The three main characters in the much-loved French novel The Three Musketeers, Athos, Porthos, and Aramis, are a collection of good and evil. In varying degrees, they were intelligent and courageous. They had their vanities, theatrics, and good nature. The hero, a young D’Artagnan, is also central to the story. He is a young man who leaves home in search of his fortune. He recklessly pursues his ambition of becoming a musketeer. The twists and turns and the sordid stories of power and greed excite the story and lead to some ruination. If not in action and sword fights, modern-day musketeers in the business world manage well-choreographed theatrics to reach their financial goals. Some hide under the veneer of altruism and being global change makers. They want to be influencers who can impact the world positively. Some seek the freedom of money, even to the detriment of some. Their common denominator is money. Sam Bankman-Fried (SBF), Changpeng Zhao (CZ), and venture capitalist Chamatha Palihapitiya and their business models are under scrutiny and, much to their disadvantage, are seen as no more than being mere capricious financial opportunists.

Words Jennifer Paldano Goonewardane

A shortcut to prosperity

The prosperity theology movement is the hunky-dory version of the road to financial success, which every believer loves to embrace. It speaks of a commitment to much more significant gains. It offers spiritual legitimacy for wealth accumulation. Its famous movers promise the fruit of health and wealth and appeal to their followers to tithe generously to reap the benefits and prosper or, in worldly terms, become rich. Sure, there is prosperity. Unsuspecting followers who invest fatten the coffers of their promoters as they seek the road to redemption through riches. Their giving transforms the fortunes of the prosperity preachers, who soon fall from grace as their messages fall flat as mere hubris and manipulation.

That may be about the dubiousness of religion. However, it is also the story of those in the business world who create a religion and a following by promoting the same tale of creating value and goodness to those who would care to listen and invest. These individuals weave elaborate narratives for intent ears that deem their wise counsel gospel truth and have great faith in their ability to interpret the scriptures of the modern business Bible that could unfold the road to salvation, no matter what an individual’s status is right now if only they believed their advice and lent their money, soon to be multiplied, sending the lenders on a prosperous trajectory and upward mobility. It is the story of how billionaires, the new tycoons, are riding the wave of prosperity on much-imagined and ingenious business practices sweeping the world of investment and returns. They are the sought-after speakers at Ivy League Colleges and graduations. They speak to students who aspire to be like them, to change the world by becoming rich, and their wise words inspire future generations.

