Feizal Samath & Rohan Gunasekera

With prices of Ceylon tea, Sri Lanka’s main export commodity, soaring to record highs for the second successive year, and estates, revitalized by the private sector which took them over under the government’s plantations privatization program, showing profits after years of losses under state control, the industry looks set to regain its position as one of the key sectors in the island’s economy. The country has more than a 100 year tradition of tea production and export and accounts for about 20% of the world market. ‘With the right inputs, adequate returns can be obtained from this industry,’ declared Ajit Gunewardene, of John Keells Holdings (JKH), one of Sri Lanka’s biggest conglomerates which acquired an early stake in the industry and now controls between 10-12% of tea produced in the country and 6% of rubber. ‘The whole picture has changed with (privatization of) ownership. We have been very bullish on the whole plantation scenario,’ he told Business Today.

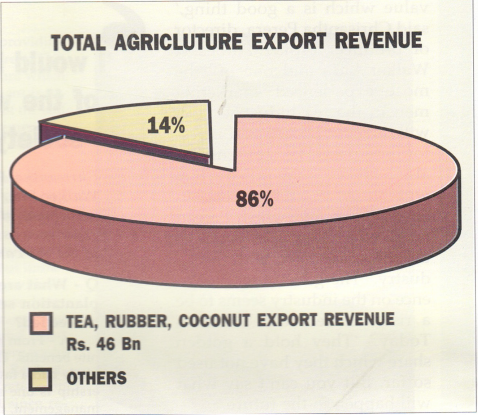

The turnaround of the tea, rubber and coconut industry, earnings from which accounted for 46 billion rupees or 86% of the island’s total agricultural export revenue and 20% of total export revenue last year, has been remarkable, given that hardly five years ago, when the government took its first tentative steps to privatize management of the 23 Regional Plantations Companies (RPCs) which control the estates that were under state ownership, the sector was losing billions and had to be kept alive by regular injections of government funds. While the upturn in world commodity prices no doubt partly helped revive the industry, it is the potential for long term growth offered by the more dynamic approach of the private sector, which has cut costs, raised productivity and improved product quality as well as value-addition, that has given investors a new found taste for a stake in the sector. ‘This is a

sector where there is tremendous potential,’ said Russell de Mel, manager (Corporate Finance) of National Development Bank (NDB), which has invested heavily in the industry. ‘It is very heartening to see an agricultural sector being considered this way because you are open to the risks in the environment like excess rain, drought.” Within six months of management being privatized there was a major turnaround in the sector, with more discipline brought about, elimination of wastage, introduction of new systems and faster decision making. ‘Attitudes changed,’ de Mel said.

Recent public issues of shares in privatized plantation companies have been oversubscribed many times over reflecting the bullish sentiment among investors, while the firms listed on the Colombo Stock Exchange (CSE) in the initial phase of the privatization exercise are trading far above their par value. ‘(The initial IPOs) were listed at 10 rupees a share and there’s not a single one doing less than 25- 30 rupees,’ Mano Tittawella, director-general of the Public Enterprise Reforms Commission, the government’s privatization body, told ‘Business Today’. ‘We’ve seen an average of 350% growth in about a year. That’s one of the reasons why there was such massive demand for the Maskeliya issue. People think it is an absolute bargain.” A good indicator of investor confidence in plantations is the way conglomerates like JKH, Hayleys and Richard Peiris bought into the sector to establish downstream links to feed their existing agriculture-based industries. JKH, in a joint venture called RPK Management Ltd, with Richard Peiris and Co, has bought Maskeliya and Kegalle Plantations, while Hayleys, through its Dipped Products subsidiary, owns Kelani Valley Plantations and manages Thalawakelle Plantations. ‘Most of the new IPOs are being offered at 15 rupees per share while their controlling interest was traded far above this price. So there’s definitely a big discount to the public,’ said Nouzab Fareed, general manager of Allied Phillips Securities Ltd. ‘Fifteen rupees for a share in a company with a lot of growth potential is very attractive. It is also so in terms of the return on investment. The future looks very bright in the plantations.’ But, he said, foreign demand for plantations shares has been limited.

