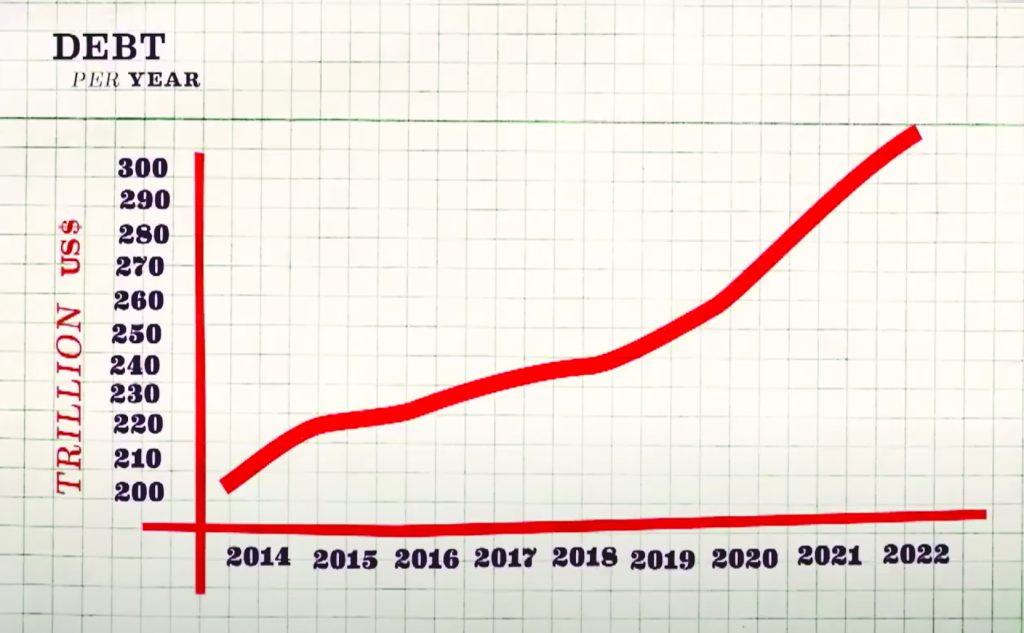

Imagine every living person in the world, adults, children, and even infants, every able-bodied individual to the not-so-able, having to work for three and a half years to pay off a colossal global debt of $300 trillion. The debt narrative has come to grip an increasingly unstable world, even as many countries have hit the pit with unwholesome debt in recent years. Everyone’s taking stock of the dangers and consequences of unbridled borrowing as the fear of households, businesses, and countries drowning in debt looms.

Words Jennifer Paldano Goonewardane.

Can debt be so bad that a mineral-rich Argentina, among the first five wealthy nations a century ago, declares bankruptcy nine times? There is indeed a debt crisis in the world, spiraling out of control. According to official data, 70 countries are in an acute debt situation. Many of them, mainly in Africa, have defaulted on debt repayment in the last two years. Many are on the verge of defaulting. But there is even more shocking news. Making a bad situation catastrophic, 42 percent of the world’s population and 90 percent of the extremely poor live in the countries with the highest debt burden. To understand the impact better, imagine the corollary of unchecked household borrowing. Anyone in a debt-laden predicament will vouch for losing personal peace and freedom, fear and insecurity, and stymied progress. Meeting hostile creditors demanding to pay up is traumatic. It’s akin to bondage. Sadly, rather than the intended, the reverse happens. It plunges individuals into poverty. Their only restoration is a debt write-off. The story reads the same for countries with the highest debt burden.

The repercussions of household, business, and country borrowing decisions reverberate with each other. True to the age-old saying that all that glitters is not gold, some of the best symbols of extravagance and prosperity stand on mounting debt piles, and those edifices that scream modernity become skeletons of barrenness. A good example is Dubai. Opulent real estate projects in Dubai ended with no takers in the aftermath of the 2008 financial crisis, as the real estate boom withered. As investor sentiment declined, the value of some of those assets plummeted. They led to project withdrawals, bankruptcies, and even personal tragedies. Luckily for Dubai, the bailout came in the form of a good neighbor, allowing it to complete its grand Burj Khalifa, although many of its other hyped development projects still lay empty or half-built. While Dubai continues to sparkle as a land of great opportunity and attracts immense wealth into its soil, others have had a rough landing. The aftermath of the COVID pandemic and the war in Ukraine has only intensified the global debt crisis.

