The Sri Lankan government offers a wide range of incentives for investors, both domestic and foreign. There is no incentive bias between the foreign and local investor. The incentives offered belong to two classes or “regimes”, and the enterprise may become eligible for incentives offered by either of these two regimes.

The two regimes are: BOI Incentives Under Section 17 of the BOI Act Special incentives, outside identified laws of the country, are available to enterprises approved by the BOI, under Section 17 of the BOI Act, if they meet certain criteria.

General Incentives Under the Normal Laws of the Country The incentives offered under this regime are also available to both local and foreign investors. Firms that do not qualify for concessions under Section 17 of the BOI Act may seek incentives available under the normal laws of the country such as Inland Revenue Act, Turnover Tax Act, Excise (Special Provisions) Act and Customs Ordinance. Foreign investment entry to operate under the normal laws is conferred under section 16 of the BOI Act which entitles the enterprise to repatriate profits and dividends attributable for foreign shareholders.

The BOI is responsible for the approval of all foreign direct investment. Foreign investors need to invest at least US$ 50,000 in the equity of the enterprise in order to qualify for approval under sections 16 or 17 of the BOI Law.

Incentives Under Section 17 of the BOI Act

Enterprises which satisfy specific eligibility criteria qualify for incentives under Section 17 of the BOI Act. The incentives offered by the BOI were expanded in November 1995. The new incentives represent a two-pronged strategy: diversification of exports towards advanced technology and value addition, and investments in large scale projects including infrastructure.

For the purpose of granting the new incentives, “advanced technology” has been defined as follows by the Ministry of Finance.

1.Technology which introduces a new design, formula or process for the manufacture of an article or in the provision of a service, resulting in one or more of the following:

a. Higher productivity resulting in lower cost of production

b. Quality improvement of product/service

c. Better Utilization of raw materials

d. Upgrading of technical skills

e. Minimizes/controls environmental pollution and/or wastage

2. Manufacture of products using a technology hitherto not applied in Sri Lanka (excluding technology involving only simple processing)

3. Technology for the local processing of raw materials, which are currently imported in processed form, excluding simple types of processing

4. Technology hitherto unutilized in Sri Lanka that would make use of local resources to provide public utilities and infrastructure services.

Given below is a list of the types of investment that qualify for incentives under Section 17 of the BOI Law, with applicable conditions. It should be noted that all enterprises qualifying for concessions would also be:

• exempt from income tax on capital gains due to transfer of shares (However, stamp-duty shall be payable)

• exempt from the provisions in the Import and Export Control Act.

• subject to the National Security Levy (currently 2% on imported capital goods).

• entitled to repatriate profits and dividends.

Investments in Non-Traditional Export-Oriented Manufacturing

A new company that manufactures non-traditional goods and exports 90% of its output overseas or sells 90% of its output to a BOI approved direct exporter is considered an Export Oriented Manufacturing Company. A new export company with a minimum project cost of Rs. 12.5 million or more is entitled to certain BOI concessions. These projects will benefit from a concessionary tax rate of 15% for twenty years and are exempt from exchange control. They are also exempt from import duties, turnover tax and excise duty on project-related goods imported or purchased locally.

However a new export-oriented manufacturing company with a minimum project cost of Rs. 50 million and providing employment to at least 50 persons and using “advanced technology” as defined earlier will be granted a 5 year tax holiday (effective from the commencement of business) followed by a concessionary tax rate of 15% for fifteen years thereafter.

“Companies engaged in export of advanced electronic products may apply for special grants through the BOI”

An existing BOI approved export-oriented company, undertaking an incremental investment of not less than Rs 2.5 million and qualifying under the advanced technology criteria as defined will be granted incentives under the Inland Revenue Law.

Additional Incentives for the Electronics Sector

In order to encourage investors in the field of advanced technology electronics, the BOI has formulated a special scheme of financial assistance. This takes the form of direct financial grants to eligible enterprises through a special Technology Transfer Fund administered by the BOI. Companies qualifying for direct grants under this scheme would be engaged in the export of advanced electronic components, usually manufactured within a “clean room” environment. Assistance under this scheme, granted on a case by case basis and a formula established by the BOI, can take the form of financial grants linked to incremental export turnover and/or reimbursement of costs associated with training, acquiring equipment for testing and calibrating, manufacture of prototypes, dyes and moulds and developing programmes pertaining to quality as surance.