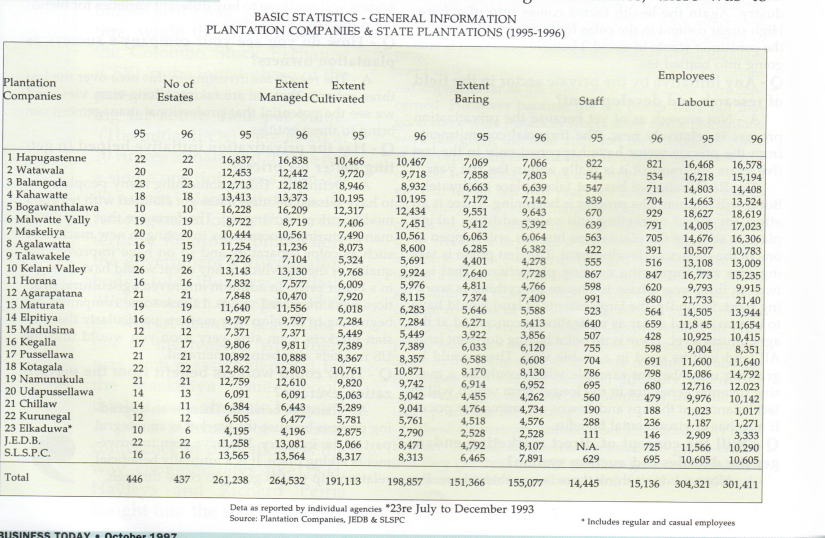

The privatization of state ownership in the plantation industry began in 1992 with the formation of the 23 RPCs to control the 500-odd estates managed by two giant state organizations, the Janatha Estates Development Board (JEDB) and the Sri Lanka State Plantations Corporation (SLSPC), and their subsequent handover to private management companies. The state-run estates had been incurring huge losses because of neglect, waste and inefficiency after the industry was nationalized in the early 1970s. “The two state corporations, the SPC and the JEDB, were too large to manage the estates, there was to some extent a degree of inefficiency, low productivity, wastage, high borrowings, huge losses,’ said NDB’s de Mel. Also, there was no commercial or market orientation. Our global shares of the tea and rubber markets narrowed. The estates had excess labor.’ Poor world commodity prices also contributed to the industry’s decline and accumulated losses were about seven billion rupees by 1991.

However, the actual change of ownership began only in 1995. Today, out of the 23 RPCs, six firms Kotagala, Bogawantalawa, Kegalle, Agalawatte, Horana and Kelani Valley Plantations have been fully privatized and listed on the CSE and the government retains only 10% of the shares which are to be given free to the workers. The government has divested controlling interest (51%) in another 12 companies; Maskeliya, Watawala, Madulsima, Agarapatana, Hapugastenne, Balangoda, Uda Pussellawa,Maturata, Elpitiya, Namunu- kula, Kahawatte and Malwatte Valley; and is in the process of selling 20% stakes in a public offer while retaining 19% of the shares for sale later on and another 10% to be distributed among the workers. ‘The government is offering these shares at a comparatively reasonable

value which is a good thing,’ said Chrisantha Perera, director of producer broker Forbes & Walker Ltd., and one of the most experienced marketing men in the tea industry. ‘You will then get widespread investor interest. The government also retains a ‘golden share’ that will allow it to intervene in emergencies and which Fareed of Allied Phillips feels is one of the risks associated with the industry. The government influence on the industry seems to be a risk, Fareed told ‘Business Today. They hold a golden share which they have not used so far. But you can’t say what will happen in the future.”

Under private ownership, profits are being ploughed back and new investments made in replanting, infilling, machinery and fertilizers, the fruits of which will be visible in the years to come. The improvements made under private management are already apparent with most RPCs showing healthy margins, having improved productivity and kept under control cost of production, which is high compared to other producer countries. Private companies, now owning former state- run estates, are taking better care of the fields, improving yields and paying workers and management better. ‘Under privatization people are not judged by the same yardstick but by their performance,’ said an industry official. ‘If a superintendent delivers the goods his bonus is very much more than a super- intendent who does not deliver the goods. Also incentives are given which were not there

when plantations were in the public sector. Under the short term management contracts that were given out in the first phase of the privatization of plantations there was no incentive for the new managers to spend money because they did not own the estates. When you own something, you are obviously going to take more care of it,’ said Michael de Zoysa, managing director of the tea division of multinational Unilever and the chairman of the Colombo Tea Traders Association. This is expected to lead to increased production and better prices.

Industry officials said Sri Lanka appears to be heading for a record tea crop this year too with output up by 5.3% to 156.3 million kg in the seven months to July from 148.4 million in the same 1996 period. Low grown teas, popular with the Common- wealth of Independent States (CIS) and Middle Eastern consumers, accounted for the bulk of the crop at 73 million kg while the volume of high grown teas was 50 million kg and that of medium growns was 33.2 million kg. Tea output rose 5% in 1996 mainly because of increased production of low grown teas, made largely by small holders, which now make up more than half the total crop, to reach an all time high of 258 million kg, compared to 246 million kg in 1995. Rubber production last year rose by 6.3% to 112 million kg, the highest since 1990. But prices fell from the previous year’s record highs because of increased output from other producers, although they are still remunerative for producers. Raw rubber exports are falling as rubber-based domestic and export industries use more of the local output. Coconut prices rose sharply in 1996 because of a shortfall in the crop, which fell by 8% to 2.5 million nuts from 2.8 million nuts the year before, mainly because of drought.

The high prices for tea and coconut products were the main reasons for the 2% improvement in Sri Lanka’s terms of trade last year, according to the Central Bank. In 1996 exports grew by 13% and imports by 7%, resulting in a reduction in the trade deficit to 9.5% of Gross Domestic Product (GDP). ‘This was largely due to an improvement in tea prices,’ the Central Bank said in its annual report.