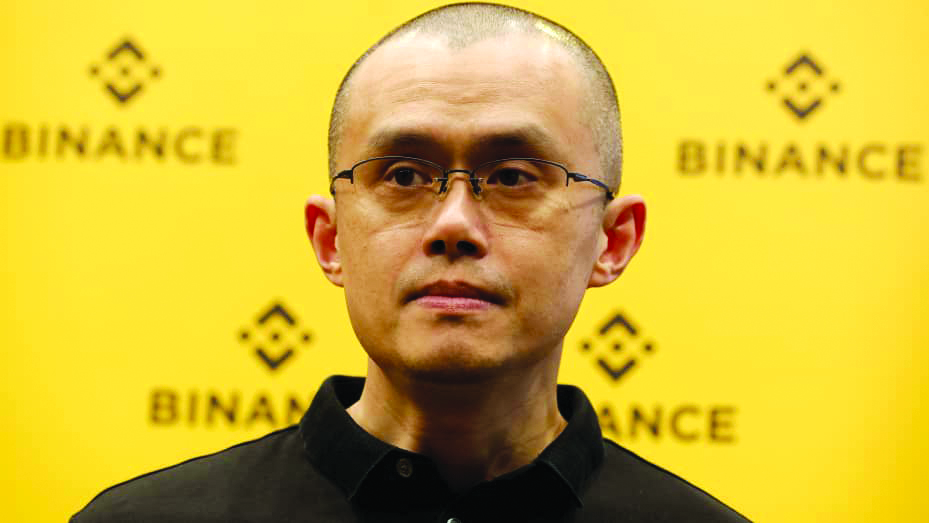

Well, wanting to be affluent is not a bad thing. After all, from time immemorial, human beings have advanced from one stage to the next, from one civilization to another, based on their desire to prosper. For that, the human spirit of innovation has always propelled life into better realms. But inherent and intrinsic to the human desire for change and prosperity is greed that blemishes all good intentions and drives corruption and crime. The business world has witnessed crimes committed by white-collar men, men serving in esteemed institutions with legacies, and men whose actions have led to collapses in the global financial system, as they did in 2008. Most recently, the stories of Sam Bankman-Fried of FTX and Alameda Research and the founder of Binance, Changpeng Zhao, have been hitting business headlines. Then, from a different space, but less under the radar but still under scrutiny, is venture capitalist Sri Lankan-born Chamath Palihapitiya. These individuals have been able to wield significant influence in markets and were widely acclaimed and celebrated for their genius and power. Today’s media stands on the dock, accused of promoting their narratives vociferously, especially the business channels. These men could command a seat at the table where influential people sat.

The digital asset sector may be the future, and there is heady involvement globally. But the focus here is not so much about its future. It is how so-called business leaders use their platform to don the garb of goodness, but beneath the veneer are smooth manipulators who lure people, manipulate the market to their benefit, and allow the age-old credence of ‘money talks’ to take root and if we may add, ‘when money talks, people listen’, allowing transactions of ill-gotten money, making exceptions for VIP customers and walking away with huge profits at the expense of their gullible followers.

These individuals have been able to wield significant influence in markets and were widely acclaimed and celebrated for their genius and power. Today’s media stands on the dock, accused of promoting their narratives vociferously, especially the business channels.

A prop for criminal activities

If we begin with the smaller story with the hefty fine, Binance, once led by CZ, has to pay a whopping $4.3 billion fine in the United States, the most extensive enforcement action in the US Treasury’s history, as the world’s largest virtual currency exchange stood accused of consistent and violations of US anti-money laundering and sanctions law. Taking Binance to task and exposing its activities by the US Treasury, assisted by investigations by its Department of Justice and other law enforcement agencies, was tantamount to safeguarding the US financial system, vis a vis the global financial system.

An investigation found that Binance lied. Under the leader-ship of CZ, the company had claimed to have exited the US market, which it had not, and according to investigations in October 2020, one-fifth of Binance’s users were in the US. Moreover, the crypto giant pretended to follow US regulations under CZ. The company had made at least one thousand illicit transactions with sanctioned individuals and 1.5 million trades that violated US sanctions. CZ pleaded guilty to breaking Know Your Customer standards and anti-money laundering laws by facilitating questionable transactions from questionable sources that he knew. Hence, $1.6 billion of the fine was based on the fees it collected from US residents and transmitted roughly $900 million to people in sanctioned countries. The DOJ accuses Binance of pretending to comply with federal laws but prioritizing profits over the safety of the American people. The US Treasury accuses Binance of knowingly evading US laws. Henceforth, the DOJ will impose strict monitoring and reporting requirements on the company, with it having to report suspicious activities and go through past transactions to trace suspicious activity. In the past, Binance had failed to file a single suspicious activity report. Although CZ admitted and pleaded guilty to breaking US laws, those closely monitoring the developments in the most extensive crypto base also point fingers at CZ for going beyond breaking the rules. They accuse him of knowingly navigating them to avoid impeding his business growth and profit.

As a result, Binance continued to serve US customers without registering with the US authorities and simultaneously served users in sanctioned countries, resulting in transactions between Americans and sanctioned individuals and hundreds of millions of dollars in illicit transactions and trades. Well, banks have done the same and have been slapped with hefty fines in the past, not that the practice has stopped; some global banks of repute doing it repeatedly and getting away with penalties given their size and influence, especially influence with the powers that be in the rich countries, they know that someone has their backs in the corridors of power. According to media reports citing court filings, the crypto exchange has been ordered to pay a criminal fine of $1.8 billion and forfeit $2.5 billion. Part of the fine is $150 million owed to the Commodity Future Trading Commission, of which $50 million will go to the US government, subtracted from the CFTC fine. CFTC is the leader in enforcing crypto-related regulations.