The COVID pandemic slowed economic activity – a decline in revenue from tourism, exports, and remittances. Government expenditure on health, welfare, and bailouts increased. The war in Ukraine sent energy and food prices soaring, plunging many into a balance of payments crisis. Central banks responded to rising inflation by hiking interest rates, which increased refinancing costs and debt servicing. The pandemic cost and the war in Ukraine had an impact even on the world’s biggest economy. The USA’s debt has grown to more than $33 trillion. However, there is a fundamental difference in the debt burden in the Global North and Global South. The latter is not in a strong position when they borrow from capital markets, often acceding to weightier terms than the countries in the Global North. However, in both instances, increasing debt means increasing inequality in all those societies. It gives way to increasing poverty. In turn, people choose to borrow money to lead modest lives, only to be plunged further into chaos, forcing them to work harder and sometimes do multiple jobs to repay their debt. There is a drop in the quality of life. The most vulnerable become the hardest hit in this crisis. Access to health and other qualitative services becomes sparse.

In the US, the American Dream is a distant possibility for many, the nucleus of capitalism, where to this day, wealth remains concentrated in the hands of an elite, where the benefits of economic growth have trickled down not to the vast majority but to a handful of the wealthy, generating high-income disparity. However, the establishment offered a solution to those who needed help. They could borrow money. With this lifeline, people would even indulge in luxury and high-end consumption while living from paycheck to paycheck, each time failing to meet their debt obligations while their other household bills mounted. Their debts piled up with interest. They were poorer than before, barely meeting their daily needs with meager incomes. But these people, burdened by financial difficulty, were offered unbridled access to money. And borrow they did. But, their investments were merely credit-leveraged. That is the problem that many debt-ridden countries are saddled with today, buried under a mound of credit-leveraged development projects, some of which are non-revenue generating.

Pundits will say that borrowing money for development is not bad because capitalism thrives on debt, and a world without debt means the end of capitalism, as they expound. Capitalism has been the bedrock of prosperity, marked by investment in infrastructure, education, and multiple State mooted projects. This fundamental applies to the wealthy and the emerging and developing economies. Hence, seeking wealth and prosperity is at the heart of capitalism. Buttressing that desire are lenders, financial institutions, and global capital markets. Among those international lenders are those that demand prudent oversight, want a say in how the debtors spend the money, and seek accountability. That becomes burdensome to countries that seek to fast-track their development plan. So, they look for a creditor willing to lend with few questions asked. Enter China, the generous lender to countries spurned by the preachy and morally upright governments and agencies.

Chinese lending has benefited countries that couldn’t afford colossal infrastructure projects, including developing ports that opened them to external connectivity. But there is also a downside to this unrestrained behavior. Many such projects have ended up as unproductive white elephants built on the behest of leaders, their pet projects aimed at augmenting their appeal among the masses. They not only stand on a vast multibillion-dollar debt pile, they are the crux of the debt crisis. The knock-on effect is devastating, as we witness today.

Households, businesses, and countries are in a debt trap because they fall for the lure of creditors willing to lend as much as they demand, not checking where the money goes, whether those investments were worthwhile, or whether the borrower could repay without falling into distress. But that is the beauty of capitalism. Capitalism is where freedom reigns supreme. You can buy, borrow, or sell. But its terms are also brutal. Repayment is a prerequisite for free borrowing. It’s a system that bleeds the majority from already open pores. It’s a system that proliferates poverty and inequality under the guise of freedom, where, unfortunately, flawed choices plunge an already destitute population into further misery. While their governments would not hesitate to bail out the big banks in a crisis, restitution for them is not essential. And it is they who foot the bill and take the fall for their government’s debt.

Information source – The global debt crisis – Is the world on the brink of collapse? DW Documentary