The takeover and revival of the industry by the private sec- tor is also seen as helping in another crucial sector – labor. In the past highly politicized labor unions managed to wrest wage hikes from the government through strikes and the threat of strikes which could have crippled the industry. ‘We are the highest wage paying country in the world in tea and have the lowest productivity,’ said Fareed of Allied Phillips. ‘The power of the labour unions is very high. However, productivity has increased after privatization.’ With labour being one of the main factors affecting cost of production, the collective agreement being negotiated between the plantation companies and labor unions assumes critical importance for the future well being of the industry. Of more significance, however, is the grant of shares to the workers. ‘The workers themselves are going to be shareholders of each company,’ said an industry official. That is the thing that will revolutionize the whole industry. If I’m a shareholder of a company definitely I will work very much better than I did earlier. Also, they have very good incentives like profit bonuses and more payment for plucking more than the norm.’ Under the new management, greater mobility of labor, which had been inflexible in the past, will help solve the problem of excess labour on high grown estates and labor shortages in low grown estates. Some industry analysts even suggest there could be a shortage of workers in the future with a certain amount of labor retiring and a better-educated younger generation seemingly not inclined to continue the jobs their parents did.

Business Today would like to thank Malcolm Talwatte of the Plantations Ministry for providing information and statistics for this story.

Diversification hedge against ups and downs of commodity markets

With tea, rubber and coconut estates covering some 900,000 hectares or 41% of Sri Lanka’s cultivated land, scope for diversification in the industry is immense and could help reduce dependence of the plantation companies on the vagaries of the world’s commodities markets. “These are not going to end up being tea and rubber plantations. There is a whole range of diversification that will take place,’ said Ajit Gunewardene of John Keells Holdings. ‘It is going to enhance the value of the land and result in a massive economic benefit. That is what we see in the longer term.”

Gemming, hydropower, tourism, golf courses, vegetable cultivation, mineral water and fuel wood are some of the possibilities being mentioned as sources of diversification to make the best use of the land. ‘Plantations have so much of land in abundance there’s tremendous potential for diversification,’ said NDB’s de Mel. “Many firms have started diversifying, such as reviving their mini-hydro plants which were not functioning. So there will be other avenues of income for the plantation companies which would reduce the risk of 100% dependence on traditional crops.

“Nouzab Fareed of Allied Phillips believes that most of the future profits will come from the diversification projects planned by the new private sector owners of the RPCs, and not from the export of traditional primary commodities like tea, rubber and coconut. ‘Almost all RPCs have about 20% of uncultivated land,” he said. ‘So buyers have big plans. There’s a world of opportunity.”

Kahawatte Plantations, for example, is said to have large deposits of precious stones. ‘You could find a strategic partner coming in, in a more specialized project… in gemming. There could be big mining companies – looking further down the road,’ said Chrisantha Perera, of brokers Forbes & Walker. “There is a whole new ball game arising out of these new plantation companies. The resources of these companies, land etc., can be utilized in a more commercial sense.”

‘We’re very bullish on plantations’ – Ajit Gunewardene

Ajit D Gunewardene, overlooks the financial services sector at John Keells Holdings, one of Sri Lanka’s biggest and most diversified groups with a wide range of activities including trading, shipping, construction, services, owning and managing tea and rubber plantations and running a string of high- class hotels. Gunewardene, who is also a director of the Colombo Stock Exchange, told ‘Business Today’ in an interview that plantations are attracting private foreign investment because the immediate benefit is private sector management which is going to result in better returns. Excerpts of the interview:

Q-There have been two phases of privatization. In 1992, the government privatized the management of state-owned estates followed by the sale of estates, to private investors, by the present government. What are the improvements that can be seen now under private ownership compared to the post-1992 private sector management?

A-Under the private management of the estates we saw an improvement as far as inputs were concerned which resulted in an increase of yields, diversification programs and so on. The whole change in the management style and the private sector presence had a substantial impact as far as the state of the plantations were concerned. However because the tea prices were not that good there were instances where some of the plantations were not given the total attention they required. Some of the capital investment such as upgrading of machinery and replanting as well as proper fertilizing was neglected. In the last two years we have seen two things happening. One is the change in crop prices and the second is the privatization of the controlling interests. Both these scenarios have had a very positive impact on the industry. When ownership changes hands, we are talking of a financial commitment which means you got to get a return on your investment. This has seen a dramatic change in styles of management. To add momentum to this process there has been an improvement in crop. prices which has helped cash flows of these companies. Some of the companies which were running at substantial losses and were in financial difficulty, about four ..five years ago, have turned completely into substantially profitable companies.

These are primary commodities and commodity markets are volatile. So the management has got to ensure that they get their returns and they get it in a consistent manner over the longer term. And that is the difference in the investments and the thinking that is taking place.

Q-Does the industry attract foreign investment and if so why?

