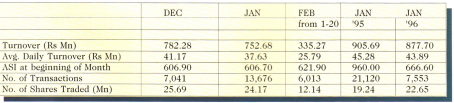

The market, as predicted, appreciated during the month of January by a modest 2.5%, but during the first three weeks of February a marginal decline was witnessed. The investor optimism which was seen in January withered gradually in February mainly due to the uncertainty in the manner in which the upcoming local government elections would be conducted. Uncertainty remains as to the extent of political violence, and the outcome of the elections, although, the result will not have a significant bearing on the government’s hold on power. It certainly will be a test of the government’s popularity, particularly with a referendum proposed with regards to the Devolution Package. The corporate results being released for the quarter ended December 31, is as expected improvement over the previous quarter. In fact, this should have propelled the market to greater heights, but the political uncertainties are a damper to the market. On the military front the government forces appear to be having an upperhand against the LTTE and if political violence can be curbed this will result in an upward movement in the indices.

Turnover and volume have declined drastically during February as both local and foreign investors have adopted a wait-and-see attitude, with regards to the political outcome of the local government elections. But fortunately foreigners have not been net sellers, in fact, a marginal inflow was witnessed during the last two weeks. Stocks that traded in large volumes during the last one month were Lion Brewery, Blue Diamond, Richard Pieris, Asian Hotels and Vanik Inc.

Corporate News

The Monetary Board is still to decide on the rival offers by Hatton National Bank (HNB) and the Development Finance Corporation (DFCC) to purchase the 40% stake in Commercial Bank held by Standard Chartered Bank. This delay by the Monetary Board has resulted in some loss of interest by market watchers in this transaction. As expected the IPO (initial public offering) of Lion Brewery was a huge success and investors who subscribed to these shares were immediately rewarded with a massive 35% capital gain in under two months. As much as offering short term capital gains, this stock will certainly offer long term capital gains to investors. Vanik Incorporation has called for an Extraordinary General Meeting (EGM) to seek the approval of the shareholders to negotiate the purchase of two companies, namely Forbes & Walker Limited and Forbes & Walker International Limited. This will effectively enable Vanik to control Forbes Ceylon Ltd., the CSE listed company with a cash reserve in excess of Rs 1000 million. The offer made by Asia Capital Limited (ACL) to acquire Vanik prevents Vanik from proceeding with the proposed acquisition and therefore it has become necessary for Vanik to seek shareholder approval at an EGM. The Takeovers and Mergers Code requires an offeror to make a mandatory offer to all the shareholders of the listed company if it

intends to acquire in excess of 30% of a listed public company. But this does not apply to Vanik as they are seeking to acquire two unlisted companies. If Vanik is successful with this acquisition it would be a tremendous boost to Vanik’s liquidity and operational flexibility. Merchant Bank of Sri Lanka’s stock price declined by 12.5% following the press release that the company has misled shareholders with regard to its profits, and that it intends to issue 5 million bonus shares to the employees through the ESOP (Employees Share Option scheme). Merchant Bank, claiming this was incorrect, confirmed positively that the figures for FY (financial year) 1996 were accurate and those were published with the purpose of highlighting the performance in 1996. The issue of 5 million bonus shares will certainly be disadvantageous to the existing shareholders as their holding in the company would be diluted by as much as 10% without any identifiable benefit to them. The arguments by Merchant Bank as to the benefits to shareholders in this transaction appear feeble, and the objective is to reduce the losses in the ESOP at the expense of the other shareholders. The Board of Directors of The Colombo Fort Land & Building Co. Ltd. (CFLB), have proposed to proceed with the mandatory offer for the outstanding shares in Colonial Motors Ltd. By this, the CFLB is looking forward to increase its investment in Colonial Motors. Also CFLB has proposed a rights issue of 1:1 (18 million shares) at Rs 7 per share. Considering CFLB’s current liquidity position, it appears that the funds from the rights issue may be utilized to purchase the shares at Colonial Motors and also reduce the company’s massive debt.

Corporate Results

John Keells Holdings (JKH) recorded a modest 11.5% growth in net profit, for the nine months ended December 31, but this is certainly commendable considering the 1.9% profit growth for the six months ended September 30 and the prevailing economic climate. Considering the above and the prospects of a good Winter tourist season we have upgraded the earnings of JKH for the FY 96/ 97 (ending March 97) from our earlier forecast of Rs 275 million to Rs 315 million. Our recommendation on JKH has too been upgraded to Long Term Buy from Hold. ACL Cables Ltd., also recorded improved results for the nine months ending December 31. The company recorded a turnover of Rs 630.66 million, a 10.13% increase from the turnover for the same period in 1995. The earnings grew by a mammoth 70.3% (Rs 27.38 million to Rs 46 million) for the same period. This is mostly due to the reduction in raw material cost. Dankotuwa Porcelain Ltd., completed the FY 1996 on flat earnings although they recorded a growth in turnover of 17% (Rs 533 million to Rs 624 million) when compared to the same period in 1995. The flat earnings were (Rs 104 million to Rs 106. million) because the company’s tax holiday expired and the company had to pay corporate tax on their earnings (profit before tax- Rs 130.48 million). Commercial Bank recorded an impressive 31% growth in net profit for the year 1996, which outdid our forecast by over 23%. This certainly is an outstanding performance considering 1996 to be one of the worst years in terms of GDP growth.

Most other companies are also expected to record improved corporate results particularly in the plantation and tourism sectors. With attractive tea and rubber prices continuing during the last quarter and output also improving. plantation companies will continue to show massive profit growth above our expectations.

Tourism Also is enjoying a minor boom during the current Winter due to the relative stability, this will certainly be a boost to the tourism sector. The two conglomerates Aitken Spence and John Keells will benefit from the revival in tourism. Market Outlook The market is expected to remain stagnant and relatively quiet until closer to the elections.

Thereafter depending on the manner in which the elections are conducted and the outcome, investors will begin to take positions. Further, investors will also watch the outcome of the current military offensive, i.e. would it only bring short term political gain to the government or whether the military would actually achieve territorial gains, which would not be abandoned later. On the economic front, we expect gradual improvements in both the macro and micro outlook and stability of both interest rates and exchange rates (annual depreciation of rupee against the dollar not to exceed 6- 7% ), but now the key criteria appears to be improved political and military situation to drive the indices further.

We advise investors to watch

for buying opportunities in the following stocks:

Banking and Finance: HNB, DFCC. Vanik ,

Manufacturing: (Ceramic Sector) Lanka Ceramic, Royal Ceramic.

Conglomerates: Aitken Spence, John Keells.