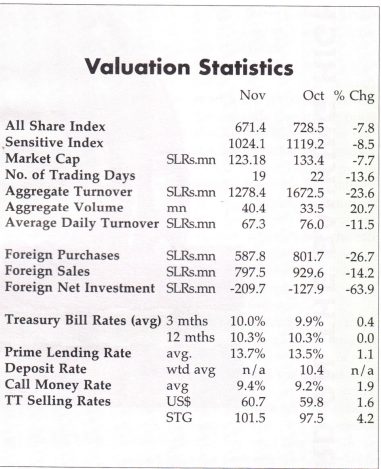

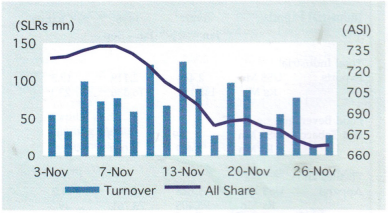

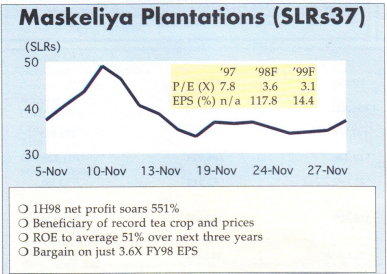

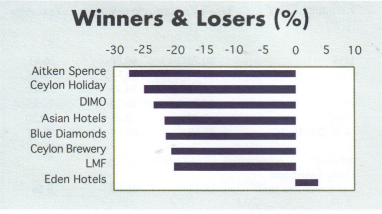

Currency jitters drag the market down. The All Share Index fell 7.8% during the month despite some very impressive corporate results hitting the market. Attractive fundamentals and valuations were ignored altogether as aggressive foreign selling continued due to currency and financial sector woes in key South East Asian markets. The major casualties were the bluechip large market caps, causing the Sensitive Index to fall by a higher 8.5% in the month. Adding to the uncertainty was the volatile ride of the Indian Rupee, which was earlier perceived as safe given the restrictions over capital account transactions very similar to that of Sri Lanka. This also resulted in a short-lived run on the Sri Lankan Rupee as importers scrambled to cover their positions. The bearish sentiment was aggravated due to heavy selling by margin traders who were seen busy off-loading their positions on fears of a further slump in the market. Foreigners also remained net seilers with buying interest more or less limited to bluechips Hayleys and NDB. The only notable event of the month was the spectacular debut of Maskeliya Plantations (MASK), which commenced trading at SLRs30 (compared with its offer for sale price of SLRS15) and steadily climbed to SLRS50 before succumbing to profit taking.

Budget disappointment. The much looked forward to fiscal budget for 1998 was unveiled during the month but turned out to be somewhat of a disappointment given the relative absence of specific proposals impacting directly on corporate earnings in the short term and the marked lack of revenue raising plans. The budget mainly accorded priority to long term development of agriculture, tourism, direct investment and the debt capital market. The key highlight was the reduction of the corporate tax rate from 35% to 30% w.e.f April 1998, for listed companies with a public shareholding of over 25%. Further, the corporate tax rate was brought down from

35% to 15% on profits from tourism, agriculture, fisheries and livestock. The government estimates the 1997 budget deficit (excluding privatisation proceeds) at SLRs67.1 bn or 7.6% of GDP. This compares very favourably with the initial target of 7.8% of

GDP. While better than anticipated economic conditions and strong import growth is expected to have enabled tax and import duty collections to boost government revenue, the sharp fall in domestic interest rates have contributed to the lower than expected current expenditure.

1998 budget deficit at 6.5% of GDP? The government projects the 1998 budget deficit (excluding divestiture proceeds) to fall to 6.5% of GDP (SLRs58.7 bn) and to 5.7% after privatization proceeds and expects to meet its target from revenue growth of 11% and current expenditure growth of only 3%. It is not immediately clear from the proposals how the government expects to meet its revenue target in the absence of any increase in taxes. In the light of the Goods and Serv- ices Tax (GST), which will replace the Turnover Tax in April 1998 being revenue neutral, (the rate was reduced from the earlier expected 17.5% to 12.5%), we believe that government may look to increase indirect taxes (particularly excise duties) during the course of the year to meet its revenue targets, in addition to relying on a pick-up in economic growth to provide a higher tax base.

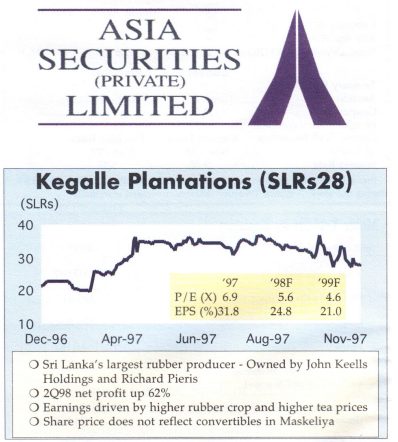

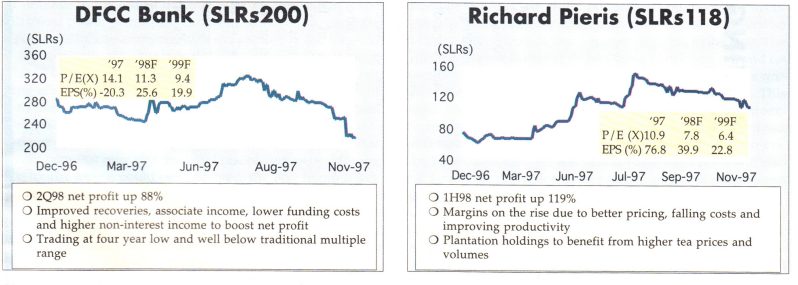

3Q97 results season kick off. Led by the conglomerates, Sri Lanka’s corporate sector continued to report results that surprised on the upside, in marked contrast to almost every other market in the region which is being hit by earnings disappointments and downgrades of forecasts. Impressive 3Q97 results were posted by John Keells Holdings (+112% YoY), Hayleys (+34%), Aitken Spence (+90%), DFCC Bank (+88%), NDB (+111%) and Richard Pieris (+164%) and also plantation companies, Bogawantalawa, Kegalle, Maskeliya and Kelani Valley. Behind the revival in profit growth at these companies are a pick-up in economic activity driving consumer demand, burgeoning exports, lower interest costs, higher commodity prices and a recovery in tourism and above all, a focus on cost

control. However, these excellent results were ignored in the face of regional stock market problems as the herd instinct overtook rationality.

Valuations are attractive. The recent slide in share prices has returned the market to valuations last seen at the beginning of the year. Sri Lanka’s market has historically traded within a sustainable PE range of 10X to 14X prospective earnings and given the current market valuation of a PER of 10X FY1998 earnings, we see little downside from current levels. We also believe that technically the market is now in deeply oversold territory. Although upside in the short term may be limited due to investor concerns on continuing turmoil in key regional markets, we expect a sustained rally in the market in 1Q1998 as institutional interest is refocused on extremely attractive fundamentals. Our expectations are also based on our belief that Sri Lanka’s economy is poised at the commencement of a new growth cycle after over three years of contraction, which will serve to lift EPS growth. We expect the bluechips, John Keells Holdings, Sampath Bank, DFCC Bank, Richard Pieris and LOLC to lead any such rally and recommend accumulation of these counters at current price levels. Also look to pick second liners in the plantation sector and as well as Grain Elevators, Lion Brewery, Dockyard and Cold Stores.