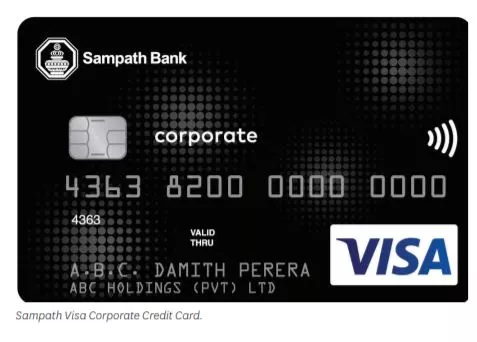

Sampath Bank announced the launch of its new Sampath Corporate Visa Credit Card in partnership with Visa, the leader in digital payments, to facilitate better financial management for corporates. The card, which is accepted worldwide, enables companies to track and monitor expenses by providing real-time data seamlessly.

The card helps businesses gain complete control over their corporate expenses, minimize administrative costs, and avoid the hassle of unnecessary paperwork. Along with this, the Bank is also offering free estatements and SMS alert facilities for the card. Businesses can designate a central administrative email ID and phone number to receive these updates and track every transaction made on their cards. They can also automate the settlement of their recurring payments, such as monthly utility bill payments using the Sampath Automated Bill Settlement service, which is offered free.

The cards also come with tap to pay technology, allowing cardholders to make contactless payments safely and conveniently by simply tapping the card on the POS machine.

Businesses can also avail themselves of a wide range of zero percent interest installment plans and a host of other benefits and privileges offered by SampathCards.

Darshin Pathinayake, Head of Card Center, Sampath Bank, said, “We have always strived to be in the forefront of offering the latest technology products to the discerning Sri Lankan customer, and this launch is yet another much needed, timely step in that direction. While strengthening our product portfolio, we are providing corporate customers with an effective and smarter financial management that will help the company during this global pandemic.”

“Over the past year, we have seen the increased need for businesses to digitize their finances and automate processes like supplier payments and reconciliation. To give them more control over their finances, we are delighted to extend our partnership with Sampath Bank to offer corporate credit cards to all eligible businesses. With these cards, they can make payments contactless, faster, safer, and more efficient,” said Anthony Watson, Country Manager, Sri Lanka, and Maldives, Visa.