According to the Development Policy Framework of the Government of Sri Lanka, as far back as the early 1970s, the local milk production covered as much as 80 percent of local demand in the country. However, with the advent of the open economic policy and increasing demands, imports of milk and milk products increased. By 2009 the local milk products met only 33 percent of the national requirement. In order to reduce the drain on foreign exchange resources, the Government set key targets towards self-sufficiency. The Government hopes to reach 55 percent self-sufficiency by 2015 through developments at various levels of the industry from processing to marketing. Milco, Lanka Milk Foods and Cargills, the key players of the industry offer their views on the local dairy industry, its current standing and the way forward.

By Prasadini Nanayakkara

The Industry at Present

The state-owned dairy firm Milco, which began its operations 55 years ago, is well-known throughout the island for its Highland dairy products which range from fresh milk to condensed milk. In order to cater to a high dairy consuming population, Milco is gearing its operations to meet the country’s long-term goal of self-sufficiency. “We have come a long way, but we still have a long way more to go,” says Sunil Wickramasinghe, Chairman of Milco. While the current national milk requirement stands at 1.7 million litres a day, at present Milco’s production is at 200,000 litres a day of which 15 percent is supplied to the fresh milk market. Milco’s main business focus remains on the procurement of milk from the local farmers. In addition, are production at its four production facilities and sales and distribution throughout the country. “All these areas need a lot of planning and a vision for the future,” he adds.

“We have come a long way, but we still have a long way more to go”

– Sunil Wickramasinghe

At present Ambewela milk remains the market leader in liquid milk with 70 percent of the market share. Ambewela farms and factories, which were privatised in 2001 is managed by Lanka Milk Foods, a member of the Stassen Group of Companies.

“At present our production capacity is at 15,000 litres a day which we hope to increase to 20,000 litres in the future,” says Sanjivani Clarinda Jayawardena, Director of Lanka Dairies a subsidiary company of Lanka Milk Foods. Lanka Milk Foods was the first in the country to introduce the tetra pack to the market. The Ambewela dairy brand was launched in 2004 towards the development of the local industry. Its full cream liquid milk was first introduced in UHT tetra pak with a shelf life of six months at room temperature. “The six layer tetra pack is what preserves the nutritive value of the milk. This advantage, together with our stringent quality standards observed at the farm and our marketing strategies have contributed towards the success in the liquid milk sector,” she adds.

“At present our production capacity is at 15,000 litres a day which we hope to increase to 20,000 litres in the future,”

– Sanjivani Clarinda Jayawardena

Another company that has also directed its target towards fulfilling the national requirement is Cargills Ceylon. Established as far back as 1844, Cargills Ceylon’s fully owned subsidiary Cargills Quality Foods includes its ice cream and dairy manufacturing brand Cargills Magic, and the recently acquired Kotmale, a leading brand in the dairy sector. “We are the third biggest milk procurement company in Sri Lanka and we produce around 50,000-60,000 litres per day,” says Nimal Pathirana, Director Production (Dairy Sector) of Cargills Quality Dairy. The low demand for liquid milk and its consumption is a thing of the past he remarks as “we have seen a very positive trend due to the growing awareness amongst consumers,” adding that, “based on the statistics from the custom supplied documents, consumption has gone up from 150,000 litres per month to one million litres.” While imports have remained static for the past two years, he notes that Sri Lanka is still far away from meeting its goals. “The World Health Organisation says the per capita consumption should be 200ml per day but Sri Lanka has not yet reached 100ml. There is a need to change our dietary pattern.”

“we have seen a very positive trend due to the growing awareness amongst consumers,”

– Nimal Pathirana

Dependency on Imported Milk

“We spend almost USD 350 million per year to import milk powder which we can produce here,” says Sunil Wicrkamasinghe. The gradual dependency on imports resulted with the increasing demand. “If you go back many decades most houses in the village had a cow or two, to provide fresh milk. As time passed and the country developed, with the increasing demand, Sri Lanka required refrigeration facilities to preserve fresh milk.” It was at such a time that countries such as Australia and New Zealand had an excess of milk production and converted their milk to powdered form. In their search for markets, Sri Lanka became a prime target. “25 years ago we barely imported 5,000 mt per year, this soon increased to 12,000 mt and last year it rose to almost 85,000mt.”