Investments in Export Oriented Services

A service company where 70% of total output rendered to non- residents for payment in foreign. currency is considered export oriented for the purpose of qualifying for BOI incentives. (e.g ship repair, software) A company providing a service, in excess of 70% of total output, to improve/enhance the quality/character of exportable products of a BOI approved export-oriented company is classified as an indirect exporter of services (e.g garment washing plant, quality testing services).

Except in the case of ship repairing and ship breaking, where a minimum project cost of Rs. 10 million shall apply, a minimum investment criteria does not apply to companies exporting services, directly or indirectly. These projects will be entitled to a concessionary tax rate of 15% for twenty years and are exempt from exchange control. They are also exempt from import-duties and excise-duty on project related articles imported or purchased locally. However, an enterprise engaged in direct or indirect export of services will be liable to turnover tax on sales and raw materials and assets imported or purchased locally.

A new company undertaking direct and/or indirect export of services, employing at least 25 persons and using advanced technology as defined, will be eligible for a 5 year tax holiday, effective from the commencement of business, followed by a concessionary income tax rate of 15% for fifteen years thereafter.

An existing BOI approved company engaged in the export of services undertaking an incremental investment of not less than Rs. 2.5 million and qualifying under the advanced technology criteria as defined will be granted incentives under the Inland Revenue Law.

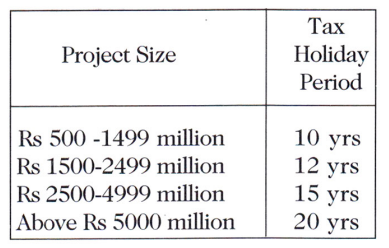

Large Scale Projects

New Enterprises with a total project cost exceeding Rs 500 million are classified as Large Scale Projects eligible for tax holiday periods varying according to the size of the investment.

The tax holiday period applicable for the respective investment schemes is shown below. Note that the tax holiday and Exchange Control exemption would be available for both export and non-export-oriented projects. Furthermore, manufacturing projects must employ at least 100 persons to become eligible for concessions.

Export-oriented projects are free of import-duties, turnover tax and excise-duties on imports of machinery and raw materials for the life of the project. They also

enjoy a further concessionary tax rate of 15% after the total tax holiday upto a cumulative period of 20 years.

The above concessions to non-export-oriented enterprises how ever will apply only during the project implementation period as determined by the BOI. If the project cost is less than Rs. 2,500 million, expatriate employees are subject to a concessionary tax at 15% during the first five years of employment.

Projects with an investment of above Rs. 2,500 million qualify for further incentives, as “flagship” companies under the Inland Revenue Act and Turnover Tax Act. These are:

• Lower rate of 15% on income tax of expatriate employees, throughout the company tax holiday period

• Non-resident consultants to such companies providing certain specified services are exempt from Sri Lankan income tax in excess of tax in their home country for the services rendered.

• Non-resident consultants providing certain specified services are free of turnover tax on fees, commissions and other charges

• All project related imports are exempted from turnover tax.

Small Scale Infrastructure Projects

This category of investment includes investments in ware- houses, environment improvement, data and voice transmission, power generation, industrial estates and housing. The minimum project size to qualify for incentives is Rs. 50 million for housing and power projects and Rs. 125 million for other activities. Housing projects should produce at least 100 units in a maximum of four locations.

The preferential tax rates offered are:

• For project size between Rs. 125 million and Rs. 249 million – income tax of 15% for seven years

• For project size between Rs. 250 million and Rs. 499 million – income tax of 15% for ten years. (Projects above Rs. 500 million would qualify for incentives under Large Scale Projects)

• For housing projects with an investment of more than Rs. 50 million income tax of 15% for seven years.

Other benefits include exemption from import and excise-duties on operational and construction machinery, equipment and construction materials during the project implementation period. Expatriate employees are eligible for a 15% reduced income tax for the first three years of employment. Note that infrastructure projects where total project cost exceeds Rs. 500 million will qualify for incentives under Large Scale Projects.

