China recently announced its decision to issue digital currency in a move that can shake the pillar of American power. The fear is whether the digital Yuan would undermine the Dollar in a global financial system. To address this matter, the National Press Foundation recently conducted a briefing on Digital Currency. The speakers consisted of Josh Lipsky (Director of GeoEconomics Center, Atlantic Council), Adrienne Harris (Professor of Practice at the Ford School, University of Michigan), and Daniel Gorfine (Co-founder of Digital Dollar Project & Founder and CEO of Gattaca Horizons LLC) who explored the implications of Central Bank Digital Currency along with Heather Dahl (Former Journalist and CEO of Indicio.tech) who moderated this discussion.

What is a Digital Dollar?

According to Josh Lipsky, digital currency is a relatively new form of currency as it came into existence only five years ago. He further claimed that to understand the digital Dollar, one must explore the three types of digital currency. The first category is Unregulated Decentralized Cryptocurrency, which is not issued by the government or any central authority. They are not attached or pegged to the Dollar/Euro/Yuan. It is created by a network that utilizes distributed ledger technology to secure and verify the currency. In other words, this technology creates a network effect whereby a group instantly asserts that it is a valid token or an asset. It’s value comes from its scarcity and the willingness of others to exchange it for goods. Some prominent examples include Bitcoin, Ethererum, Dogecoin.

The second category is Stablecoins. While these use the technology of a cryptocurrency and distributed ledger, it has a value attached to it. The ledger could be a dollar, gold, or even a currency basket-like what Facebook does. But it is not as volatile as Bitcoin as it does not fluctuate 30% or 40% a day, as the Dollar does not fluctuate by such amounts. That is why it is called Stablecoins. They are more grounded in the fluctuations of traditional currency markets. The most famous example would be Facebook’s Libra Project, which is now referred to as the Diem Project.

The third and final category is Central Bank Digital Currency. It is a digital representation of the country’s fiat currency and a liability of the central bank. The US Central Bank is getting into the game, claiming that since Bitcoin and Facebook are making their way into the economy, the traditional money supply also needs a voice in this matter.

Who is going to develop the Central Bank Digital Currency?

As per Adrienne Harris, the central bank will implement the digital currency as the government will back it. However, the infrastructure/the coding of the digital Dollar may be a partnership between the Federal Reserve and the private sector. It is also possible that the Federal Reserve may do it on its own. While some countries have a public-private partnership for the development of digital currency, others do not.

How will the Digital Dollar be distributed?

Daniel Gorfine stated that a two-tiered banking system had been proposed to handle the distribution. Under this system, the retail individuals would be required to open an account or wallet service with the Central Bank. After that, the distribution would occur through the bank or a regulated fintech company. This process can be likened to withdrawing money from an ATM as there is no need for an individual to go directly to the Central Bank.

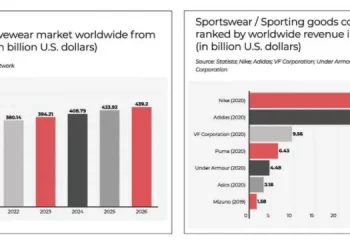

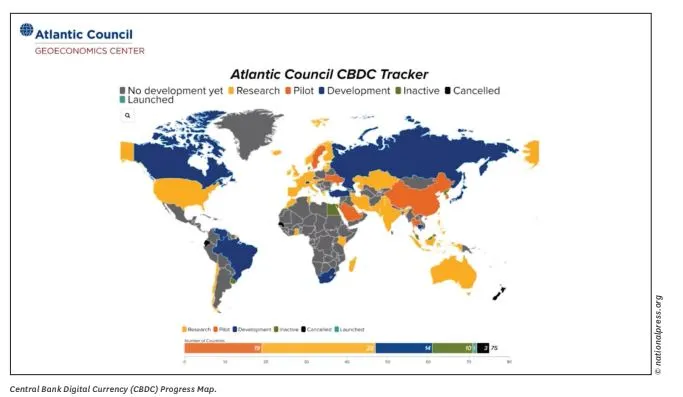

What countries are leading the adoption of digital currency?

In response to this question, Josh Lipsky held that only 10 to 15 countries were in serious exploration for digital currency a few years ago. However, that number has now increased to 75, with some countries conducting pilot studies while the Bahamas have launched it. The Federal Reserve, the European Central Bank, and the Bank of Japan are considering issuing their digital currency. The growth shows how rapidly this practice is spreading around the world. Few countries are ahead of the game. Sweden, for instance, has launched the pilot study for their E-krona project and is currently testing it.

