Lanka Realty Investments (LRI) broadens the Group’s exposure to the Real Estate Sector with a view of becoming the largest asset backed income generating real estate holding company in the country. The Group concluded the largest acquisition share swap of 5.6 billion rupees. In October 2017, LRI was acquired by a consortium of British and Sri Lankan investors with the aim of becoming the largest real estate company listed on the Colombo Stock Exchange

“We Are Excited And Optimistic About What The Future Has In Store For This Company And Are Relentless In The Pursuit Of Positioning Ourselves As The Largest Asset Backed Income Generating Real Estate Holding Company In The Country.”

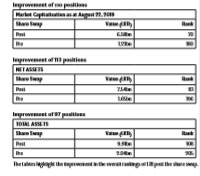

Subsequent to the acquisition, LRI carried out a rights issue raising 632.9 million rupees in October 2018 and in August 2019 concluded a 5.6 billion rupee share swap for the acquisition of the entire shareholding in six privately held companies, which have exposure to the commercial property, affordable housing and tourism and leisure sectors. Thereby expanding the Group’s overall real estate exposure. Through the Share Swap LRI issued 149,179,853 ordinary voting shares of the Company at an issue price of 37.52 rupees per share to the shareholders of the six private companies in return for their shares in these six companies. Following the share swap, LRI Group has 11 subsidiaries and three sub-subsidiaries with business interests in commercial property, affordable residential property, real estate land banks, leisure and manufacturing. The Group holds 8.4 acres of freehold land in Colombo with planning permission for the development of 1,649 residential units, a circa 100,000 sqft office building in Colombo 10, three operational boutique hotels and villas in Colombo, Weligama and Ahangama with 44 rooms, two leisure sector development projects under construction for 30 rooms in Yala and 53 rooms in Ambalangoda and two companies operating in the manufacture of construction material. The recently concluded acquisition is expected to boost foreign investor interest in LRI due to the opportunity it provides by acting as a platform for foreign investors to participate in real estate investments in Sri Lanka, which is restricted in unlisted companies as per the Land (Restrictions on Alienation) (Amendment) Act No 21 of 2018. The blend in terms of operational, development and land banked assets is expected to further enhance returns to the investors in the LRI Group. Hardy Jamaldeen, Executive Director, LRI said that, “These acquisitions have paved the way for LRI to embark on the next phase of growth and we are eager to execute the plans that we have to setout at the beginning of this exercise. We are excited and optimistic about what the future has in store for this company and are relentless in the pursuit of positioning ourselves as the largest asset backed income generating real estate holding company in the country.”