By our correspondent

Our correspondent talks to Gotfried Thoma, Managing Director and CEO, Ceylon Tobacco, Hiran Gooneratne Managing Director, W M Mendis regarding their concerns for the tobacco and liquor industries and comments made by Dr V P Vittachi, Chairman Distilleries Company of Sri Lanka

ACED WITH SOME OF THE HIGHEST TAXES IN THE world and a growing threat from illicit products which are hurting sales, the tobacco and liquor industries are appealing to the government for relief. Both industries have asked the government to slash taxes so that their products can be priced more competitively against illicit products which are now being sold at much cheaper rates since the illegal manufacturers do not pay taxes.

We’re the highest taxed cigarettes in the region and the second highest in the world,” Gottfried Thoma, managing director and chief executive officer of Ceylon Tobacco Company said in an interview. ‘Eighty two percent of our revenue goes to the government in the form of various taxes.’

It has become a case of ‘diminishing returns’ as the chairman of the Distilleries Company of Sri Lanka, Dr. V.P. Vittachi, told ‘Business Today’ in November, ‘Governments are keeping the taxes so high that they themselves are actually losing around Rs 5 billion in taxes every year. You keep raising taxes and you increase your earnings but at a certain point you raise the tax and get less money and that is the point of diminishing returns. This point has passed long since and yet the government continues to raise taxes. So the ‘kassippu’ (illicit liquor) merchant thrives and the government loses revenue.”

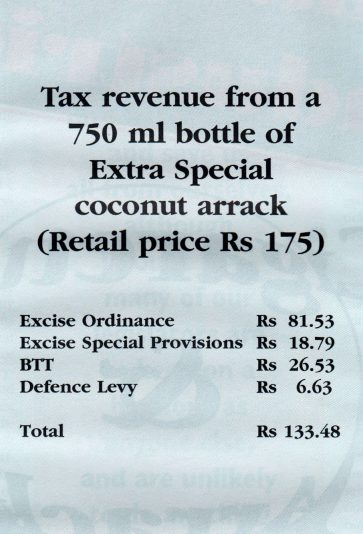

According to Finance Min- istry officials 80% of the whole-

sale price of a bottle of Extra Special Arrack (Rs 166.20) and 76% of its retail price of Rs 175 go to the government in the form of taxes while in Goldleaf cigarettes 81% of the whole- sale price and 75% of the retail price go as taxes. The total duty on Bristol accounts for 84 % of the wholesale price and 79% of the retail price, they said. The cigarette tax revenue to the government in 1996 came to Rs 13 billion while revenue from liquor taxes amounted to Rs 5.8 billion.

Industry analysts said that more people will consume legal products if the wide price difference between the legal and illegal products is narrowed with government tax cuts

Government taxes are far too high,’ said an industry analyst. Hard liquor can’t compete with illicit liquor because of taxes. The tobacco industry is asking the government to cut taxes because it is losing a lot owning to competition from il- legal, smuggled cigarettes.

She said illicit liquor accounts for as much as 67% of the liquor market, with the le gal market 30% and the beer market 3%. If the government cuts taxes by 50%, then prices of legal liquor would only be Rs 3-4 more than illegal liquor, the industry analyst said. “It means that people will turn to legal liquor because of health reasons etc and the government will not lose revenue be cause the 30% market share will go up to 60% as more people drink legal liquor. There will be no revenue loss.

With more youngsters being able to afford hard liquor if prices come down, the rule banning the sale of liquor to anyone under 18 years will have to be enforced very firmly, for example by cancelling liquor licences if retailers are caught selling to underage people, the analyst said.

Dr. Vittachi said that the increase in tax in 1996 was about 25% resulting in a total tax from a bottle of Extra Special Arrack reaching Rs 137.15 from Rs 109.22 at the start of the year. ‘After the latest wave of increases in taxes on hard liquor there is a marked reduction in sales of tax-paid liquor,” he said. The re- ductions appear to be sustaining, unlike in the case of previ- ous increases and this may be an indication that the increases in liquor prices have surpassed the level of consumer endurance. The inordinate jump in price directly resulted in a large number of drinkers of legal arrack demoting themselves to the kassippu market.

With more than 80% of the price of a bottle of arrack go- ing to the government by way of taxes, all other costs like wages and salaries are negligible, said Hiran Gooneratne, Managing Director, W.M. Mendis & Co., Ltd. ‘Illegal manufac turers do not pay taxes to the government,’ he said. ‘So natu- rally his product is 85% cheaper. We just can’t compete. It has

come to a stage where the actual core business cannot run without having other sources of income.”

Increased taxation means not only diminished revenue for the government but more and more drinkers are being forced to drink. kassippu, said Dr. Vitachi of Distilleries. I taxes are brought to a level at which we can sell a bottle at a competi tive price not only will drinkers turn to legal i.e. more hygi enic liquor but the government will actually earn more rev enue.”

Finance Ministry officials said the government plans to amend the Tobacco Tax Act to prevent smuggling by increas ing penalties. But they said the government was unlikely to slash taxes because both industries were important revenue sources for the government.

Industry analysts said the government should also consider opening more licensed liquor outlets because in Sri Lanka there are only 1,500 liquor outlets for 16 million people whereas in Malaysia with the same population there are 20,000 outlets, the analyst said. ‘More people will turn to the legal brew if it is freely available,’ she said. There are 12,000 people per outlet in Sri Lanka while in Malaysia the ratio is 640 people per outlet.