Overview:

continue to affect Global Equities despite measures by the world’s central banks to inject liquidity.

Index Commentary

In the initial part of December global equities recovered from the losses of last month aided by positive US non-farm payroll data, which came in slightly higher than expected with 94,000 new jobs created in November. As expected, the Federal Open Market Committee (FOMC) decided to reduce the federal funds rate by 25 basis points (bps) to 4.25%, with the FOMC having mentioned the potential for a slowdown in consumer spending. The following day European and North American central banks unleashed a coordinated attempt to end the credit squeeze in global financial markets, however, the underlying mood remained cautious as conditions in the markets remained strained by normal standards.

Inflation returned to the forefront in the US after producer prices rose to their fastest rate in 34 years and headline consumer price inflation rose to a two year high. Equity markets were also tempered by downbeat news in the US housing market, as new home sales in November fell from 728,000 to 647,000 against an expected 717,000. The fall was the slowest rate for 12 years, with the data coming on the heals of a record decline in US house prices in October. The FTSE Global All Cap Index fell 1.2% over the month and up 10.0% over year of 2007.

In an unprecedented step aimed at easing the global credit squeeze, the European Central Bank (ECB) allocated a greater than expected EUR 348 bn in a refinancing operation at a flat rate of 4.21%, which spokesman Niels Buenemann said was aimed “at helping the banks over the year-end period” as well as saying that the ECB would make more cash injections next year if needed to ensure credit markets were well supplied. There was also news that Eurozone inflation rose 3.1% in November, the highest in more than six years as well as the Ifo index of German business confidence falling to its lowest level in almost two years in December. The FTSE Developed Europe All Cap Index fell 2.0% over the month and rose 10.4% over the year of 2007.

Asian equity markets also fell in December with the FTSE Asia Pacific ex Japan All Cap Index, down 0.7% over the month, however the index gained a substantial 37.1% over the course of the year. As expected, the Bank of Japan (BoJ) kept its key interest rate unchanged at 0.5% at the monetary policy meeting, with the tone from the BoJ being softer than on previous occasions. The FTSE Japan All Cap Index fell 4.4% in December and fell 6.3% in 2007.

The Brent crude spot price rose 5.8% over the month and finished at 93.82/bbl, on an un-expected drop in US crude inventories as well as Opec rejecting calls for an increase in pro-duction. Precious metals that are used as a hedge against inflation and as a consequence of the political uncertainty fell over the month, with platinum hitting a record high, while gold climbed 6.8% over the month, back to a 28-year high. There was a downturn in base metals over the month on concerns a US economic slowdown may affect demand expectations.

The cut in US interest rates set in motion a US dollar rally, which appreciated 0.4% against the euro to finish at EUR 0.684 and also rose against the yen to finish at JPY 111.715, up 0.7%. The Bank of Japan’s Tankan survey did not help the yen’s cause as it showed Japanese business sentiment slipped to a two-year low. The euro also rose against the yen, up 0.3% to finish at JPY 163.332. The Bank of England’s Monetary Policy Committee voted to reduce the benchmark interest rates and with mounting expectations of further interest rate drove sterling to a six-month low against the US dollar, down 3.2% over the month finishing at USD 1.991. Sterling also fell to its lowest level against the euro during the month falling 0.4% to finish at EUR 1.462.

FTSE All Cap (AC) Regional Performance – USD, FTSE All Cap (AC) Size-based Performance – USD, FTSE All Cap (AC) Regional Indices- USD

COUNTRY BREAKDOWN

FTSE All Cap (AC) Developed Markets – USD, FTSE All Cap (AC) All-Emerging Markets – USD

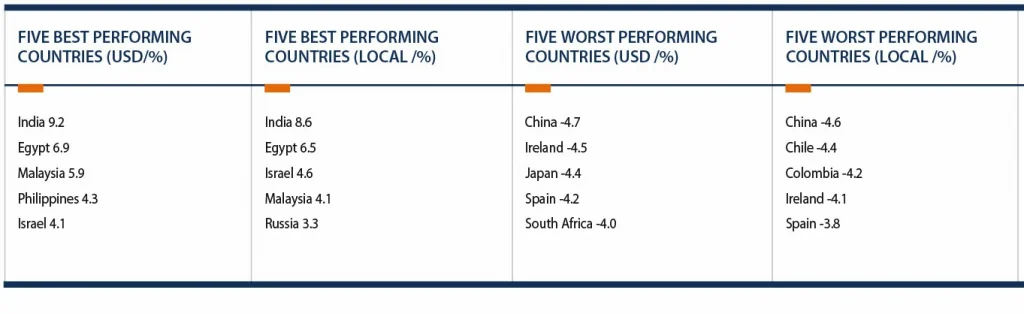

COUNTRY PERFORMANCE

SECTOR BREAKDOWN, FTSE Global All Cap (AC) Markets

Industry Sector Performance

Oil & Gas Producers was the best performing sector, with the largest contribution to the performance coming from Exxon Mobil Corp., up 5.08%. Real Estate was the worst performing sector, down 5.3%, with the largest negative contribution coming from Centro Properties Group, down 81.7%. The company that invests in and manages retail properties, suspended dividends saying it may have to sell assets on the collapse in the subprime mortgage market, with lenders setting a 15 February deadline to negotiate maturing debt.