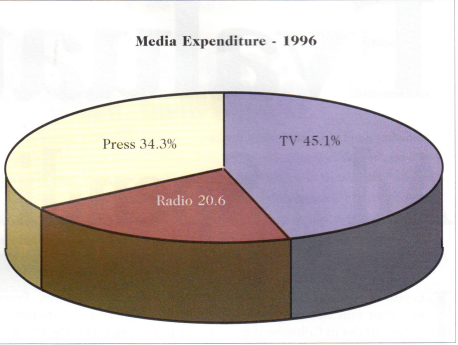

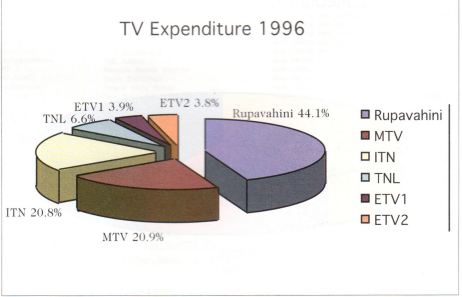

Inspite of a power crisis, total blackout and two major terrorist attacks in Colombo during 1996, the Advertising Industry has recorded a Rs 1507 million or Rs 1.5 billion spending on TV, Radio and the Press. In 1995, the spending was approximately Rs 1318 million giving a Rs 189 million increase in 1996. The overall inflation of media costs has been less than 10% while the advertising revenue growth from 1995 to 1996 is 15%. Television Advertising accounts for Rs 663 million, an increase of almost Rs 100 million from 1995 and Radio accounts for Rs 335 million, a mammoth increase of Rs 117 million from the 1995 figures. Press has seen a decrease in revenue of Rs 25 million to reach Rs 509 million in 1996.

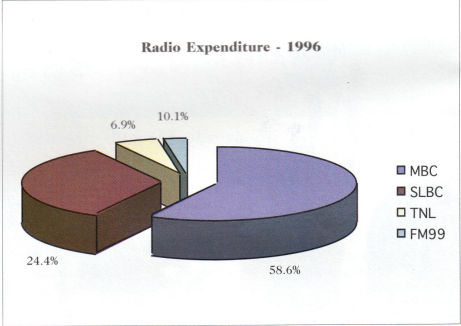

The growth in Radio Advertising has been largely due to the power crisis when most TV advertisers moved their TV budgets to Radio, at short notice. Radio Advertising does not involve time consuming methods unlike the Press or TV. and today with modern technology, a good quality radio jingle could be produced in a day and broadcasted on Air. The private radio stations, especially MBC network, has a 58% market share at the 1996 spending. while SLBC has 25%, TNL 74% and capital radio 10%. MBC,TNL & Capital Radio stations have shown a market share growth from 1995 to 1996, while SLBC has lost approximately 10% of market share in 1996. This is due to the private sector radio stations having tailor- made and innovative radio packages for their clients. Further more, these private radio stations have infused new and young talent and better customer care than the SLBC.

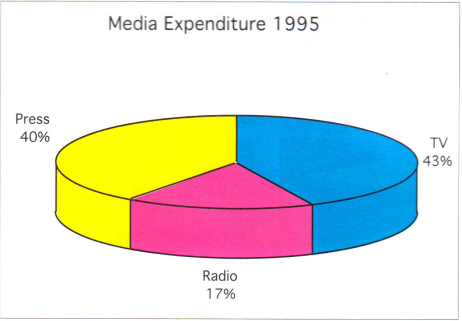

Looking at the market share growth of the media in Sri Lanka over the past 3 years from 1994. we see TV growing from 42% to 13% in 1995 and 45% in 1996. Radio had 10% share in 1994 which moved to 17% in 1995 and leaped to 21% in 1996. A great year for the Radio. The Press had 42% in 1994 which was reduced to 40% in 1995 and dropped to 34% in 1996.

In 1996, Rupavahini had a total advertising income of approximately 300 million of which 75% (Rs 225 million) came from 10 leading advertising agencies. While ANCL had a total advertising in- come of Rs 240 million from con- tracts of which 50% came from 10 leading advertising agencies. The top 10 advertising agencies to give revenue to Rupavahini are, JWT. McCann, Phoenix, Lintas, Fastads. TAL, Bates, Sevana Media. First & Forward, and Mel Ads. While the

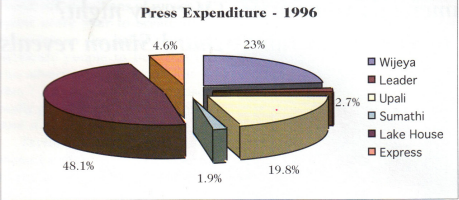

top 10 revenue earners for ANGL were Lintas, Fastads, Minds, Holmes, McCann, JWT, Phoenix, Mel Ads, TAL and Advantage.