Tourism, Recreation and Leisure Projects

A preferential tax rate of 15% for fifteen years applies to investments of more than Rs. 10 million in hotels, recreational complexes, golf courses and other projects related to tourism and leisure. Such projects may also import equipment and construction materials free of import and excise duties during the project implementation period. Expatriate employees may enjoy a reduced tax rate of 15% during the first three years of employment.

This category of enterprise may also obtain foreign loans to meet cost of imports with the prior approval of the Controller of Exchange. Note that tourism, recreation and leisure projects where total project cost exceeds Rs. 500 million will qualify for incentives under Large Scale Projects.

Agriculture Sector Projects, Fisheries, Dairy and Livestock Development Projects

Firms in animal husbandry, dairy, non-traditional crops, marine and inland fisheries, agro-processing and the collection and storage of agricultural produce are entitled to a tax holiday and certain other concessions. The project investment should be a minimum of Rs. 7.5 million for foreign investors and Rs. 2.5 million for local investors. A minimum investment of Rs 10 million is required in the dairy sector. Firms should employ more than fifty persons if they are in manufacturing. They should also be located outside the Colombo district.

The incentives provided are a tax holiday of five years. A 15% concessionary tax thereafter for a period of 15 years is available only for investments that export more than 90% of output. The export-oriented companies will also enjoy concessions on imports, such as exemption from import duties, turnover tax and excise-duties.

Institutions Providing Training Facilities

Tax concessions are also available for institutions providing training facilities to approved sectors. The sectors chosen for this purpose are information technology, technical training, management and garments and textiles. Other sectors too, depending on the contribution to the national economy, may be approved by the BOL. These institutions are eligible

for a preferential tax rate of 15% for ten years. They are exempt from import duty and excise duties on the import of machinery and other inputs during the project establishment period. Expatriate employees enjoy a reduced 15% income tax for the first three years of employment.

Local or foreign investors not qualifying for incentives under section 17 of the BOI Act can take advantage of incentives available under the normal laws of the country.

Mining and Processing of Non-Renewable Resources

Concessions applicable to such projects will be decided on a case by case basis by the Board in consultation with the Ministry of Industrial Development and within the given framework of regulations published under the BOI Law, Mines and Minerals Act and other related Acts.

All enterprises which have entered into an Agreement under Section 17 of the BOI Law after November 1993 and have created an additional 100 permanent jobs after November 8, 1995 will be eligible to import a passenger vehicle free of import duty upto a value of US $ 30,000. A special application has to be submitted for the purpose. The BOI may also consider the approval of duty-free import of off-road vehicles on an individual basis depending on project requirements. Specialized project-related vehicles such as ambulances (for hospitals), freezer trucks (for food processing operations) are approved for duty-free importation automatically.

General Incentives Under the Normal Laws of the Country

Local or foreign investors not qualifying for incentives under Section 17 of the BOI Act can take advantage of incentives available. under the normal laws of the country.

Concessions under the general incentive regime fall into the following broad categories:

• Incentives for industry and services using advanced technology

• Incentives for direct and indirect exporters

These are described below in greater detail.

Incentives for Investments in Advanced Technology

For companies not satisfying export orientation criteria and/or minimum investment criteria under the BOI Law and using advanced technology as defined may apply for incentives under the normal laws through the Fiscal Incentives Committee serviced by the Ministry of Industrial Development. The incentives are available to industry and services. There is no minimum export requirement.

Under this regime, new firms in the manufacturing and service sectors which • use advanced technology • employ a minimum of fifty persons • invest a minimum of Rs 10 million on machinery are approved by the Minister of Finance and entitled to tax and import duty concessions that include a • five year tax holiday • tax free dividends if paid out of exempt profits during tax holiday and one year thereafter • import-duty waiver and corresponding turnover tax exemption on machinery and equipment imported for the purpose, within one year of approval by the Fiscal Incentives Committee.

Existing firms, which meet the same criteria are eligible for all concessions where the corporate tax exemption will be on incremental profits. If the investment in machinery is lower than Rs. 10 million but not less than Rs. 2.5 million for an existing company, the benefits are limited to the import-duty waiver and corresponding turnover tax exemption. To be eligible for incentives for advanced technology, investors must submit applications prior to 30th Sept, 1996.

