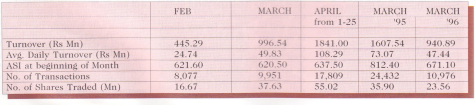

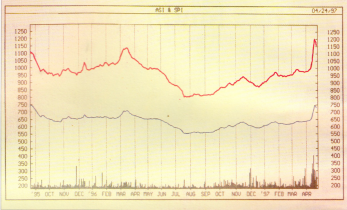

April has been one of the most active months seen in the market for the last two years, with turnover increasing tremendously from an average daily turnover of Rs 49.8m in March to Rs 108m in April. The All Share and Sensitive indices also gained an impressive 17% and 23% during the month of April but thereafter lost some of its gains as investors began to take profits.

The main reason for the sudden upward movement can be attributed to an exchange of letters between the President and the Leader of the Opposition with regards to a bipartisan approach to solve the ethnic conflict. This has certainly been viewed by both local and foreign investors as a very positive first step to solve the ongoing conflict. Fundamentals from both the macro and micro aspects did also play a role in the revival of the market. Amongst them the low interest rates, reduced Central Bank reserve requirements, improvements in tourism and the continuation of strong tea prices. The Central Bank has been deliberately pushing down interest rates during the last few months and as a result the twelve month treasury bill rate is 269 basis points (17%) below last year’s rate. The reduction of the reserve ratio from 15% to 12% in two stages increased liquidity further. These factors will certainly have a positive impact in that investors are expected to move funds into the stock market. Tourism has in the last few months witnessed a gradual revival with arrivals increasing by 20% as compared to the last winter season. Plantation companies have continued to be excellent performers due to increased output and continued strong prices for tea and rubber. From a micro aspect the improved corporate results released for the-quarter ended December 31, and the expectation of further improvements for the quarter ended March 31, ant the currant period will have a positive impact on the market.

The initial rally started mainly on low valued growth stocks, with Grain Elevators, Lion Brewery, Ceylon Brewery and hotel sector stocks making substantial gains.

Thereafter we witnessed interest being concentrated on under- priced low valued stocks such as Seylan Bank, Blue Diamonds and Asia Capital. Finally the blue chip stocks such as National Development Bank, Development Finance Corporation, Commercial Bank, Hatton National, Lanka Orix and, the diversified holdings Aitken Spence, John Keells and Heyleys witnessed a massive surge in prices. Initially the rally started off quietly but with a massive increase in turnover. Turnover levels came close to those witnessed during the boom times of 1993 and 94, with strong participation from both foreign and local institutional investors. As has been the case of the past retail investors latterly joined the market. Thereafter we witnessed a gradual decrease in turnover but the indices kept appreciating rapidly. During the first five days of trading after the Sinhala and Tamil New Year the indices gained an impressive 8.4%. But thereafter the inevitable profit taking set in and the indices lost 4% during the next three days of trading although turnover and volumes remained high. Leading the downward trend in the market was the blue chip stocks which lead the market during the upturn, be-cause unlike on previous occasions the rally on blue chip stocks was sparked of by retail investors.

In March foreign participation declined to a low of 38% of the turnover much below the past average of 45-50%, but with increased market activity in April foreign transactions accounted for over 40% of the turnover. In March we witnessed a marginal net inflow of Rs. 25.6m from foreigners while April witnessed a Rs. 91m inflow. Stocks that traded in large volumes during the last one month were Asian Hotels, Blue Diamonds Distilleries, Aitken Spence Hayleys, Sampath Bank and John Keels. Political Outlook

The current political outlook is positive both from a country and regional perspectives. With the local government elections completed the government is now concentrating on economic development and solving the current conflict with the LTTE. The Opposition Leader has also, unlike the previous opposition leaders placed the interest of the country before party politics and agreed to a bipartisan approach to solve the ethnic conflict. On a regional front the appointment of Indra Kumar Gujral as the Prime Minister of India is considered very positive. Gujral’s policy of developing a close working relationship with South Asian neighbors will result in greater economic corporation between these countries and also greater stability in the region. Market Outlook

After wide swings in the indices during the last three weeks we expect the market to pick up again in the short to medium term. This expectation is based on the following assumptions:

The possibility of a power crisis is gradually receding with the catchment areas receiving rainfall and the monsoons expected to breakout in a few weeks time. Further additional thermal capacity will come in the next few months. Therefore power cuts are not expected in the next few years.

Interest rates are expected to remain low as the Central Bank will continue to follow such a policy, this together with reduced corporate tax will improve the profitability of the corporate sector.

Further the improved liquidity and low interest rates will spur new investments leading to further GDP growth.

Tea and rubber prices are expected to remain at the current high levels in the medium term and tourism will witness a rival with a project 20% growth over the previous year.

Privatization of Lanka Telecom and Air Lanka (sale of majority ownership and management control to a strategic partner) is expected to be completed by the end of this year.

From the stock market point, we would see the introduction of screen based trading from May. Screen based trading is expected to be fully operational by August and this will certainly increase the trading volumes in the market. Which in turn will attract more local and foreign institutional investors to the market.

Considering the above factors we recommend investors to take medium term positions in selected stocks in the banking and finance, conglomerate and plantation sectors. Companies in these sectors would benefit most from the current improvement in both the macro economic and political outlooks. Our top recommendations continue to be blue chip stocks such as NDB, DFCC, Sampath Bank in the banking and finance sector and John Keells and Aitken Spence in the diversified holdings sector.