A-Yes it does. The immediate benefit is the private sector management which is obviously going to result in better returns. Then look at the long-term potential of the two major commodities – tea and rubber. It is envisaged that the demand for tea is going to increase with the opening up of global markets, the health aspect of tea catching on and as far as Sri Lanka is concerned, the quality of our product is improving. All this is positive and investors would like to take part in it. Then in the case of rubber, the demand for natural rubber is increasing globally with protection against AIDS and other needs. The value-added potential is going to be very large. What the investor looks at is the potential of sustaining prices due to quality and value-addition and basically due to increasing of margins from better productivity.

Q-Can Sri Lanka tea compete strongly with other beverages like Coca Cola for instance? Or what role do you see for our teas against other competitive drinks?

A-It is a difficult thing to take on a massive multi- national like Coca Cola head on. But my opinion is that tea is a drink that can run parallel to the soft drinks industry. Again the health factor comes into play here. High sugar content in the colas for instance is something the consumer wants to avoid. I believe Coca Cola is also going into bottled tea.

Q-Any initiative by the private sector in the field of research and development?

A- Not enough as of yet because the privatization process is relatively new. The financial commitments from the private sector have happened only in the last five years and most of it is really within the last year.

The R&D initiative has not taken place adequately. But it will happen. The process is beginning. There is an effort for direct marketing and value-addition taking place in some of the plantations but this will happen as one of the phases of development. The first phase is taking care and improving existing plantations. That is a two- to three-year phase to ensure everything is working right. Secondly, the large extents of land would have to be maximized as far as utilization is concerned at the agricultural level. There is no point having dormant land. All land will be used in a viable way. There could be growing of timber for example which could be a massive revenue generator in the longer term which will in fact balance out the ups and downs of commodity prices. It also has environmental benefits.

Q-Will the concept of direct marketing endanger the decades-old auction system?

A- Not so. I don’t think there is a problem here. Exporters will continue to buy different varieties for blending purposes.

Q – How do you see your company’s success as plantation owners?

A-The reason for investing in this area over the last three years is that we are taking a long-term view and we see the potential that professional management can bring to these entities.

Q-Has the privatization initiative helped in getting better tea prices?

A-Definitely. This is something many people seem to have missed because it has got clouded with tea commodity prices moving up. The facts are that improved manufacturing processes by investing in new machinery such as color separators and so on have improved the quality of the tea which in any event would have brought in a better price. In addition improved agricultural prac tices have increased yields. I think some companies are beginning to develop new markets particularly the Russian markets. I am sure very soon you would find the US markets also being penetrated.

Q- How could workers benefit from the privatization exercise?

A- There are benefits. There is an upgrading process because the worker is an integral part of the industry. We have seen improvements taking place. It is a mutually beneficial relationship that is going to come through.

Privatization brings huge chunk of economy into stock market –

Mano Tittawella, director-general, Public Enterprises Reform Commission

Q. Can you describe the objectives of the plantations privatization program and its current status?

A-With plantations being one of the biggest sectors of our economy, we felt it was necessary to attune the sector to more efficient management techniques and also to allow the sector to have access to a larger investment pool which the sector needed to develop if they were to compete in the world market in the future. We also felt that through private sector management and investment the plantations sector would suitably diversify itself and get involved in the more high-tech value-added type of production that is required for it to compete internationally. We felt the private sector was in the best position to effectively bring in the diversification that the plantations needed and thereby not depend entirely on traditional bulk tea manufacture and sales. If there was no diversification the industry would be very vulnerable to future trends in bulk tea prices. Also, it was in the overall strategy of the government that the private sector would be the engine of growth in the economy and it was felt that the large part of the economy which belonged to the plantations sector had to be put in the hands of the private sector if that objective was to be achieved. There were a lot of ancillary reasons to broadbase the share ownership, add more liquidity to the Colombo stock exchange, improve the accountability of these firms, and also to bring the economy into the stock market. In the past the stock market was largely unrepresented vis-à-vis the economy. But by bringing in plantations we brought back a huge area of the economy into the stock market.

There are four different aspects of this privatization. The first is to sell off 51% of the Regional Plantations Companies (RPCs) to the private firms and along with it the management. The second aspect is to list the companies by selling the 20% stake. The third aspect is to give the employees their 10% of the shares. The fourth aspect is for the government to divest the balance 19%. The idea was that in each plantation 51% was held by the owning company and there was a free float effectively of 49%. One of the problems in the Colombo stock market is that the free float stock is small. All four of these stages are at different levels now.

The divestment of the 51% – 18 of the 23 RPCs have been sold. Elkaduwa is being sold at the moment.

