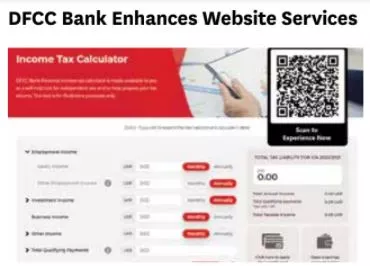

As a part of DFCC Bank’s ongoing effort to enhance its digital service offerings via the Bank’s dedicated website, the Bank introduced a new income tax calculator tool. The debut of this tool complements the existing gamut of interactive services and tools made available to customers through their industry-leading website.

The income tax calculator has features that can be optimized according to the customer’s inputs. In addition to that, the values in LKR can be entered according to various income forms, including employment, investment, and business income. Additional fields such as other income and qualifying payments are also available for input, making the entire customer-specific. The collapsible fields also allow for customers to segregate each form of income.

As a bank that understands the uniqueness of each customer’s income, the collapsible areas enable inputs to be made in subcategories such as rent, dividends, and consultation income, among many other options.

Customers are also given the preference to input the income as a monthly or annual figure. If the form of payment is input as a monthly figure, the tool automatically converts the amount as a yearly figure for the computation process.

Additional queries are addressed via the tips option, which elaborates more on how values should be input. Upon a successful calculation, the tabulated result can be printed or downloaded in a PDF format for the customer’s reference. Voicing his thoughts on the reason behind the addition of this tool, Lakshman Silva, CEO, DFCC Bank had this to say, “The addition of this income tax calculator tool to our state-of-the-art website all comes down to customer convenience. This tool is a method of value addition that complements our holistic digital approach. It leads us well on our way to becoming the most customer-centric and digitally enabled bank by the year 2025.”

The convenient tax calculator tool will be well received by many of the Bank’s high income and affluent customers who earn above 250,000 rupees, thus, falling into specific tax brackets.

A significant proportion of these individuals tend to be DFCC Pinnacle, DFCC Prestige customers as well as Infinite and Signature cardholders, together with existing and potential home loan customers with a loan value of over five million rupees.

DFCC Bank was ranked amongst Business Today’s Top 30 Corporates in Sri Lanka.