They Became the Beacons of Hope in a Critical Moment in Sri Lankan History.

The Business Today TOP 40 for 2022/23 comes out at an opportune time. It covers a challenging period in Sri Lanka’s history – a time that seemed to stand still. But a year later, through the Business Today TOP 40 award, one witnesses a business landscape that has been on the move against all the odds and ensured the delivery of goods and services to Sri Lankans, and the awards are in appreciation of their response to a nation in need.

Words Jennifer Paldano Goonewardane.

Corporates epitomize the heart of resilience. They are a textbook in fighting the good fight and running the race even as everything around them closes in on them. The year that they had just passed was like a tempest. They describe their operating environment in the most powerful words – unparalleled, profound, dynamic, volatile, and uncertain. But then, they prevailed. The Business Today TOP 40 awards for 2022/2023 are an ode to hard work and conquering the unconquerable. They all rose to sail across the winds by adjusting their sails, leveraging opportunities, reorienting, envisioning, innovating, being proactive, spirited, and bold. It was a time of inspiration, leadership, and endurance. If there is a testament to the permanency of changeability, then 2022 would stand out, especially in Sri Lanka.

But it’s in these variances that stories of resilience and perseverance emerge, and through the TOP 40 awards, one meets such stories of immense sacrifices and compromises, of people who continued to believe that Sri Lanka could win, that it could rise after all. The forty companies that have found a place in the Business Today TOP 40, in a spirit of ‘never saying never’ and with the courage to continue, faced an environment where key indicators were on the move. It was a period of economic activity amid contractions. They had to contend with rising inflation and interest rates, energy security and tariffs, shrinking forex liquidity, currency devaluation, increasing taxation, import restrictions, and enlargement in working capital while critical economic sectors such as agriculture, manufacturing, and services recorded contractions. While those seemed to be the order of the day, given their maturity, the forty corporates, primarily diversified, ensuring that all eggs were not in one basket, adopted strategies, robustly pursued prudent financial management in which cost-cutting was vital, and kept an eagle eye on the operating environment to spot risks and incoming shocks and trends. At the same time, the events demanded a solid proactive and hands-on approach to operational management. When a product or sector took the brunt of a downturn, the leaders promptly switched to float and promote alternatives that side-stepped the problems brought about by the other.

The impact was collective. However, some harnessed the strengths of their subsidiaries whose businesses did feel the pinch of price escalation on production but got cushioned by the growth in returns. In contrast, some others have had to accept an overall dip in performance as price hikes impacted multiple sectors, such as organizations operating in construction, leisure, consumer foods, and financial services, which had to make do with subdued performances owing to macroeconomic constraints but managed to contain the situation through prudent financial management.

The financial services sector faced enormous challenges. Collectively, they had a lot on their plate – rising interest rates, inflation, and exchange rate pressures, while non-performing loans were piling up amid reduced demand for credit and costs escalating. With Sri Lanka halting its debt obligations, local banks could no longer issue letters of credit. In addition, subdued economic activity and weak investor confidence meant the sector had to deal with limited opportunities for credit expansion. Remarkably, the financial services sector stepped forward to perform its duty towards the country, in doing its part to help the government re-set the growth trajectory and hence sat down with their borrowers, representing SMEs, the economic drivers, to help them restructure their loans while offering moratoria and other concessions. This level of magnanimity towards this vital ecosystem allowed businesses to continue, ensuring jobs and economic activity. But it was no easy task. It was like walking on broken glass, balancing the external environment, regulatory measures, and assuaging customer requirements. In doing so, many financial institutions took the fall. However, given their solid asset and capital bases together with their reputations, they stemmed the fall and rode the wave to safety in their year of reporting. But that hasn’t made them complacent. They know the vulnerabilities of rising non-performing loans and tight liquidity conditions. Hence, they are rooted in the present, watch the future, and are ready to respond to new challenges from lessons learned.

The State’s response to the scenarios is well-known and documented. The companies supported Government efforts to set the course to economic recovery that included increasing the standard corporate income tax rate, removal of certain concessions, raising the marginal personal income tax rate, and raising the standard on value-added tax, among others. This enormous shift naturally impacted the businesses during the reporting period and told on their bottom lines. However, as a prerequisite to spearheading the recovery process and setting the engine in motion, the corporates welcomed the IMF’s Extended Fund Facility and are pinning their hope on its ability to strengthen multiple areas of the economy. The IMF is pushing for revenue-based fiscal consolidation, accompanied by stronger safety nets and fiscal institutional reforms, restoration of public debt sustainability through debt restructuring, achievement of price stability, and rebuilding reserves under greater exchange rate flexibility. The corporates welcome the policy interventions tied to the program, which include a commitment by the government to introduce wide-ranging reforms, such as managing public expenditure, restructuring state-owned enterprises to improve performance, supporting trade and investment, and improving governance and accountability mechanisms.

Months into the IMF-backed intervention, Sri Lanka is experiencing a return to normalcy, not in every sense, but a semblance of normality is returning with disinflation, a downward trend in interest rates and exchange rate gains, and more substantial reserves to achieve debt sustainability. Corporate leaders are hailing these positive outcomes as a step in the right direction as they desperately seek the infusion of a business-friendly environment in the country and an operating environment that is less volatile than the earlier year. However, the continuity of implementing the proposed reforms is crucial to the recovery process. Any midstream waning will likely threaten fiscal consolidation, revenue mobilization, and reserves.

In the end, there is much to hope for. It may be a long road to recovery, but the signs are encouraging. Sri Lanka is in the recovery phase, and the corporates are relieved. In the short to medium term, the corporates expect the challenges to remain amid curtailed consumer spending and economic activity. The World Bank projects positive growth in 2024, an economy that contracted by 7.8 percent in 2022, 11.5 percent in the first quarter, and three percent in the third quarter of 2023 will see the silver lining of the government’s fiscal consolidation measures. The Asian Development Bank has evaluated the government’s stabilization plan as very comprehensive. Fiscal reforms are critical for long-term macroeconomic stability. That the corporates know and what they desire amid these wide-ranging measures is a measure of caution to prevent their impact on sectors essential to growth and recovery. Businesses in the export space may find it challenging to pursue business expansion with limited investment capacity, which impacts their competitive edge and could dent their forex earning capacity.

The private sector took the brunt of the economic fallout and crawled out of the cramps, if not are still wriggling. It must be equally more complex for those in decision-making to reroute the wayward indicators back on track and declare to the world that Sri Lanka is ready for business. President Ranil Wickremesinghe said Sri Lanka will no longer be treated as a bankrupt country upon securing the Extended Fund Facility with the IMF. That was in March 2023. Since then, Sri Lanka has come quite a distance from its woes of the previous year. But the journey has been a difficult one. Wickremesinghe has often pointed out that as the country’s economy lay in shambles, the presidency vacant, and the political system in disarray, no one was willing to take over the helm, not even the critics. He took up the highest job in the country with nothing to offer. The coffers were virtually empty. He didn’t promise the moon nor pledge to change the situation overnight with the wave of a wand. The recovery will be slow, Wickremesinghe has always said. However, he has equally been confident of Sri Lanka’s bounce back and the support of creditors and multilateral agencies in staying the course of recovery. He has admitted that his role as President in the past year was one of the most challenging jobs he had done, which he has survived following a year of it. At the same time, he deems the job of Treasury officials to be more complicated than his, having to achieve the envisaged figures to help him progress with the economic recovery agenda. The central bankers had an equally tough time. Their decisions were equally onerous as they drove monetary policy decisions during a challenging period for the people and businesses, which were hard decisions, such as the devaluation of the rupee and increasing policy rates to contain inflation and shore up reserves. The Governor and the Central Bank had to take the flak for their decisions, including the decision to halt debt repayment. However, the President, the central bankers, and Treasury officials persisted and prevailed, the results of which are slowly visible, much to the relief of the private sector. Indicating that there is much to do to bring about comprehensive changes to the system, Wickremesinghe is a proponent of IMF’s proposed reforms, fiercely supportive of cutting down public expenditure and driving efficiencies while advocating strongly to replace Sri Lanka’s archaic economic model with a new one where private sector investment will be front and center. The leaders of Sri Lanka’s top companies have endorsed the recovery efforts so far, especially the EFF and debt restructuring efforts, and hope for political stability in the future to usher in economic stability.