“The Local Dairy Industry Is Not One That Can Stand Alone As Yet. Even If We Do Increase The Demand For Fresh Milk It Is Unlikely That We Will Completely Be Able To Replace Powdered Milk Due To The Refrigeration Deficiency Particularly In The Rural Areas”

Despite the success of Ambewela in the liquid milk sector, one of the greatest setbacks in the industry’s move towards self -sufficiency is the lack of refrigeration facilities observes Sanjivani Clarinda Jayawardena. “While the industry is yet to meet the demand, powdered milk remains popular among the local community. The local dairy industry is not one that can stand alone as yet. Even if we do increase the demand for fresh milk it is unlikely that we will completely be able to replace powdered milk due to the refrigeration deficiency, particularly in the rural areas,” she says. “However as a company we are proud of being able to popularise liquid milk and gain a substantial presence in the local market,” she adds.

However, on a positive note Nimal Pathirana states that, “our living standards are going up and maybe in the next five years or so there will be a refrigerator in each household and with that the consumers will shift to fresh milk consumption.”

The Role of the Dairy Farmer

Milco’s fresh milk supply is dependent on a wide network of local farmers. “Currently we have 55,000 farmers supplying milk, to whom we provide an income. As a result 77 chilling centres have been established throughout the Island to preserve the milk until it reaches the factories.” Milco has established a system where milk is collected through farmer managed societies, and at present there are 2,200 such societies throughout the country.

“In This Whole Exercise The Farmer Plays An Important Role And If We Do Not Strengthen Our Farmers, You Can See That We Will Have To Continue To Import Milk…”

In a strategic move to strengthen the farmer while preserving the quality of milk, Milco has handed over its chilling centres to the farmer managed societies. The farmer as a result receives his due place, as from the point of milking the cow, the responsibility of preserving the quality and quantity of the milk remains in the hands of the farmer. “There is no inbetween, it is a great step forward in looking after our dairy farmers. In this whole exercise the farmer plays an important role and if we do not strengthen our farmers, you can see that we will have to continue to import milk.”

Milco at present covers 24,500km around the country, daily, to collect milk and deliver to the farmer managed societies. Giving the farmers a greater role in the process has further improved their income with 55,000 families earning an average of 5,150 rupees per month. This contributes towards raising the economic level of the country where milk is produced locally and the farmer earns a reasonable return. “In 2012, we have paid 3.47 billion rupees to the farmers as against 2.56 billion in 2011. That’s almost a billion rupee increase and this year we expect much more,” adds Sunil Wickramasinghe.

“If we produce our total milk we will save foreign exchange worth 35 billion rupees, which will trickle down to the low income dairy farmers in the country.” To further strengthen this initiative of uplifting local farmers, Milco will hand over its contract bowsers to the farmer managed societies,” he further elaborated.

Cargills also has transformed its products to increase the use of fresh milk and in turn encourage the efforts of local farmers. “We have converted all our products to utilise fresh milk. For instance we use only fresh milk for our ice creams to give local farmers the opportunity to join us,” says Nimal Pathirana. He also notes that the Government has taken several initiatives to encourage the dairy industry, for instance attractive loan schemes at low interest rates are being given by Central Bank to attract farmers. The milk purchase price too has increased from 30-35 rupees to 50 rupees per litre which encourages farmers to produce more milk. “I believe we are the highest paying manufacturer, and have seen good improvements as a result.”

“We Test Milk Provided By Each Farmer, Individually, And We Pay Based On Fat And Non-Solid Fat Content. Farmers Who Produce High Quality Milk As A Result Receive Higher Rates And In Effect We Are Penalising The Low Quality Milk Production.”

Cargills focuses on quality and quantity of milk and its operations are carried out through farmer societies maintained by their team. The dairy societies collect and supply milk directly to Cargills, which is tested for two components. “We test milk provided by each farmer, individually, and we pay based on fat and non-solid fat content. Farmers who produce high quality milk as a result receive higher rates and in effect we are penalising the low quality milk production.” Although an arduous and expensive process, he further explains that it affords farmers the right price and encourages production of good quality milk.

At present farmers are yet to mechanise their operations such as milking from the udder and preserving in the chiller. “I strongly believe if we continue to give farmers the right price they can reach a stable state. Once we improve the existing quality and quantity of milk then we can introduce modernisation of farms,” said Nimal Pathirana.

