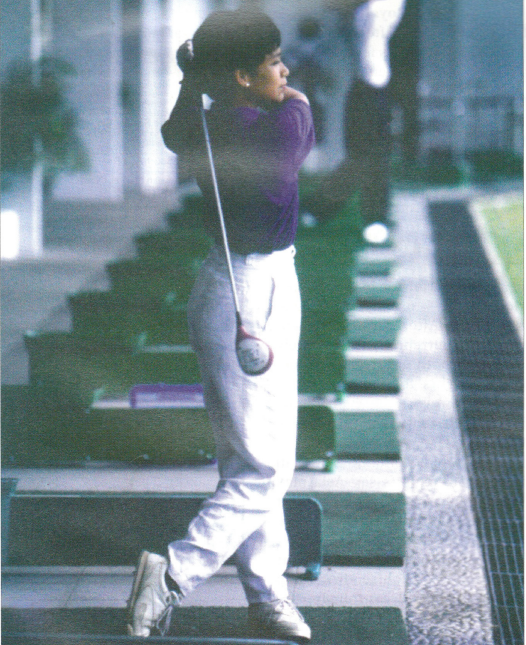

You’ve seen the sunny pictures of lush putting greens and swanky clubhouses and you’re hooked you and thousands of others. across Asia are swept up in the phenomenon that is golf.

But for many it’s not just the lure of playing on 18 holes designed by champions like Arnold Palmer. It’s the appeal of a speculative investment which could in time earn you a considerable profit.

In that respect Asia is unique. In other parts of the world memberships are seen as providing access to a sporting facility, across Asia many see them as investment opportunities or negotiable instruments, to be bought or sold like shares.

You don’t even have to like the game. Many ‘golfers’ responsible for the big rise in membership costs in recent years snapped them up without even seeing the course! Some in the industry tell tales of mainland Chinese businessmen with probably no intention of learning the game buying four or five club memberships at over US$25,000 a piece and paying for it in cash.

A quick glance at the classified advertisements in any English language newspaper in Asia will give you an idea of the sort of prices being asked. At the very top end, a nominee membership to Royal Hong Kong Golf Club, for example, can cost as much as US$1.3 million.

Playing for Profit? Some experts say market conditions are changing and memberships are no longer a guarantee of doubling your money. As more courses come on stream and more people actually play the game rather than see it as a simple investment, prices at some clubs are returning to more affordable levels.

‘The boom times have probably gone, says Spencer Robinson, managing editor of Asian Golfer Magazine. I’m not saying you won’t make money in the long term you probably will.”

‘But it’s not like it was four years ago. The market has become more sophisticated, people understand it more. There’s no question that prices are coming down.” He points to courses in Thailand for example, where the cost of memberships at some clubs has more than halved due to a crowded market.

Thailand in many ways is where the golf boom really struck Asia in the late 1980s and early 1990s,’ he says. ‘Dozens of projects were launched and people perceived that memberships were a license to print money.”

‘But after a while the market became saturated and people began losing money because the values couldn’t keep up and there weren’t enough people playing the game.”

China, he believes, is showing similar signs of overcrowding al- though the same probably couldn’t be said for places like Singapore or Hong Kong where space is at a premium.

Who Joins?

This more measured mood may be good news for anyone wanting to buy a membership at one of the new courses springing up across the region. For despite the market’s less frothy nature, golf experts say memberships still represent a good investment in more ways than one.

Chua Kee Lock, general manager of Singapore’s Laguna National Club, says that from a business point of view, memberships offer a form of entertainment and a venue for making contacts. More importantly, they are a form of property investment which will appreciate over time.

In addition, if you buy shares rather than a membership, you will be considered a co-owner of the property with certain rights. over and above those available to members. From a leisure standpoint, he says, a membership gives busy executives a means of relaxation. They can also form the basis of a holiday if the club is a resort style venue offering activities other than just golf.

In fact the lure of golf as a game rather than as a straight investment may be the force which drives the market in the coming years. Oh Chee Eng, executive di rector of the new Legends Golf & Country Resort in Malaysia’s Johor Bahru, says many of the people who have signed up as members are keen golfers rather than speculators.

‘I think today people who are coming into the market to buy a membership are basically buying it for their own use,’ he says. “And if the club’s going to turn out to be a very good resort or a very good club they will keep it for a long- term investment and they won’t sell.’

Spencer Robinson adds: ‘Initially it was a case of people who were buying purely from an investment viewpoint and it became a case of too many clubs and not enough players. We’re now seeing public courses opening and the hope is that it will encourage people to play the game and help people buy memberships.”

Which Club?

So you’ve decided to join the golf craze and want to buy a membership. What should you look for?

■Location, location, location is a phrase heard often in the restaurant industry and golf, it seems, is little different. Robinson says. the course should not be too difficult to get to and should be within easy reach of a city center.

■Look carefully at the background of the developer and the state of the course itself. Does the company have a track record in Asia? Has it run into problems before? At what stage of completion is the course? Is it the same course as shown in the pretty pictures?

■The course designer may also be important if, at some stage, you want to sell the membership. ‘It’s far easier to sell a big-name course, says Robinson, ‘even though it doesn’t necessarily mean the course is any better.”

■Finally, does the club have reciprocal rights giving you access to other courses in Asia?

Buying and Selling

Unlike shares, golf memberships are not bought and sold on a central exchange. The most obvious place to buy is at the offices set up by developers to promote their club. Many courses try to drum up interest with temporary stalls in large shopping malls.

Golf magazines and English- language newspapers are also at forum for trading and for the names and numbers of companies which specialize in bringing buyers and sellers together.