If you take the next thing as the public listing, we have six listed companies now and are in the process of listing the balance 13, the first of which is Maskeliya that we have seen now. There were a lot of reasons for the delay. We felt that some of the privatized companies needed time to get their act together because they’ve taken about six to seven months to put in the management, get better results. The timing of a listing is dependent on many issues. Firstly, it depends on how well the company is doing. There’s no point in listing companies that are not doing very well because you don’t get a demand for them and they end up with the underwriters. When we listed the first six companies all six public issues ended up with the underwriters and it did not serve the purpose of broadbasing the shareholding. Secondly, it all depends on stock market sentiment. You list a company when the sentiments are good. Now market sentiments are quite good. There is a general bullish feeling. The third reason is simply that it takes time to list a company.

The third aspect is the employee shares which hopefully will start from the middle of October. Over a period of three to six months all the employee shares would be distributed in the 19 RPCs. This is a huge exercise- there are 200,000 to 300,000 people who are getting shares.

The fourth aspect of the privatization program is for the government to sell the balance 19%. Now out of the six firms we privatized, we have sold the 19% in five. That means there are five companies which were privatized where the government has no shares at all. We are only hanging on to the golden share.

The balance four RPCS- that have got delayed partly because originally these companies were broken up into profit-making and loss-making companies, and the so- called profit making companies – now what has happened is that the loss-making companies are making more profits than the profit-making ones – were going to be given to the managing agents which resulted in all these shares being sold at 10 rupees. That may have been good at that time the market sentiment was bearish. It is not a very appropriate mechanism right now because we all know that the 51% shareholdings of these companies are worth far more than 10 rupees. We are doing the IPOS at 15 rupees because it is not 51% and the purpose of selling that 20% IPO is to get the retail guys into it. But selling the 51% at 10 rupees is not a viable proposition now particularly because all of a sudden this industry has become very, very profitable. So we’re at the moment looking at other strategies for these four companies and that might take a little time. But it does not unduly worry me because 19 out of the 23 companies have been privatized.

Q. What are the terms and conditions under which the RPCs are being privatized?

A The land is on a 50 year lease from the government. The RPC shares are sold to private sector investors to run the company. About 5% of the land of each RPC is kept for village expansion and various other activities like building schools. For these privatized companies the Asian Development Bank (ADB) has given a significant grant cum loan for development of plantations, diversification etc. There is a golden share-holder who is the secretary to the Treasury who has certain powers in terms of actually giving approval to certain basic things: e.g. if the fundamental nature of the business is going to be changed, then the firm has to get approval from the golden shareholder. That is essentially kept as a safety mechanism. We don’t hope to use it because we have sold these plantations by and large to very responsible people who are really interested in the business. Retrenchment of excess labor is not possible. That is a policy of the government’s privatization program.

Q-How much money has the government earned and how much more does it hope to earn from the plantations privatization program?

A-At the end of the exercise when we sell all of it, the government will earn in excess of about eight billion rupees. At the moment it has given us about five to six billion rupees.

Q-Once the government has sold its holdings it will not get any revenue.

A-It never got revenue. Ever since it was taken over by the government it never earned revenue. It ran into billions of rupees in losses. Government revenue comes from things like export cess. That’s where the revenue will grow because the private companies are increasing yields. Also there will be revenue from taxes.

Q-The industry has been making losses for many years. How has privatization helped it recover?

A-One big reason why this year has been a fantastic year for plantations is that tea prices have been very – good. Also, last year rubber was very good. Then two or three years back coconut had a record year. Apart from that the private sector will raise yields, which will send up production and lower the cost of production per kilo. Then your margins go up. So even if you have a downturn in prices, because of larger margins, you might still earn the same profits. When you have bigger margins you can give a better deal to labor. Next, they will be doing a lot of backward integration. Instead of producing and selling tea in bulk, they will make iced tea, packeted tea- all the value-added aspects. The real profit in the tea industry is in that segment, not bulk tea. Also, they have use of a massive landmass and can diversify into tourism, vegetable cultivation, mini-hydro schemes etc.

Q-While the industry is an attractive investment today there are certain risks associated with it. E.g. the cyclical nature of the commodities market, the over dependence on the tea market in the Commonwealth of Independent States (CIS) and the problems of unionized labor. How do you think these issues could be tackled?

A – The cyclical nature of the market is definitely a risk. The only way you can hedge yourself against it is by diversification, achieving greater margins by increasing yields so that you can take in a downturn in prices and prudent financial management. The over dependence on one particular market is also an issue but this is where the private sector will take a much more aggressive marketing approach and not depend on the CIS. The simple solution to the labor issue is that, if labor is kept occupied, if margins increase and ultimately the conditions of labor can be improved if the companies do well, then labor does not become an issue and I think that’s what we are seeing now. We’re seeing labor co-operating much more with private sector companies because they have a lot of work now. The people I have spoken to in the private plantation companies feel that if they are left alone they can handle labor very effectively.

Tea seen as health drink

Recent efforts to promote the image of tea as a health drink, based on re search that it has properties that may help prevent cancer, heart disease and diabetes, could turn it into a ‘hot’ product among increasingly health conscious consumers in the world beverage market. If the research conclusively shows that drinking tea does have health benefits it could expand the market in a big way.