But this time, Sri Lanka can only afford to succeed. It can’t afford to take one step forward and two back. Now is Sri Lanka’s opportunity to change for the better, rethink its development model, and elevate trustworthiness. Now is an excellent juncture to pivot a different proposition to the private sector, just like what the IMF-led agenda proposes to encourage private sector activities by synchronizing trade and investment policies, thereby driving export growth and lessening the economy’s dependence on imports. Now is the time to reduce the misallocation of resources in favor of state-owned enterprises, stop their inefficiencies and monetary losses, enhance productivity and competitiveness, trade and investment and elevate the private sector to consolidate their positions, support a robust export-oriented economy vis-à-vis supporting SME growth, modernize traditional sectors, drive innovation and technology, invest in research and development, increase trade competitiveness by joining global and regional value chains and help the country return to a green, resilient and inclusive recovery and global competitiveness. The road ahead seems visible. Choosing to take that path is ours.

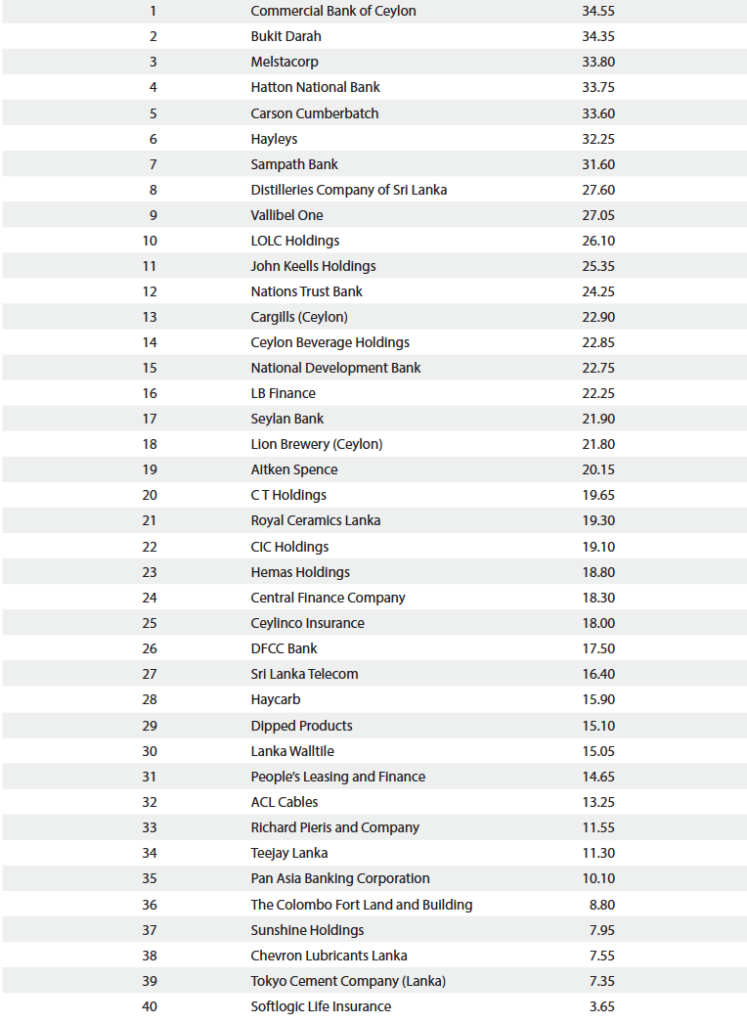

In making the Business Today TOP 40 awards relevant to the times, every year, the awardees and their rankings are decided according to the prevailing economic situation in Sri Lanka. Hence, the 2022/2023 Business Today TOP 40 awards are significant in the country’s recent history. Notably, the Business Today TOP 40 platform brings the potential of Sri Lankan corporates to the fore. It is an opportunity to showcase to the country the private sector’s vital role in economic growth and their constancy when everything seemed to come to a standstill. Their stories are worth reading, hidden reserves of courage to not survive but thrive and create value across the board.

We thank Keith Bernard and Shiron Gooneratne, who have been part of this listing for years. We cherish their invaluable support and guidance. KPMG Sri Lanka assisted in tabulating the Data.

1. Commercial Bank of Ceylon

In an eventful year, the largest private sector commercial bank in Sri Lanka, Commercial Bank of Ceylon is number one in the Business Today TOP 40 corporate awards, an extremely worthy achievement for the Bank, which, like the rest of its peers proved its mettle and emerged indisputably strong in a risk-elevated domestic and global backdrop. Kudos to Commercial Bank for successfully navigating the ‘perfect storm’ with forward-looking strategies and a calculated combination of taking advantage of its strengths, profiting on selected opportunities, managing risks, and minimizing the impact of threats. It ended 2022 triumphantly with a solid performance that included making the highest-ever impairment provision in a year, the first in the Bank’s history.

Maintaining its status as a systemically important bank in Sri Lanka, Commercial Bank ran a well-thought-out program to steer through the economic crisis that seemed insurmountable and unattainable at its height and looking back on its performance in the reporting period. The Management is highly pleased with the outcome that showed a marginal decrease in post-tax profit compared to the previous year.

The immensity of the macroeconomic volatilities failed to deter Commercial Bank from maintaining its flagship reputation and legacy. Professor Ananda Jayawardane, Chairman of Commercial Bank, attests to the resilience and grit of the Bank through 2022. They planned well, he said, with the strategic planning process to which the Bank’s five-year corporate plan and budget are integral being set on a rolling basis, allowing it to respond according to the shifts in the operating environment. Guided by constant strategic stewardship of the Board, the challenging period focused on managing forex reserves, facilitating remittances, promoting export-focused relationships, prioritizing crucial imports, and supporting threatened businesses through rehabilitation while strengthening their position in the SME and micro enterprise customer segment, especially with women-led and women-connected enterprises.

Championing the cause of empowering women in the workplace and the community, Commercial Bank provided fair access to capital and tailored solutions, specialized education, and advisory services to many women in Sri Lanka. Commercial Bank’s Managing Director/CEO Sanath Manatunge said that the Bank’s collaboration with the International Finance Corporation under the IFC-DFAT Women in Work program increased women’s access to finance. In a testament to its commitment to promoting SMEs and enabling their growth, the Bank revisited its SME portfolio to gauge their growth prospects and prioritized the portfolio quality to manage the pressure on profitability and capital. The Bank has participated in government-sponsored credit lines introduced by funding agencies and the Central Bank to assist SMEs. Moreover, it has extended its outreach towards rural and semi-urban areas under the agriculture and micro-finance segment.

The Bank graciously offered a lifeline to the hardest hit SMEs, and in acquiescing to Central Bank instructions, the Commercial Bank considered special moratoriums for loans for the value of 175 billion rupees, of which 41 billion represented SMEs. Commercial Bank celebrates its commitment to the country’s economic recovery and supporting development by reaching out to its customers needing relief. It has offered 668 billion in moratoria to over 54,000 customers across all segments, continuing to lend and provide liquidity to support economic activity.

Speaking on their performance, overall, the results reflect their appetite and tolerance of risks, which Manatunge assures continues to be well managed, especially in the context of the challenges faced by the economy and the banks. As a Bank that toes the line, they will continuously focus on maintaining loan book quality, managing interest rates and liquidity risks cautiously while improving compliance to minimize regulatory and reputational risks. The Bank’s operational performance is due partly to the noteworthy contribution made by its Bangladeshi operations. Customer deposits and deposit growth became the single most significant source of funding for the Bank. The contribution of the Bank’s personal and corporate banking division to pretax profits increased significantly in 2022, driven by increases in net interest income, net fee, and commission income.

