asia Capital to take controlling interest in Vanik Inc. does not appear to have attracted investor interest, infact most didn’t even consider this offer seriously. The offer price of Rs 10 and one Asia Capital share was extremely low considering the growth potential of Vanik Inc. when the economy turns around. Asia Capital’s objective appeared to be to stall Vanik Inc. at tempts to take controlling interest in Forbes Ceylon Ltd., in which Asia Capital has a 12% stake. The Lion Brewery Ceylon Limited’s initial public offer opened on November 28 and is expected to be fully subscribed. The company, a subsidiary of Ceylon Brewery, will brew Lion lager, Carlsberg beer and Guinness stout which are well-established. brand names, with the main objective of satisfying the currently unfulfilled demand in the market.

The market dipped marginally during the past few days and is expected to remain at these levels, with the exception of reactions to corporate results. We maintain our view that investors should take positions in selected blue chip and growth stocks during the next one month, as the market is expected to appreciate during the first quarter of 1997. The positive outlook for the first quarter of 1997 is based on the following assumptions.

• Expected reduction in lending rates, due to export companies being able to borrow free of exchange controls and the improved liquidity ensuring stability in treasury bill rates at 18%.

• Results of rationalising corporate operations being seen next year in company profits.

• Reduction in labour unrest, and the power crisis atleast temporarily being overcome.

• Expected moderate improvement in tourist arrivals during the current winter season.

• Reduced taxation levels and liberal provisioning allowances in creasing corporate profits.

Stock Recommendations

Our recommendation for investors is to take a two year investment horizon, but to take profit when substantial returns have been realised even in a short timeframe, due to the volatility in the market. They should detest from speculative trading and concentrate on stocks with strong fundamentals. We advise investors to watch for buying opportunities in the following stocks:

Banking and Finance – NDB, LOLC, Mercantile Leasing, Commercial Bank.

Manufacturing – Richard Pieris.

Hotels – Ahungalla Hotels, Asian Hotels.

Food and Beverages – Ceylon Brewery, Ceylon Tobacco.