All indications today are that tea is going to be a fantastic health drink,’ said an industry official. ‘Next to water the cheapest drink in the world is tea. I think people who are health conscious are going to go for tea in a much bigger way than any other beverage. Tea is very much cheaper than Coca Cola. So we will sell more as long as we can keep this drink cheap.”

The fact that corporate giants like Coca Cola and Nestle have developed tea products show that they see sizable potential in the beverage, he added.

I would like to see integration of the worker in mainstream society’- Chrisantha Perera

Chrisantha Perera, director of brokers Forbes & Walker Ltd., is one of the most experienced marketing men in the tea industry, having over 35 years experience as a tea broker. He is a former chairman of the Sri Lanka Tea Board.

Q- What are your views on privatization of the plantation sector? Has the privatization exercise succeeded?

A – From an industry point of view there are definite benefits. The privatization of management has definitely had a favorable impact. The privatization of ownership is one step further. Under the privatization of management, there was no capital formation nor the in- vestment requirements and the long term funding possibilities that would arise out of the privatization of ownership. This is another step in the right direction.

Q- The companies that came under the privatization phase were they profitable or loss-making companies?

A-Some of the companies were profitable, some were not. By and large the estates were generally not profitable. Most of the privately-managed companies, other than those which had a large component of rubber, made losses in 1992 in the first six months of privatization. These were due to factors like the drought. Then in 1993 the turnaround occurred and gradually the position kept improving. Today most of those companies are profitable.

Q-How have private companies coped with res- tive labor, high cost of production and other issues that state companies were confronted with?

A-Cost of production was tackled through what we call productivity-linked issues. Productivity was improved, output per man-day was improved and yields improved. So while your daily wage went up on one hand, output per man-day and other productivity also production even if not declining is controlled. At the moment the cost of production is still high compared to other producer countries but definitely it has improved since the privatization of management commenced. And of course today with the high tea prices, you are having reasonably high margins. But we are still a long way to go in improving productivity further and that is why privatization of ownership will enable us to achieve this. There is a very ambitious Asian Development Bank (ADB) funding program that is now going on for private companies where the ADB is providing long-term funds at reasonable rates of interest. This enables companies to raise capital expenditure which is needed to improve plantations. Investment is required in replanting, infilling, rejuvenation of the soil and other agricultural inputs. Also improvements in the factory, machinery.. all this will further enhance the productivity of the property. The ADB program also helps in the diversification of plantations, and this has long-term potential.

Q- Is there any progress in increasing yields per hectare?

A – Yes, an increase in the yields can take various forms. Developing the soil comes first but immediate benefits could be seen from infilling without doing large scale replanting, which is a more long term impact. Many companies in the management exercise have improved soil conditions and filled fields. Under the ADB funding program there could be a certain amount of replanting going on. Replanting must be done cautiously because the return on investment has to be carefully evaluated since replanting costs a lot and the return is recovered only after a long period. There are a lot of yield-improvement measures that are going on. Replanting takes a period of five years before the field is back at the stage of plucking, from the time of actually uprooting the old tea bush. So there is a five-year period where there is no income plus you have the capital costs that comes with replanting.

Q-Has the privatization program helped in netting good tea prices, clinching new markets?

A There is no correlation between the two because remember, the trade has always been in private sector hands. The tea trade was never controlled by the government. Because it was not in government hands, Colombo has always been a dynamic marketing center for tea.

Q-So there is no nexus between international prices or markets and a more dynamic plantation sector?

A-No but what is happening is that with the privatization of companies, there is a greater focus on possible new marketing avenues like for instance the producer looking at new marketing ties particularly internationally. While the existing marketing links continue with the private sector, the privatized firms are also trying to develop new marketing links. This could enhance Sri Lanka’s marketing image overseas.

Q-Could there be any overlap here. Both the producer and the buyer trying to sell overseas?

A- That is why we should be cautious. I don’t think we should undermine the existing marketing system for tea. But while working under the existing marketing system for tea, there could be areas where companies could forge links with strong marketing companies internationally and thereby get a greater impact or get more value-addition for Ceylon tea. There would be improvement. I believe some companies have developed direct marketing opportunities. But I must stress again that in these new marketing avenues, it is essential that we don’t undermine the existing arrangements. If this happens we would have a breakdown in the existing mechanism and develop new ones that would not necessarily enhance the value of Ceylon tea. If we do it along- side our existing mechanism, we can get greater benefits.

Q- How does one ensure these structures go hand in hand rather than in different directions?

A-For instance, if a private sector firm has a producer company which produces a fair volume of tea or rubber, that gives them an opportunity to link up with a marketing organization or create a new marketing organization. You would notice that many of the Indian plantation companies have done this. Sometimes within India or sometimes internationally. Thereby the marketing company can market its tea to the existing marketing mechanism but in addition also have a marketing arm. It could be a strong tea marketing arm.. an entirely new profit center for the plantation company..

Q-In the procedures followed for the sale of estates to the private sector.. is the government handling it the right way? If not, are there any changes needed here?