Citing their future course, Manatunge stressed that resilience and future readiness will be the Bank’s dual pillars of their plans and road maps, given that the country’s path to recovery will possess some unique challenges while always being vigilant to seizing every opportunity to become the Bank that it has been to the nation through every changing and varying circumstances of the country.

2. Bukit Darah

The thrust of diversified conglomerate Bukit Darah, led by the Selvanathan brothers, has always been to grow and expand its global footprint, and true to its commitment to unwavering growth, the Group with businesses in oil palm plantations, oils and fats, beverages, portfolio and asset management, real estate, and leisure, recorded a tremendously successful outcome of managing its multiple segments with extreme foresight and maturity. Placed second in the Business Today TOP 40 corporate awards, the Group operates a global network of businesses in Sri Lanka, Indonesia, Malaysia, Singapore, Mauritius, and India.

For Chairman Hari Selvanathan, the growth in revenue and profitability amid the diverse industry and country-specific and general risks, especially persistent high inflation, duties, and taxes, is an outstanding achievement. By judiciously pivoting to manage risks, the management steered the diverse businesses towards positive results. To their advantage, Bukit Darah’s business spread across regions and industries buttressed their impressive performance.

As the Group reports, the performance of its diversified industrial portfolio spread in other geographies had helped balance the adverse impacts that specific domestic sectors were confronting at the time, leading to positive outcomes. The Group is a testament to how companies operating in the export sphere reaped the benefits of a devalued rupee, with the Group’s export business reaching an increase in dollar revenue and volumes compared to the previous year. Accordingly, the Group’s beverage sector achieved a massive turnover, with Lion Beer contributing to the growth in the Group’s export volume, reflecting the success of the sector’s targeted market expansions compared to the previous financial year. The oils and fats sector focused on achieving a favorable product mix and acquiring new customers with revenue and profit gains. The oil palm plantations sector also achieved a remarkable growth in revenue in the reporting period. The portfolio and asset management sector strategically adjusted its fund allocation in response to the heightened interest rate regime and favored the higher interest rate instruments to maximize returns, posting growth in revenue and profits.

The Group’s leisure sector results reflect the trajectory of the period, a situation that businesses in general operating in the tourism sector had to weather. Domestic issues were the primary cause, accompanied by decreased disposable incomes, despite which, again guided by the Group’s unwavering pursuit to beat the odds, its leisure sector produced growth, although profitability took a hit. The real estate sector recorded an increase in revenue amid subdued demand for office space as corporates cut back on expenditure, despite which the prime locations under this portfolio benefited from improved occupancy and rental rates.

As tough times called for stringent decisions, Selvanathan explained that managing costs across all sectors in 2022/23 guided their operations positively. As the telltale signs of recovery become visible, Selvanathan called for consistency in tax policies, which pose a risk for the Group that could upend stable plans and investments. In continuing its growth journey, Bukit Darah is astutely managing the risk of rising interest rates by improving financial stability and strategic deleveraging of businesses. The Group’s future trajectory will robustly follow a growth agenda, a mission it hopes to fulfill by expanding its global footprint and driving value across all business segments while enlarging its product coverage in international markets and maximizing efficiencies.

3. Melstacorp

Veteran business tycoon Harry Jayawardena led Melstacorp, a leading diversified conglomerate with a portfolio comprising beverages, plantations, telecommunication, insurance, power generation, textiles, leisure, logistics, BPO, construction support services and healthcare, and other diversified businesses has emerged third in the Business Today TOP 40 corporate awards.

Melstacorp prides itself on being an organization epitomizing endurance, courage, multiplicity, and longevity, qualities that have guided its journey through trying times and molded it into a better shape determined to succeed. This ethos guided the Group in the reporting period, which was marked by a storm of macroeconomic dynamics, helping it keep steadfast to its mission and emerge with remarkable profits. The Group’s subsidiaries – Distilleries Company of Sri Lanka (DCSL), Aitken Spence, and Continental Insurance endured the challenges with resilience, contributing sizably to the consolidated bottom line. Of course, the Group had to face the consequences of some of the shortsighted shifts by decision-makers, notably the ban on chemical fertilizer, which impacted the Group’s plantation sector subsidiaries – Balangoda and Madulsima, amplified by adverse weather conditions, constant increases in labor cost, and finance cost. The fertilizer shortage led to lower yields, although the sector recorded revenue growth propelled by the devalued rupee.

Thanks to the Group’s beverage and brewery subsidiary DCSL, there was a boost to the bottom line. The beverage subsidiaries recorded remarkable profits riding on the advantages of a devalued currency and the contribution from the Group’s diversified sector subsidiary, Aitken Spence.

Key to achieving significant profitability by Aitken Spence, noted Jayawardena, was the contribution of its overseas operations in maritime, freight logistics, and tourism sectors. Its financial sector subsidiary, Continental Insurance also made a notable contribution to the Group’s bottom line. Jayawardena pointed out that their insurance sector grew despite the challenges of increased costs driven by inflationary pressures and the motor vehicles import ban, which the subsidiary circumvented judiciously by venturing into the life insurance business. Meanwhile, the Group’s primary healthcare services provider, Melsta Hospital in Ragama, delivered an impressive growth in performance during the year, with the Management investing in improving healthcare infrastructure and introducing cutting-edge technology to enhance its offerings. Jayawardena also revealed that the Group was in the process of divesting from its telecommunication sector business owing to declining revenues and losses.

As they move forward, Jayawardena is hopeful. The end of their financial year showed a glimmer of recovery in the country’s economy, a transition that Melstacorp hopes would happen to help it pursue its growth agenda, a growth journey firmly grounded in and guided by the four qualities, enabling them to seize opportunities that would ultimately benefit their employees, customers, and shareholders.

4. Hatton National Bank

Hatton National Bank rose to serve the nation fittingly, focusing on resilience and sustenance, where protecting its invaluable portfolio of customers became pivotal in navigating one of the most extraordinary macroeconomic landscapes in the country’s history. In fourth place in the Business Today TOP 40 corporate awards is Hatton National Bank, which recorded moderate growth and profitability for the 2022 reporting period. The Bank’s subdued profitability stems from the absorption of impairment charges, which had escalated colossally in the reporting period and reflecting its commitment to longevity and maintaining trust, HNB had traded growth and profitability to build resilience, which Aruni Goonetilleke, the Bank’s Chairperson during the 2022 reporting period attributes to the Bank’s enduring presence in Sri Lankan’s banking landscape for over a century.

Moreover, the unprecedented macroeconomic changes forced the Management to conduct wide-ranging reviews across the Group to assess their impact on customers, stakeholders, and the Bank. Of concern was the Bank’s investment in foreign currency-denominated sovereign debt, impinging on the Bank’s liquidity and capital, and the impact of increased interest rates on customers that necessitated careful monitoring to ensure recoveries and asset quality.

HNB experienced a positive movement in its retail banking sector, marked by increased deposits. At the same time, the corporate banking segment also supported the growth in deposits, with growth in the export business helping the Bank offset the pause in import activity to a large extent.

The sustainability of the Group was core to their operations. Hence, the Management focused on maintaining liquidity, capital, and people to soften the potential consequences of the unfolding scenarios in the macroeconomic environment. Their high levels of capital, sound asset quality, and robust risk management processes gave them the sails to navigate the stormy waters of the country’s economic realities.

HNB stepped up to the challenge, said Jonathan Alles, Managing Director/CEO. From ensuring access to cash to extending moratoria, the Bank provided a range of targeted interventions that balanced the interests of various stakeholders while ensuring the Group’s sustainability. As a bank supporting Sri Lanka’s economic development, its engagement with the entrepreneur ecosystem has been tremendous. The Bank prides itself on being one of the largest lenders to the sector. Its impactful initiatives include providing concessionary funding to critical industries, facilitating market linkages, and promoting financial literacy and digital capability through regional capacity-building programs.

