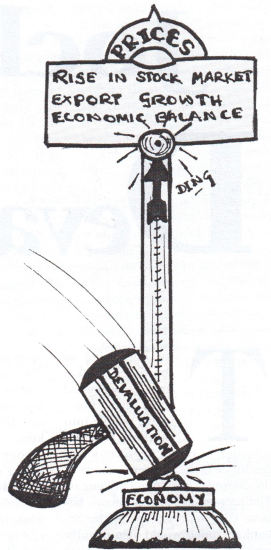

The bottoming of the Stock Market has awakened some highly innovative people into thinking that devaluation or rather depreciation of the rupee is the answer to many of the country’s economic dilemmas. The proponents of this theory believe that depreciation of the Sri Lankan rupee would significantly revive the stock market from its present state of inertia.

At first glance, this concept may seem like a “last resort” attempt at finding ways to restore some economic activity into the country. True enough, there are no quick-fixes to grave economic issues. But the time may appear to be ripe for devaluation, if its importance to the economy is understood. However, the consequence of such an action can result in a tremendous shock to the economy.

On the other hand, if devaluation is delayed by the government then over-valuation of the rupee will make Sri Lanka less competitive in the international market thus threatening the entire development strategy of the government, in the context of an export-driven economy and attracting foreign investment into the country from global markets.

Some experts claim that Sri Lanka’s currency appreciated by some 40% in real terms against the US dollar between 1983 and 1993 while those of India depreciated in real terms by 53%, Pakistan by 4%, and Bangladesh by 19%. This means that the Sri Lankan rupee has become overvalued in comparison to the currencies of competitor and trading partner countries. The other successful Asian examples which have pursued competitive exchange rate strategies are Taiwan, Korea, Indonesia, Malaysia and Thailand.

Financial Evolution

Though the fixed dual exchange rate was replaced in 1977 by a managed float (and now by Central Bank announcing a reference rate for the US dollar at the beginning of each day), with the aim of achieving economic growth and stability through the reliance on market forces, the Central Bank would intervene in the market.

frequently to stabilize the movement of the exchange rate with a view to avoiding the serious repercussions of a rapidly depreciating currency. This is because in textbook terms depreciation could have a serious impact on domestic price stability and employment.

Generally, any devaluation of the exchange rate has to be combined with restrictive monetary and/or fiscal policy to ensure economic growth and stability.

This is because devaluation makes the price of imports expensive triggering domestic inflation, and inflation has to be curbed through either a rise in interest rates or restricting government expenditure. In some cases, short-term adjustments of foreign reserves are used to maintain the exchange rate during times of high domestic inflation. This is done by financing those temporary imbalances of payments.

To regulate the economy, tight money or tight fiscal policy is re quired for a devaluation, as it shifts spending away from foreign goods and towards domestic goods, and is thus an important ingredient of a policy mix. Foreign goods become more expensive, thus reducing the purchasing power of the goods Sri Lanka produces. Therefore, the standard of living usually falls while inflation keeps rising after a devaluation.

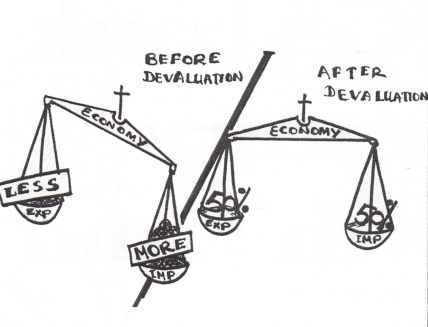

A devaluation of the rupee is needed because over the years domestic inflation has been steadily rising faster than world inflation. This is largely due to the heavy dependence of imported in puts combined with the government’s pattern of public expenditure. The over valued rupee has steadily eroded Sri Lanka’s competitive advantage in the international market for its goods and considerably cut exporters’, profit margins. Similarly, an overvalued rupee also has this effect of impairing the balance of payments.