Lanka Milk Foods however, holds all of its processes within its own farms in Ambewela and Pattipola. Milk collection is carried out at the farms and the supply of fresh milk does not include the milk of individual local farmers to maintain quality for its fresh milk products. “Each step from the point of collecting till packaging is carried out within the farms with the guarantee that the milk is untouched by hands. This is to ensure that there is no contamination of milk,” says Sanjivani Clarinda Jayawardena. The farms and its many operations while generating employment for the communities of the region, milk of local farmers are utilised towards the company’s other dairy products such as milk powder and cheese.

Quality and Pricing of Milk

While in the past the price depended on the quantity, today it is based on the quality of the milk, in particular, the non solid fat, explains Sunil Wickramasinghe. “We have been through tough times when many changes were taking place. We increased the price of milk for farmers, without increasing the selling price for almost a year.” As a repercussion Milco incurred a loss and furthermore, as a result of improved field work of Milco’s dairy team, the milk production increased. However the capacity to process the milk fell short. “At such a time we bought every litre of milk from the farmer and we didn’t increase the selling price either. I believe as good corporate citizens we looked after both the producer and the consumer and we are proud of that.”

To avoid such setbacks in future Milco has increased their selling prices that remain below their competitors. “To compete with the imported products the Minister of Livestock and Rural Community Development along with the Treasury and the Ministry of Finance has taken steps to ensure that there is a level playing field between imports and local goods.”

Lanka Dairies’ success of the Amebwela UHT full cream milk within the short span of five years, led to the brand being extended to other forms of the liquid milk such as UHT non-fat milk, UHT flavoured milk and other products such as yoghurts and natural cheeses. Despite the high quality standards and technology involved, Sanjivani Clarinda Jayawardena explains, “our innovative UHT full cream milk tetra pak is not targeted towards a high end market, it is reasonably priced which allows it to compete successfully against imported goods.”

Increasing Production

“There has been an increase in fresh milk production of 31 percent in comparison to the previous year which I must say is very significant,” states Sunil Wickaramasinghe. However during the peak season of the last year there was an excess of milk that overwhelmed the industry’s capacity. “A serious issue that we are ensuring will not be repeated this year,” he adds.

When it comes to the production side, Milco is looking to upgrade its facilities as their four production factories are over 45 years old and the machineries have in turn become obsolete. “We are looking into a project by DESMI, a Danish outfit that will refurbish three factories, Ambewela, Polonnaruwa and Digana. At the same time we will commence a new state-of-the-art factory in National Livestock Development Board farms in Badalgama.

Modernising the factories will further increase the capacity up to 700,000 litres per day. This is Milco’s target amongst other players to reach the required target of 1.7 million litres which would stop the importation of milk.

At Present The Government Has Brought Down 2,000 High Yielding Cows From Australia With The Intention Of Developing The Dairy Industry

Nimal Pathirana shares his views on increasing production where elevating the farmer and bringing up the standard of milk is a step that should precede modernisation of farms. “At present most of our farmers milk by hand and do not use machines. Then the issue of hygiene comes into question,” he adds. The dairy farmers of Sri Lanka, are at present small-scale farmers the need to improve existing farms remains. “The challenge is the input cost and the productivity of cows.” In Sri Lanka local cows produce only 1-4 litres a day whereas in Europe, New Zealand and Australia, cows yield about 40 litres per day. “This is a very large gap, and we have to get our animals to that level through practices such as artificial insemination.” Accordingly he adds that the Government is taking steps towards elevating yield to 12-15 litres per day through suitable hybrids. “We have to develop a breed that can withstand our climate conditions whilst giving higher yields,” he adds.

At present the Government has brought down 2,000 high yielding cows from Australia with the intention of developing the dairy industry. “They are at the Bopaththawala Farm and yield a high quality milk. They can also conduct breeding. Sri Lanka is also applying a latest technology in breeding called ‘sexed semen’ to increase the chances of a female animal being produced,” he explains of initiatives taken by the Government.

Another area that needs focus to increase production is feed for cattle. While the input cost is high, farmers at present utilise available grass and leftover food from their household. “This should not be the practice and farmers should instead feed their cattle high protein grass and formulated concentrates.” Minimising cost of chilling, distribution and collection cost are other aspects that need to be addressed to develop the dairy industry, he further notes.

