For the first time in Sri Lanka, Business Today in collaboration with Suren Rajakarier used an assessment methodology for corporate governance for its TOP TWENTY winners in 2011. With a view to further enhance good corporate governance practices in listed companies we continue to rate these companies to influence better transparency and accountability in public listed companies, which will result in the growth of the capital market. Corporate governance reporting is a means of building and restoring public trust in the corporate sector and also of building the reputation of our country’s corporate sector. The challenge is to reduce the consequences of unethical corporate activity.

Background

The purpose of this analysis is to assess the extent to which the Business Today TOP TWENTY FIVE companies report the structures, strategies, policies and management systems that they have in place for good governance, address environment and social issues, combat bribery and corruption. The assessment focuses on how companies report on their approach to corporate governance and the efforts they are making to prevent or address misuse of resources.

Every assessment or article on corporate governance starts with; what is meant by the term “corporate governance”? A basic explanation is that it is the systems and processes established by corporate entities for ensuring proper accountability, probity and openness in the conduct of their business. However, its contribution to the stability and equality in society as an outcome makes it a global issue. Adrian Cadbury captures this well in his words, “corporate governance is concerned with holding the balance between economic and social goals and between individual and communal goals. The governance framework is there to encourage efficient use of resources and equally to require accountability for the stewardship of those resources. The aim is to align as nearly as possible the interests of individuals, corporations and society.”

There is no generally applicable global corporate governance model. Therefore, Sri Lankan companies work within the parameters set out by a local code and regulations and certain expectations of shareholders. Assessment of corporate governance is a subjective area and a subject where you cannot make everybody happy. However this assessment is performed with an aim to encourage better transparency, accountability, fairness and responsibility founded upon the concept of disclosure to improve trust and confidence of shareholders. The benefits of such exposure will trickle down to society to impact on daily lives over the medium to long term. Often, citizens experience little benefit from economic activity of corporates while suffering the consequences of unethical/non transparent corporate activity.

Bribery & Corruption

Though there is limited focus and disclosures on the issue of bribery and corruption, corporates should pay more attention to reduce such occurrences. We need to find a mechanism in Sri Lanka to encourage leading companies to disclose policies and measures they are taking to combat bribery and corruption. To quote from a Transparency International report on Transparency in Reporting on Anti-Corruption (TRAC); “bribery and corruption remain endemic problems in many countries, weakening governance and posing a major impediment to development. At the same time, bribery and corruption are a significant risk for companies around the world: not only must companies comply with anti-bribery legislation, but corrupt company practices are increasingly scrutinised and punished by both investors and society at large who demand that companies behave as responsible corporate citizens. To ensure compliance with laws and to manage the broader risk of corruption, firms must adopt coherent policies and systems to prevent and redress bribery and corruption”.

Evolution of Rules

The corporate governance best practices for Sri Lankan companies have gradually evolved over a period of time from the introduction of the first voluntary code of best practice in 1997.

The Central Bank of Sri Lanka (CBSL) issued a mandatory code of corporate governance for Licensed Commercial Banks in Sri Lanka in April 2008. This has been designed as a series of rules based upon certain fundamental principles, which promote a healthy and robust risk management framework for banks with accountability and transparency through policies and oversight by the board of directors. It is a comprehensive code of corporate governance setting out principles and rules for responsibilities of the board, composition of the board, criteria to assess fitness and propriety of directors, management functions delegated by the board, roles of chairman and CEO, board committees, related party transactions and disclosures.

Further, the CBSL issued a Direction on Corporate Governance for finance companies registered under Section 2 of the Finance Companies Act, No 78 of 1988. It sets out principles and rules in relation to finance companies based on the same aspects described above.

These mandatory rules on corporate governance have helped improve compliance due to independent verification of compliance with such rules, which were also mandated by CBSL. Insurance companies operate on monies received from the general public by way of premiums and they are allowed to operate without such rules applicable to the financial services companies. Is this good enough? Globally, banking, insurance and investment management are considered to have little difference where regulatory supervision is concerned and should be monitored in a similar way.

Assessment approach

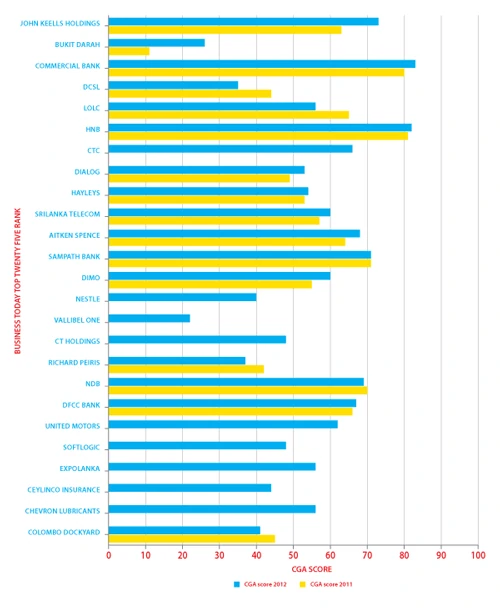

Corporate governance assessment can be done in several stages. This exercise is limited to a desk-top compilation of corporate governance profiles of the companies in the Business Today TOP TWENTY FIVE. Companies are scored from 0-100 based on their disclosure of information important for investors and the general public, such as, corporate governance policies, level of compliance with local regulations, management controls, performance and what they are doing to prevent corruption along with some of the best practices identified through research. In the scores, 100 is most transparent, and 0 is least transparent.

