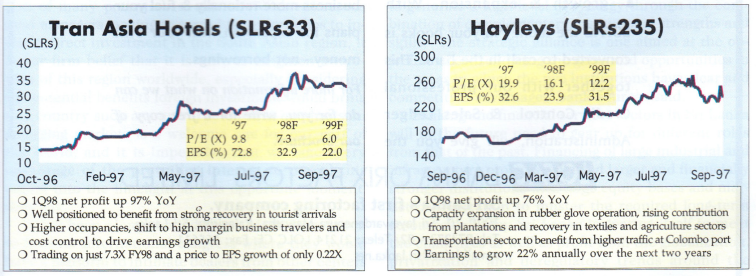

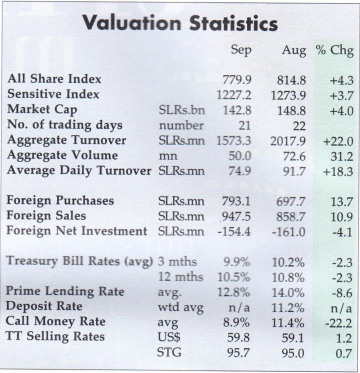

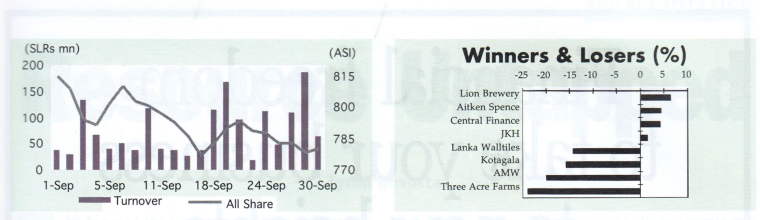

Searching for direction. With regional stock markets continuing to be in a state of turmoil and domestic investor attention being firmly focused on the primary market, it was hardly surprising that the ASI ended the month down a further 4.3% at 779.9 points. Despite improving during the second half of the month, average daily turnover also fell by almost 20% to US$1.3 mn. Foreign investors remained cautious about committing new funds to the region and their activity during the month was largely limited to crossings in perennial favorites Hayleys, JKH, NDB, Sampath Bank and new kid Lion Brewery. Although retail investors were seen aggressively cutting positions to get liquid ahead of the ongoing plantations offer for sales, continued heavy trading was evident in low priced liquid counters such as Asia Capital, Magpek Exports and Vanik Incorp.

Plantations grab the headlines. Investor attention has been distracted by the ongoing plantation offer for sales (OFS), the first of which – Maskeliya Plantations was oversubscribed by over 14 times on 19 September. The first six plantation OFS in mid- 1995 attracted little interest and devolved substantially on the underwriters, NDB and Merchant Bank/ Bank of Ceylon. This time around though, it is likely to be a completely different cup of tea. Following the sharp rise in productivity and commodity prices in 1996, most plantation companies have shown a dramatic reversal of fortunes for the better. Not surprisingly, the six listed companies’ share prices too have risen by more than 200% on average. A further 11 plantation OFS are scheduled for the next few months

and we expect the bulk of them to be comfortably oversubscribed by investors who missed out in 1995. Next up is Watawala Plantations, which opens on 6 October at a near giveaway price of SLRs15 per share.

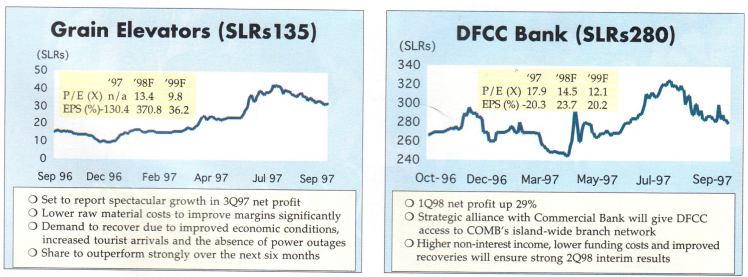

DFCC Bank in strategic alliance with Commercial Bank (COMB). DFCC, one of the country’s two development finance institutions, acquired a 29.5% stake in COMB on 18 September. The stake was purchased from Standard Chartered Bank at a price of SLRs136 per share, i.e. a total consideration of

SLRs1,003 mn, with the approval of both the Central Bank Monetary Board and the SEC. This acquisition is in line with DFCC’s intention of becoming a universal bank and DFCC will immediately benefit from COMB’s 44 strong branch network, through which it is likely to promote its long term lending activities to the SMI sector. The complementary skills of DFCC and COMB (i.e. – long term project finance and short term trade finance respectively) should thus enable the group to service most clients’ financial requirements. This strategic alliance is likely to further boost DFCC’s profits and we believe that after two disappointing years, DFCC is now coming back to its best. With improved recoveries and higher non-interest income likely to ensure solid 2Q98 interim results, we remain strong buyers of the stock.

Low interest rates hold the key. We are now nearing the period of the year when T-Bill rates traditionally trend upwards due to increased GoSL borrowing requirements. However, given the recent receipt of substantial privatization proceeds – via Sri Lanka Telecom and NDB and given a financial system that continues to be awash with liquidity, we suspect that any upwards movements in T-Bill yields during 4Q97 will be relatively restrained. Indeed, the money market has been so liquid that the Central Bank (CBSL) had to issue its own securities to mop up surplus liquidity during the past month. Investors who locked in attractive one year rates during Oct- Nov 1996 (L.e.- now approaching maturity), are likely to have second thoughts about re-investing their funds in fixed income securities, which are also subject to income tax. With T-Bill rates falling under 10% for the first time this decade during the past month, it is more than likely that a significant portion of this maturing money will be diverted toward the equity market. The next major impetus to the market is however only likely to be provided by the release of strong 3097 corporate results beginning mid October.

1998 Budget in early November. The 1998 GOSL budget, which is scheduled to be presented in the first week of November, is also likely to provide a further boost to the market. With higher privatization proceeds and lower interest costs likely to ensure a lower than expected 1997 budget deficit, we believe that the GoSL will present an investor friendly budget. Among the possible proposals are a greater than expected reduction in the rate of corporate taxation, a slight relaxation of the curbs on equity investments by the state pension funds and incentives to the tourism sector. Given our expectations of a pro-business budget that will re-kindle investor enthusiasm in equities, we maintain our view that the ASI will hit 900 points by the year-end.