As they continued their relationship with MSMEs during one of the most challenging periods in history, they showed compassion and sensitivity in their decisions and actions, sensitive to their status as the most vulnerable during the crisis. They hence launched renewed efforts to support them in managing their cash flows. Crucial in their intervention was ensuring businesses stayed afloat in stressed conditions instead of overburdening them with costly debt. Accordingly, Alles explained that the more exhaustive task of carrying them out of danger commenced with portfolio reviews and realigning payment schedules to meet cash flows. Consequently, portfolio growth was not an actively pursued strategy. Instead, the Bank focused on restoring the health of the businesses and capacity building. The SME sector will continue as a primary area of focus for HNB, given its central role in reviving the country’s economy.

Alles maintained that the shortage of forex was one of the most challenging during the 2022 reporting period, preventing it from serving its customers adequately, forcing it to make choices, especially amid stringent rules for importing, prioritizing significant sectors like food, medicine, and energy imports to meet the needs of the citizens. Hence, he said that allocating forex for priority sectors, supporting exports and local manufacturing, driving inward remittances, and regulatory compliance were given precedence. It was a difficult call and a choice to make, said Alles, for a bank that has won multiple accolades for its exemplary corporate citizenship.

A future optimistic HNB that showed extreme resilience during a not-so-easy period locally and globally has prepared it to navigate the future that shows signs of easing in the new reporting period. For HNB, the economic turbulence that impacted performance is an opportunity for change to continue focusing on becoming the most resilient Bank, creating value for customers, and contributing to communities while delivering sustainable returns to investors. As a future-ready bank, HNB, cognizant of possible future instabilities, will reinforce its liquidity and capital buffers and passionately pursue its long-term strategy of becoming the most customer-centric Bank, the best digital Bank, the most preferred employer, and the most resilient and sustainable Bank, and promote sustainable development to support the country’s long-term socioeconomic stability.

5. Carson Cumberbatch

A diverse portfolio of sectors prudently spread across multiple geographies proved a winning combination for Sri Lankan conglomerate Carson Cumberbatch PLC, coming in fifth in the Business Today TOP 40 corporate awards. The Group’s diverse portfolio includes businesses in beverages, oils, and fats, real estate and leisure, oil palm plantations, and portfolio and asset management across multiple geographies in Sri Lanka, Indonesia, Malaysia, Singapore, Mauritius, and India.

Most of its business sectors operate in the export ecosystem to the Group’s advantage, allowing it to leverage the rising dollar value despite cost escalations. Against a volatile setting marked by multiple challenges of price increases, taxes, and disruptions to the tourism industry, the Group excelled in propelling its revenue and profitability in the 2022/23 reporting period.

Contributing to the bottom line significantly was the Group’s beverage sector, represented by Ceylon Beverage Holdings and Lion Brewery, two operations based in Sri Lanka. According to Chairman Tilak De Zoysa, the industry encountered supply-related challenges, high taxes, and currency depreciation, impacting volume growth during the reporting period. Notwithstanding the challenges, the beverage sector continued to drive innovation during the reporting period, making the most significant revenue contribution to the consolidated earnings, propelled by a surge in exports leading to growth in dollar revenue and volume due to market expansion and a devalued rupee.

Meanwhile, the oil palm plantations sector witnessed the highest output in a decade. Price instability in the market had been a concern, judiciously lessening its impact through strategically timed sales and a higher average selling price while managing the adverse effects of inflation and price increases through cost control measures. The oils and fats sector also recorded improved profitability in the reporting period, marked by higher margins in downstream products, driven by improved market insights, a favorable product mix, and successful customer expansion endeavors in Malaysia. The sector strategically invested in plant facilities and reduced its debt exposure during the year.

In tune with the turbulent times that witnessed a downside in tourism, the Group’s leisure sector confronted multiple challenges, the disproportionate increase in operational costs and high interest rates imposing further strain on the sector’s performance. The revenue generated by the Group’s real estate sector grew, bolstered by higher occupancy with new tenants and increased annual rentals from existing tenants. Moderate investor participation driven by uncertainty and concerns surrounding the economy’s direction impacted the Group’s portfolio and asset management segment, which recorded a lackluster performance.

The Group hopes for an economic rebound soon accompanied by a favorable economic climate with greater thrust to revitalize revenue-generating sectors like tourism and exports. Fortunately, the Group has confidence in its strength to anticipate the shifting tides and deal appropriately, its past strategic initiatives and capital commitments bearing witness to its readiness. Their strong capital base stands in good stead amid the unexpected, a base the Group has built through prudent Management, and will relentlessly pursue enhancing shareholder value through consistent and sustainable growth.

6. Hayleys

The Hayleys Group has described its journey during the reporting year as swimming against the tide. The Hayleys Group, with business interests across 12 industry sectors spanning 17 countries, described how it continued its journey even as the tides raged, demonstrating versatility and resilience. In sixth place in the Business Today TOP 40 corporate awards, the Group prides itself on its impeccable reputation as a loyal, partnership-oriented, and valuable entity. Sri Lanka’s leading diversified conglomerate with businesses in eco solutions, hand protection, leisure, purification, textiles, construction material, plantations, agriculture, industry inputs, power and energy, consumer and retail, transportation and logistics, and others went through a grueling time of testing in 2022/23 that forced it to move against the tide. However, guided by clever decision-making and timely action, decisive leadership, and the exceptional mindset of its teams, Hayleys stood resilient to record outstanding results.

Hayleys Group, led by Chairman and Chief Executive Mohan Pandithage, delivered the highest revenue and pretax profits in the Group’s operating history. The growth in its export-oriented sectors, including transportation and logistics, textiles, purification, and hand protection sectors, contributed to the Group’s highest-ever revenue, which Pandithage emphasized was a testament to the Group’s businesses’ extensive socioeconomic impact, being a proud contributor of 5.5 percent of the country’s total export earnings during the reporting period.

The transportation and logistics sector emerged as the most significant contributor to Group revenue, followed by the hand protection, agriculture, and textile sectors. Pandithage stated that high interest rates strongly impacted the borrowing costs of the consumer and retail sectors of the Group, leading to a decline in pretax profits.

The strength of the export market to buttress Group results and revenue was yet again reinforced by the constructions materials segment, mainly bolstered by the rupee depreciation in the wake of the crisis, which, despite the slowdown in the construction industry. However, overall, the sector’s profitability was impacted by the rise in finance costs, leading to a decline in pretax profits. To their advantage, the strategy to enter nontraditional markets and the emphasis on process efficiencies resulted in the eco-solutions sector recording growth in revenue and profitability. Likewise, the Group’s plantation companies also weathered the shortcomings in agrochemicals and increased input prices to record revenue and profitability.

The Group’s leisure sector reflected the countrywide trend, the impact of the economic headwinds in the reporting period, with domestic unrest and instability impacting tourist arrivals, forcing the Management to focus on domestic travelers while enhancing its food and beverages proposition that may have helped revenue growth, accompanied by a persistent focus on cost management and productivity improvement. However, the sector reported an overall loss.

Opening out into regional markets and expanding in export-oriented businesses bolstered the revenue and pretax profits of the industry inputs sector. On the other hand, the power and energy sector was impacted by the downward revisions of applicable tariffs, leading to a drop in profitability.

Driven by the Group’s deeply rooted ‘can-do’ attitude, Pandithage praised the internal teams for their strategic foresight and nimble execution to ensure continuity of operations across all locations, effectively plan inventory cycles, sustain customer confidence, and manage liquidity.

Chairman Pandithage contended that its ability to predict emerging challenges and strategic foresight in addressing the risks helped it build resilience that delivered strong results. Steadfastness, commitment and diversity helped the Group to swim against the tide, allowing it to harness opportunities, beat challenges, and master the unknown. Hayleys Group demonstrated agility and responsiveness to change, leveraging the opportunities amid the crisis to grow while circumventing the weaknesses and the threats to move on as a stronger entity buttressed by the strength of its resources, capabilities, people, and partnerships.

