Dinesh Dias

For the month ending May 23, 1997. A complete wrap-up from the Pacific Rim to Wall Street

‘Bull Run!”, that’s what the analysts said when the stock markets in Europe and most of the Asian markets soared to record breaking levels, moving in line with Wall Street’s upturn of 10% during the month ending.

ASIA

In Japan the Nikkei passed the 20,000 mark for the first time this year, up by 10% during the month ending. Analysts expect the trend to continue with strong economic data releasing to the market. Some of them were the Trade Surplus for April, risen by 163.7% (USS 7.23bn) and 4.07bn in US alone.

The Hongkong market closed with a record high on Tuesday at 14,153.58 points, up by 13% this month. The upturn in Hangseng was due to strong economic fundamentals in the US and a growing stability in China. Analysts expect the Hangseng to pass the 15,000 level in the near future.

Another big winner was the Chinese market with the US granting it the permanent Most Favored Nation’ (MFN) status and its rising exports which is 20% and the 4- month high trade surplus which was at 10.28bn in April ’97. Before granting it the MFN status, the US expected China to join WTO and this is still under consideration by China.

A strong upturn was experienced in India when the Bombay benchmark index edged up by 4% during the month. The investors welcomed the move by the government to reappoint P Chidambaram as the Finance Minister and for involving him in the budget talks.

Among the losers were the Thailand, Bangkok SET Index which dropped by nearly 14% in this month and which is the 8 year lowest. This drop resulted in a drop in the Malaysian and the Philippines markets too because of the regional impact.

The continued drop in Thailand was due to the financial and economic crisis prevailing in the country and the over-tied up investments in the property sector. Analysts expect the Bangkok SET to drop further with fall in currency and economic instability.

The Philippines is also experiencing a similar climate as in Thailand with disappointing results in the corporate earnings, the fear

due to the recent drop in the property market and the rise in trade deficit to 8%. As a preemptive measure, the government decided to raise interest rates to stabilize the inflation and the currency. In May alone the Manila Composite Index dropped by nearly 15%

Meanwhile, in Australia, the Index rose by 6% to close at 2,543.2. This upturn resulted after the release of good corporate earnings and a strong market growth in Wall Street. The government’s decision to cut interest rates by 0.5% also helped in the Aussies upturn.

Corporate News – Asia

The biggest scam in the History of Gold Mining was reported from Indonesia, when Canadian owned Bre-X Minerals was caught in a fraud for hiding Gold reserves in Busang. Their stocks were pulled out of the Toronto Stock Exchange and the US-NASDAQ index with this news. But according to a re- cent report the stocks made its debut in the Unlisted Security Market in Canada with a value well above zero.

The strong Dollar made most of Japanese export oriented stocks to show record profits. Among them were Honda, Toyota and Sony. Honda the 3rd largest auto maker in Japan reported an increase of 239.4% (US8 3.0bn) in profits for 1996. To reward the investors, Honda decided to raise their dividends by 20%. Toyota’s profits soared by 50% to US83.4bn in 1996. Analysts expect the profits to grow even further to US85.0bn in 1997. Prosecutors in South Korea have declared a 20-year jail sentence to the chairman of Humble Steels in connection with bribery and fraud. Humble steel was liquidated earlier this year, suffering heavy losses.

EUROPE

The European markets entered the record books when London, Frankfurt, Paris and Zurich soared by nearly 10%, followed by Wall Street’s rally.

The move by the new British Labor Party to restructure economic decision-making in UK supported the FTSE’s upturn. According to government officials, the Bank of England will hold total responsibility in determining the interest rates leaving the inflationary and economic growth targets in the hands of the British Government.

With an overheated economy. Bank of England’s first move was to raise its interest rates from 0.25% to 6.25 %. The move made stocks and UK bonds more attractive than that of the rest of Europe due to the high yields.

In Germany, even though the market is performing at record levels the economic data released during the period was not as sound as in the other parts of Europe. The latest unemployment and inflation figures have risen compared to the previous months. Economists are now in doubt about the GDP growth target of 3% which is the requirement by the European Union for single currency.