Meanwhile, Binance will be monitored for the next five years by a unit representing the US Treasury to ensure that it exits the US market, an entity that will have complete access to its systems, transactions, and accounts, which will be in addition to the monitoring by the DOJ that will work within Binance. According to official information, the DOJ overseer will work for the next three years within Binance to focus on KYC, anti-money laundering, and sanctions violations. Many see the hefty fine as a warning to crypto and decentralized finance (DeFi) companies who wish to do business with US users about adhering to US laws, rules that apply to centralized and decentralized exchanges, or otherwise face consequences.

There has been much speculation about the impact of the penalty on the crypto market. However, despite the drama and some negative press, the overwhelming support the crypto world garners and its following are undeniable. The numbers are proof. Despite the dent, the rebound has been spectacular. At the time of completing this piece, cryptocurrency had soared to more than $42,000, cementing analysts’ predictions of a rebound or a surge in demand for crypto to unprecedented levels since the pandemic, a speculation that was early on supported by a report in the Financial Times, which came up with a bullish prediction for 2024, with Bitcoin projected to grow between $60,000 and $250,000 while other tokens are already surging ahead. Hence, many concerned about the rise and impact of cryptocurrency view the mere financial settlement with Binance, as a little too moderate, very much in its favor, an amount, given its value, is affordable. And, despite the guilty plea and exposure of its law-breaking business dealings, Binance can continue in business. At the same time, CZ is unlikely to face jail time, or if he does, he may receive a lenient one as it is up to the judge to decide the penalty for the maligned crypto master.

Sam Bankman-Fried Founder, FTX and co-founder, Alameda Research.

A benign crime?

Following his guilty plea, CZ can no longer be involved in Binance. However, he has tweeted that he will be available to the team to consult as its shareholder and former CEO. Moreover, his pleading guilty to evading compliance regimes and sanction laws did not change his position as the crypto’s richest person. As reported, the ruling applies only for three years, and he could someday return as CEO. While pleading guilty to money laundering and allowing illicit transactions and questionable entities to transact through his platform, CZ also audaciously claims not to have misused any customer funds like some of the more notorious crypto operators, who have either gone missing or are on trial, claiming that the US authorities had not found any misuse of funds or market manipulation by Binance. A holier-than-thou attitude, no doubt, sheds light on an alternative narrative supporting CZ’s claim of a solid company despite the humongous fine and shady past. His claim to good credentials is that he has not defrauded anyone or misused customer funds. His proponents sing the same chorus, point-ing to the resilience of the crypto space as Binance’s woes did not result in any closures or disruptions, allowing customers to trade and withdraw, unlike FTX. So, does that wash all CZ and his team’s sins of letting illegal activities? If anyone wonders how digital currency can be evil, given its unregulated nature and anonymity, it is an excellent space for criminals to roam to launder their money freely. Reports indicate that in 2022, crypto crime, or crime on the Blockchain, reached a record $20 billion. And Binance should rightly hold its head down for enabling transactions through its platform for terrorist and drug financing and, shockingly, child sex abuse, all done under a cloud of secrecy, as the company’s leaders did not deem it a threat to humanity.

Changpeng Zhao, Founder of Binance.

The digital address is beyond regulation; hence, any entity could continue operating illegal enterprises and still feel confident they could store their ill-gotten largess comfortably on the Blockchain. The problem lies in the lack of controls, giving criminals a free pass. So, no matter what his actions could have led to, CZ alludes to what he had not done: not misusing customer funds for personal needs and safeguarding customer funds; hence, his hands are clean. The problem is that crypto proponents are washing CZ and Binance clean. Fundamentally, they say that CZ has not harmed customers. Personally, to these millions of people, his illegal actions are acceptable, even if it is blood money or drug money, as long as he guarantees their investments are safe. The cost to human lives is irrelevant in all these activities. People are washing off CZ’s sins very benevolently. Fundamentally, there is a convenient take on what is right and wrong, just like the ‘white lie’ narrative that has gone on for years. The middle path dictum applies here, where some actions are deemed redeemable with a favorable penalty or less harsh outcome. After all, it is a time of alternative facts. So, a little veering from the norm is accepted even if it is immoral, like what people are accusing venture capitalist Chamath Palihapitiya of doing.

Venture capitalist Chamatha Palihapitiya.

