Asgar Hussein

With the Central Bank this year surprising the business community by relaxing its tight monetary policy, the economy has started showing signs of a rebound.

The lowering of the Statutory Reserve Ratio (SSR) by in January and a further 2% in March has had a significant impact on the historically high interest rates. This move is expected to benefit all business sectors across-the-board

Although credit demand has not seen a big increase so far, analysts expect the lower interest and lending rates to propel investment in the medium to long-term.

However, economists fear that if the increased credit is not utilized to enhance production, and instead towards consumption and speculative activities, inflation could result.

Central Bank Governor AS Jayawardena said they felt it advisable to relax some Of the monetary controls when they saw indications that inflation was declining and the fiscal deficit was being brought under reasonable control by the government.

He noted that the economy which suffered mid-last year due to the drought and power cuts, showed a rebound in the later months, and continuing with a tight monetary policy would have dampened the growth momentum.

Javawardena told ‘Business Today’ that the SRR cuts don’t mean that the banks will go on a ‘loan splurge’ but the measure will bring down interest rates and promote investments. ‘We like the monetary policy to be conducive to development, but want to avoid the risk of runaway inflation.’ The Central Bank would prefer using more market-oriented instruments to control money, rather than strong instruments like SRR, Jayawardena emphasized. The utilizing of market-oriented instruments would include the selling of Treasury Bills in the market, and mopping up market liquidity.

He observed that lending rates have dropped, and expects interest rates to down even further in the coming months. Jayawardena felt lending will pick up gradually. claiming that credit demand had increased the way they expected it to.

According to him, the Central Bank believe that the SRR lowerin± would cause a resurgence in inflation as the country is presently at a lower level of inflation.

Inputs of capital and intermediate goods would lead to new activities and new industries which will create supplies in the market, said Jayawardena. ‘So the tendency for prices to go up by cost increases will be less this time.’

The reduction of the SRR would have contributed to the re- cent resurgence of the stock market, he opines. The Central Bank believes this year’s growth of money supply would be 15%, up from the recorded in 1996.

Following the second SRR revision, the Central Bank stated it expects this measure would lease around Rs 5300 million of funds into the banking system and enable commercial banks to in. crease their lending by about Rs 15 billion over time. It also said the move would enable banks to reduce their lending rates by about 1.5 to 2.

The Central Bank further stated it will continue to monitor monetary and price developments and the impact of these policy changes very closely, and will institute further policy changes as and when necessary.’

Reputed Economist Dr JB Kelegama who described the SRR reduction as a good move, said that liberal credit facilities are for rapid economic development in a developing nation. He however stressed, that the credit should made available for production of goods and services.

He warned that if the increased credit is extended for consumption and speculative activities ( e.g., on property and stock), inflation would result.

Dr Kelegama pointed out that the Central Bank is conferred many powers under the Monetary Law Act, one very important being ‘selective credit controls• under which they ean encourage certain forms of credit and discourage or restrict other forms of credit. For example, he says, the Central Bank can increase credit to production and export, while restricting credit for eon- sumption and speculation.

Dr Kelegama told ‘Business Today’ that the Central Bank should now use these credit control powers over commercial banks, as it had done on past occasions. He cautions that if such action is not resorted to, there is a risk of inflation. ‘If the effects of the SRR reduction prove negative, the Central Bank should review this policy.’

Jardine Fleming Research stated that concerns over an inflationary impact from the injection

of liquidity are valid. ‘But we believe that the impact will be subdued as cost-push inflationary pressures are less this year. Be-sides, the link between excess money supply and inflation is weak in Sri Lanka.’

According to Azra Jafferjee, an economist attached to the Jardine Fleming Research team, inflation will fall this year (though not substantially) for a number of reasons

— these include improved weather conditions, lower food prices and the improbability that price revisions will be of the same magnitude as last year.

Jafferjee stated, ‘cutting reserve ratios alone cannot boost economic activities. However. in view of its impact on the cost of credit and the prospect of sustained low rates. we believe that it will have the desired effect on the economy.

Moreover, with Central Bank’s new approach to domestic price stability and our belief that the move will not be significantly inflationary, future prospects for the Sri Lankan economy may begin to look bright again, especially in the present climate of improving economic and political fundamentals.’

Business leaders also welcomed the SRR lowering. Chairman of John Keells group Ken Balendra called it an ‘excellent’ move, as interest rates would be brought down. Ile however felt reducing the SRR should not be overdone because of the risk factor involved.

‘We must ensure that additional liquidity that is lent at lower interest rates should be used for productive purposes,’ Balendra said. According to him, declining interest rates should propel investment in ventures, and the measure will result in employment generation. President of the National Chamber of Commerce of Sri Lanka, EA Wirasinha was of the view that the success of the SRR reduction will depend on how banks (particularly the state banks) structure their lending policies

to divert the additional money available for long-term capital in tensive project development and infrastructure development.

