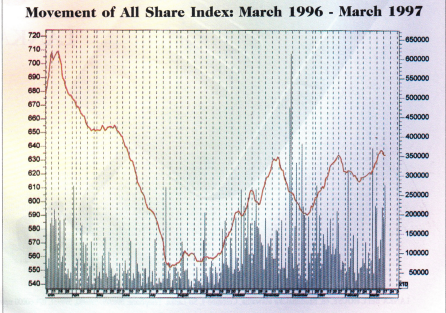

In the last few weeks most investors were preoccupied in trying to predict the impact of the local government elections. With the elections conducted in an atmosphere of violence and intimidation most investors abstained from the market. It was saddening to note that both the law enforcement authorities and the Elections Commissioners Department were unable to ensure a free and fair election. But on a positive note the maturity of the Sri Lankan public must be commended as the country got back to business immediately after All the elections. these factors together with the election results did, and will have a bearing on the market. The strong corporate results for the quarter ended December 31, 1996 and the expectation of continued growth for the current quarter did not result in the indices making substantial gains during the last two months. If not for the elections the indices would certainly have gained at least 10 percent during the first quarter. But now that the government has been able to consolidate its position through a mid term poll and control a majority of the local bodies means, that they have further strengthened their position. Further, the government did not witness a growth in its vote base and that gives the message that it needs to do something more if it is to stay in power, which in turn will motivate it to improve its performance. On the military front we did not witness any significant events which had a bearing on the market, but unfortunately there appears to be no end in sight to the conflict.

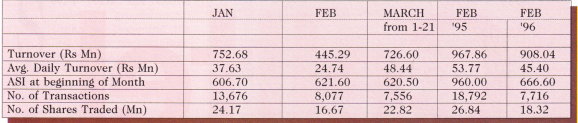

In the month of February the indices fluctuated within a narrow band, and the market was extremely dull. Thereafter in March the market witnessed increased activity due to two factors. Firstly, foreign interest was seen in sedated blue chip stocks such as John Keells, Hayleys and Aitken Spence as a result of improved performance in tourism, plantations and export sectors. Interest was also seen in the plantation sector with tea prices continuing to record impressive levels. Secondly, it was evident that local institutions particularly those controlled by the government were active in the market thus ensuring that prices remained at current levels. Retailers continue to be inactive in the market but some activity was witnessed immediately after the elections, particularly for the lower valued and speculative counters.

In February foreign activity accounted for 45 percent of the turnover, while for March (1-21st) it had declined to 35 percent of the turnover. Net foreign purchase for March (1-21st) was a healthy Rs 95 million although some foreign selling was witnessed during the last few days. Stocks that traded in large volumes during the last one month were DFCC, Kotagala, Distilleries, Seylan Bank, Vanik Inc, Commercial Bank, John Keells, Ceylon Tobacco, Kegalle Plantations and Sampath Bank.

Corporate News

As expected most companies in the manufacturing, plantations, banking and finance and the conglomerate sectors recorded improvements in their earnings for the quarter ended December 31, 1996. The star performers in the banking and finance sectors were Commercial Bank and Lanka Orix Leasing Co. In the manufacturing sector Lanka Ceramics recorded earnings well above analysts’ expectations, the main reason being the strong contribution from its associate company Ceyexxe Plantations which in turn owns Horana Plantations (which is involved in tea and rubber plantations) and, strong demand for its core product the medium range ceramic tableware. Of the conglomerates Aitken Spence due to a moderate growth in tourist arrivals was able to wipe off its losses in the first half of the FY 1996/97 and record a marginal profit. The decision by Merchant Bank not to proceed with its 5 million bonus share offer to the ESOP is noteworthy in that it protects the rights of the other share- holders, this certainly will have a favourable impact on its share price.

On the macro front the government has been successful in placing the US$50 million floating rate note at an interest rate of 1.51 percent above LIBOR, this is commendable given that Sri Lanka still doesn’t have a credit rating. Further the privatisation programme appears to be on track with some minor delays, but will certainly achieve well above the targeted Rs 5 billion for 1997, infact our expectations are that if the sale of the 30 percent stake in Lanka Telecom is completed, revenue. would be in the range of Rs 15 billion This in turn will help to reduce the budget deficit from the current 9 percent of GDP to a manageable 8 percent.

Market Outlook

We expect the market to wit- ness renewed activity immediately after the elections through to the first week of April. Thereafter a lull is expected as the traditional holiday season comes up with the Sinhala and Tamil new year. On a positive note the political climate is much clearer, the military certainly has the advantage over the LTTE, the privatisation programme is gradually achieving its objectives and interest rates although controlled by the government are low, tourism is on the increase after last years disastrous performance and our primary export crop tea continues to enjoy attractive prices in world markets. On the negative side the continuing drought which could result in power shortages although not of the magnitude witnessed last year and, the possible impact on rice and tea production could affect macro economic and corporate performance.

Considering the above factors we recommend investors to take medium term positions in selected stocks in the banking and finance, conglomerate and manufacturing sectors. Companies in these sectors would not be unduly affected by the drought and power shortages, but are positioned to benefit from some of the above mentioned positive factors (most of the quoted manufacturing sector companies have developed sufficient power generating capacity internally).