Good Corporate Governance is essential for attracting investment and creating employment. Thus, Suren Rajakarier assesses the commitment of Sri Lanka’s TOP 30 corporates to both economic and environmental-social performance.

Background

This year’s assessment report focuses on the importance of corporate governance to achieve a balance between economic performance of corporates and environmental-social performance. The report also aims to showcase global trends in aligning the interests of individuals, corporates and society. Inclusion of the new Organisation for Economic Cooperation and Development (OECD) Principles are intended to help policy makers evaluate and improve the legal, regulatory, and institutional framework for corporate governance, with a view to support economic efficiency, sustainable growth and financial stability.

Good Corporate Governance practices will immensely contribute to the government’s plans of creating an International Financial Centre in Colombo. Further, local investments can become more attractive to investors, leading to growth and further employment opportunities.

Good Corporate Governance Practices Will Immensely Contribute To The Government’s Plans Of Creating An International Financial Centre In Colombo.

If the Colombo International Financial City (CIFC) is going to operate under a separate regulatory environment and if this is driven by global developments some of the OECD practices may also be implemented within the CIFC. This would be a great example for our local corporates to follow. Further, the local regulators should try to eliminate weaknesses in the system by observing such principles. The new G20/OECD Principles of Corporate Governance was released by the OECD on the sidelines of the G20 ministerial level meetings, in September 2015.

The new code calls for enhanced cross-border cooperation among regulators, including through bilateral and multilateral arrangements for exchange of information. It also states that the impediments to cross-border voting by shareholders should be eliminated, while shareholders should be allowed to consult each other.

The new code also contains recommendations for financial disclosures by companies, behaviour of large institutional investors and the functionalities of stock markets. It also asks regulators to ensure that conflict of interest in related party transactions are addressed effectively.

On remuneration of board members and key executives, the link between the executive pay and the company’s long-term performance is key information for the shareholders and must be adequately disclosed. Other information about board members including their qualifications, selection process, other company directorships and whether they are regarded as independent also need to be disclosed actively. The code also prescribes detailed suggestions for the responsibilities of the Board.

New Paradigm for Corporate Governance

Harvard Business Review (HBR) annually publishes its list of best performing global CEOs. HBR’s ranking of CEOs is meant to be a measure of enduring success. Their research methodology tracks and analyses each CEO’s performance. Until 2015, the ranking was based exclusively on hard stock market numbers like, total shareholder return, as well as the change in each company’s market capitalisation.

Many Global Corporates Are Racing To Make The Business Case For Long-Term Investments, Reinvesting In The Sustainable Business For Growth And Pursuing R&D And Innovation.

However, in 2015 the HBR methodology added a measurement of each company’s environmental, social, and governance (ESG) performance. Thereby, long-term financial results get a weightage of 80 per cent and ESG performance 20 per cent. This minor tweak changed the rankings for top performing CEOs and hopefully will influence more global CEOs to pay adequate attention to ESG performance.

The change to recognise environmental and social impacts of products has commenced as we can see from the following global examples; Walmart is buying clean energy, PepsiCo is promoting healthier snacks, P&G is committed to improving environmental sustainability of its products and Apple is into recycling. Unilever’s sustainable living plan pledges to cut the company’s environmental impact in half by 2020, it also vows to improve the health of one billion people and enhance livelihoods for millions.

Many global corporates are racing to make the business case for Long-Term Investments, Reinvesting in the Sustainable Business for Growth and Pursuing R&D and Innovation. These corporates are striving for minimal negative impact on the global or local environment, community or economy.

In this new paradigm for governance, each company should articulate how such investments are reviewed and demonstrate why and how they matter to long-term growth and value creation. Stakeholders need to understand that sustainable business investments will take time to bear fruit and the value creation in terms of the planet and people will be as equally important as profits and dividends. Sharing sustainability information and corporate responsibility initiatives publicly and bringing them to investors’ attention are significant actions in the new paradigm.