The decline in press advertising has been a trend in the past 3 years. The top three press advertising categories of banking, lotteries & housing in 1996 reduced their press advertising by Rs 10 million from the 1995 spending. As the country moves ahead at a rapid pace, more and more people are switching over to the electronic media of TV & Radio which is more interactive, entertaining, informative, and cost-effective.

Today, it costs approximately Rs 12/- a day and Rs 400/- a month for a newspaper while it costs less than Rs 200/- a month for a TV & Rs 50/- a month for a Radio. And one gets more information in a shorter time from Radio & TV, than from the Press. In 1996, TV had reached 2 million homes while 2.5 million homes had a Radio. All newspapers put together on a Sun- day do not reach 1 million homes and on a weekday the Press reaches less than half a million homes. Therefore, the cost per thousand reached through TV or Radio is far less than through newspapers and most advertisers who look for cost- effective methods in advertising prefer Radio or TV. Products, like soap, soft drinks and milk powder have elected TV as the main media for advertising, and soap alone spent Rs 28 million on TV in 1996. Today in Sri Lanka, we have an average of 30,000 TV advertisements a month which makes the country a high clutter TV market with 1000 advertisements a day.

However, in 1996, we observed a decline in liquor advertising by Rs 8 million as against 1995. This is due to price reduction on Beer which has pushed hard liquor to second place on purchase preference. With two new breweries launching into operation by end 1997, we can envisage an increase in Beer advertising in 1998. The banking sector was the largest advertiser in 1996 with a spending of Rs 250 million, with Rs 78 million devoted to the Press. Seylan Bank was the largest spender with approximately Rs 90 million, a 36% share of the Rs 250 million spent. HNB has spent Rs 33 million and Sampath Bank Rs 23 million . Lotteries spent Rs 72 million on TV, Rs 24 million on Radio and Rs 28 million on the press.

About 80% of urban share households and 58% of rural households today, have a TV set. 30% of these are B & W sets in the rural areas. With 2 million TV sets in the country we have 10 million TV audience. Rupavahini & ITN have practically a 100% reach while MTV, ITN & ETV reaches approximately 80%. However , the rural sector reach of TNL is more than MTV or ETV. The monthly income of an average urban TV household is Rs 6750/-, while that of a rural household is Rs 4250/-, Radio is listened to by more people from 6.00 am to 8.00 am while urban professionals prefer radio from 9.00 pm to 10.00 pm. The audience share of TV channels by end 1996 are : Rupavahini-45%, ITN-34%, MTV- 12%, TNL-7%, BTV-1%, and others less than 0.5%).

In Asia, where 3 million people live, the advertising spending grew from US$50 million in 1983 to US$4 billion in 1993. The total advertising spending in Asia is 1/3 of that in the USA. There are 400 million television households in Asia. In a series of forecasts for 1997 Zenith Media Asia says that advertising growth in Asia would continue to stay ahead of inflation. but markers would not see dra- matic increases. Year-an-end adspend in Asia grow 7,51 0 1995. to US870 billion, the highest ris since 1989 In 1996, the prosth was approximately 6.72. Zenith, Asia predicts it may slow down to 5% in 1997.

Towards the end of 1996. Rupavahini reduced the airtime costs for Teledramas from Rs 34.500 to Rs.27,600/- sending a warning signal that TV advertisement spending in 1997 will not be

as much as in 1996. ITN, MTV and the new EAP Channel Swarnavahini will consider reducing their air time price or offer more benefit air times to advertisers to keep up with the competition. Further more, with more Research Data coming in from the Survey Research Lanka (SRL) & the Lanka Market Research Bureau (LMRB), the advertising agencies are becoming more scientific

in their media planning and buying. Advertisers will not pay crazy prices charged by TV stations. they will simply accept less or look for smarter ways to spend, like sponsorships. Last year in Korea, leading TV stations experienced unsold airtime after years of feeding advertisers and their agencies 15 seconds scraps. It may be better for young advertising executives to stay at their agencies this year rather than job hop. The advertising industry will have to start using new media as more than a PR tool. Advertising will continue to grow as most brands want to defend their market share or in- crease the share in 1997.

Courtesy: Survey Research Lanka.