Benevolent billionaires or just charlatans

There are similarities between Chamath Palihapitiya and Sam Bankman-Fried. Both focused on amassing wealth to help the world. Of course, it is only fair to celebrate people’s success. Sri Lankan-born Palihapitiya, subsequently growing up in Canada, had worked hard to the top and is known for his time at Facebook and his contributions while there. But of late, he has been the talk among many online commentators interested in the space in which he operates. Palihapitiya set up Social Capital, a start-up venture capital fund, as a purpose-driven enterprise to generate a profit and positively impact the world. That pronouncement sounds very familiar as that is what businesses like to show – their business impact on people. Palihapitiya is said to donate to climate-change-related causes and equality. Like SBF, who in this instance is the belle of the ball, who had a savior mentality, Palihapitiya too spoke about how he cares about making an impact, which his detractors allege is only a charade to lure investors into his schemes. Palihapitiya has a large social media following as he shares investment advice through his popular podcast and X. So, what are people accusing Palihapitiya of?

Palihapitiya has touted SPAC or Special Purpose Acquisition Companies, a publicly traded corporation, to raise capital through an IPO to acquire an existing operating company. It is common for businesses seeking to raise money through a SPAC, a blank cheque company. It is fundamentally a fund-raising initiative bypassing the traditional capital market. The sponsor receives a share of free stocks from the company. Once the sponsor raises the required money, he merges his SPAC with an existing operating company for which he presents the cash through the SPAC process. In the past, Palihapitiya has sponsored large companies like Virgin Galactic, Opendoor, Sofi Technologies, and Clover Health, none of which took off as envisaged. They failed. Investors lost money. But Palihapitiya made plenty of it.

Skepticism is important

The SPAC process is trust-based. Where he fails is in pitching unprofitable businesses to retail investors. In the past, he made lofty projections. They trusted his wisdom. His podcasts are exciting and encouraging. He would over-validate a stock and heap praise on its potential. The retail investor who knows little to nothing about how the stock market works or the viability of a particular business gets excited about increasing their life savings by investing in his SPACs. As capital pours in, the stock prices soar.At this point, Palihapitiya, who holds free stocks by being the sponsor, sells his shares on the market for a massive profit.

This behavior has earned him the title of the biggest pump and dumper in the stock market. In effect, the retail investors give Palihapitiya the liquidity to exit. Then, as the stock prices plummet, the retail investors stare upon a tumbling value as their life savings go down the drain. When accused of hood-winking his followers, Palihapitiya has often been on the offensive and combative, accusing retail investors of not following his lead and selling off their stocks when the price was high. But these are not sophisticated investors; instead trusting this man to guide them through and deliver on his promise. This way, Palihapitiya has made massive gains from his $750 million investment, doubling it. His companies, it is said, have lost more than 60 percent of market value. They call his practice predatory. While some commentators have put some of the onus on the investors to take a cue from the stock market behavior and to take personal responsibility for deciding to invest in a particular stock just because someone told them to do so. Others felt that his actions were immoral, money grab at best, who lured people into trusting him, who used his public image to exploit people’s trust to fatten his pockets. Some have even gone to the extent of defining him as a conman who takes people’s money.

Then, he dares to speak at Stanford on how he wants to earn money and spend on the world. Public forums are essential platforms to market their over-hyped images and pronounce their lofty ideals for the world while being driven to achieve and master the business world. Interestingly, Palihapitiya recounts tipping a restaurant steward $500, an example of how he intends to impact beyond a mere review to help them support their families back home. He spoke of the joy of giving this way, calling it emotional and transformational. He considers his ability to give anonymously a great gift he has. It is human nature to feel content with ourselves for giving to those who deserve it; it is often a selfish joy to feel liberated and liberate someone else. It is often a pat on the back for ourselves because it makes us feel good that we have done something good and feel the redemptive power of doing something good. Taken that way, one can only say that Palihapitiya felt the same way. Like SBF, Palihapitiya makes a connection between money as an instrument of change. He has spoken on how 150 men control the world and its assets and money flow and intends to penetrate that circle, in his own words, to do what they do as well as they do it or do it better than how they do it. He wants to acquire enough money to be in a position of power and influence to redirect that money into the world for good purposes. Emotional outpourings of their noble visions capture millions’ attention, and unsuspecting and gullible people, let us say with altruistic missions themselves, want to partake in the billionaire’s transformative journey and will fall hook, line, and sinker for their explicit high-mindedness.