In 2015, Procter & Gamble partnered with Constellation, a subsidiary of Exelon, for the development of an up to 50-megawatt biomass plant that will help run one of P&G’s largest US facilities. The plant will significantly increase P&G’s use of renewable energy, helping move the company closer to its 2020 goal of obtaining 30 per cent of its total energy from renewable sources.

The Various Local Codes And Regulations Need Immediate Attention To Include Global Developments And The Appreciation For Good Governance. Now It Is Time To Strengthen Some Of These Rules If Sri Lanka Is Aiming To Become A Global Or Regional Hub For Business.

P&G is working to eliminate deforestation in its palm oil supply chain. Separating sustainable sources from non-sustainable sources in the production of palm oil and palm kernel oil is highly complicated, but Procter & Gamble is stepping up to address the problem. The Company is conducting an in-field study to understand the practices of small farmers – and how those practices can be improved to protect local forests.

P&G also found US households spend three per cent of their annual electricity budgets to heat water for washing clothes and if they switched to cold-water washing, P&G reckoned, they would consume 80 billion fewer kilowatt-hours of electricity and emit 34 million fewer tons of carbon dioxide. That is why the company made the development of cold-water detergents a priority. Tide Coldwater laundry detergent was launched in 2005 by P&G as a way for consumers to switch to cold water washes to help save energy, reduce their carbon footprint and cut down on household utility costs. Heating water for laundry loads accounts for up to 80 per cent of the energy used per wash load in the US.

The sustainability reporting aspects of the TOP 30 companies is adjusted to recognise any improvements in environmental and social performance as described above. However, in a research report on “Sustainability Reporting in Sri Lanka” (by SheConsults) it was noted that only 17 listed companies on the CSE report on Products & Services as a material aspect, which includes seven financial sector companies for whom this is not a material aspect. It’s probably an indication of the lack of focus and understanding in the local environment.

Changes or Improvements required in Sri Lanka

The various local codes and regulations need immediate attention to include global developments and the appreciation for good governance. The local requirements were diluted during their initial drafting to encourage corporates to comply rather than complain. Now it is time to strengthen some of these rules if Sri Lanka is aiming to become a global or regional hub for business.

Specific need to have a Financial Expert in the Audit Committee

In the developed markets there is a need to have a financial expert in the audit committee. The term audit committee financial expert more pointedly suggests the characteristics that are particularly relevant to the functions of the audit committee, such as: a thorough understanding of the audit committee’s oversight role, expertise in accounting matters as well as understanding of financial statements, and the ability to ask the right questions to determine whether the company’s financial statements are complete and accurate. The board’s responsibility is not fulfilled by merely appointing a person with accounting qualification.

A realistic question that comes to mind is, “Do audit committees have at least one financial expert?” An expert should be somebody who is capable of getting results that are superior to those obtained by the majority of the population. Therefore, such a person must be recognised for his or her extensive knowledge, skill and experience in finance to qualify to be the financial expert in the audit committee.

It Can Be Observed That 23 Companies Pay Less Than 28 Per Cent Of The Profits Earned As Taxes And Seven Companies Pay More Than The Statutory Rate (On The Accounting Profit).

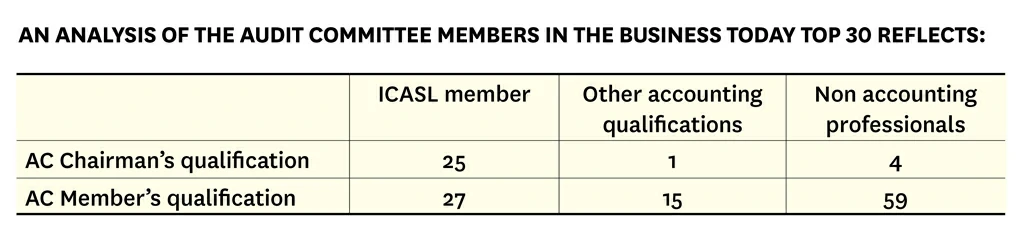

In the TOP 30 companies’ 42 per cent of audit committee members have a financial qualification and only 27 per cent are members of the Sri Lankan Institute. The chairmen of 25 companies were members of ICA of Sri Lanka. However, financial experts’ proportion was low at 25 per cent in most audit committees, which indicates a weak composition.

