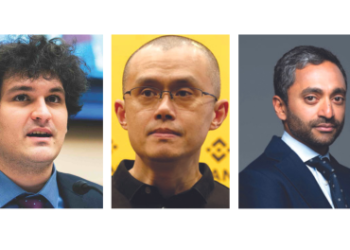

(L–R): Ann Silva, Legal Officer, DFCC Bank; Thusitha Subramaniam, Executive – Retail Asset Products, DFCC Bank; Asanka Patabadige, Assistant Vice President – Leasing and Retail Assets Products, DFCC Bank; Samathri Kariyawasam, Vice President – General Legal, DFCC Bank; Aasiri Iddamalgoda, Senior Vice President – Head of Retail Banking & SME, DFCC Bank; Nadeem Shums, Head of Sales & Marketing, John Keells Properties & Vice President, John Keells Group; Roshanara Hatch, Manager Sales, John Keells Properties; Shafeeka Gunasekara, Head of Sales & Marketing, John Keells Properties; and Kanishka Herat, Manager Legal, John Keells Properties.

DFCC Bank has partnered with John Keells Properties. This alliance is poised to redefine the home financing experience for potential buyers of units at Viman Ja-Ela. The partnership leverages the strengths of both entities, merging John Keells Properties’ market leadership and expertise in crafting iconic living spaces with the industry-leading innovative financial solutions of DFCC Bank. Homebuyers will enjoy benefits, including competitive interest rates starting from 13.5 percent per annum, flexible down payment requirements, and an exceptional customer experience. The overarching goal of the partnership is to create a seamless and rewarding homebuying experience that addresses the evolving needs of Sri Lankans.

Aasiri Iddamalgoda, Senior Vice President and Head of Retail Banking and SME at DFCC Bank expressed his enthusiasm, saying, “We understand the significance of homeownership and its financial commitment. This collaboration with John Keells Properties enables us to provide homebuyers with flexible financial solutions, including attractive pricing and flexible repayment methods for home loans that align with their unique requirements. It demonstrates our commitment to supporting individuals in their dream of owning a home while revolutionizing the entire process with our signature customer service, renowned for its reliability, efficiency, and seamlessness.”

The structured payment plan features a grace period on capital repayment until the handover of the unit. During construction, homeowners only need to pay 10 percent of the capital and the interest payments. Additionally, the plan includes annual bullet payments for the principal, with 50 percent of the loan to be repaid as the last installment, ensuring a financially accommodating approach. Furthermore, DFCC Bank’s specialists will advise customers and tailor their home loan plans according to individual requirements.

Nadeem Shums, Head of Sales and Marketing at John Keells Properties and Vice President – of John Keells Group, added, “We are pleased to partner with DFCC Bank and redefine the home buying experience for our discerning customers. This collaboration allows potential Viman homeowners to access flexible mortgage packages that set a new benchmark in Sri Lanka’s real estate space. The simplified financial options also enrich the overall journey of acquiring a home within this new development.”

DFCC Bank is ranked among Business Today’s Top 40 Corporates in Sri Lanka.