March 3, 2023. Elizabeth Kerr

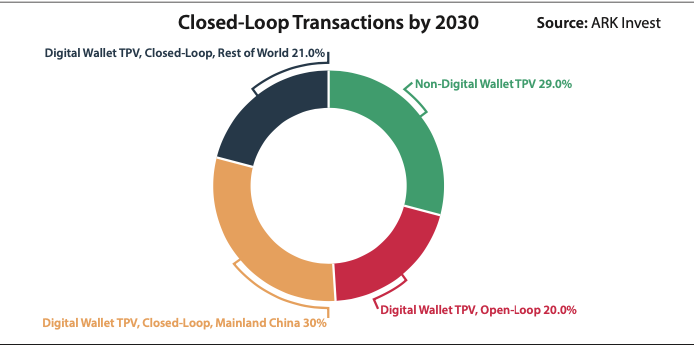

Digital payments have become an integral part of our daily lives. In the last few years, we have seen a significant shift in how people make payments, from traditional cash and cards to digital transactions. According to CryptoMonday.de, by 2030, it is expected that more than half of all digital transactions will be conducted through secure closed- loop systems.

Speaking on the report, Jonathan Merry, CEO of CryptoMonday, said: Closed-loop transactions are becoming the preferred method of digital payments in the market. As we look to the future, I expect more digital payments to go through closed-loop transactions. The financial services industry has an exciting opportunity to adapt to this innovation. Closed-loop transactions will provide greater convenience and security for consumers.

Rising popularity of closed-loop transactions

Closed-loop transactions are digital payments between two parties within a closed system. In this system, the payer and the payee must have accounts with the same provider. The provider is an intermediary between the two parties, ensuring faster and more secure transactions.

Closed-loop transactions are commonly used in retail environments. Retail environments foster a direct relationship between clients.

The popularity of closed-loop transactions has grown in recent years. The increased adoption

of digital wallets and prepaid cards is driving this adoption.

Consumers are increasingly opting to use these payment methods to make purchases online and in-store due to its convenience and security.

In addition to consumer benefits, closed-loop transactions benefit merchants and service providers. They can reduce the cost of payment processing and simplify reconciliation. Besides, they provide valuable customer data that you can use to improve marketing and sales efforts.

Benefits of closed-loop transactions

There are several benefits to using closed-loop transactions. They provide a secure and reliable way to make digital payments. Since both parties use the same provider, the risk of fraud or unauthorized transactions is shallow.

Closed-loop transactions are faster and more convenient. Moreover, it can offer personalized promotions since the provider has a payer and payee transaction history. This creates a win-win situation for both parties.

The growing demand for contactless payment drives the rise of closed-loop transactions. Due to the benefits of closed-loop transactions, more merchants and consumers are adopting them. Thus, we see a shift from traditional payment methods like cash and cards to digital payments.

With the increased adoption of digital wallets and prepaid cards, closed-loop transactions are becoming more popular.