But they have faced some trouble with near-field communication. That is figuring out how to transfer money offline, which China has already figured out. That is because if an internet connection exists, one can easily Venmo the funds. Sweden is trying to figure out how digital currency would work when there is no internet connection in rural areas. Another country ahead of the pack is Saudi Arabia, which initiated a cross-border payment called Project Aber with UAE. They are trying to determine whether distributed ledger technology can share currency between two countries.

China is leading the race, where around 500,000 people are using digital Yuan. Another 28 pilot cities in China will start testing. It has also been rumored that the digital Yuan would launch ahead of the Beijing Winter Olympics. In response to whether China is trying to take over the Dollar, it can be said that only 0.01 percent of the money supply consists of the digital Yuan. Therefore, it is being used only in selected places and cannot be considered a threat. It is important to understand China’s domestic priorities. The People’s Bank of China is competing with domestic financial service providers such as Tencent and Alipay. They are thinking about whether they want these companies to control all the payments or whether they want more of a say. They are thinking about macroeconomic policies like other countries. For instance, they are thinking about whether they can deliver stimulus checks through their digital currency. They are also considering the domestic use of this digital currency to gather surveillance data. They want to understand people’s spending habits in real- time and the social implications of such practices. They are therefore not thinking from an international perspective of overtaking the Dollar. But this may very well be a possibility for them down the road.

How does the US compare to other efforts?

According to Josh Lipsky, the European Central Bank believes they will have a Digital Euro by the middle of the decade. The Bank of England, on the other hand, announced a new project with the treasury in the UK. The Bank of Japan declared its interest in conducting pilot studies. But the US is still far behind others as they are still studying Digital Currency issues.

What is wrong with the way things are today?

Josh Lipsky believes that a system being developed from scratch today won’t use legacy technology and processes of 20 years ago. Thus, the idea of settling on the status quo and assuming that it is as good as it will ever be is not the way to develop the future. The systems of the present day do work effectively, especially in countries such as the US. That is why we have been reiterating that Central Bank Digital Currency would not replace physical cash. But there may be instances where Central Bank Digital Currency would prove to be more effective. It will then be an option available to the citizens like the present day individuals have the option to choose between cash, credit, or debit.

Bitcoin, Ethererum, Dogecoin, XRP, Stellar… why can’t one of those become the digital Dollar?

These currencies aren’t attached to a Dollar, explained Josh Lipsky. Instead, they are based on scarcity, mining, and other factors that give Bitcoin its value. The whole premise of Bitcoin is to move away from a central system of financial control. There is even an ideological debate where Bitcoin proponents consider Central Bank Digital Currency to be a threat. These individuals don’t want Central Bank involved in this matter, using the technology they developed to control the money supply. They believed that they were breaking down walls and creating a new monetary and financial system worldwide. Josh thinks that the idea of Bitcoin becoming a digital dollar would lead to several Twitter Fights. An alternative can be found in Stablecoins as they are already attached to the Dollar/Euro. The idea that the Federal Reserve could somehow license/contract Stablecoins to deliver digital Dollars is within the realm of possibility.

Does the government want to get rid of cash?

Daniel Gorfine addressed this question by stating that physical cash is only one method of payment. Central Bank Digital Currency is government-issued money backed by the full faith and credit of the government. This form of currency can operate alongside other forms of currency. A trend has been observed in some countries towards the reduction in the use of physical cash. The Central Bank is looking for avenues to ensure that Central Bank money would remain in the hands of the retail individuals. Over time if people prefer to move away from physical cash, another form of government money would still be accessible. Central Bank Digital Currency can be complementary to physical cash. It can also be used as an alternative to physical cash. But that would not lead to the death of physical cash within this ecosystem.

Will I still need to exchange the currency if I hold a digital dollar?

While Adrienne Harris held that the answer to this question depends on how digital currency would develop. She elaborated further by stating that the exchange to the local currency would most likely take place within the digital wallet. It will be in the application on your phone, where you will have to switch from a Dollar to a Yuan or from a Dollar to a Krona. It can also occur at the point of sale. Irrespective of whether the purchase was made online or in person, you will have to select the currency you want to complete the transaction. That is how the Cambodian pilot has been operating, allowing the consumers to choose between the local currency and the Dollar at the point of sale. Ultimately you will still have to exchange to local currency, but it will not be the analog version of waiting in line for the teller to hand over your cash.

