Regional jitters hit market

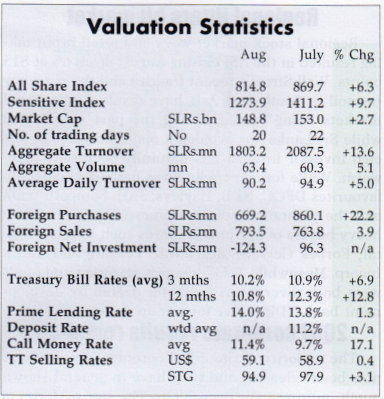

Regional stock market woes and retail profit taking resulted in the ASI closing August down 6% at 815 points. Wall Street’s recent frailties and the currency turmoil in South-East Asia have resulted in regional markets being routed during the past month and while Sri Lanka has avoided a major correction, foreign investor interest has naturally been only lukewarm. While foreign trading was limited to bluechip favourites DFCC, NDB, Hayleys, JKH, Sampath Bank and the plantation stocks, domestic investors were heavy buyers of low priced shares such as Asia Capital, Forbes Ceylon, Mercantile Leasing and Vanik Incorp. Meanwhile, retail investor attention and funds were both diverted to a certain degree by development bank NDB’s offer for sale in August.

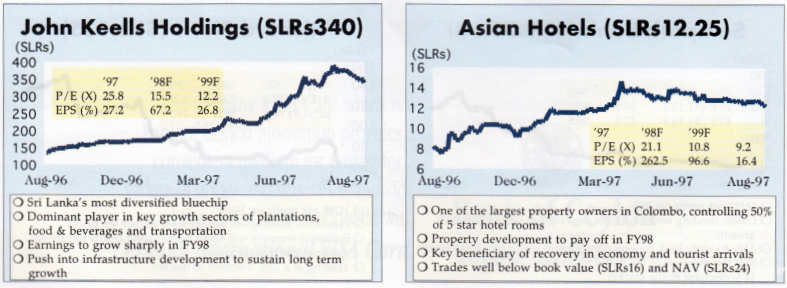

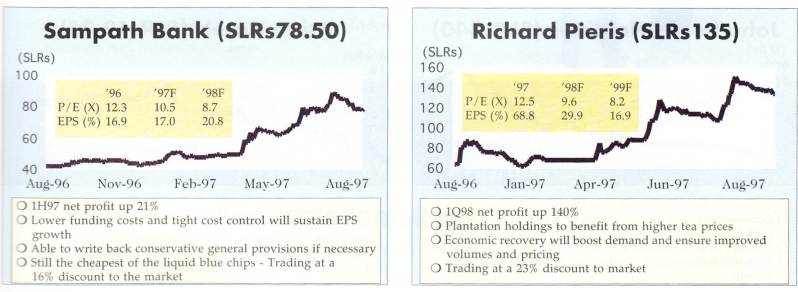

2Q97 corporate results round-up The majority of the 2Q97 corporate results have now been released, and they have in general shown much improvement over 2Q96. The star performers have however undoubtedly been the three main conglomerates, which have benefited from a sharp recovery in tourism, firm commodity prices and improved margins. While strong performances were also recorded by the two DFIs as a result of improved collections and higher capital gains, with the exceptions of Sampath Bank and Mercantile Leasing, much of the banking sector has underperformed due to margin erosion and relatively poor demand for credit. However, given our expectations of improved demand for credit. during the second half of the year, we expect most banking sector companies to report stronger results during 2H97. While the plantation companies have reported steady earnings growth on the back of higher yields and better prices, the manufacturing sector results have been mixed, although lower raw material costs and firm selling prices have enabled Richard Pieris and Grain Elevators to report exceptional results. We however believe that the manufacturing sector performance will improve as the full impact of the economic recovery is felt by the end of the year.

Privatisation proceeds of over US$300 mn in July The most significant event of the month though was Nippon Telegraph and Telephone Corporation’s (NTT) purchase of 35% of the equity of Sri Lanka Telecom (SLT) for US$225 mn. The purchase price was significantly higher than most estimates; the di- vestment will also benefit the economy by contributing to lower interest rates and an improved Balance of Payments position. Meanwhile, under an early conversion agreement, the GoSL’s 27.5 mn 12% convertible debentures in NDB were converted last month into 18.33 mn ordinary shares, with 16.5 mn being placed with foreign investors at a price of SLRs 260 per share. A further 916,700 shares were snapped up by domestic investors at SLRs 250 per share in an offer for sale on August 28 and the remainder was bought by NDB to set up an ESOP. While the early conversion has significantly improved NDB’s valuations, it has also raised a further SLRs 4.7 bn (US$80 mn) for the state coffers.

A flexible and lean corporate sector to drive market

Amid the regional currency and economic woes, Sri Lanka’s corporate sector has remained unscathed and is now even thriving following two years of general economic contraction. We attribute this to a fundamental change that has been gradually wrought in the corporate sector during the politically induced hiatus in economic activity and tight money in 1995 and 1996, which compelled corporates to restructure and refocus operations and concentrate on areas of core competence. This nimbleness and flexibility in the face of adversity is a hallmark of Sri Lanka’s corporate sector enabling it to stand out in the region.

1Q97 corporate results confirmed our view of a rejuvenating corporate sector, which has been further corroborated by emerging 2097 results which indicate earnings growth in excess of 20%. Much of this growth is being driven primarily by a leaner and more streamlined corporate sector and secondarily by sharply lower interest rates. We believe that profit growth in the second half of the year will be much stronger, given improving business confidence and recovery in consumer demand which will rekindle top-line growth in the corporate sector.

The above lead us to believe that a fundamental change is taking place in Sri Lanka’s corporate sector enabling earnings growth to accelerate over the next three years. Stacked together with this will be relatively low sustainable debt yields following the government’s commitment to fiscal discipline and economic reform. We also expect a business and an investment friendly budget to be presented in parliament in November and boost interest in equities further. Given this unprecedented positive outlook for sustainable corporate profit growth we expect the market to re-rate to higher earnings multiples from the current 12.5X after a brief period of consolidation. Consequently, we expect the ASI to rise above the 900-point level by the end of 1997 led by a few key stocks which we have highlighted below.

Courtesy: Asia Securities (Private) Ltd. BT