Furthermore, over valuation of the rupee retards the growth of the import-substitution industry, as imported goods become cheaper to buy. The government should concentrate on developing this sector as it can be used to combat domestic inflation and help develop the economy on a larger scale.

However, it must be borne in mind that without cost of living safeguards, devaluation would directly result in making the price of imported goods expensive and bringing the standard of living down. Its a well-known fact that Sri Lanka’s economy heavily depends on imports for its sustenance.

Intermediate Goods imported amounted to some Rs 148 billion compared to Industrial Exports of Rs 147 billion in 1995. This shows that if devaluation is suddenly introduced there can be a loss of export markets for certain industrial items such as Textile and Garments, as rising domestic prices would cause wage push and/or demand-pull inflation, adversely affecting profit margins for these industries. The low price elasticity of demand. for its primary commodity exports implies that exchange rate changes would do little to help in augmenting exports. Similarly, other domestic firms will find it difficult to meet the demand for increased wages owing to poor productivity, once again further aggravating unemployment.

Extravaganza

On the other hand, if the present overvalued exchange rate were to prevail, it can result in the loss of export market for Sri Lankan goods as they become more expensive in the international market. But in the long term, the economy. will go through an adjustment process of declining domestic wages and prices as continuing unemployment slowly reduces wages or slows down their rate of increase.

Such an adjustment would, over a period of time, lower domestic costs and prices as compared to prices of foreign goods.

The economy would gain in competitiveness in world markets and thus restore export earnings and employment. There is no doubt that this is a feasible adjustment process, and indeed, is the process that would occur by itself given enough time.

In order to diversify the export base and reduce our dependence on a narrow export selection and move onto the next stage of industrialization (light manufacturing), it may be expedient to devalue the rupee…

It is a known fact that to contain inflation policy-makers have to retard the velocity of money by decreasing its supply. The most effective way of doing so is through open market instruments which earn high yields, thus increasing the general level of interest rates.

The recent upward trend in treasury bill rates were unavoidable. A rise in the interest rate usually causes the stock market to perform sub-normally as treasury bills are more preferred to shares especially during market down- turns. Regional fund mangers now look for economic fundamentals before investing in any region, as the Chinese example of teeming inflation made investors think twice before moving into countries where Government had lost its economic discipline.

On the other hand, a movement of investment funds has the effect of depreciating the exchange rate of the lending country and ap preciating the exchange rate of the borrowing country. Thus, a restrictive domestic monetary policy will tend to cause high domestic interest rates. In most cases, this will lead to an inflow of foreign capital and an appreciation of the country’s exchange rate. In addition, capital inflow into the stock market from overseas investors tends to have this effect. An expansionary monetary policy and capital outflow from the CSE will tend to have the opposite effect.

In Philippines, the government advertised for foreign investment offering various incentives for foreign investors despite the back- drop of an appreciating domestic currency. This is because an appreciating domestic currency has the effect of insulating the country from price instability, so crucial for combating inflation and protecting the wider populace from financial hardship.

Looking Ahead

The government may tend to keep the exchange rate of the rupee over-valued to keep the costs of imports low, as a means to regulate inflation. This is because they are unable to maintain fiscal discipline due to their political commitments and other routine expenditure. If this is done at the expense of the export sector then the cost to the government’s export-led economy would be high.

The highest export earning comes from the garments and textile industry. In order to diversify the export base and reduce our dependence on a narrow export selection and move onto the next stage of industrialization (light manufacturing), it may be expedient to devalue the rupee to make a head-start before we lose lucrative markets for our products. We should forge ahead to establish a global market niche.

A recent study done by the World Bank has shown that there is a fairly clear relationship between devaluation and export growth in the 1980s with Taiwan, Korea and Malaysia, and we should study these models if we are to use devaluation as an effective means to achieve economic balance.

and contributes regularly to

“The Island” newspaper.