Are there benefits to a digital dollar?

Josh Lipsky stated that according to Treasury Secretary Janet Yellen, the Federal Reserve and the Treasury are exploring digital currency as it is faster, cheaper, and safer. Many countries are also discovering that it can be used domestically and across borders very quickly and safely. That is said to be the promise of digital currency, instantly verifiable and secure transactions. Stimulus remittances and unemployment benefits that people wait for weeks can be delivered within days or even minutes. Joining the discussion, Adrienne Harris held that implementing a digital dollar would be essential for Clearing houses and settlements. Elaborating further, she stated that specific settlement processes take two days to reach fruition. This two-day window would increase the risk of the counterparty not being able to satisfy this transaction but reducing the wait to even one day would also reduce the risk of a counterparty defaulting on the transaction. Digital currency can make the capital market safer and more efficient.

How does a Digital Dollar improve financial inclusion?

To answer this question, Daniel Gorfine first distinguished between a token and an account bases system. According to Daniel, a token is a digital bearer instrument that means the individual who holds the digital dollar token can prove his ownership. While with an account- based system, a person can only prove that they own the account. That is because the money in this account is not tangible. This explanation thus indicates that a digital dollar token would be a true analog to physical cash. If cash features can be replicated in a digital context, it may be possible to bring forth underbanked individuals into the financial system. These individuals would then be able to hold these bearer instruments and thus have access to traditional services.

Will my identity be assigned to my digital Dollar?

According to Josh Lipsky, while different regimes are in place for other countries, most of them retain some form of anonymity. But as per the data collected, many consumers and users don’t believe this fact. Even then, they are willing to trade what they perceive as a loss of anonymity for convenience of use, clearly illustrated with China’s digital Yuan. In this case, the People’s Bank of China has guaranteed that they cannot monitor their transactions. However, the consumers who have been interviewed state that they don’t believe this claim. Nevertheless, they are still willing to use it.

When it comes to the USA, the question arises as to whether the treasury can use AML and KYC regulations to flag transactions. For instance, if a transaction involves a value over the de minimis threshold, that would appear suspicious. Then we would need to go to a version of Fisa court to ascertain how the money was spent. That means there are regulatory questions that need to be addressed. If the US and the congress can figure out an answer then other countries can adopt the US privacy policies.

Daniel Gorfine stated that zero-knowledge proofs can be used to solve the privacy challenges, where you can verify certain information without disclosing any other information. For instance, when it comes to money laundering it is possible to confirm that an individual is not on a terrorist watch list without revealing to the network this individual’s name and social security number. Instead, customer checks can be used for verification purposes.

When I pay with cash, no one can data track me or my purchases. With a digital dollar, what will stop online tracking of everything I buy?

Adrienne Harris addressed this question stating that the US would develop a digital Dollar with privacy in mind. Therefore, the Federal Reserve or the government would not see what a citizen is purchasing or where it is being purchased. But the private company that is overseeing the rails might be able to observe some levels of data. There are various ways to develop a Central Bank Digital Currency to maintain privacy or not depending on your jurisdiction and government values. It is not as black and white as stating Central Bank Digital Currency does not offer privacy. It can be designed to offer all the levels of privacy that we are accustomed to today.

Josh Lipsky held that since the digital Dollar would not be replacing physical cash, citizens can choose when to use their digital Dollar. For instance, one can limit its usage to interactions with the government, such as paying taxes.

Will a Digital Dollar create a more significant Digital Divide?

According to Adrienne Harris, if near-field communication is not considered, people without internet or cell access will be left out. But suppose a two-tiered banking system is considered. In that case, the digital currency can be programmed to regulate bank accounts to make them accessible and developing near-field technologies to make transactions possible without requiring internet access. It would then make it easier for the underbanked to gain access to the financial system.

What are the economic policy implications of a digital dollar?

Josh Lipsky answered this question using programmable money that is being circulated in China as an example. For instance, what if the government states that your money is expiring in two months? That could be useful from a macroeconomic policy perspective as it would encourage people to spend money instead of saving it. But such a move would also involve an array of civil liberty concerns.