7. Sampath Bank

Like the hazardous sport of swinging from a trapeze, for Sampath Bank, 2022 was akin to the dangerous moves that acrobats do on a trapeze, which, despite the danger, they continue relying on their strength and years of practice. The Bank’s journey in 2022 was the same, a year where it showed strength in motion. In seventh place in the Business Today TOP 40 corporate awards, Sampath Bank achieved a commendable performance for 2022 despite continuous market and operational disruptions. Endorsing their strength and stability from years of practice, Chairman Harsha Amarasekera endorsed the Bank’s performance, which, in a year of change, impacted the bottom line, leading to marginal improvements in revenue, but guided by its expertise and knowledge, the Bank weathered the period in perfect unison and motion. Most importantly, amid the haywire, the Bank’s maturity and judicious conduct ensured that it retained a solid capital base and adequate liquidity, safeguarding the trust of thousands regarding the Bank’s stability and that of the financial system as a whole.

Like its peers, rising tax expenditure significantly impacted the Bank’s profitability, with VAT on financial services increasing at the beginning of the financial year. Meanwhile, the Bank leveraged the interest rate hike to record an increase in Net Interest Income in 2022. It also improved the Net Interest Margin in 2022, showcasing a growth in the interest income over interest expenses. In addition, the Bank’s net fee and commission income also got a boost from the fee-based activities.

As the macrocosmic headwinds blew in, Sampath Bank got into action, moving in tandem to redefine its future, in which the Bank set aside its growth and expansion plans, focusing instead on the adaption of moving in motion to the changes in an uncertain ground of economic uncertainty. Naturally, the Bank had concerns, explained the Managing Director during the 2022 reporting period, Nanda Fernando, regarding rising interest rates and debt repayment. That led the Bank to take a calculated approach to lending, targeting systemically essential sectors of the economy while safeguarding its consumer banking portfolio. SMEs are a critical customer base, and given their value to the economy, the Bank had geared to boost investment in selected SME sectors even during the crisis, especially investments in renewable energy, modern agriculture, information technology, e-commerce, and education, for which it had opened its credit line and the ADB funded credit line.

Having passed a tumultuous period, Sampath Bank looks hopefully to a future of sustainable growth through prudent risk management, high standards of governance and internal controls.

8. Distilleries Company of Sri Lanka

In eighth place in the Business Today TOP corporate awards is the Distilleries Company of Sri Lanka. Harry Jayawardena’s company has emerged victorious with overwhelming performance, sustaining its market leadership and National Long-Term Rating of ‘AAA’. Throughout the 2022/23 reporting period, the business segment endured multiple challenges, notably tax increases, levies, and price increases in inputs and overheads. However, guided by prudent management teams, the Company managed costs scrupulously while high-interest rates favored it, helping it multiply its turnover and profits.

Jayawardena went on to underscore the issues facing the industry, particularly pointing out the tax policy governing the industry. According to Jayawardena, every industry has an optimum tax rate level that maximizes the tax revenue. Whenever there is a breach in a given optimum level from newly imposed taxes, it becomes counterproductive, leaving the industry and the authorities facing its consequences. He lamented that the legal spirits industry in Sri Lanka has suffered as a result of rampant tax imposition, derailing turnover and giving the space for the rise of the illicit industry and given the unaffordability to consumers, there would be a trend towards resorting to unsafe and illegal alternatives. Jayawardena urged the policymakers to reassess the taxation policy on the legal sector to make them affordable to the public and to discourage the consumption of illicit alcohol and substances. He also highlighted the discriminative policies followed by the authorities towards different product categories.

Further, Jayawardena urged the authorities to carefully evaluate the existing retail licenses system as it is paving the way for a gradual monopoly and is enabling bootleggers to sell illegal products with ease while calling for changes to the outdated Excise Ordinance to capture the demands and changing landscape of the industry and the country.

Its market leadership intact, and with years of experience under its belt, the Company, guided by one of Sri Lanka’s veteran businessmen, recorded a two-fold increase in post-tax profit. Customers being the Company’s top priority, Jayawardena noted that it would pursue research, innovation, and improvements to its products to ensure that they are of the best quality and produced according to international standards, thereby continuing its reputation and market leadership.

9. Vallibel One

Vallibel One is geared to face change. Its dynamic system and structures remain in motion to respond to change. Their inherent energy and optimism drive them to seek opportunities amid adversity. And their far-reaching presence and partnerships across many sectors allow it to drive impactful outcomes. That sums up the ethos that guided the operations of Vallibel One in the reporting period. In ninth place in the Business Today TOP 40 corporate awards, Vallibel One, with a portfolio spread across lifestyle, finance, consumer, leisure, plantations, aluminium, investment, and other sectors, adopted responsible resource management, productivity improvements, and well-balanced strategies to record a commendable performance.

As for all, escalating operational costs during the 2022/23 reporting period impacted the pre and post-tax profits of the conglomerate. Chairman Harsha Amarasekera pointed out that as operational costs soared, the Group’s sectors had adopted judicious risk management, cost rationalization initiatives, responsible resource management, and productivity improvements to reduce the impact. In a weakened backdrop where businesses would not seek growth opportunities, the Group’s sectors had engaged in new market opportunities and diversification while elevating their value propositions through product innovation, brand building, and quality assurance.

Supporting the chairman’s sentiments, Vallibel One Managing Director Dinusha Bhaskaran commented on how well the Group had persisted in its mission, pursuing new avenues of growth and venturing into fresh territories to expand its influence and deliver consistent value with the reliance on technology, stakeholder engagement, and flexible structures making them ready to foresee and respond to changing scenarios with ease.

Regarding sector performance, Bhaskaran said that the Group’s lifestyle sector faced demand and supply constraints, which impacted business continuity and performance, strong relationships, optimized channel management, innovation, and prudent planning mechanisms, helped it record growth in revenue and profitability.

Increased interest rates and a tightened monetary policy had impacted the Group’s finance sector, although prudent Management of its product portfolio to drive demand helped revenue growth. The plantation sector was affected by adverse and restrictive policies, challenged by the chemical fertilizer ban, resource shortages, and rising operational costs. However, the sharp increase in depreciation favored the sector’s progress, resulting in revenue growth.

The leisure sector of the Group continued to feel the downsides that began with the pandemic, continuing into the reporting period marked by domestic volatility affecting tourism adversely. Despite the high inflationary regime in the country, the Group’s consumer sector pulled off revenue growth based on its potent marketing mix, customer engagement, and renowned portfolio of brands.

Economic stability is the hope for the future of Vallibel One. The Group is future-focused, determined to create value through holistic growth that ushers in positive transformation for all. The Group is confident of its inherent agility, dynamism, and strength to support achieving objectives. Meanwhile, Bhaskaran said the Group’s onward journey must entail preparedness for every eventuality. On that, Vallibel One will continue to focus on expanding and building capabilities to meet current and future needs while pitching the Group’s diverse products, partnerships, and dynamic approach towards doing business to empower them to retain stability and longevity in the years ahead.

10. LOLC Holdings

LOLC Holdings with a footprint in Sri Lanka, Cambodia, Myanmar, Indonesia, Pakistan, and the Philippines in South and South East Asia; Tajikistan, Kyrgyzstan, and Kazakhstan in Central Asia and Nigeria, Zambia, Zimbabwe, Malawi, Kenya, Tanzania, Egypt, and Rwanda in Africa has been adjudged tenth in the Business Today TOP 40 corporate awards. Deputy Chairman Ishara Nanayakkara, commenting on the operating environment of the 2022/23 reporting period, observed the challenges that the economic and political instability posed in creating stakeholder wealth, despite which the Group had continued diversifying into new markets, citing strong leadership and Management imperative for continued success accompanied by agile and dynamic global teams and in-depth domain knowledge.

