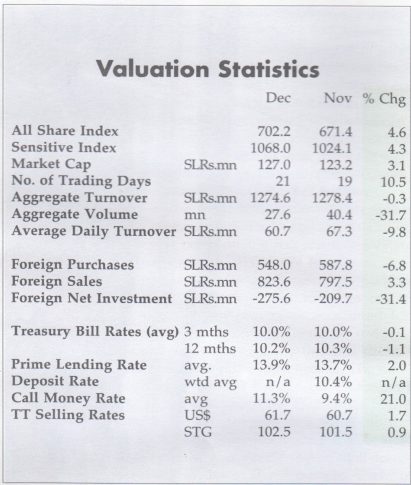

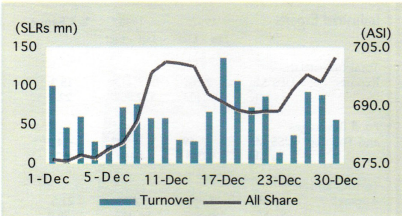

Bucking the trend. The All Share Index shrugged off the regional uncertainty to gain 4.6% during the month to close at 702.2 points on the back of renewed retail participation and selective foreign buying in blue chips. The debut of Watawala Plantations (WATA), which followed a trading pattern similar to that of Maskeliya Plantations a month back, was the high- light of an otherwise rather calm month of trading, with the exception of a few large blue chip crossings. WATA (which was offered to the public at SLRS15) commenced trading at SLR$33.50 and climbed to SLRs40.25 on its first day of trading, before succumbing to profit taking to close the month at SLRs34.50. However, the offer for sale of finance house LB Finance failed to excite investors, with over 80% of the shares devolving on the underwriters.

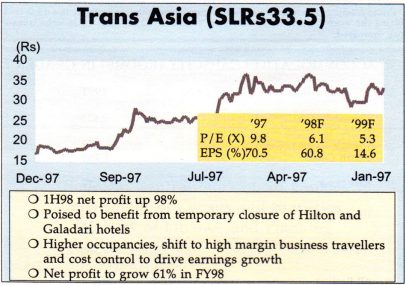

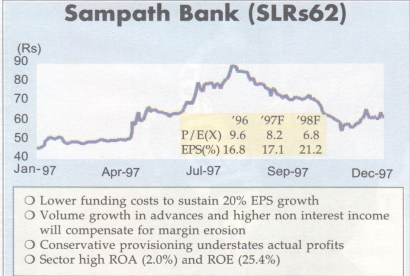

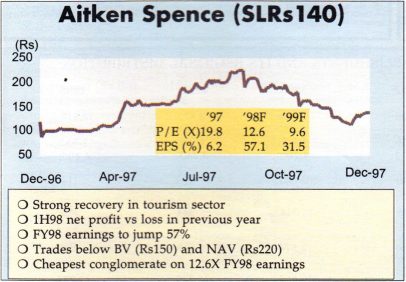

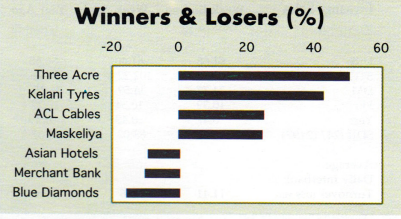

Plantation stocks remain in flavour. Both foreign and domestic investors continued to be fans of plantation stocks, with large quantities of Kegalle, Kotagala, Maskeliya and Watawala Plantations changing hands during the month. Domestic institutions were also seen to be buying fundamentally strong stocks such as Grain Elevators, Lion Brewery, Mercantile Leasing, Sampath Bank and United Motors. Pending fresh asset allocations for 1998, foreigners however remained net sellers, with their purchasing being largely limited to market heavyweights Aitken Spence, DFCC Bank, JKH and NDB. However, with most investors clearly being in a holiday mood on account of the Christmas season, average daily turnover fell by 9.8% to SLRs61 mn.

Focus on the SLRupee. Given the continuing turmoil in South-East Asian currency markets, investor attention was focused on the possibility of a devaluation of the Sri Lankan rupee. While increased demand for US$ resulted in the SLRupee falling 1.7% vs the greenback in December, we believe that the closed nature of the capital account will ensure

that the SLRupee will not come under sustained speculative attack in the short term. The Central Bank (CBSL) was also quick to raise its overnight repo rates and increase the cost of speculation. The managed float maintained by the CBSL,

backed by an all time high level of external reserves (US$2.8 bn), has indeed enabled the SLRupee to only depreciate 8.8% in 1997 against the US$, in contrast to the sharp devaluations of over 25% of some South-East Asian currencies. This has obviously resulted in the short term price competitiveness of Sri Lankan exporters falling to some extent via-a-vis their regional competitors. In this scenario, if productivity improvements are not pursued aggressively, Sri Lankan exporters would be at a distinct disadvantage in the case of price elastic demand. While conceding that export growth may suffer to some degree over the longer term if the currency were not to adjust, we believe that a sharp one-off devaluation is unlikely due to the following reasons:

Higher inflation: Given Sri Lanka’s high import dependency, increased import prices will be the inevitable result of any devaluation. While this would increase prices of consumer products and thus be politically unpopular, it would also raise the cost of imported investment goods that are essential to achieve higher economic growth in the longer term. Higher inflation is also likely to have a knock on effect on interest rates. Unless significant productivity gains are achieved any competitive advantage gained by a devaluation will hence most likely be temporary.

High import content of the country’s main export:

With textile exports accounting for almost half of the country’s total exports and 70% of the value of these exports consisting of imported raw materials, a devaluation would simply translate to higher production costs due to the higher import prices and not necessarily result in a significant competitive advantage.

Higher government debt servicing costs: Approximately half of Sri Lanka’s government debt is denominated in foreign currencies, primarily US$. While the foreign interest

burden is admittedly low due to the concessionary nature of most foreign loans, any devaluation would add to the interest burden and undo much of the recent good work in reducing the budget deficit and controlling interest rates.

SLRupee to fall 10% in 1998. Given the above, we believe that a sharp spot devaluation is unlikely and also politically unpopular. However, in the longer term, the government clearly would also have to consider the needs of exporters, a difficult balancing act. We therefore suspect that the Central Bank will allow the SLRupee to gradually depreciate at a faster rate in 1998, while stopping short of an actual devaluation. Our target is for the SLRupee to fall a steeper 10% against the US$ in 1998, compared to the historical average of 6% this decade.

ASI to hit 750 by June 1998. On the back of reduced concerns over the currency, steady economic growth prospects, continued low interest rates, strong EPS growth expectations and relatively cheap valuations, we see increased investor interest in equities during 1H98. With South-East Asian markets remaining relatively unattractive, we anticipate that foreign funds will also increase their asset allocations to the Indian Sub-Continent next year and expect foreign buying to return in the New Year. With panic selling looking to have dried up, we thus see limited down-side from current levels and expect a sharp rally to kick off in 1998.