Record level inflationary rates were reported from Italy. Inflation had dropped to nearly 1% in April 1997 and this is a 28-year lowest recorded in Italy. The market expects interest rate cuts by the government.

The French elections has made the Paris stock market nervous and could bring the markets down with the elections. Currently, the present government which holds the majority in opinion votes, promises that it will keep fiscal policies and exchange rates in a stable condition in the future.

Corporate News Europe

Among the big winners during the month were the stocks in Financial, Drug and Utility sector in Europe. Strong earnings forecasts made the investors move into these sectors. With the corporate restructuring in Industrial sector, companies such as Volkswagen and Philips increased their profits by 43% and 29% respectively. This also helped British Petroleum to increase profits by 19% in the 1st quarter.

The British clothing industry giant Marks & Spencer reported a International Markets profit of US$ 2.0bn. This was due to an increase in revenue and careful restructuring plans which helped to cut its expenses.

Deutsche Telecom recorded a 50% jump in its profits and expects to double this in 1997. Deutsche Telecom was one of the biggest gainers in the Frankfurt Market mainly due to the heavy buying spree from institutional investors.

A Star Alliance was formed in the air industry when Lufthansa, United airways, Air Canada, Thai Airways, and SAS formed a strategic alliance to control a bigger stake in the air industry. With this move all the five aircrafts expect to gain 13% of British airways and American Airlines.

NORTH AMERICA

Stocks in Wall Street broke 3 consecutive records when it reached 7,300 points. The upturn in Wall Street was due to strong economic fundamentals prevailing in the economy. This was proved by lower inflationary figures both from Consumer & Producer and fall in unemployment. Another factor which added to this upturn was the US Government’s move to balance the budget by the year 2002.

Dow Jones Industrials however closed at 7,290.69, down by 100 points after a record closing on Thursday due to nervousness on the Fed’s meeting on raising interest rates. The Fed’s next policy meeting will be in July 1997. Analysts however expect the Fed not to raise the interest rates due to lower inflation rates and a strong GDP growth rate and the drop in unemployment figures.

Corporate News – United States.

Boeing Co. earned super profits in 1996 due to an increase in overseas aircraft sales in Asia and Europe, but the profits were lower than market expectations.

The recent rise in US$ made General Motors’ cars less attractive in the World Car Market. The car sales had dropped by 5.2% in April 1997. Analysts expect GM profits to drop further due to labor disputes, demand for higher wages etc.

Digital, the computer hardware manufacturer has filed a court case against its largest chip maker Intel for using its name in making Intel micro-processors.

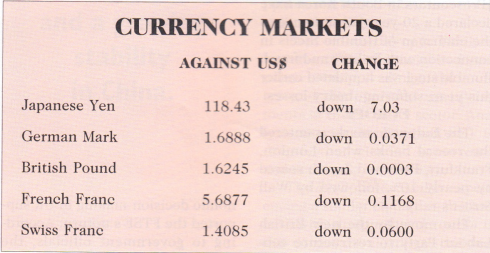

The Dollar rally ended in the beginning of May with the intervention of G7 on a stronger USS position against other major currencies. The Dollar which dropped to 113 Yen level in the 3rd week of May was the biggest drop recorded this year. The Bank of Japan had shown interest in the Yen- Dollar rates and says that it will raise interest rates to support the Yen’s strengthening. The fall of the US Dollar against the Yen was seen by analysts as a Yen strengthening rather than as a Dollar weakening with good economic fundamentals prevailing in Japan.

The weakening of Dollar against Sterling Pound was seen partly as a result of Bank of England’s decision to enter the European Currency Grid to stabilize its currency.

The US Dollar is expected to remain in this range in the near future but analysts believe that by the end of this year, the rates would go down to 110 to the Japanese Yen and 1.6 to the German Mark.

The weaker Dollar made the Bond markets less attractive making US Treasury Bond yield to drop to 6.95% from 7.09% in the previous month.