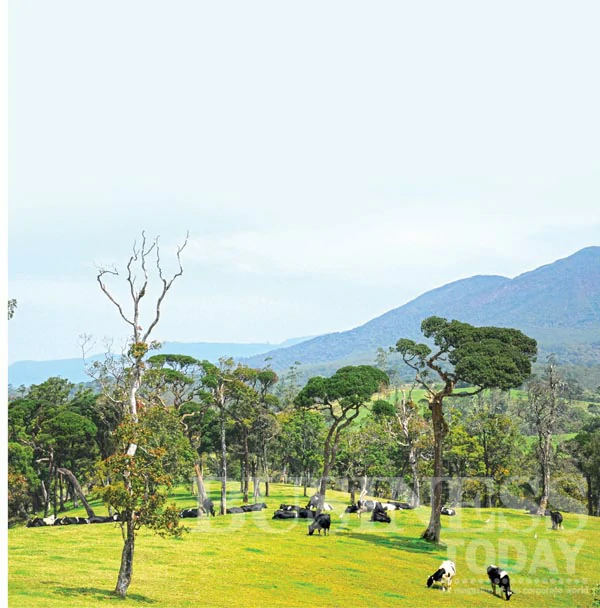

At the Ambewela farms over the past five years milk production has increased from 2.7 million litres to 4.7 million litres per annum, a growth of 74 percent. “Both the Ambewela and Pattipola farms are state-of-the-art farms of international standards,” explains Sanjivani Clarinda Jayawardena. “The farms are home to high-yielding purebreds, Friesian and Ayrshire cattle, and imported rye grass is grown at the pastures for use as cattle feed.” These practices have resulted in an increase in the daily milk production with yields of 17 litres per cow. With 1600 animals housed at the farms the high quality milk is also exported to the Maldives as UHT packs.

The Ambewela yoghurt too achieved substantial growth of 117 percent and a second filling machine had been installed during the year. However, more capacity is still required to meet the market demand.

Products and Popularisation

Milco has ten categories of products that include pasteurised milk, sterilised milk, yoghurt, ice cream, cheese butter, curd, condensed milk and the latest being the UHT milk. The UHT liquid milk production began with acquiring of a new UHT pouch pack machinery last year, with a capacity of 120,000 litres per day.

While increasing the production of local milk, the importance of popularising milk amongst consumers is also seen as an important step in developing the industry. “Milco has recently introduced a school pack especially designed for the ages between five and twelve at an affordable price of 20 rupees. It is particularly targeting school children and is nutritious,” says Sunil Wickramasinghe.

Milco also intends to increase their distribution network, where at present 135 distributors reach ten sales regions. “The sales have increased quite well to 6.2 billion rupees which is a 26.05 percent increase in sales as against 2011.” One of Milco’s selling points is that they do not add any preservatives to their products and focus on three aspects; freshness, nutrition and taste.

Notably for Ambewela, consumers have been drawn to its fresh milk tetra paks that are available in various sizes and flavours. The company’s newest addition to its product portfolio Daily Activ is also produced from fresh milk. The product was introduced to meet the demand for a malt-based dairy beverage in the local market and furthermore 3,500 cases a month are also exported to Maldives where it has met with success amongst consumers.

However it is not only the product portfolio of fresh milk that Lanka Milkfoods affords its consumers. Its state-of-the-art farms in Ambewela and Pattipola are open to visitors as well. “Visitors can see first-hand each and every quality controlled process at the farms from collecting milk to packaging,” explains Sanjivani Clarinda Jayawardena. Not only do the farms serve as tourist attractions but also facilitates educational tours for school children.

Awareness of the benefits of consuming fresh milk can also contribute towards in popularising liquid milk among consumers notes Nimal Pathirana. Fresh milk either in pasteurized or UHT form is available in all of the Cargills Food City outlets. “The UHT packs are very convenient, however, for pasteurized milk consumers are made aware of how to store below 4 C as displayed on the packs. We also distribute handouts to build awareness of how to preserve milk.”

He also stresses on the importance of bringing to light the nutritional value of fresh milk as opposed to milk powder. “A great amount of energy is spent on removing the moisture of milk to produce milk powder,” he explains. “87 percent of moisture has to reduce to three percent to make milk powder for which heat treatment is required up to 160 C and as a result destroys many nutrients.” The right product available at the right price would also contribute towards popularizing liquid milk. “If that can be achieved and with education, Sri Lankan consumers will convert to liquid milk.”