Stronger rules to nominate Independent Directors

Independence cannot be codified through statute or rules, but without rules it’s like ‘survival of the fittest’ or ‘anything goes’ in relation to the appointment of independent directors (ID). In limited circumstances the board may resolve that a director is independent even if he doesn’t meet a criterion. Like in many countries around the world Sri Lanka also should have better rules to ensure minority shareholders are protected and the capital market develops in a transparent manner with ‘fit and proper’ independent directors contributing to good governance.

The following are considered in this assessment. Hope these may be considered by regulators to ensure listed companies get the right composition, selection and nomination of independent directors:

1) At least one third of the board should comprise independent directors (not limit to 1/3rd of NEDs) and in case of an executive chairman, at least half of the board should be independent.

2) Where a person is an independent director of a business conglomerate (parent company, subsidiary, associate and any affiliate), he may be elected as ID to a limited number of companies of such conglomerates/groups.

3) There should be limits to the number of companies that a person may be elected to as an ID. This may vary depending on whether a person is a full time ID or practicing a profession or in employment or business.

4) The term of an ID should be limited, similar to regulations in the financial sector.

5) Using a partner or employee of an audit firm as an ID needs to be tightened to ensure independence by looking at the status of immediate family members too.

6) Set a threshold for payments for property or services to the director or an immediate family member, other than director fees or other compensation for prior service, if exceeded that may deem to compromise independence.

Decouple tax avoidance and director’s duties

Should governments tolerate big businesses paying less tax than the janitorial companies used by the top corporates? Are directors performing their statutory duties properly in terms of ensuring proper taxes are paid or hiring rogue consultants to avoid/evade taxes?

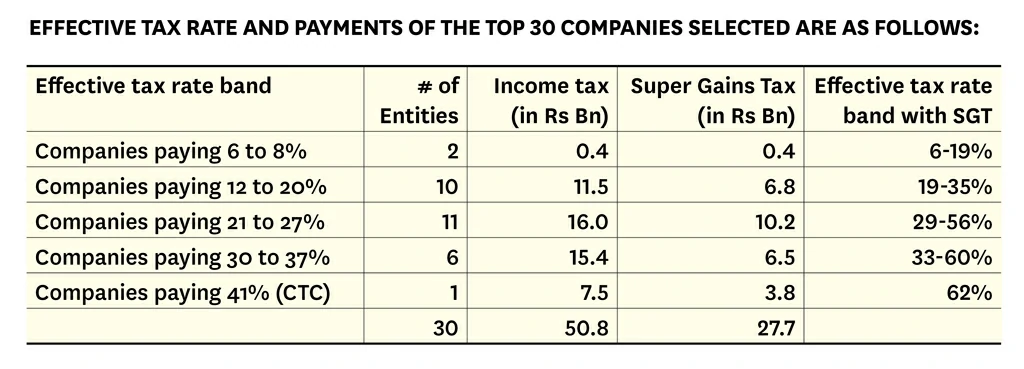

It can be observed that 23 companies pay less than 28 per cent of the profits earned as taxes and seven companies pay more than the statutory rate (on the accounting profit). Whereas, with the one off Super Gains Tax 23 companies paid more than 28 per cent effective tax for the year.

The global war on tax avoidance led by the G20 leaders committed to the implementation of the Base Erosion and Profit Shifting project (BEPS) which closes gaps that allow corporate profits to “disappear” or to be artificially shifted to low or no tax environments. There is also progress being made to boost transparency and fairness in the global tax system, by implementing a system of automatic exchange of information, for tax purposes.