As a multinational, LOLC Holdings maintains a business interest in diverse segments: financial services, manufacturing, leisure, plantations, trading, insurance, and a portfolio of auxiliary investments. Commenting on the Group’s global operations, Nanayakkara said that the financial year was a period of consolidation for the Group as it played a pivotal role in enabling financial inclusion for the bottom-of-the-pyramid populations in 18 countries where the Group has its financial services operations. With high interest and inflation impacting the poorest of the poor, LOLC had worked closely with the affected populations across 18 markets to help balance their cash flows and obligations. Despite the domestic and global volatilities, the Group had managed to record strong income growth, which Nanayakkara attributes to the enhanced performance of the local financial services businesses and the achievements of the Group’s global enterprises.

Commenting on navigating the volatility at home, Group Managing Director/CEO Kapila Jayawardena said that agile decision-making and focusing on the needs of their clients helped them prevail over the challenges to emerge with impressive results. Jayawardena pointed out that all their businesses felt the impact of the challenges in the operating environment. As market interest rates rose, the Group’s interest expenditure heightened based on their borrowings. However, high-interest rates attributed to the Group’s domestic financial services to perform remarkably well, contributing to growth in overall revenue, while increased earnings from trading, plantations, manufacturing and leisure sectors, and profits from insurance operations positively impacted Group revenue. He observed that the Group’s geographic diversification was crucial in helping them circumvent the risks, thereby minimizing the negative impact from any single country while having the opportunity to expand and grow the operations in each of the nations, thereby capitalizing on the growth potential from a significantly larger population base.

Sustainability is a core focus of the Group as it moves ahead into the future. In pursuing sustainability, they have aligned all their operations with sustainable development objectives, focusing on advancing women’s empowerment, enabling financial empowerment, automation, and mechanization of farming and small businesses. As a Sri Lankan multinational, Nanayakkara wants LOLC Holdings to exemplify an enterprise that sustainably promotes equity and inclusion. Everyone in the business community hopes for a quick recovery. LOLC is no exception. But as a conglomerate, they have pledged to continue their mission and pursue their growth journey.

11. John Keells Holdings

Through the volatility and uncertainty of the previous years, John Keells Holdings has maintained the belief that challenges can also be triggers for positive transformation, said Chairman Krishan Balendra, whose diversified conglomerate is in eleventh place in the Business Today TOP 40 corporate awards. JKH is one of the largest listed companies on the Colombo Stock Exchange, with a legacy of over a hundred years and a prominent presence in transportation, consumer foods, retail, leisure, property, and financial services, and most recently, has been hailed for two landmark transformative projects – Cinnamon Life Integrated Resort and the West Container Terminal (WCT-1) at the Port of Colombo. Group revenue grew as each sector responded to its unique operating realities. Therefore, it is unsurprising that in a challenging 2022/23 reporting period, the bottom lines felt the pinch, especially the impact of increased market interest rates on driving expenditure upwards, impacting leisure and retail.

The Group’s revenue growth was despite the significant EBITDA contribution from its property sector, which included the revenue and profit recognition from the handover of the residential apartments and commercial office floors at ‘Cinnamon Life Integrated Resort’, compared with the absence of any corresponding revenue recognition in the reporting year.

The Group had to contend with decreased pretax profits propelled by higher finance expenses triggered by increased market interest rates that had a bearing on the leisure and retail sectors, driven by their relatively higher working capital and debt facilities. However, the silver lining appeared from the Maldivian resorts and the recovery momentum in the Colombo hotels and Sri Lankan resorts segments, helping the leisure sector record a strong performance supported by a return to normalcy on the back of continued political and social stability during the second half of the financial year.

Steep increases in fuel prices and volumes in the first half of the reporting period helped the Group’s bunkering business record a significant increase in profitability. The Group’s port and shipping operations gained from a depreciated rupee.

Balendra noted that despite the macroeconomic interruptions, the consumer foods businesses recorded strong volume recovery in the first half of the year, only to respond negatively to heightened inflation and price increases in the second half of the year, affecting consumer demand. Likewise, despite the challenging operating environment, the supermarket business recorded a strong performance, with same-store sales recording encouraging growth. Given the notable shortages in essential goods and other fast-moving items in the first half of the reporting period, the business proactively ramped up its direct sourcing strategy to bridge gaps and, more importantly, provide its customers with such products at the best possible value.

Through the volatility and uncertainty of the previous years, JKH maintains the belief in spurring positive change through challenges. So together with their partners, the Group launched the large scale ‘Cinnamon Life Integrated Resort’ project, which, despite the challenges of the reporting period, has moved closer to completion, an investment that the JKH chairman hopes will boost the Group’s prospects towards an upward trajectory of ‘re-rating’ of its performance from its already robust platform built over the years. It is to the strength and willingness of its internal teams that the Group stood tall to ensure the continuation of business momentum. The economic environment is easing, so they are coming together again to prepare, pre-empt, and navigate challenges successfully. Emerging from the lessons learned in the preceding year, JKH, as a cohesive group, is focused on the core mission of driving profitability in the future. Toward that goal, it will unite to drive productivity, manage costs, and actively seek new investment opportunities. The Group has pledged to actively buttress the nation’s economic revival through its landmark projects and economic activities across diverse sectors.

12. Nations Trust Bank

Nations Trust Bank had embarked on a unique journey in 2022. It had a destination and, at the end of the year, had successfully reached it. But that is not the whole story. The compelling part is how the Bank finished that journey with much endurance. NTB’s journey in 2022 was amid challenging macroeconomic conditions, but judicious planning and calculation helped it move through that journey successfully. In twelfth place in the Business Today TOP 40 corporate awards, Nations Trust Bank recorded a strong performance, supported by building resilience across its business verticals, risk management, a cautious and selective approach to lending, and continuation of its productivity and cost-saving initiatives.

CEO/Executive Director Hemantha Gunatilleke attributed NTB’s long-term view and focus to its emerging solid and agile at the end of a challenging period. Innovation, service excellence, teamwork, and prudent banking practices enabled the Bank to record the highest return on investment in the country’s banking sector.

According to Chairman Gihan Cooray, a returns-focused strategy impinging on risk management and capital optimization, combined with selective growth, proved a winning strategy driving profitability in 2022, when many of its peers in the industry recorded a decline in profits. Increased interest rates also helped the Bank record higher revenue. Of course, the Bank had to contend with the changes to the tax regime and an unprecedented impairment increase, which the Bank dealt with thanks to its farsighted strategy. Cost management was another success area for the Bank, which recorded a decline in the Cost to Income ratio for the seventh consecutive year.

Optimizing returns, balancing asset quality and liquidity will be the Bank’s priority areas in the year ahead, a formula that has been to its advantage as it navigated the challenges of 2022.

13. Cargills (Ceylon)

It’s been a value-creating journey for Cargills Ceylon, which prides its community engagement with farmers and many homegrown entrepreneurs as a defining business model that sets it apart. According to Louis Page, Chairman, the challenging operating environment of 2022/23 has reinforced the Group’s commitment to the Cargills community development philosophy. Emerging in thirteenth place in the Business Today TOP 40 corporate awards, Cargills Ceylon has stamped its presence among a large domestic base of suppliers, farmers, and consumers it calls partners, generating shared value by working closely with them while giving back to communities and supporting the country in its economic recovery.

Guided by the astute leadership of Deputy Chairman/CEO, Ranjit Page, who led the team in establishing the Cargills business model, the Group continued to invest in building markets across the country, expanding production capacity, strengthening distribution channels, and driving digitalization across business units. Expressing the core values of the Cargills business model he championed, Ranjit Page speaking at a World Bank forum on ‘Building effective Public-Private Partnerships’ had said, “Today we are more than a retailer, more than a manufacturer, we do more than buy, sell and produce. We build people and communities and take hope to where it is needed the most. Today we are proud that CSR is our BUSINESS”.

With business operations in retail, FMCG, dairy, convenience food, beverage, culinary and confectionery, distribution, restaurants, and real estate, the Group continued to make selective investments to grow the business during the reporting period. They focused on consolidating their strengths. Pruning expenses while productivity improvement across all business units and shared services was a prerequisite, and all those prudent decisions enabled the Group to maintain market leadership in their business segments and sustain growth in revenue and profitability amid the impact of rising input costs and operating expenses.