A-Privatization of plantations is now virtually at the tail end of the program. Looking back on the sale of the 51% controlling block of shares, the government could probably have generated more revenue if they had a more consistent policy from the beginning. Some of the earlier privatized companies which were the so-called profit-making ones got a lower price for the controlling block of shares than the companies that came up with open bidding, and it obviously looks as if they could have generated more revenue. So the government probably lost in terms of revenue. But I must say in the public listing of the balance 12 companies the government is offering these shares at a comparatively reasonable value. In that respect I think the government is doing the correct thing although they could, just to maximize revenue, have got a higher price. Making these shares available to the public at a reasonable value is a good thing. You will then get widespread investor interest in the stock market for the plantation company shares in particular and the share market in general. So that is a good exercise.

Q-How are foreign investors looking at the plantation sector?

A-Particularly now very, very positively. Plantation companies are doing well not only because tea prices have gone up but also because the industry, since the private management of plantation companies, has been improving. We have had all-time highs in tea production for four consecutive years.. that is something that never happened in the past. This was despite droughts and adverse weather conditions. This year we seem to be on track for an increase over last year’s 258 mln kg. This year we should hit 260 which is another all-time high. Hence investors realize that the privatization of plantations has had a beneficial impact adding to the other advantage of strong tea prices. This has resulted in the privatized companies recording fairly high profits. There is another major impact. A tea company was floated in the UK called the Tea Plantations Investment Trust, a public listed company which raised money specifically to invest in plantation companies. A large portion of its funds have been invested in companies that bought control of the plantation companies. I believe shares of this UK public company are trading at a slight premium. They have done a further rights issue and raised additional funds for making additional investments

Q-Have plantation workers benefited from privatization?

A-I can’t quantify the direct benefits but you would find that one of the important developments the plantation companies are discussing with the major trade un- ions is to arrive at a collective agreement – a long-felt need. That would bring in far more disciplined relationships between the employer, the employee and the trade unions. Also, the ADB funding program has set aside monies, much through grants, to build up infrastructure in estates including the workers’ social welfare conditions. It can cover hospitals, schools, housing and better sanitation. There is already a plantation social and welfare trust which has an ambitious program. All these benefit the people. What I would like to see is the integration of the worker in the mainstream of society. The children of plantation workers need not follow their elders as plantation workers. There can be a greater integration. They could move away. With plantation companies going into new areas of activity, you would find the whole scenario changing within the next decade. What must also change is the old-style theory that the plantation worker must constantly get higher wages, be guaranteed employment and so on. It will have to move away from that..Workers would overall benefit from the privatization exercise.

World crop shortfall, CIS demand keep tea prices firm

Tea prices this year are expected to stay high because of the shortfall in the world crop, mainly because of a sharply lower crop in Kenya, which last year edged out Sri Lanka as the world’s largest tea exporter, and continuing demand from the Commonwealth of Independent States (CIS) as well as the traditional Middle Eastern markets.

‘This year one of our biggest competitors, Kenya, has seen a 39.8 million kg drop in their crop up to July,’ said an industry official. ‘Bangladesh too has a lower crop. Other exporters have excesses but overall 1997 crops are going to be much less than in 1996. So definitely we are going to be very short of tea this year compared to last year. Obviously prices have to go up.’

Export revenue from tea, the island’s main net foreign exchange earner, shot up by 20% to 22.1 billion rupees up to July this year from 18.4 billion rupees in the same period in 1996, according to broker Forbes and Walkers. Tea export volume rose 6.7% or by 9.3 million kg to 148 million kg in the first seven months of this year from 138.7 million kg in the same period last year.

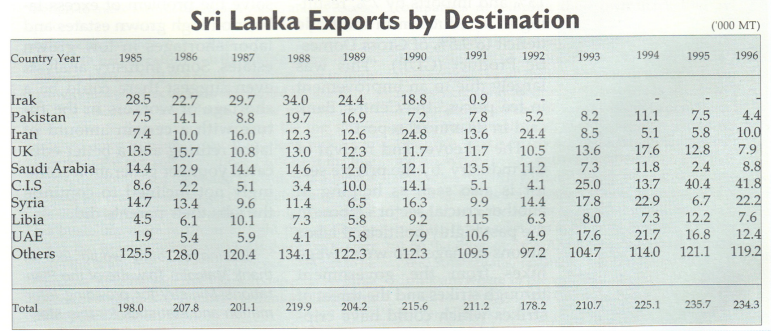

Ceylon tea also fetched far better prices this year compared with last year, the brokers said. The average unit FOB price per kg was 149.38 rupees in the period to July 1997 compared to 132.72 up to July 1996. The CIS continues to be the main market followed by Turkey, the United Arab Emirates and Egypt. Exports to the CIS rose by 30% or seven million kg to 31 million kg up to July this year from the same period in 1996.