The latest news of the world’s largest company Apple being fined 13 billion euros by the European commission due to a tax deal between Apple and the Irish tax authorities which was considered illegal by the EU, supports the new trend of intolerance towards obvious tax avoidance schemes. Apple booked its profits in Ireland rather than the country in which the product was sold. Apple is not the only company that has been targeted for securing favourable tax deals in the European Union. Last year, the commission told the Netherlands to recover as much as 30 million euros from Starbucks, while Luxembourg was ordered to claw back a similar amount from Fiat. Another famous case was when the Indian tax officials ruled that Vodafone pay a multi-billion dollar tax bill, retrospectively.

The above rulings are the tip of the iceberg on the war against tax avoidance. IDs and NEDs should make it a point to ensure their companies are paying dues to the government and supporting the development of the national economy. At the same time the government will hopefully keep the local economy free of global tax avoidance schemes and not make Sri Lanka a tax haven, which is a concept that is fast becoming illegal.

Hold the Board responsible for Fraud, Bribery and Corruption

This would virtually never happen, but is the only way to give credence to the implementation of the many suggestions towards improving governance. All the above mentioned concepts will fall on deaf ears unless people are held responsible for economic crimes. In the UK, there is a move where Company directors could face prison if they fail to prevent corruption and fraud among their employees, in line with Prime Minister Theresa May’s ongoing focus on corporate excess and malfeasance.

Recent revelations about potential political donations by private companies in Sri Lanka and investments through the Panama law firm by Sri Lankans have not been addressed publicly. Is the Inland Revenue Department concerned about the amount of tax that was avoided or evaded by such persons? It may be a case of the relevant persons thinking of ‘you scratch my back and I’ll scratch yours’ hoping for a quid pro quo in the future? A mechanism will be required to encourage leading companies to disclose policies and measures they are taking to combat bribery and corruption. This aspect of disclosure has not improved.

Recent Revelations About Potential Political Donations By Private Companies In Sri Lanka And Investments Through The Panama Law Firm By Sri Lankans Have Not Been Addressed Publicly.

“Corruption, embezzlement, fraud, these are all characteristics, which exist everywhere. It is regrettably the way human nature functions, whether we like it or not. What successful economies do is keep it to a minimum. No one has ever eliminated any of that stuff.”- Alan Greenspan

Better diversity and nomination committees:

Most boards reflect the majority shareholder interest rather than the broader stakeholder interests in how and who they recruit into their ranks. Boards should establish a proper nomination committee to encourage a diversity of discussion in appointing the right people to its board. Such discussions should focus on the composition of women, professions and age of new directors. An ideal board composition strategy should take into account the most appropriate skills and competencies, experience, organisational ‘fit’ and the market profile of the business.

When the board composition is not balanced and is made up of ‘yes men’ who support the major shareholder or the CEO, the company cannot be expected to be transparent and well governed. This runs the risk of boards perpetuating themselves in terms of a similar demographic background and people they know.