The Group’s engagement with the farming community has been an enduring one, which it continued throughout the reporting period, a relationship integral to its business model. Their engagement was especially vital in 2022/23 to help them improve their capacity and reduce the cost of production. The chemical fertilizer ban severely impacted the farming community. Page said that the Group had increased the local sourcing capabilities and support to local MSMEs during the year. They are tremendously proud of their honorable role of being one of the most significant contributors to the economy and remain the single most prominent collector of fruits, vegetables, and fresh milk in Sri Lanka, with their purchases alone generating a direct income of 15.8 billion rupees for the local farming communities during the year under review. While adding value to local production, the Group continued to support capacity-building initiatives of the farming community. It reinvested back into the community through its homegrown fund, providing 25 million rupees of scholarships to children of the farming community during the reporting period under the initiative.

Commenting on sector performance, Imtiaz Abdul Wahid, Group Managing Director, said that the vicissitudes of the reporting period, such as high interest rates, rising expenditure and cost of inputs and production, and import restrictions, impacted the sectors in various ways. However, the Management devised strategies to circumvent the downsides to ensure the continuity of the Group’s business segments.

Consumer being king, Wahid said that they did their utmost to curtail the impact of the high cost of living. To make their products affordable to the consumer, the Management has taken numerous measures to improve productivity across all businesses and shared services. The focus has been to drive their strengths, reengineer processes, improve capacity utilization, rationalize unproductive assets, streamline logistics and distribution, and digitalize back-end operations.

In addition to productivity-enhancing measures within the Group, the Management has also invested in strengthening its partners, such as the dairy and agriculture farmers connected to the Group in business. Cognizant that the farming community has faced many setbacks during the economic crisis, impacting their productivity and incomes, the Group has invested resources in agriculture and dairy development to increase food production and drive down prices. Through these efforts, the Management is confident of reducing the cost to the consumer and improving profitability during the year ahead.

14. Ceylon Beverage Holdings

In a challenging financial year, Ceylon Beverage Holdings, in fourteenth place in the Business Today TOP 40 corporate awards, states that they faced adversities with unwavering determination where effective Management and planning were pivotal in ensuring uninterrupted production, distribution, and sales.

Commenting on the Group’s results, which posted growth in turnover and post-tax profits, Chairman D A Cabraal said that prompted by price increases in commodities, imports, fuel, freight rates, and taxes, the Group had to implement multiple price increases during the year under review leading to stagnant sales volumes in the second half of the year. That drawback, however, eased as the country saw inflation reducing towards the latter part of the year, although Cabraal stated that consumer spending on their beverages remained constrained by price concerns.

Cabraal revealed that while the Group has made encouraging progress in expanding its market reach, they have adopted a fresh approach to structuring the business for further growth. In the meantime, he stressed the need to address bureaucratic obstacles facing exporters and support the diversification of its export portfolio. The push on portfolio expansion resulted in the introducing of three new products to the market during the 2022/23 financial year.

Meanwhile, Rajiv Meewakkala, Chief Executive Officer, said that the Group persistently pursued driving category growth through innovation. The organization is rapidly building the capability of co-existing two value chains. One built on scale and efficiency, and the other on the ability to handle smaller, more innovative product lines. However, he lamented the impact of tax increases and new taxes on the legitimate industry, which is threatened by the rise of the illegal sector as price increases make it unaffordable to consumers. At the same time, the limited number of licensed stores across the country is a barrier to more people accessing legal outlets. However, he lauded the government policy to grant licenses to supermarkets and Tourist Board-approved establishments as a step forward in curtailing the illicit sector, increasing the tax net for the government, and creating business opportunities for SMEs in the tourism and hospitality business. The Group’s subsidiary, Lion Brewery’s international business, had recorded exceptional growth and resilience throughout the 2022/23 financial year, demonstrating its ability to adapt and overcome challenges, said Meewakkala.

While the Group expects the new financial year to be challenging with excise increases, it is pinning its hopes on the growth in tourism and its positive impact on the economy.

15. National Development Bank

With years of experience, the National Development Bank exuded confidence, energy and flexibility to change in consonance with the times with ease, thereby continuing its impactful role among a host of stakeholders. In 2022, NDB realigned itself to meet the challenges under new circumstances and opened the doors to its customers to serve them with dexterity in a new landscape.

In fifteenth place in the Business Today TOP 40 corporate awards, NDB prizes its role as a market intermediary supporting the country’s economic revival, embracing the multifaceted nature that water embodies. It was a challenging year for NDB and its customers facing repayment pressure. Yet NDB became a source that customers could depend on, reaching out to them and demonstrating their commitment to sustaining their interests through proactive and ongoing engagement, debt restructuring, and advisory. Chairman Sriyan Cooray echoes the ethos of purposefully serving their stakeholders, moving steadily through agility to carve a path that takes it to its goal.

If any bank has its roots in development banking, then it’s unequivocally NDB that has remained a constant pillar of strength to the country’s SME sector. And so, rising to serve in a challenging period came naturally, as the Bank offered a unique value proposition to the SME sector, helping them diversify their portfolio while supporting the country’s revival and growth. Through the Bank’s business unit, officers maintained interactions with customers in various parts of the country, helping the Bank to identify the most vulnerable points, advice, and devise customized plans to ensure that businesses remained afloat. The remedial management teams set up in the regions were a unique proposition to deal with a vulnerable group whose members liaised with the central Remedial Management Unit to reschedule and restructure portfolios. At the end of the 2022 reporting period, 16.6 billion of the SME portfolio received offers of concessions and moratoria.

Like others in the industry, NDB had to endure the troubles accompanying the foreign currency crunch. But NDB rose to the occasion, stepping up efforts to facilitate the importation of essential commodities required to foster daily life, such as medicines, food, and fuel. The Bank is mindful of the role it can play in economic revival through a well-thought-out delivery of solutions addressing the country’s increasing poverty, thereby playing its part in enabling and driving the country towards a future trajectory of growth and prosperity.

As a Bank closely working with Sri Lankan entrepreneurs and supporting their endeavors, Cooray said that NDB works through a unique program designed by them to continuously help the country’s exporters and entrepreneurs through a holistic value proposition which includes advisory, market access, ecosystem partnerships, and financial and non-financial assistance.

Elaborating, Dimantha Seneviratne, Director/Chief Executive Officer, explained that amid a complex operating landscape, NDB adopted a strategy to preserve the portfolio quality, manage costs, and manage the Bank’s rupee and foreign currency liquidity levels, focus on its lending strategy, and digitalization. Managing risks, he said, was integral to their response to the unfolding scenario, as it was exerting considerable pressure on their operating model and financial performance. NDB, he said, sought to strengthen its defenses by improving its risk and control environments. Accordingly, he said the Bank recalibrated its risk exposures in line with the shifts in the risk landscape while its risk appetite frameworks were made more stringent. Further, NDB strategically focused on nurturing a culture of risk ownership and accountability through ongoing awareness creation and training programs across the Bank. Credit, market, and liquidity risks emerged as critical exposures. Hence, the leadership team worked closely with relevant groups to close the gaps.

As NDB’s journey with its stakeholders continues, according to Cooray, in the short-term, the Bank foresees macroeconomic challenges bearing upon performance, mainly from rising impairments from a deterioration of credit quality and investments in government securities. At the time of reporting, Cooray said that a speedy deal with IMF and funding is a much-anticipated relief, without which the country’s return to normalcy would be interrupted.

16. LB Finance

In a financial year abounding with multiple outcomes, LB Finance, sixteenth in the Business Today TOP 40 corporate awards, is celebrating its performance, its profitability exceeding its budgeted target. LBF describes the year under review as ‘making the right move at the right time’, relying on foresight, strong analytical skills, and a perfectly formulated execution strategy to drive results, which it managed to deliver in 2022/23. Hence, the nature of the response to the macroeconomic challenges helped them protect the business and the interest of their customers and stakeholders, said Chairman Dimuth Prasanna. They acted urgently and focused on informed risk decisions supported by stricter governance and oversight across all risk defenses. Simultaneously, the Board critically assessed its strategy’s effectiveness and capacity to create a conducive environment for growth, development, and prosperity, notwithstanding challenges. From that process, LBF refreshed the current strategy under four key themes – business, digital, people, and sustainability. That step reflects a complete turnaround the Group intends to take to build a resilient, dynamic, and future-oriented business that will serve as a blueprint for the entire NBFI sector.