Cargills has implemented its own initiative in popularising milk by encouraging consumption of milk among its milk producing societies. “After their consumption we only take their excess milk for our productions. It is one way of getting rural communities to consume fresh milk,” states Pathirana. “If not they sell us fresh milk and buy milk powder. Through our dairy development team we have initiated a communication programme to inform farmers to not give away their entire production and instead consume fresh milk and only provide us with the balance.” Cargills is also formulating awareness programmes under their fresh milk, Kotmale brand. “People look at convenience and price rather than nutrition, because of that we decided to install a new plant for Kotmale to provide fresh milk in a convenient form as well,” he adds.

Looking to the Future

The aim of Milco Sunil Wickramasinghe states is to become a ten billion rupee company by 2014. “The only way to grow is to innovate new products,” he says and accordingly Milco has taken forward its products particularly its UHT liquid milk products. “Our aim is to convert powdered milk consumers to liquid milk, just as everywhere else in the world.”

Milco also offers its liquid milk range in various forms including, pasteurized and sterilized milk as well. Milco is already aiming to venture into the export market with its condensed milk product. “Sri Lanka has the potential to become an export hub for milk based products,” says Sunil Wickramasinghe. Countries such as India and China are falling short of meeting their local markets, and would serve as potential export markets for Sri Lanka. “Our campaign focus in the future should not be ‘lets drink milk’ but ‘lets eat milk’.”

As a state-owned entity Milco focuses on products that have a greater reach. “Many forget the bottom of the pyramid. However, that is about 75 percent of the population,” says Sunil Wickramasinghe adding that “the Hon Minister and the staff at Milco are together in reaching our goals as good corporate citizens.”

Cargills aims its development targets to become the number one local dairy company in the Island. “We have a capacity of about 4,220 mt, however we only produce 1,500 mt per month, which includes, cultured, UHT, flavoured milke, cheese and other products.” With aggressive dairy development activities Cargills hopes to also reach the North and East of the Island to procure milk from farmers and produce high quality milk required for UHT milk. The company has already invested 1.3 billion rupees to open up its new factory for ice cream and comprises of its own fleet of trucks so that the right product reaches the consumers. “We must ensure that proper cold chain facilities are available from beginning to end. While we have cold rooms to store our products and our own trucks, the difficulty is at the retailer level. They are reluctant due to the electricity cost and cost of investing in a freezer. It is their thinking that we must convert diplomatically, so that consumers receive a product of the right quality,” he elaborates.

“There is a definite increase in the local demand for liquid milk in the recent past,” says Sanjivani Clarinda Jayawardena and consequently the company is undertaking the installation of a next generation Tetra Pak packaging machinery to further enhance higher production efficiency for the convenience of consumers. While cold storage does not pose a setback for the UHT fresh milk products like Ambewela, in addition, “all of the processes are carried out within the farm and cold chains are not required for tetra pak products, which can be stored at room temperature for six months,” she says. The tetra pak technology facilitates the convenience of storage at retail outlets until it reaches the consumer and the pack is opened.

The Government At Present Is Making Efforts To Create A Level Playing Field So That Local Products Receive Due Place In The Market

The Government has set down its targets to reach self-sufficiency in the dairy industry of Sri Lanka by the year 2020. While key players of the industry have taken steps towards increasing production to meet the local demand of 1.7 million litres per day, there are many challenges that still lie ahead. From increasing production with the development of livestock to storage at the retail and consumer level, all aspects of the industry require developments. One of the key shortcomings seen is the lack of storage facilities at the retail and consumer level to preserve the nutritive and qualitative value of milk. There remains the requirement for fresh milk to elevate its status as a competitive product against imported milk products. While modernising farms is currently underway to increase production and quality of milk, long-term goals of building up local dairy farmers, encouraging dairy farmers to recognise the importance of dairy farming as a commercial industry are seen as significant steps in the overall development of the industry.

Consequently elevating the income of dairy farmers while delivering competitively priced products to the market are focus areas that need to be given due consideration in the way forward. The Government at present is making efforts to create a level playing field so that local products receive due place in the market.