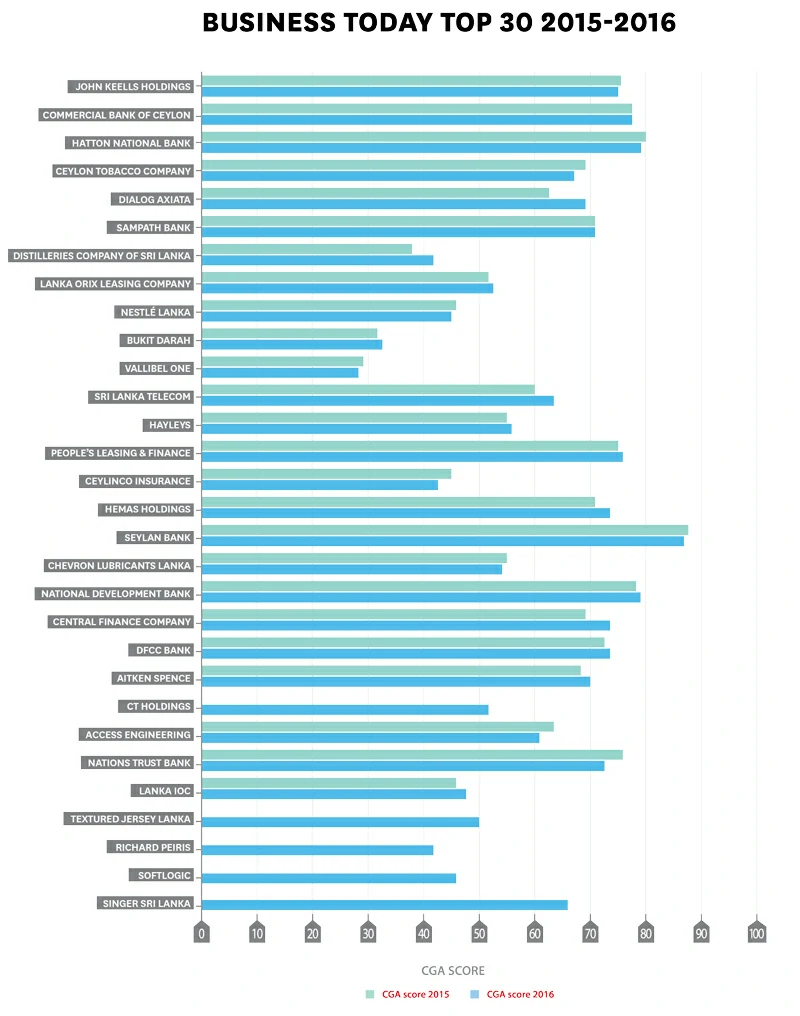

Assessment approach

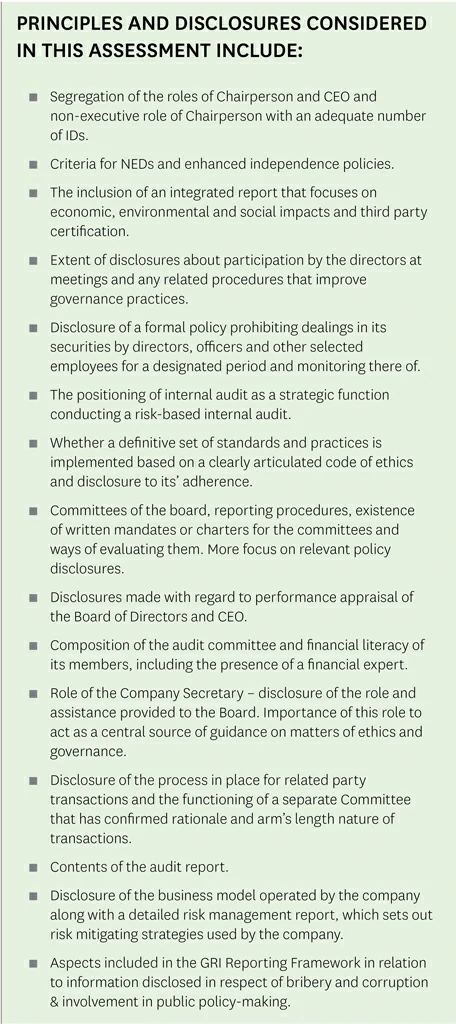

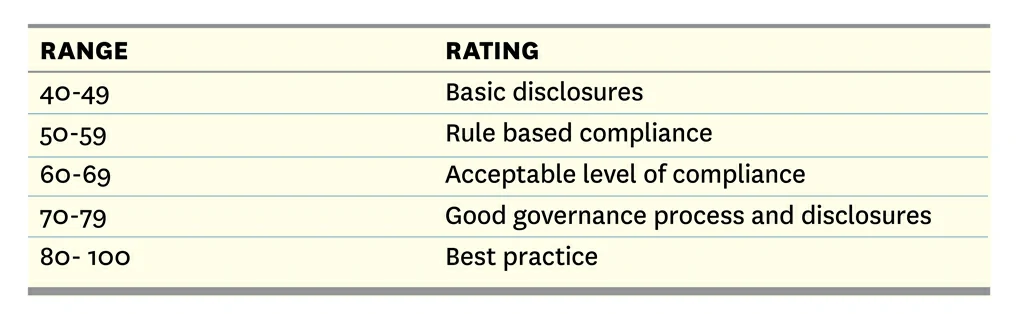

Corporate governance assessment can be done in several stages. This exercise is limited to a desk-top compilation of corporate governance profiles of the companies in the Business Today TOP 30. Companies are scored from 0-100 based on their disclosure of information important for investors and the general public. In the scoring, 100 is most transparent, and 0 is least transparent.

This assessment does not conclude that companies with better scores (based on disclosures) will make better results or vice-versa or in fact are better governed. Some of the issues in Sri Lanka, where companies do not focus on transparency relate to;

– Concentration of ownership

– Conflict of interest of Non-Executive or Independent Directors

– Low level of financial literacy of audit committee members.

– Inadequate focus on proper capital market regulation and/or monitoring mechanism

Findings and Conclusions

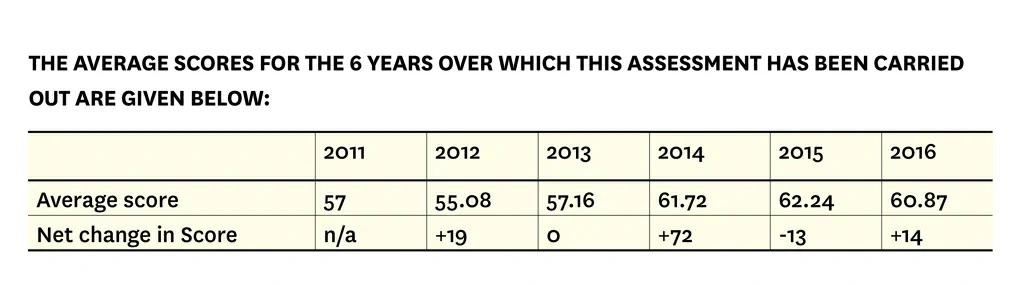

The slow improvement in scores over the years is not due to a lack of awareness by the Companies, however due to a weak monitoring system over listing requirements of companies. Lack of monitoring does not help in improving compliance above the minimal level of ‘tick a box’ approach.

This year, 46 per cent (36 per cent in 2015) of companies in the above list are below the 60 per cent level of compliance. Some of the common deficiencies continue to be; standard template type of disclosures in the board sub-committee reports, assessment of independence of Independent Directors, financial literacy & composition of audit committee members, lack of a strong framework for related party transactions & avoidance of conflicts of interest, non-disclosure of a formal policy prohibiting dealing in securities by directors & officers, not fully recognising the role of a company secretary, the strategic importance of internal audit and board balance between executive & non-executive directors and non-disclosure of policy on bribery & corruption. As there was no significant improvements noted the criteria was made more stringent compared to the previous years and more marks were deducted for minimal compliance.

Due to the change in the TOP 25 becoming 30 there is a decline in the average scores, as the new entrants have not paid adequate attention to governance disclosures. Only 16 of the TOP 30 companies have reached the 60 per cent level and this trend may reflect the quality of reporting in the rest of the listed companies in the Sri Lankan capital market, which is not the ideal situation.

The corporate governance code being a voluntary code may have something to do with the slow traction. It is time that listed companies are influenced by the regulator to comply or explain to a higher level of qualitative governance to improve the integrity of the market.

The Business Today TOP 30 companies produced nearly 150 billion rupees in profits and seem to be having an ability to produce consistent results, which indicates that the Boards are able to drive higher quality of earnings. The rest of the listed companies together will not even come close to the 150 billion rupees mark. This publication serves as a recognition of Corporates who have demonstrated good governance and transparency in their disclosures and produced outstanding results.

© Assessment tool development and technical input by Suren Rajakarier FCA, FCCA, FCMA (UK), CGMA. Head of Audit- KPMG Sri Lanka.