Incentives for Direct and Indirect Exporters

Incentives are available under the Inland Revenue Law to exporters not qualifying for concessions under Section 17 of the BOI Law. These concessions are briefly out lined below.

• Profits attributable to the export of non-traditional goods by an undertaking are made liable to income tax at 15% till 1 April 2014. Dividends declared will be subject to a 15% tax.

• Enterprises that supply to export enterprises also benefit from a 15% tax on the profits of such sales till 1 April 2014. Dividends are also taxed at 15%. Manufactured items supplied to an exporter are exempt from Turnover Tax, if such supplies are covered by domestic letters of credit, or backed by international letters of credit or confirmed export orders.

• Profits attributable to the performance of any of the following services for payment in foreign currency are made liable to income tax at a maximum rate of 15% ship repair, ship breaking, repair and refurbishment of marine cargo containers, computer software.

• Companies that export gems and jewellery enjoy an open-ended exemption from income tax on its profits and income.

• Companies that operate and maintain facilities for the storage of specified goods brought into the island for re-export and operate yachts and pleasure crafts registered with the Director of Merchant Shipping are exempt from taxes on profits and income.

• Offshore companies that earn profits and income through the use of a Sri Lankan registered ship in international operations are exempt from income tax in respect of profits other than those arising from operations to and from a Sri Lanka port.

• Firms in the agricultural and fisheries sectors are entitled to a 5 year tax holiday on profits and income.

Other general benefits include accelerated depreciation allowances and exemption from Turnover Tax on inputs and export sales.

Several schemes help exporters to obtain duty-free access to imports and local purchases, if they form an input for export production. These facilities are administered by the Committee on Exemption of Fiscal Levies serviced by the Export Development Board. These include the following:

General Exemption on Fiscal Levies on Import of Capital and Intermediate Goods

Full entitlement if production is for 90% export, 50% entitlement if 50-90% is exported

Inward Processing Scheme

Clearing of imports simply by submitting a block bank guarantee of 25% of duties payable, a personal bond for the balance.

Manufacture-in-Bond Scheme

Using customs approved bonded warehouses for duty-free clearance of good against a block bank guarantee of 25% of duties payable on such goods not converted for export purposes.

Customs Duty Rebate Scheme

Exporters who have paid duty for export production other than in garments, can receive this rebate if they have not benefitted from any other exemption scheme.

Direct Financial Assistance to Sri Lankan Exporters

The Export Development Board (EDB) offers further schemes to assist local exporters, regardless of whether such exporters meet BOI criteria.

Direct Financial Assistance

The EDB invests in the equity of export ventures of innovative and pioneering nature. Such investment does not exceed 30% of equity. The EDB also grants “pioneering status” to some types of projects, in which it may invest in equity. Such projects also benefit from the reimbursement by the EDB of some types of expenses. Examples are the cost of feasibility studies, design and technical expertise, overseas market exploration and media promotion expenses.

The status of “Pioneering Project” can be given by the EDB to an enterprise considering the export of a new product. Such a venture will then be eligible for assistance up to 80% of the cost of product or market research with a limit of Rs. 200,000. Assistance for the expansion of exports in the short term is available up to Rs. 1 million to manufacturing and processing exporters.

Small-scale export oriented manufacturers can receive low interest loans from the EDB up to Rs. 250,000, for machinery, training and research and development. Small and medium scale exporters receive financial assistance to execute orders prior to trade fairs, up to Rs. 500,000. Low interest loans are also available to resolve special needs of exporters who are not eligible for other schemes.

Product Oriented Special Financial Assistance

The following product categories receive incentives and assistance from the EDB:

• Diamond cutting

• Handloom textiles

• Gems and jewellery

• Electronics

• Rubber products

• Horticulture

• Spices and essential oils

• Coir products

Financial Assistance for Market Development and Promotion

The EDB offers assistance to exporters for participation in overseas trade fairs and exhibitions, and to establish marketing outlets overseas. Support is also provided to establish a quality assurance system conforming to ISO 9000.