Some experts have warned against being too dependent on one market. ‘To be over dependent on any one buyer is not a very good sign,’ the industry official said. ‘But we are not solely dependent on the CIS although they are a major buyer. All indications are that CIS countries will continue to buy from us because they have got used to our tea and we also have been giving them good tea which they cannot get from others. Now the Russians are doing their own blending in Sri Lanka. We’re also once again exporting tea to places like Iraq.’

However, the recent import tax hike on value-added teas by the CIS, designed to protect and help revive the tea packaging industry in the former Soviet Union, could pose a threat to Sri Lanka’s market share, Merrill J Fernando, a leading tea exporter to the CIS warned recently.

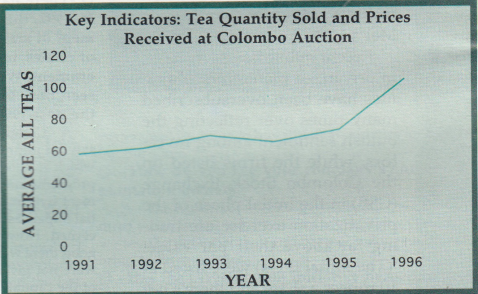

The average price per kilo at the Colombo tea auction, the world’s biggest, has hit new highs this year. At the August 12-13 auction the average price soared to an all time record of 125.51 rupees per kg, compared to the previous record of 124.08 rupees per kg set last October. The increase was mainly because the average price for low grown teas rose to 140.56 per kg, which was also a record for that elevation, compared to the previous record of 139.04 per kg reached at the sale of June 18 this year. Another healthy sign is that the bottom of the market is staying above the 100 rupees per kg level

Privatization of ownership needed to revive industry – Michael De Zoysa

Michael De Zoysa, managing director of the tea division of multinational Unilever, is also the chairman of the Colombo Tea Traders Association and a well-known authority on various aspects of the industry.

Q-How has privatization benefited the industry?

A-Well, when you own something, you are obviously going to take more care with it.. than by just managing something. This was the first step in privatization. Under management contracts, there was no incentive to go in and spend money. The industry had fallen so far behind in replanting, infilling, factory machinery, technology, in terms of clones, etc. It needed privatization through ownership to revitalise it. Also labor was unwieldy.. almost 90% of total labor is employed upcountry. There is a shortfall of labor in the low country and this labor is inflexible. I think they are trying to move people around with incentives like housing. That could alleviate the problem because there is a genuine labor shortage in the low country and excess labour elsewhere. Privatization might help in that area. Companies are taking care of the fields better, the bush better, standards will and are improving. In the factory, repairs will be attended to promptly if there are breakdowns. There is always a question of a shortage of power in upcountry areas and constant power failures in other areas. Last year, lots of estates invested in generators and the privatization process saw estates investing in small power plants, therefore they did not lose production. When you lose production or find production interrupted, then you lose money. So that kind of investment has been made. Managers are being trained better, paid better. There are incentives to work. The whole picture has changed with ownership. There is a concerted effort by whoever who took over the management of estates to do better, to make improvements in yields and of course prices have nothing to do with that. But prices are helping the market to develop.

Q-With privatization mostly taking place in up- country estates, will the focus shift from low to high growns since better techniques would be used?

A- Upcountry areas have several in-built problems. The terrain is very steep and the top soil is washed away in many areas. It is a long process to refurbish the top soil.. you need to rest it for five years, uproot the tea plant and replant. It is almost a 10 year process before you get crop again. So will people do it? They might rest a field, they might prune the tea bush, use more fertilizer to fight this declining yield. But to actually increase yields you have to start from the beginning. It is a long process.. you got to be thinking 50 years. Not five years. It depends on these owning companies-as to who is thinking long-term as opposed to short-term.

Q-Will privatization have a beneficial impact on the trade?

A-To an extent it would be more competitive because the government has also allowed the producer to sell his product directly. He can sell it directly to a local exporter or to an overseas buyer. He can avoid the auction system as long as he gets a fair valuation approved by the Tea Board. He can go outside the system to generate funds, sell his produce quicker since the auction system takes between three and five weeks from the day of manufacture. If you want to get your cash flow quicker, you can go outside it. The government has also allowed the producer to add value to his teas. If he wants to pack all his teas in tea bags or packets, 100% of his teas can be sold outside the auction system. There are companies that are developing their own value-added structure.

Q-Could the auction system be under pressure with companies developing their own marketing avenues?

A-The auction system is tried and tested. The producer brings all of his produce to one point which is then sampled by all the exporters in this country who represent not only themselves but overseas buyers and foreign orders are therefore canvassed. In one central point you create all the demand.. so you must get the best price. That is clearly understood by everyone selling tea. When they go outside the auction system, they add value towards getting a better price and are able to sell faster than the system allows. Also nobody is going to sell below the market. That would be foolish because this market has everybody bidding whether it be the Russians, the Americans, the South Americans, Australians, Japanese.. you name it. If tea is drunk anywhere in the world, that demand comes to Colombo. And Colombo is the only universal market.