Palihapitiya has made massive gains from his $750 million investment, doubling it. His companies, it is said, have lost more than 60 percent of market value. They call his practice predatory.

The weird world of SBF

If there was anyone who captured the public’s imagination, then it certainly was and is Sam Bankam-Fried. His public appearance was so starkly different that it evoked comparisons with geniuses past. Those who knew him said he had the aptitude that Wall Street craves. He was also altruistic. He combined both to make the most money to impact the world. He piggybacked on the ‘earn to give’ idea. However, he lacked social skills. He was a tad isolated, not much of an interactor, and devoid of facial expressions, making it hard to gauge his emotions. But he was a risk taker, a quick decision-maker who thrived in chaotic situations. SBF had built an enigmatic persona that the world was captivated with as he became a crypto billionaire before his thirtieth birthday. The world is fascinated with wealthy people, and when they are somewhat odd and do not fit the mold of ostentatious living, the curiosity gets intense.

The one-time poster boy of the crypto world, the influence-wielding founder of Alameda Research and crypto exchange FTX, is on trial for fraud. Here was a young man who wanted to do nothing but impact the world with his billions. All he wanted was to give his money away. After all, he looked dowdy with unkempt hair, shorts, and t-shirt, driving a Toyota Corolla when he could afford more. But that is what altruists do. They create impressions. They take great pains to paint characters that people love to follow.

Alameda Research, a cryptocurrency trading firm, was SBF’s first company set up in 2017. He had set up FTX 2019, a cryptocurrency exchange, to help Alameda’s trading business partly. Retail customers and venture capital money supported FTX. The defining feature of his ventures was the team’s energy, consisting of intelligent young people from Stanford and MIT who had high aptitude and were math virtuosos. They were in their twenties. The problem was a lack of oversight and record-keeping in their unconventional work environment, couch and beanbag sleeping arrangements, collective living spaces, and sparse living arrangements.

At his zenith, SBF enjoyed the company of leaders, celebrities, entrepreneurs, and executives. Bill Clinton and Tony Blair were paid speakers at his Crypto Bahamas Conference. During his journey to the top and then to bankruptcy, writer Michael Lewis had the privilege of trailing him with unprecedented access. In his book Going Infinite: The Rise and Fall of a New Tycoon, Lewis has fascinating stories about the young entrepreneur who truly believed in wanting to do good to the world. His detachment was evident when Lewis tried to get in touch with those who knew SBF as a kid below 18, and other than his parents, he could hardly trace anyone else, which indicates that SBF had not had many relationships outside his family.In contrast, his relationship with his brother was non-existent. He would not respond to people with facial expressions because he felt he did not have to. He was also unconventional. He had no organizational structure, which perturbed his staff, who had complained to his psychiatrist about not knowing where they belonged in the corporate hierarchy. Lewis recounts the day he found that SBF did not know Vogue’s Anna Wintour or what Met Gala was when he went in for a virtual meeting with her, all the time playing a video game and at intervals checking WikiLeaks for information. Lewis found his intentions genuine, but his thirst for risk-taking was mind-blowing. He had unique and intelligent trading strategies, some riskier than others, and embraced cutting-edge technology. He was also callous as he chose to act solely, disregarding team discussions and consulting, much to their chagrin, and Lewis feels that is what led to the downfall. However, Lewis is biased towards SBF and still thinks he was frank about wanting to make an impact by making money.

Money talks

The rise of FTX was so phenomenal that it bought a sports arena for millions of dollars, got its name on umpires’ uniforms, and sponsored the 2022 Super Bowl with adverts by celebrities and sports personalities who promoted FTX overwhelmingly. At its zenith, FTX had the blessings of some of the most potent global influencers with immense visibility. The company spent whopping sums soliciting their patronage to promote the name. The advertisements and joint celebrity engagements with SBF were interactive and funny and appealed to their target audience – retail customers. FTX was reaping the returns of a bull run in crypto that began with the pandemic. By January 2022, FTX had a valuation of $32 billion, a rise of 77 percent in just six months, and at one point, it had a valuation of $40 billion. FTX certainly had earned legitimacy before the public with tremendous endorsements from high-profile individuals, and hence, who would doubt that its enigmatic owner was juggling funds to and fro in the most erratic manner?