The Bank of Ceylon reduced its lending rates across-the-board by 1% following the initial SRR cut. After the second SRR reduction, the bank reduced its lending rates by a further ().5 to on a selective basis. mostly to priority see- tors such as exports, agriculture, animal husbandrv and fisheries.

Deputy general manager (Treasury), Bank of Ceylon, R Nadaraja felt that lending rates across-the-board will now stabilize, and expressed doubt that they will come down further before the end of this year unless the government takes further steps towards a lower interest regime. Nadaraja told ‘Business Today’, ‘we believe it will take 3-6 months more for credit lending to be significantly increased for investment purposes.

Sampath Bank has reduced its lending rates to around 18 % . The bank’s CEO, Kumar Abayanayaka said there has been a small increase in credit lending for investment purposes, and expeets it to rise over time. ‘People will now find it more attractive to re-invest in their businesses and diversify’, he stated.

Hatton National Bank (IINB) decreased lending rates across-the- board by following the first SRR lowering and after the second reduced lending rates further on a selective basis to preferred corporate clients.

Assistant general manager, Corporate Finance, HNB, Duleep Daluwatte said there is a possibility that lending rates will be reduced further depending on the equity in the call money market and Treasury Bill rates.

General manager of CT Smith Stockbrokers, Mahendra Jayasekara, said achieving increased investments through the Central Bank’s measure is difficult in a short period, but ean be achieved in the medium to long term. He believed the weighted average prime lending rates will continue to decline, coming down to 12% within 9 months. The weighted average prime lending rate is presently averaging around 13.8%.

According to Jayasekara bringing down interest rates further will be a gradual process because it will be very much linked to re-pricing of the commercial banks’ deposit base. He noted that the interest reductions thus far were possible because of the inflow of money bank to the commercial banks from the Central Bank, which is available for lending.

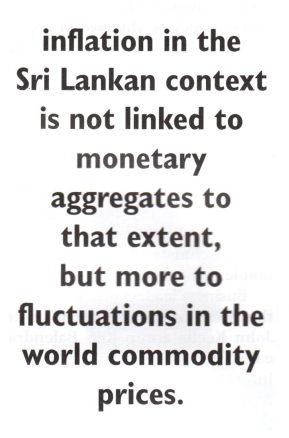

When asked whether the SRR cuts could be inflationary, Jayasekara replied there are two schools of thought on this issue. Ile said the monetarist view is that inflation is linked to monetary aggregates (money supply); hence the reduction in SRR will lead to lower interest rates, increasing money supply and causing inflation. Jayasekara says the other view (to which he subscribes) holds that inflation in the Sri Lankan context is not linked to monetary aggregates to that extent, but more to fluctuations in the world commodity prices. This, he says, is more significant in countries with a big trade deficit (such as Sri Lanka) where imports exceed ex- ports. ‘If this argument is upheld, then the government’s measure is not going to be that inflationary as argued by monetarists,’

Jayasekara believes the SRR lowering will result in an increase in domestic capital formation with more money available for investment; this will enhance production and allow achievement of faster economic growth. He said,

‘generally, developing economies should not worry too much about inflation as the rest of the economy gets affected’, As an ex- ample, he pointed out that the People’s Alliance government, just after assuming power, placed too much emphasis on controlling in nation

— this resulted in considerable tightening of liquidity leading to high interest rates and consequently low capital formation. Says Jayasekara, ‘it is very difficult to divorce inflation from development. When you take bold policy initiatives, it could be inflationary, but as long as it does not retard economic growth, such measures should still be pursued.’

Jayasekara believes that export oriented industries will particularly stand to gain from the SRR reduction and Sri Lankan goods can be more price competitive in world markets. According to him, the SRR lowering has affected the stock market already because of more liquidity in the system. On the other hand, he says, when corporate profits increase as a result of interest cost reductions, stocks would become cheap in current prices and attract investors.

Jayasekara said they under- stand that even though there has been a marked reduction in lending rates, the new loan application have not increased drastically; this is because investment planning takes some time.

According to him, since the commercial banks did not get sufficient applications for loans to take up the money that came into

their system, they have invested in alternative instruments such as Treasury Bills at lower rates, partly contributing to declining T B yields.

Jayasekara told ‘Business Today’ that a marked reduction in savings deposit rates has been seen following the Central Bank’s measure, with the rates decreasing from 11-12 % before the initial SRR cut to about 8-9% at present. He said a benefit of the SRR reduction is that it would allow the government to reduce its fiscal deficit through lower interest cost.

Indeed the island’s corporate sector seems confident that the SRR reduction will give a boost to the economy. The Central Bank should be commended for surrendering its tight monetary policy. However, the relevant authorities and the business community should ensure that the extra liquidity is channeled towards production rather than towards consumption and speculative activities.