Evaluating and assessing a range of possibilities to execute the right strategy at the right time, with experience empowering those in charge to hit the right note, the Management decided to refrain from repricing their finance books, deeming it counterproductive rather than beneficial, instead focusing on alternative strategies to reduce the concentration risk exposure on long-term assets. Managing Director Sumith Adhihetty said they started promoting refinance facilities mainly for existing customers’ short-term working capital needs and that, too, only among customers presenting a high credit score. They also revised internal loan-to-value ratios and tightened customer due diligence to realign lending priorities towards high-quality new exposures.

LBF simultaneously focused on recoveries. Following the conclusion of all government-led moratoria by the end of December 2022, LBF had further intensified recovery action for moratoria customers, with satisfactory outcomes. As a culmination of their disciplined lending approaches and substantial recoveries, LBF’s auto finance portfolio declined overall compared to the previous year, thus containing portfolio exposures within Board-approved risk benchmarks.

LBF is optimistic about the future as the country gradually recovers and is banking on the experience gained from navigating a challenging reporting period to deliver positive results.

17. Seylan Bank

Seylan Bank’s guiding principle in 2022 was in sync with creating enduring value, in seventeenth place in the Business Today TOP 40 corporates awards. It was a journey undertaken under unique circumstances where ‘team Seylan’ was powered by human ingenuity and innovation. It was a bank in sync with change, abreast with the challenges and disruptions, which Chairman Ravi Dias says the Bank proactively foresaw to forestall any severe fallout. Having navigated two challenging pandemic-driven years before, the maturity and the experience those episodes had given the Bank helped it survive the unique set of circumstances in the 2022 reporting period. Notwithstanding the spike in interest rates and the pressure on capital, liquidity, and asset quality brought about by the economic crisis, the Bank’s financial performance is a testament to its capability.

Amid the turbulence, the Bank was determined to ensure safe business continuity, with due attention to profitability, growth momentum, and adequate liquidity. The focus was on stability through diligent provisioning and sufficient liquidity while achieving profitability through operational efficiency and sound risk management. And that strategy paid off. Supported by the ‘back to basics’ program of consolidation undertaken through our new strategic plan put into force in 2021 and the agility to adapt to the drastic changes taking place in the external environment, Seylan Bank came triumphantly on top, recording the highest profit in the history of the Bank. Kapila Ariyaratne was the Bank’s director/ CEO during the reporting period. According to him, having followed a prudent approach to staying afloat and maintaining customers’ and stakeholders’ confidence, the Bank recorded higher pre and post-tax profits compared to 2021. Despite declining business volume in 2022, rising interest rates helped the Bank increase revenue from net fees and commissions.

Through all these scenarios, the Bank, said Ariyaratne, adopted an extra-cautious approach to possible future risks, thereby placing Seylan Bank on a better footing when the economy gradually experiences a reversal. He explained that there is a story behind the reported numbers. The story of a Bank made future-ready, setting it up for a swift rise in performance in step with the desired economic resurgence.

18. Lion Brewery (Ceylon)

Lion Brewery Ceylon pursued a purposeful journey in a much chequered year of operations. The Company took the bull by the horns and confronted the reality of growing its business to strength. The Company enthusiastically relaunched the Lion brand to suit a modern market to drive future growth. Thus, Lion Brewery, eighteenth in the Business Today TOP 40 corporate awards successfully expanded its portfolio and witnessed increased revenue and profitability. It did all this while the operating environment was seething from cost escalations, higher input expenditure from a devalued currency, rising commodity prices, interest rates, freight costs, and taxes. Lion Brewery Ceylon, led by Chairman Amal Cabraal, successfully navigated a much demanding reporting period of 2022/23 with minimum disruptions.

Chief Executive Officer Rajiv Meewakkala said high-interest costs and increased working capital stress on cash flow impacted their bottom line. Price increases of beverages throughout the year became usual as expenditure arose simultaneously. Naturally, price increases affected people’s buying power and gave more leeway to the illegal sector to hold sway among those who could not afford their beverages under new prices. He welcomed the initiative by the Ministry of Finance and the Excise Department to introduce tax stamps to alcoholic drinks to curtail illicit products.

Meewakkala disclosed the exceptional growth in Lion Brewery’s international business throughout the 2022/23 financial year, demonstrating its ability to adapt and overcome challenges. The results have been good for the Company despite multiple challenges that the industry confronted in a turbulent price-sensitive environment, achieving remarkable revenue growth in USD and volume compared to the previous year, attributable to strategic initiatives and targeted expansions in key markets.

Cabraal meanwhile revealed that while the Company has made encouraging progress in expanding its market reach, they have adopted a fresh approach to structuring the business for further growth while urging the authorities to address bureaucratic obstacles hampering portfolio diversification efforts, such as delays in excise duty refunds confronting the Company’s export operations leading to high-interest costs for the Company in conducting international business. He also pointed to the importance of clearing hindrances to exporters from complex regulations and administrative delays governing tax exemptions on raw materials for exports, making it difficult to price their products in the global market competitively.

CEO Meewakkala expects a somewhat turbulent future. As the country shows positive signs of heading towards economic recovery, there is much the authorities must do to enforce policy reforms overlooked for many years. He stressed that with an estimated three percent contraction of the national economy for the forthcoming year in the backdrop of a significantly inflated cost base, fiscal consolidation will continue to dampen consumer spending and create an uncertain prospect over the next few months. Further increases in excise will push up the prices of the legal sector and create a thriving illicit market, warned Meewakkala.

19. Aitken Spence

A tripartite cognition – a combination of mental prowess, experience, and perceptiveness were the triple elements that allowed Aitken Spence to remain calm while caught up in the storms of the reporting period. It was a phase that brought maturity to this diversified conglomerate that asserts its confidence building from its experience to navigate the future and the future of unknown events. It’s a future they will look at vigilantly while open to seizing the opportunities beckoning them under any circumstances.

Chairman Harry Jayawardena is naturally happy, having rendered his strong leadership to ensure that Aitken Spence comes out stronger. Jayawardena said that their strategy needed to be agile and responsive to the changing dynamics of the country’s economic landscape to deliver value to our key stakeholders.

Aitken Spence, the diversified conglomerate, is in nineteenth place in the Business Today TOP 40 corporate awards. In the 2022/23 reporting period, the various business sectors in the Group, namely tourism, maritime and freight logistics, strategic investment, and services got pitted against the turbulent external environment, each responding to the vicissitudes differently, despite which the Group recorded a strong performance demonstrating its ability to withstand the impact of interest rate and tax increases, and the volatility of exchange rates, to produce remarkable post-tax profits, a testament to the Group’s resilience.

The Group’s strategic focus on geographical diversification had yielded fruitful results, with the overseas sector significantly contributing to the Group’s pretax profit, pointed out Dr. Parakrama Dissanayake, Deputy Chairman and Managing Director.

The Group’s maritime and freight logistics sector contributed most to overall profitability, followed by the tourism, strategic investments, and services sectors. The robust growth of the maritime and freight logistics sector played a crucial role in supporting the overall performance of the Group. Contributions from apparel manufacturing and hotels in the Maldives to performance were significant.

As a dynamic and diverse corporation, Aitken Spence is constantly on its feet, looking to grow. In the future, that is what it intends to do: identify growth opportunities that align with its strategic objectives while carefully evaluating options based on industry relevance, potential returns, sustainability, and ability to create value. Even in the past year, the Group undertook a diligent approach to growth, thereby ensuring that any expansion initiatives were well-suited to them and had the potential to contribute positively to overall success.