As SBF’s star grew, so did his influence among the corridors of power. He is said to be the second-largest Democratic Party donor. Meanwhile, he began directly negotiating with politicians. SBF wanted to change the face of crypto from an unregulated space to a regulated one, for which he sought to influence elected officials to get the most favorable legislation. He had so-called puff pieces written about him, which dubbed him as having a savior complex, depicting him as a wonder kid and multi-tasker. However, some skeptics doubted SBF’s sincerity and feared something was amiss, something sinister and illegal taking place that was not visible. When FTX finally collapsed and filed for bankruptcy in November 2022, the extent of its operations and spending patterns came to light. In simple terms, SBF funneled FTX investor money into Alameda to cover expenses and debt, resulting in eight million dollars going missing. In the Bahamas, SBF had invested in an expensive penthouse and a luxury property written in his parents’ name. Moreover, his father was on the company’s payroll, and he directed vast sums of money into his parents’ personal bank accounts. As SBF stands trial for fraud, writers like Lewis feel that rather than his intentions, his reckless action based on decisions and risk-prone nature led to his downfall. But his customers who are still searching for their investments will not buy any attempts at safeguarding a do-gooder image while those who sang his praises are accusing him of misleading and deceiving them while several celebrities in the sports and entertainment fields, namely Tom Brady, Steph Curry, Naomi Osaka and Larry David and Giselle Bundchen and several others are facing class-action lawsuits for their endorsement of FTX.

Their road to redemption and prosperity became the road to hell. But even with lessons learned and written about, dubious people and dubious activities will always be part of the drama and tragedy of the business world everywhere.

Media as cheerleaders

There are increasing voices pointing fingers at media outlets for singing hosannas to these men, giving them valuable air time to pitch their business proposals a solid base to establish their credentials and win trust. Media outlets, YouTubers, and influencers spoke glowingly about their altruistic credentials and unassuming lifestyles. As if a billionaire driving a Toyota was messianic, their lifestyle choices became fodder for image-boosting exercises. They were frequent visitors to television studios, the business channels specifically, and today are accused of being complicit promoters of their money-making schemes in return for advertising revenue. But putting on pretenses is the game’s name, and these three individuals are a testament to how fakeness passes off for realness.

The future

More and more investors are crowding around cryptocurrency despite the high-profile disclosures and downfalls. Analysts say that recent collapses in tech-based startups and tech-focused banks drive investors towards cryptocurrency. Speculation is that the current activity and enthusiasm for crypto are driven by the expectation that the US regulator would approve a spot bitcoin ETF, allowing millions of investors to enter the market. Up to now, the US regulator has resisted calls for a spot bitcoin ETF, rejecting multiple applications in the process, its principal contention being the vulnerability of the crypto market to manipulation. Meanwhile, in the aftermath of the FTX and Binance sagas, the US’s Commodity Futures Trading Commission chair has not ruled out frauds similar to those committed by FTX and others happening again as there is no regulatory mechanism to prevent them. Hence, regulating the cryptocurrency market is considered a must and urgent need to have jurisdiction over the digital commodity market. Unfortunately, a new bill has been on the table in the US, which is being held back, thereby continuing to expose the market to volatility and customers to immense losses. Still, its cheerleaders would say there is no turning back for the digital currency market, and the numbers may prove them right. That may not be the case with SPACs, which have lost their luster owing to new regulations, although it enriched the big names that promoted the deals.

As everyone seeks a path to riches through some means, people depend on the wisdom of market geniuses to help them put their money for guaranteed returns. Individuals like SBF, CZ, and Palihapitiya built larger-than-life personas of themselves through media exposure with large followings and had become the modern-day Midases with the magic touch. They preached the business prosperity gospel much to the delight of their followers. And in return, they promised to enrich the world with their wealth. Whether their altruistic ventures took off is anyone’s guess, but one thing seems clear. For some, their road to redemption and prosperity became the road to hell. But even with lessons learned and written about, dubious people and dubious activities will always be part of the drama and tragedy of the business world everywhere.