This assessment does not conclude that companies with better scores (based on disclosures) will make better results or vice-versa or in fact are better governed. Some of the issues in Sri Lanka, where companies do not focus on transparency may relate to;

– Concentration of ownership and presence of a controlling shareholder

– Directors are related parties to the controlling party to primarily protect the nominator

– Directors not functioning in the best interest of the entity due to the above factors

– Inadequate capital market regulation and/or monitoring mechanism.

– No consequence for non compliance.

Findings and Conclusions

Corporate governance disclosures have moved forward by only a minimal level since the review conducted in 2011. This is not due to a lack of awareness by the Companies but also due to an impotent monitoring system over the listing requirements of companies. Lack of monitoring does not help in improving compliance above the minimal level of ‘tick a box’ approach. Therefore, 56 percent of companies in the above list are below the 60 percent level of compliance. Some of the common deficiencies continue to be; lack of a strong framework for related party transactions and avoidance of conflicts of interest, non-disclosure of a formal policy prohibiting dealing in securities by directors and officers, not fully recognising the role of a company secretary, the strategic importance of internal audit and board balance between executive and non executive directors, actual independence of the independent directors, non disclosure of policy on bribery and corruption. The only notable improvement coming from the number one company in the Business Today TOP TWENTY FIVE – John Keells Holdings!

One can see from the findings that improvements and reforms are required. However, any reform should take into account the state of our country, economy and understanding of our people. Reforms should lead to the growth of corporate entities and thereby to the development of our country.

The above scores are better for Banks only because the Central Bank of Sri Lanka has mandated several procedures in order to strengthen the Banking sector, as described above. May be the other regulators can take a cue from the financial sector regulators.

The SEC should also focus on the criteria used by nomination committees to identify proper independent directors for the job. The willingness to challenge one another’s assumptions and beliefs may be an important characteristic of great boards. Hence, there is a need for independent people with integrity and not nominees or torch bearers. In nominating members to a Board one should think – “if a fish cannot climb a tree how can you ask for it?” Find the appropriate person to do the job.

This assessment should help corporates in Sri Lanka to appreciate and know why they are required to follow ‘principles’ of governance and highlight the general level of compliance. This way one can avoid the mentality of ‘ticking the box’ to comply with rules and instead implement good practices to achieve the objectives of good corporate governance. This publication also serves as recognition of corporates who are striving to demonstrate good governance.

© Assessment tool development and technical input by Suren Rajakarier FCA, FCCA, FCMA (UK). Head of Audit at KPMG Sri Lanka and Head of Financial Services for KPMG in the MESA Region.

Our disclosures focus for 2013 on combating Bribery & Corruption may include

Strategy/Policy Level Commitments

– An overall code of conduct or statement of principles including a reference to anti-bribery

– The extent of the application of this policy to the Board of Directors, employees, business partners and others

– Prohibition of facilitation payments

– Regulation of inappropriate giving and receiving of gifts by employees

– Regulating and making transparent political contributions

Management Systems

– Requirement for business partners’ compliance with the company’s anti-corruption approach, including due diligence and training of partners, as appropriate

– Training to employees and agents and clear communication of company policies, including in indigenous languages, as appropriate

– Existence of a whistle-blowing and employee help/guidance system, including non-victimisation provisions

– Existence of review and verification systems to monitor corruption-related issues and breaches, and procedures to act against employees involved, including the external verification/auditing of these systems

– Reporting of relevant Key Performance Indicators (KPIs), including the number and nature of complaints, the number of disciplinary actions for corruption and bribery, and the extent of bribery-related training.

© Transparency International’s Transparency in Reporting on Anti-Corruption – A Report of Corporate Practices (TRAC) extract.

Principles and disclosures considered in this assessment include

– Segregation of the roles of Chairperson and CEO and non executive role of Chairperson

– Criteria for Non Executive Directors (NED) and independence policies

– The inclusion of an integrated report that focuses on economic, environmental and social impacts and third party certification

– Extent of disclosures about participation by the directors at meetings and any related procedures that improve governance practices

– Disclosure of a formal policy prohibiting dealing in its securities by directors, officers and other selected employees for a designated period

– The positioning of internal audit as a strategic function that conducts a risk-based internal

– Whether a definitive set of standards and practices is implemented based on a clearly articulated code of ethics and disclosure to its’ adherence

– Committees of the board, reporting procedures, existence of written mandates or charters for the committees and ways of evaluating them

– Disclosures made with regard to performance appraisal of the Board of Directors and CEO

– Composition of the audit committee with a majority of non-executive directors and financial literacy of its members

– Role of the company secretary – disclosure of the role and assistance provided to the Board, importance of this role to act as a central source of guidance on matters of ethics and governance

– Disclosure of the process in place for related party transactions to avoid conflict of interest and to comply with requirements for the transactions and rationale for transactions

– Contents of the audit reports

– Disclosure of the business model operated by the company along with a detailed risk management report which sets out risk mitigating strategies used by the company

– Aspects included in the GRI Reporting Framework in relation to information disclosed in respect of bribery and corruption and involvement in public policy-making

“The world will not be destroyed by those who do evil, but by those who watch them without doing anything.”

– Albert Einstein