Saliya N Wijesekera

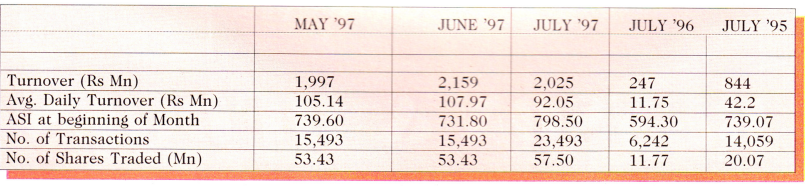

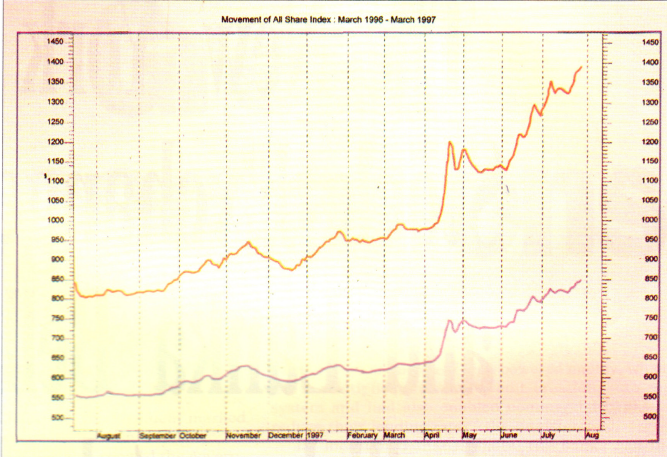

T he market continued the strong gains recorded in the last few months throughout July with the broader All Share Index. (ASI) appreciating by 9% and the Sensitive Price Index (SPI) gaining 12% during the month. Turnover also remained healthy with the average daily turnover at Rs 92m supported by active participation from both local and foreign investors. The main cause for the continued buoyancy of the market is the release of corporate results for the quarter ended June 30, which in most instances have been above analysts’ expectations. Currently, the ASI and SPI are trading at a thirty-month high.

The market was extremely strong during the first week of July with the ASI and SPI appreciating by 3.3% and 4.8% respectively, average weekly turnover and volume also remained healthy at Rs 112m and 2.1m shares. During the second week the market witnessed a large degree of volatility and the indices appreciated only marginally. A net inflow of Rs 161m was witnessed mainly on account of the foreign purchase of 3.7m shares of Lanka Ceramic. In the second week the market declined marginally by 0.71% and 1.15% for the ASI and SPI respectively. Average weekly turnover and volume declined to Rs 66m and 1.74m shares. From the fourth week the market regained its momentum and continued its upward trend throughout the rest of the month, mainly on account of strong corporate results of most companies. During this period foreign activity was limited to a few stocks while retailers were seen to be active in the market. Stocks that traded in large volumes during the month were Blue Diamonds, Vanik Inc., Sampath Bank, Bogala Graphite, DFCC, Royal Ceramics, Lanka Ceramic, Asian Hotels and Asia Capital.

Foreigners too have been active in the market since April, with a net inflow of Rs 1,455m from April to date. This inflow is certainly a very healthy sign and has been the largest net inflow seen since the first quarter of 1994.

POLITICAL OUTLOOK

There has been no significant change in the political outlook during the last one month, except the government’s concentration in drafting a devolution package in its attempt to solve the north-east conflict. The government is expected to offer this package to the public through a referendum by the end of 1997. On the military front, government forces have not been able to make any significant progress against the LTTE. The LTTE is believed to be responsible for the assassination of two opposition legislators from the north- east region in the last few weeks. This has led to international condemnation of their actions, partly from the United States.

CORPORATE RESULTS

The corporate results released for the quarter ended June 30 appear to be well above analysts’ expectations and we expect this trend to continue for the current quarter. Amongst the top performers for the banking sector were NDB with a 21% growth in earnings, DFCC a 29%, Sampath Bank 21% and MLL a staggering 300% growth over the period ended June 30, 1996. This strong performance

is mainly on account of provisioning and profits from capital market activity. In the diversified holdings John Keells Holdings lead the wav with a 175% growth in earnings, while Aitken Spence reduced its losses by over 75%. Reduced losses in the tourism sector during the April to June lean period and strong performance in the food and beverage sectors were the main contributors to these results. In the 1080 1000 manufacturing sector the top performer was Grain Elevators recording a profit of Rs 55m from a loss of Rs 15 recorded for the first six months of 1996. The reasons for this turnaround were reduced wheat prices, and stronger local sales of poultry feed and poultry products. The tourism sector also recorded improvements across- the-board with all companies either recording improvements in its earnings or reducing losses.

Vanik Inc. will soon be able to purchase the controlling interest in Forbes Ceylon, without further delays as the dissenting minority believe that Global Equity Corporation, the major shareholder is already agreeable to these terms. This certainly would be a boost to Vanik as it would have access to the cash reserves of Forbes Ceylon and also some profitable business units such as tea brokering and plantations. Mercantile Leasing (MLL) is another company which has attracted interest in the last few weeks. MLL’s performance in 1996/97 was way below expectations but the company is expected to record a 75% growth in profits for the current financial year.

MARKET OUTLOOK

Last month we made the following statement ‘after the initial rapid appreciation of the indices we now believe that the market is on an uptrend at least in the medium term. Our forecast is based on the fact that some of the major concerns with regard to the government, economy and the equity market have now receded.’ We still continue with this view and are confident that after a marginal correction, which is expected within the next few days, the upward momentum will continue. This is based on the expected flow of good news entering the market, such as continued strong results for the quarter ended June 30, privatisation of Sri Lanka Telecom and placement of 18.33m shares of NDB to foreign and local investors, and the expected completion of the privatisation of the plantation companies. To add on we expect the results for the quarter ended September 30, to record improvements over the same period last. year and this will certainly consolidate the growth momentum.

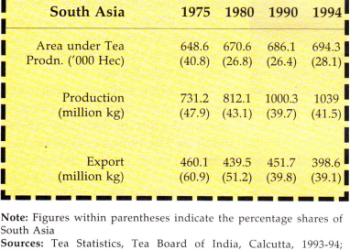

The macro economic front is gradually improving and this is clearly indicated by a host of economic indictors. Inflation has declined to 13.9% (twelve month moving average) from 15.8% in May, exports have increased by 15.7% in USS terms for the first five months of 1997, mainly sup ported by a growth in apparel exports. In the agricultural sector, rice production will increase from last year’s low levels by 20%, and tea production will at least reach last year’s levels. Tourism is expected to record a 20% growth in arrivals and a 20% increase in room rates.

In addition, labor unions have remained quiet, the continuation of the low interest rate regime is expected, and we would not wit- ness any power cuts in the near future.

Our top recommendations:

■Mercantile Leasing

■Vanik Inc.

■ Aitken Spence

■NDB

Saliya N Wijesekera is the head of research at CDIC Sassoon Cumberbatch Stockbrokers (Pvt) Ltd.